Minnie Minoso, a Cuban baseball star of days gone by once said baseball’s “been very, very good to me”. He was born on November 29, 1923, in Perico, Cuba. Minoso was 25 years old when he broke into the majors on April 19, 1949, with the Cleveland Indians.

From his write-up, Saturnino Orestes Armas Miñoso was a “Major League Baseball” player with the Cleveland Indians in 1949, 1951, 1958-1959, the Chicago White Sox in 1951-1957, 1960-1961, 1964, 1976, 1980, the St. Louis Cardinals in 1962, and the former Washington Senators in 1963. Minnie, his nickname, was rightfully named as being one of the 100 Greatest Cleveland Indians Players ever.

He was found dead in the driver’s seat of his car early Sunday morning, March 1, 2015. The 91-year young “Mr. White Sox” was driving home from a birthday party when he pulled over around 1:00 AM. With no signs of trauma and he was pronounced dead at the scene at 1:09 AM.

Hell of a history, eh? We make history everyday. I know that’s true for many reasons. The tens of thousands who follow me here and on LinkedIn show me it’s true. Where else could an older youngster discover talent half a world away? In reality, one cannot.

It always amazes me why the world cannot live in peace. Maybe that’s because I grew up in the 1960s as a 13-year old arrested for protesting the Viet Name war. When I got in the car with my Dad after the police let me go, I didn’t know what to think. He was not exactly pleased having to get up at 2:00 AM in the morning to pick me up. Words were not necessary but I knew, as a musician at heart, he shared my belief. As I watch the Grammy awards, commemorating everyone from “Tony Bennett to Tina Turner” and listening to Joni Mitchell perform, I remember that infamous day. I was proud to be an American a feeling I still value today. That will never change.

I’ve adopted an Iranian as a protege. His name is Mahdi Nikpour. It’s not that he’s an Iranian, no. I have lots of friends who are Iranian but they escaped years ago when the Shah of Iran left. No, Mahdi’s still in Iran but his ability to express himself, here and wherever we can “get” him is deserving. He wrote the following and in my eyes, it is damn good and so is he. Thanks Mahdi, your insight gave me a little extra time to do a little more work. You know I needed that.

Here’s What Talent Looks Like

How can you be a “Smart Investor” when the “Market Is Crazy”?

Have you felt some weird and unexpected movements in the markets lately? Well guess what, you're not alone!

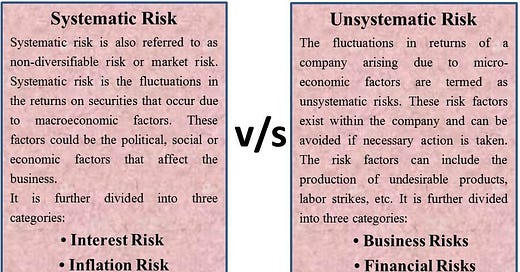

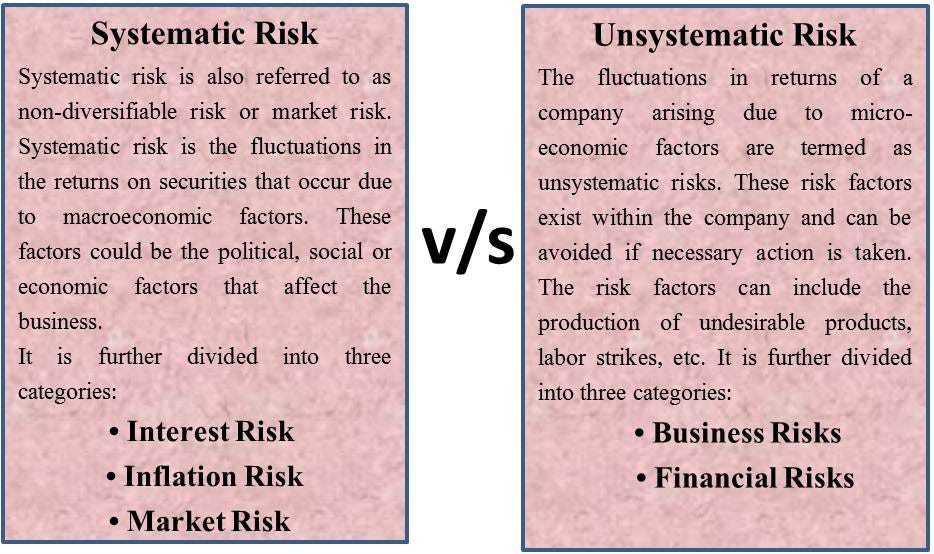

The market is influenced by various factors that affect the prices of stocks, such as things that happen in the world, the economy, the industry or any company. Some of these factors are common to most stocks and asset classes, while some are specific to certain stocks or groups of stocks.

