One of the most important characteristics I look at people for is morality and ethics. Given my religious upbringing and heritage, telling the truth is a not just requirement it’s a rule we never break. We expect the same from whomever we work with as well. It makes sense for us to act in this manner. You should as well.

Throughout social media, the Internet, and more you are going to run into all kinds of people. Quickly disregard most especially if they represent they are never wrong. As I titled this article, superheroes are always right but we’re human. Being honest enables human beings to interact with each other. We pride ourselves on being human. Given that scenario we acknowledge that we are not always right.

As you, we learn more from our basic mistakes, our bad investments, and our trades as we are human. We have rules that we preach and follow but from time-to-time for one reason or another, we don’t listen to ourselves. Shame on us but again, we’re human.

Losses Happen

If you cannot handle losses go do something else. Every investment or trade initiated is not going to be a winner. Losses occur when there’s a lack of harmony between your personality and the rules you follow. People take “winners” off the table too soon; let them run. It’s always better to manage a few good trades versus a bunch of inferior little ones.

If you begin to lose money “get out”. If your initial decision is incorrect, chances are nothing positive will happen to change that direction. Never add money to maintain a “losing position”. Take small losses; never let a small loss turn into a big loss. Get into cash and you’ll think more clearly.

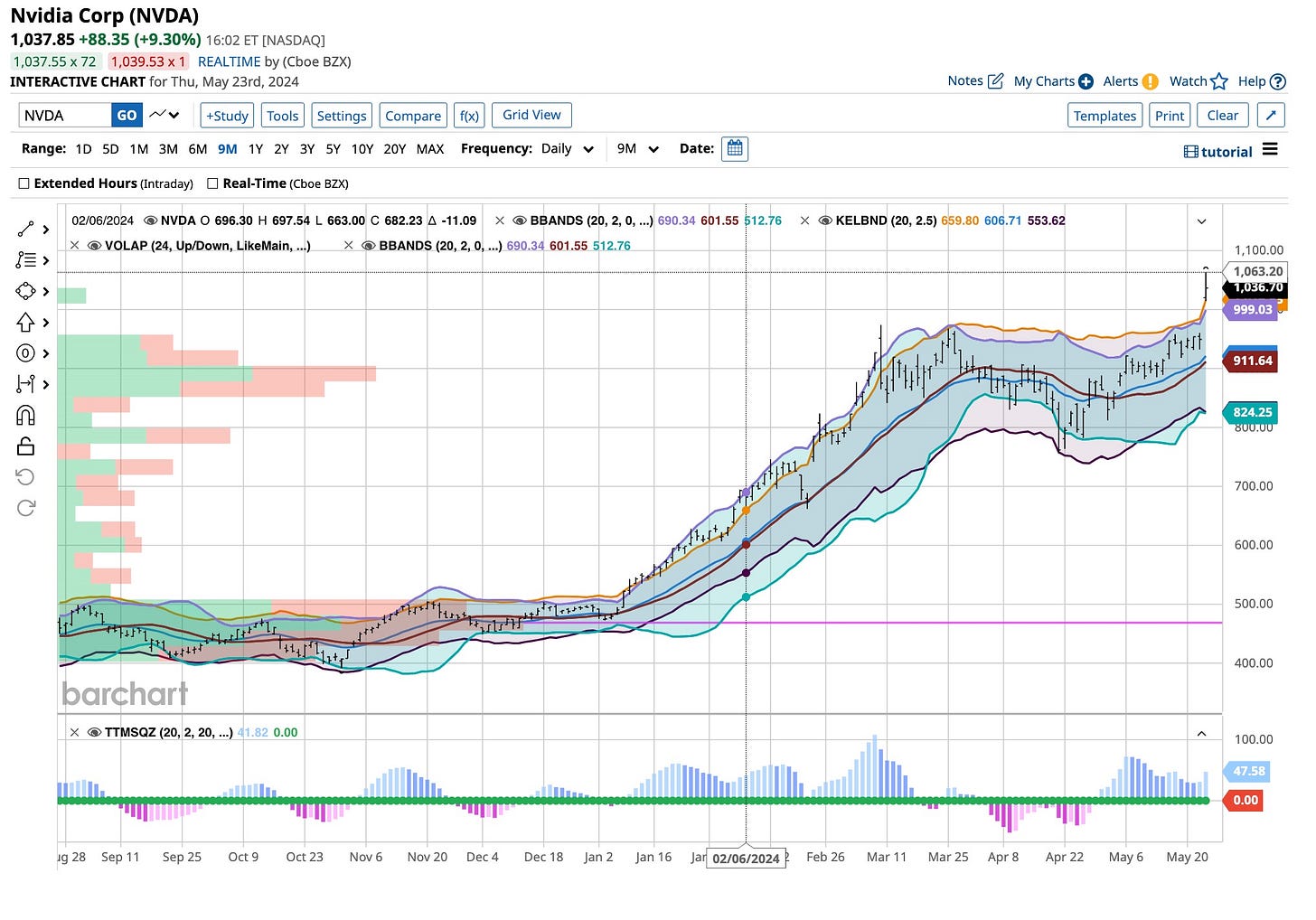

That’s what we did yesterday and we were nimble. That did not protect us from losses. It did protect us from incurring larger losses. Nvidia's earnings simply outperformed everyone’s expectations and their announcing a stock split and solid future guidance did not help either. Instantly we saw the light and “got out”. That’s how we operate but there’s a rule we broke, a couple of them. I always learn from my mistakes. How about you?

The rules I broke included trading during the week before Memorial Day. Given that the “book” is “thin” this week is one reason. Another involved letting an opportunity find me versus looking for one elsewhere. I learned. I minimized my judgment errors. Losses happen but learning from them is important. That’s a rule to always follow.

You’re going to lose, not every action you take is going to be a winner. Learning “how to lose” is an important part of becoming the “best damn trader or investor” you can be. Too many people think they need to be right every single time. You’re human; leave that for the superheroes.

