It’s a great book by a great author. I sense Charles Dickens was neither an investor, trader, nor hedger. But I am, and those who follow my chatter are as well. Remember, I am a macroeconomist, geopolitician, geoeconomist, and a true professional player of game theory, but there’s always room for technical analysis.

When charts raise their “heads and shoulders,” especially during critical times using patterns we evoke, we listen. You should, especially if you have the tools to use the underlying volumes of the futures contracts to be your guide.

To Breakout Or Not To Breakout

Given the title Dickens chose, chances are he was a Shakespeare follower. Every good author is. I am, too. When it comes down to it, technical analysis, despite most traders deploying its methodology, provides entry and exit strategies. Keep in mind, this helps if the targets are met.

More importantly, it is understanding the underlying valuation. I like silver as a solid hedge and Liquified Natural Gas as Trump’s real answer to increasing trading revenue in the system. The Hunt Brothers liked silver, and T. Boone Pickens loved the ‘silver” and “natural gas” commodities as well, but neither knew when to “get out” and take their gains. Remember, having no position is a position.

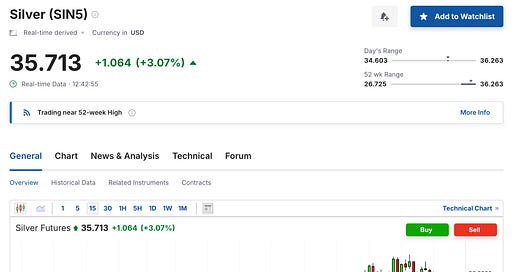

So, let’s look at silver. Overnight, it hit the $35 level, and with little real volume, it ran much higher. Is this a breakout or an interim top? Technically, it is both. Given my underlying target is closer to $50, and silver is a primary hedge, I’m sitting on my hands, but without question, it would have been nicer to see “higher’ volume as it broke through the $35 level

What about natural gas? If you read what I write, follow my words and advice, and do agree with my stance on the “widow maker,” you might not see the technical negatives that emerged over the last couple of days. Closing daily prices have been slightly less than prior day closes. Volume and range have been rather consistent. This is what we see when commodities, or any charted entity, are watched. It tells me to use trailing stops, and that is what I’m considering and probably will. Lower high, low, and close speak loudly. I hate giving up earned profits. Using “put options” to manage positions is smart. I, like you, use insurance to protect against the unknown. You should use it here.

David Bowie was right in understanding that these “changes” happen. Take total advantage of all of the tools in your bag. Remember, I use technical analysis last. It’s just the way I operate. I’m not often a trader, I’ma long-term kind of guy, but it will take all kinds to create reality. I’m also rather conservative when it comes to looking at the real world. Nothing goes to the moon or zero. If you do not believe me, check in with your local “herd” member.