From time to time we like to emphasize basic economic “rules” that when examined give you reasons behind the movement of commodity pricing. The markets in a most “transparent” manner are the best indicators we have for “price discovery”.

We’re seeing this in today’s markets with respect to Cocoa and Copper. My sense is that Jerome Powell and other world financial leaders have their eyes on it as well. It is not that everything is higher. The price of Sugar has headed back to a more “normal” level in the high teens and that’s a good thing when inflation is in the picture. Seems that the same is true for the grain complex but today we’re going to turn our thoughts to the commodities that are surging higher, Cocoa and Copper.

What Is Price Discovery

Price discovery in futures contracts is the process by which the market determines the fair value of the contract at any given point in time. It is basically the aggregation of available information, including the supply & demand dynamics, expectations about future market conditions and other relevant factors, to establish a price that reflects the consensus among market participants.

Like any financial instrument, futures contracts have bid and ask prices. The bid price is the “highest” price that a buyer is willing to pay for the contract, while the ask price is the “lowest” price at which a seller is willing to sell. Continual interaction between buyers and sellers helps establish the market price, known as the last traded price.

Information about factors affecting the underlying asset or commodity, such as supply & demand fundamentals, geopolitical events, economic indicators, weather patterns and more constantly flows into the market. This information is analyzed to assess its impact on future prices, influencing their buying and selling decisions.

Efficient price discovery relies on the incorporation of new “information” into market prices. In a functioning futures market, prices adjust quickly in response to news and events, reflecting the collective wisdom of market participants. Efficient markets will ensure that prices accurately reflect available information.

Overall, price discovery in futures contracts is a dynamic process driven by the basic interaction of supply & demand, participants' actions and the flow of information. It is essential for ensuring fair and efficient markets where price discovery accurately reflect underlying fundamentals.

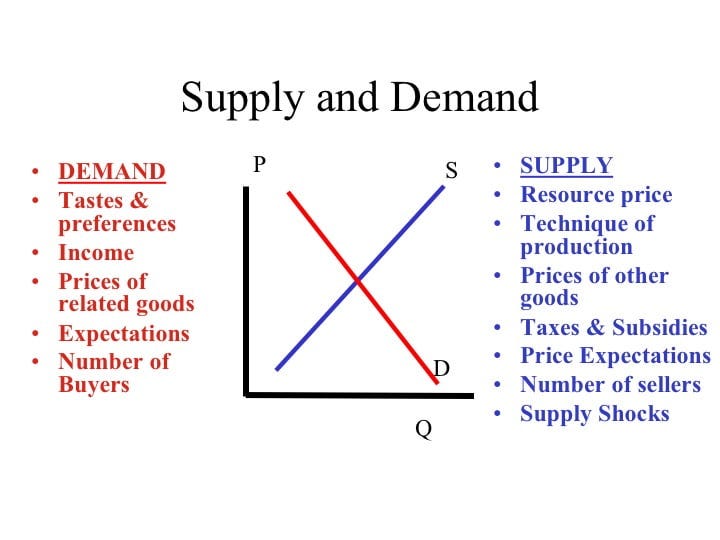

What Role Does Supply & Demand Play

Supply and demand dynamics play a crucial role in determining the pricing of futures contracts, influencing both their current value and future expectations.

The immediate supply & demand for the underlying asset or commodity affect futures prices. If demand outweighs supply, futures prices tend to rise as buyers are willing to pay more to secure the asset in the future. If supply exceeds demand, futures prices may decline as sellers compete to offload their contracts.

Futures contracts are essentially agreements to buy or sell assets at a predetermined price on a future date. Expectations about future supply and demand greatly influence pricing. For example, if there's anticipation of a shortage in supply or an increase in demand in the future, current futures prices are likely to rise as buyers seek to lock in lower prices now.

For many commodities, there are real costs associated with storing them until they're ready for delivery. These costs affect the pricing of futures contracts. If storage costs are high or there's a convenience yield, benefit from holding the physical commodity, futures prices may be higher to account for these factors.

Market sentiment and speculation drives supply and demand dynamics in all futures markets. Traders and investors may buy or sell futures based on their expectations of future price movements, regardless of current supply and demand fundamentals. This can lead to price movements that may not necessarily reflect the underlying asset's intrinsic value.

In efficient markets, price disparities between the spot, “current” price of the asset, and its futures price are quickly arbitraged away. Arbitrageurs buy the cheaper asset and sell the more expensive futures contract, or vice versa, to profit from the price difference. This activity helps keep all futures prices closely aligned with supply and demand fundamentals.

The cost of carrying the underlying asset until the delivery date, including financing and storage costs, influences futures pricing. Higher interest rates increase the cost of carrying the asset, which can lead to higher futures prices. Conversely, lower interest rates may result in lower futures prices.

In summary, supply & demand dynamics, current and anticipated, are the fundamental drivers of futures contract pricing. Understanding all of these factors is essential for participants in futures markets, including hedgers, speculators and arbitrageurs, to make informed decisions.

The Cocoa & Copper Markets

Despite the fact that some commodities, the grains and sugar have decreased in price, we’re going to take a deeper dive into Cocoa and Copper. Increased supply has had its effect in the grains and sugar markets and inflation wise that’s a good thing. Perhaps manufacturers of products that utilize these raw materials will decrease their prices or perhaps stop making their finished products smaller but we all know better. They are going to put the profits towards their bottom lines. Such is the way the world works.

