Inspired by painter Georges Seurat, Sunday in the Park with George, Stephen Sondheim, and James Lapine's masterpiece, merges the past and present into beautiful, poignant truths about life, love, and art creation. It’s one of the most acclaimed musicals of our time, this moving study of the enigmatic painter, Georges Seurat, won a Pulitzer Prize and was nominated for an astounding ten Tony Awards, including Best Musical.

It’s Sunday and this week has been a wonderful walk in the markets for The Ticker. A couple of investment thoughts made sense by sorting through what others think. I’ve done my due diligence and now it’s time for you to do yours. Here’s what I uncovered.

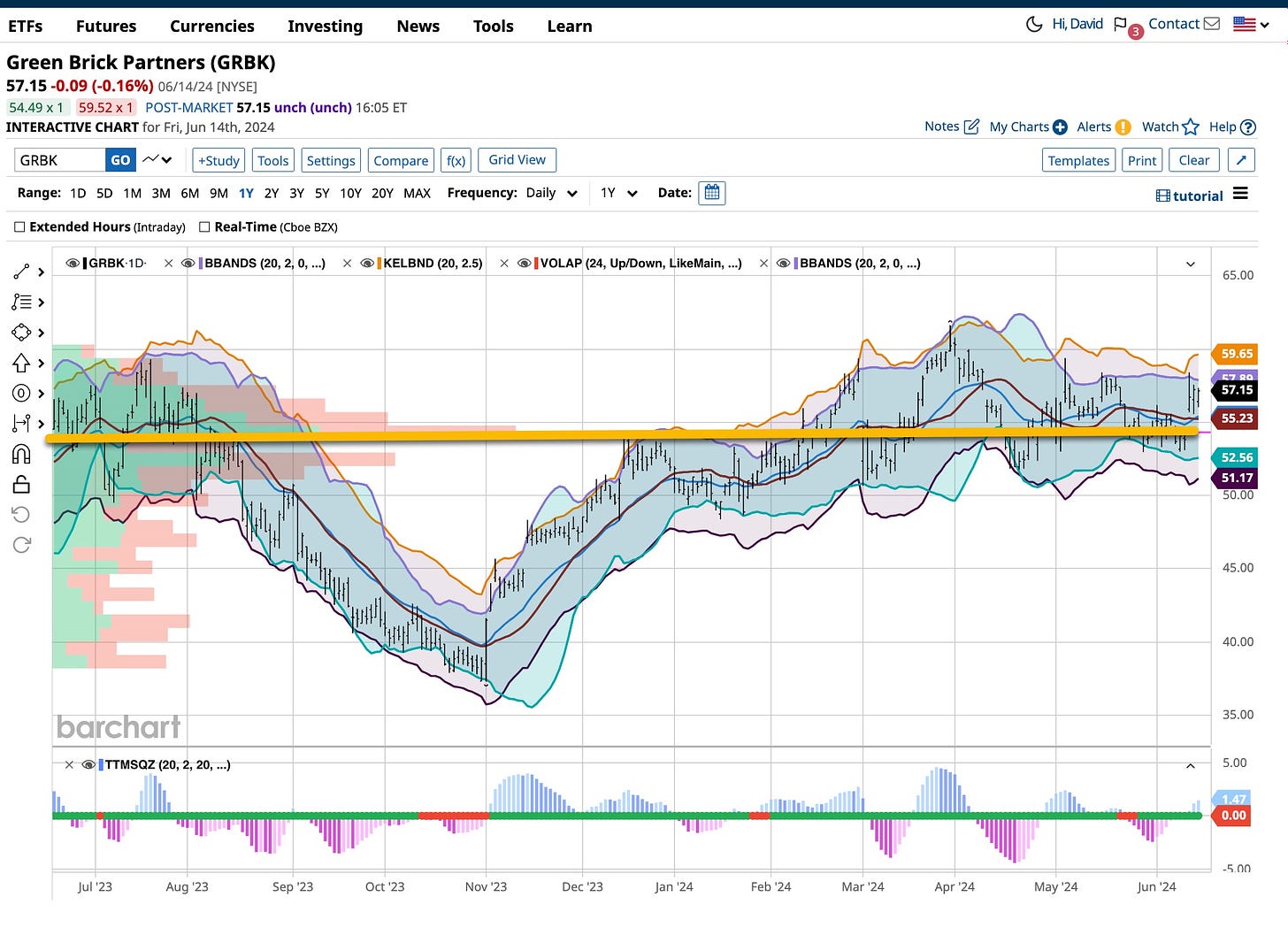

Buy Green Brick Partners

David Einhorn has built a reputation through his high-profile critiques of companies. With a net worth of $1.5 billion, he manages Greenlight Capital, which has delivered a robust return of just over 42% over the past three years, outperforming the S&P 500.