Thanks China

Boeing disclosed earlier that it has not made recent aircraft deliveries to China due to a request from the country's aviation regulator for additional certification documents. The documents pertain to the batteries in cockpit voice recorders, which are installed on all Boeing models, including the 787 and 737 Max.

The aerospace giant acknowledged the impact of this halt on its financials, with the company's Chief Financial Officer indicating an expected hit to second-quarter cash flow. The market reacted negatively to this news, with Boeing shares experiencing a 7.5%+ drop today on the New York Stock Exchange.

Boeing's CFO remarked at the Wolfe conference that the second quarter's cash flow will be worse than the first quarter's. This is attributed to the ongoing lack of aircraft deliveries to China, a significant market for Boeing's commercial airplanes.

Furthermore, the company anticipates that the number of 787 deliveries in the second quarter will be similar to those in the first quarter, suggesting no improvement in the short term. The company faces “challenges” beyond this delivery issue. Supply-chain constraints for the 787 model persist, which could further complicate Boeing's ability to increase production and deliveries.

I do not control enough actual Boeing shares to have used a “trailing stop”. Perhaps I should have. While I’m unhappy with the facts reported, it fits into my overall plan to continue to sell “naked” puts below the current market price. That’s exactly the action taken with the “put” options in the 160s coming into play.

I’m a patient investor. It’s going to take time to ‘fix’ this “brand name” behemoth. I’ll stick to my plan. I’m happy to acquire more Boeing shares at lower prices. Being long term in nature is what position investors and hedgers like me are. Boeing is telling us the truth. We can act and decide on the truth. It’s about time.

“You Can’t Always Get What You Want” especially every time you invest or trade. If you realize that you are real. You’re telling the truth and you belong here with human beings like us. We’re not superheroes and neither are you. Far too many people, those with little to no experience, think they are. Flashes in the pan are a natural occurrence as they come and go like night and day. It’s always fun to “watch” what they’re doing but in reality, they’re selling nothing more than “snake oil”. We’re real, we’re human and we’re not afraid to admit when we’re wrong. How about you.