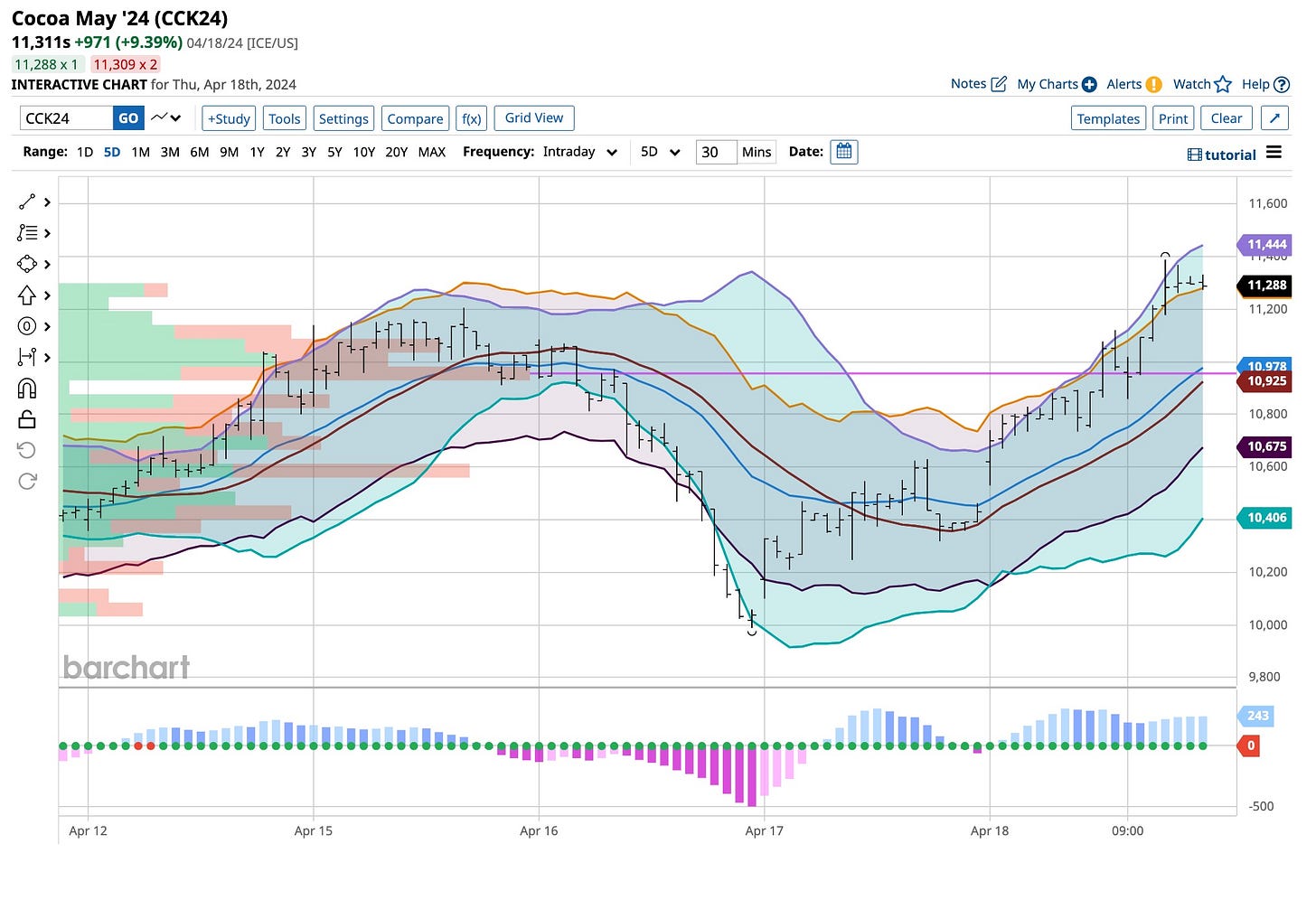

It’s different for the Cocoa market. Candy bar “prices” have done nothing more than head higher in price. In addition the actual finished and sold candy bar has decreased in size. Major manufacturers are devising strategic recipes to decrease the amount of Cocoa in their products to increase their margins. I don’t know about you but “taste” is an important determinant of mine when I enjoy eating a candy bar. How about you?

When it comes to Copper, similar to examining and evaluating the supply & demand equation of how Cocoa is priced, seasonality comes into play. I went long Copper at the $3.80+ level and I’m still long as it hits higher levels. While, by contract, I cannot reveal to you the worldwide inventory information I pay for, together with technical signals it was obviously going higher. You can better learn all of this with The Ticker.

How high it will head remains the question. I use trailing stops to preserves profits. You should too. My stops increase daily towards current price levels but the upside has outstripped that increase. I’m a lucky person and the harder I work the luckier I get. Supply & demand, coupled with accurate inventory numbers with a few technical indicators thrown in for good measure helps.

All told it’s supply and demand that drives my investing, trading and hedging. I’m not always going to be right but for certain I’m always going to be consistent. That’s all I can ask of myself which is why The Ticker exists. For $247.00 it’s worth it. Today I’m up over 50+ points on my Copper trade and more than doubled my Cocoa trade, don’t get excited, it was a “one” contract trade, but I’m out being stopped at 10,000. If you are interested in learning how I act buy The Ticker course. It is worth it if “making money” is your goal and learning the “right way” inexpensively is your goal.

I was thirteen years old when David Clayton-Thomas and Blood, Sweat & Tears came out with “Spinning Wheel”. It’s message remains valid today. What goes up must come down. There is reason behind these moves albeit the “herd” has its effect. It’s critical to follow the trend. It’s also important to spend money for good information. Supply & demand rules with respect to price discovery more so in futures versus stocks. Public trends have value as well and depending upon your source everyone receives news as it’s reported. In The Ticker we teach you “what we use & how we use it”. We’re here to teach you how to be the “best damn investor or trader” you can possibly be.