Greenlight Capital's largest holding is Green Brick Partners (“GRBK”), a construction company operating primarily in the southwestern United States. It operates primarily through its subsidiary builders and it develops residential communities, mainly in the Sunbelt region of the United States. Its markets include Texas, Georgia, Florida, and Colorado, areas experiencing significant population growth and housing demand.

The company acquires and develops land for “residential” communities. Through its builder partners, Green Brick constructs a variety of homes, from entry-level to luxury homes. By controlling land acquisition, development, and homebuilding, Green Brick aims to manage costs and enhance profitability.

The ongoing demand for housing, especially in the Sunbelt states, supports “robust” sales and revenue growth. The company's integrated model helps in managing costs effectively, contributing to strong margins. Its focus on “high-growth” markets has positioned it well to capitalize on the demographic shifts and economic growth in these regions.

The company recently delivered results that “surpassed” expectations, reinforcing a positive outlook for its stock. Reported earnings per share and revenue significantly exceeded forecasts. Additionally, the company recorded 1,071 new home orders in the first quarter, the second highest in its history, and achieved a cancellation rate of just 4.1%, the best in the industry. I’ve been looking for a company that will benefit from lower interest rates. While it does not pay a dividend, its P/E ratio of 8.67 is stellar.

In summary, Green Brick Partners stands out in the homebuilding industry due to its integrated business model, strategic market focus, and solid financial performance. I am a buyer and expect its price to be considerably higher over the next year or two.

Invest in Bitcoin With MicroStrategy

Analysts at Bernstein started research coverage on MicroStrategy (“MSTR”) with an Outperform rating and a price target of $2,890, which implies roughly 95% “upside” from the stock’s latest closing price.

MicroStrategy is building the world’s largest “Bitcoin” company. Since August 2020, MSTR has transformed from a small software company to the largest Bitcoin holding company, owning 1.1% of the world’s Bitcoin supply worth about $14.5 billion.

MSTR’s founder chairman, Michael Saylor has become synonymous with Bitcoin and has positioned MSTR as a leading Bitcoin company, attracting “at-scale” capital, both debt and equity, for an active Bitcoin acquisition strategy.

MicroStrategy has positioned itself as an ‘active-leveraged’ Bitcoin strategy compared to passive spot ETFs. Over the past four years, MSTR's active strategy has resulted in a higher Bitcoin per equity share, increasing from 6 Bitcoin per diluted share in Q4 2020 to approximately 10 today, marking a 67% growth.

I’ve been actively seeking a way to invest in Bitcoin. Identifying a correlation with the Dollar or Gold has been successful but not to a degree of certainty. With MSTR I see a way to participate in the Bitcoin market. How about you?