The risk that affects everyone is called “systematic” risk, “Beta”. It is caused by things that are beyond the control of individual investors or companies, things that happen in the world or the economy. Systematic risk cannot be avoided or reduced simply by diversifying your portfolio.

The risk that affects only some is called “non-systematic” risk, “Alpha”. It is caused by things that are specific to the company or the industry, like things that happen in the company or the sector. Non-systematic risk can be avoided or reduced by diversifying your portfolio.

Beta tells us how much systematic risk a stock has, or how sensitive it is to the market movements. The higher the beta, the higher the systematic risk, the lower the beta, the lower the systematic risk.

Beta also tells us how much return we can expect from a stock, given the level of risk we are taking. The higher the beta, the higher the expected return, and the lower the beta, the lower the expected return. This is based on the idea that investors demand more return for taking more risk, and less return for taking less risk.

When Beta increases with different factors at the same time, results are unpredictable and complex. I believe short-term positioning is a good strategy in these situations.

Now I analyze the sources and impacts of systematic risk on the financial and capital markets and suggests some ways to “hedge or mitigate” the risk, based on last week's events.

Three Sources of Systematic Risk

The interest rate and credit market developments in the US and Europe, which could affect the interest rate environment, the borrowing and lending conditions, the bond market performance and the currency movements.

Wars in Middle East and the “political and economic developments” in Latin America and West Africa, which affect the stability, growth and trade prospects of these regions, as well as the energy and commodity prices, the sovereign risk and the foreign investment flows.

The trends in shareholders' ESG proposals in the US, which affect the corporate governance, the social responsibility and the overall environmental sustainability of the business sector, as well as investor preferences, the market valuation and the regulatory compliance of various companies.

Three Strategies and instruments to Hedge Systematic Risk

To hedge against interest rate risk, use interest rate swaps, futures, and options, which allow exchanging fixed-rate payments for floating-rate payments, locking in a favorable interest rate or profiting from interest rate movements. Diversify portfolios across different asset classes, sectors, and regions, which have different sensitivities and correlations to the interest rate changes. Monitor the monetary policy signals and the economic indicators of the US and Europe, and adjust the portfolio accordingly.

To hedge against the “political and economic” risk, use sovereign credit default swaps, currency forwards and options and commodity futures and options, which transfer the default risk, locking in a favorable exchange rates or profiting from the commodity price movements. Diversify portfolios across different countries, regions and sectors. They have different exposures and vulnerabilities to political and economic shocks. Monitor the political and economic developments and the market sentiment of Middle East, Latin America and West Africa and adjust the portfolio accordingly.

To hedge against the ESG risk, use ESG-themed funds, ETFs, and bonds, which allow investing in companies that meet the “ESG” criteria, standards and ratings, and benefit from the ESG premium, performance and impact. Diversify portfolios across different themes, sectors, and regions, which have different opportunities and challenges. Monitor the ESG trends, proposals and regulations of the US and other markets and adjust the portfolio accordingly.

The importance of understanding the sources and impacts of “systematic risk”, and applying the appropriate strategies and instruments to hedge or mitigate the risk, in order to achieve a better performance and a “lower risk” in the financial and capital markets is significantly important in today's markets.

What can I say, Mahdi is far above the curve as was Minnie Minoso. Kind of a “one of a kind talent” situated in a world with exhibited tendencies different from our own. In reality they are not. Down deep, intelligent people possess duplicative capabilities. It’s just that they live in an environment that prohibits their growth. I post Mahdi’s words so everyone can read them and more. While his thoughts, especially about ESG aren’t exactly what I would preach, it is my sincere hope that someone discovers his ability and he becomes “free of the bonds that bind him”. How about you? Do you happen to know anyone or an entity that’s interested? If so, let us know.

Tracy Chapman & Luke Combs sang together on the Grammys performing “Fast Car” and receiving a standing ovation. They should have as what was originally thought to be racist in nature was everything but racist. Come on people, let’s get real here. Quit playing up the negative and look at the positive. People like Mahdi, I don’t care where they live, they need to be judged as our equals. If not, we’re really missing something.