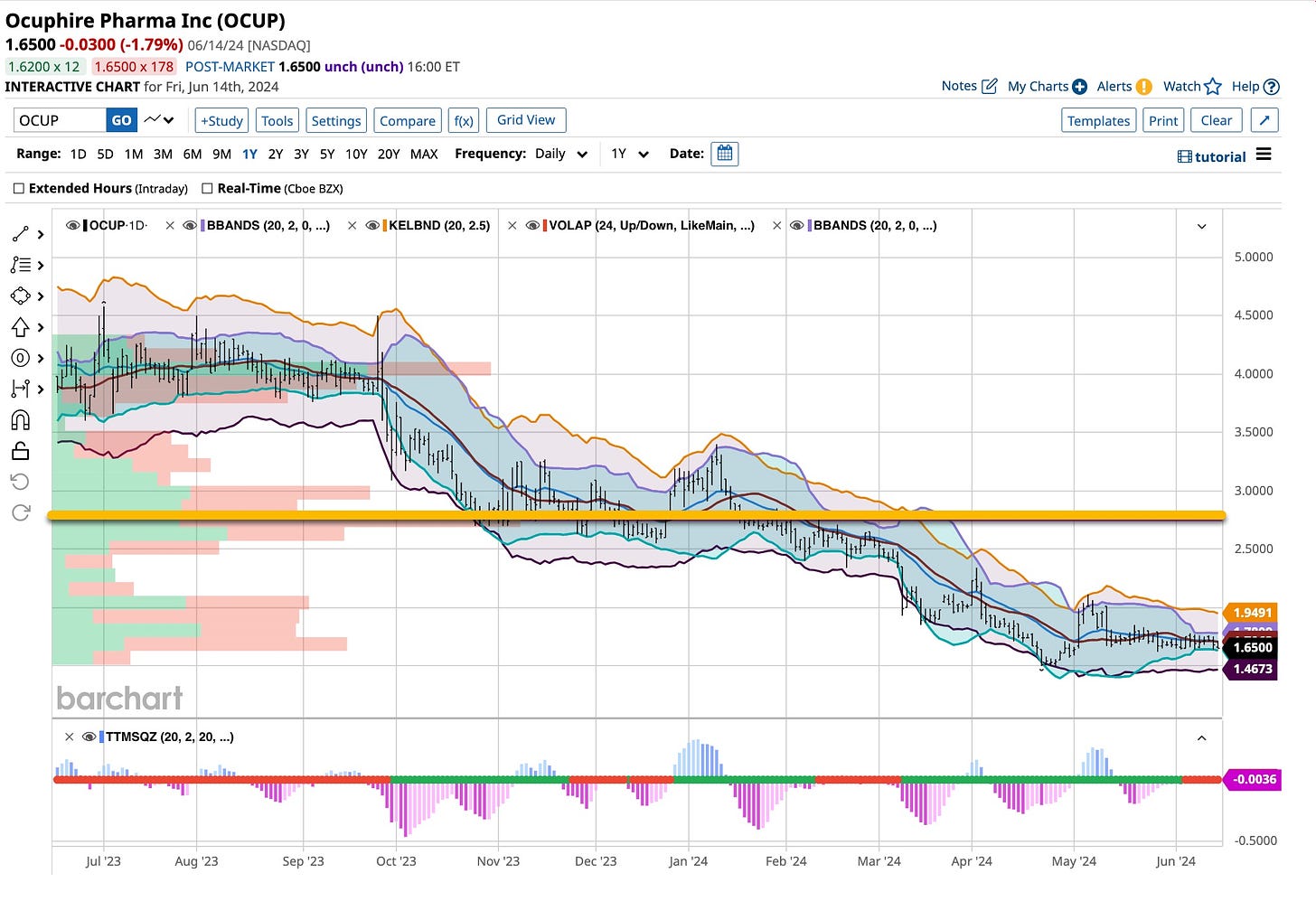

A Speculative Diabetic Biotech

Ocuphire Pharma, Inc. is a clinical-stage biopharmaceutical company that is focused on developing and commercializing therapies to treat ophthalmic disorders. Ocuphire Pharma develops treatments for a wide range of eye disorders, leveraging its expertise in ophthalmology. The company's mission is to provide innovative solutions to unmet medical needs in eye care.

Nyxol is Ocuphire's lead product candidate, being developed for multiple indications, like reversing pupil dilation caused by diagnostic procedures, age-related near vision difficulties, and night vision issues. Another candidate in its pipeline, APX3330 is an oral treatment aimed at retinal and inflammatory diseases, like diabetic retinopathy and diabetic macular edema. That’s my attraction as I’m dealing with that problem.

The advancement of Nyxol and APX3330 through various stages of clinical trials is in place. Positive trial results can significantly boost the company's prospects and stock price. Achieving regulatory “fast track” approvals or designations from bodies like the FDA are upcoming. Upon success, forming strategic alliances with other entities will be necessary for commercialization capabilities.

When it comes to the biotech industry I usually stick with the “big boys” and primary ETFs where the analysts know more than me. I’ve been burned in the past by stocks like these but given my need for a pill-based macular treatment I’m on board.

Ocuphire Pharma (“OCUP”) is a compelling opportunity in the ophthalmology space, driven by its innovative pipeline and focus on unmet medical needs. You must do your due diligence before investing in this one.

Join Us At The Ticker

Remember, it’s Father’s Day. We are taking advantage of this day in a couple of ways. I am posting this article earlier than normal. In addition to celebrating the day I will be watching the U.S. Open. I played Pinehurst a couple of times or should I say it played me. It’s been more than twenty-five years since I teed it up there but I remember how difficult it was. It still is.

I hope you are enjoying what’s posted. Substack and LinkedIn have been great ways to follow The Ticker and we appreciate your interest. Tens of thousands of you have told us how much our effort to teach you how to invest and trade the “right way” works. It makes sense to me and more is coming. Keep your eyes open as The Ticker spreads its wings, especially our introductory offer to join us that’s hitting your emails.

In the 2017 revival of “Sunday in the Park with George” Jake Gyllenhaal brought life back to this 1986 masterpiece. I enjoyed the original version but didn’t have the time to view the reprise. Sunday is an important day for me. It’s one I look forward to as the markets open Sunday night. There’s a lot to learn from what Asia and Europe put out and something I’ve enjoyed and participated in for years. All I’m trying to do is to put what’s between my ears in between yours. Follow me and join us at The Ticker. It will work for you without question as you learn the “right way”.