Listening and observing what can only be called a “diatribe” about whether this total market is “teetering” on a thread as it moves higher, takes center stage. It is apparent that the “Magnificent 7” and various other securities comprise a very high percentage of the recent uprise. Is it the same as happened in the Dot-Co bubble? Perhaps but it also seems that the conditions behind its development is different. I’ll leave analysis of this information up to you but know that I am hedged. What goes up will usually come down but there is more going on in today’s world that history can teach us a few things from. One in particular is “stagflation” and more of the “big boys” and a few of the analysts I follow are starting to talk it about it more and more.

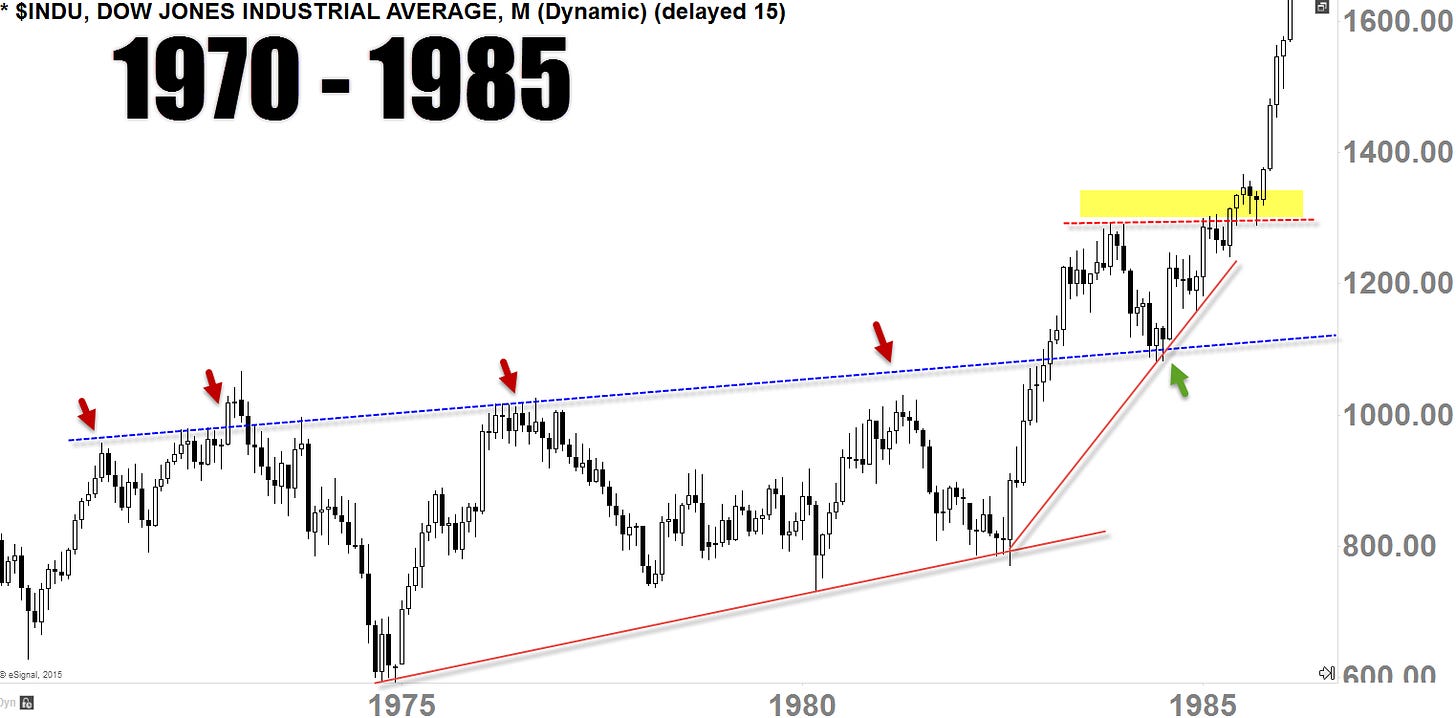

Above is a chart of the Dow Jones that covers the 1970s and more. It is interesting to note the “sideways” action. To me, being a hedger that is a good thing. From time to time the Federal Reserve broadcasted loudly that the worst of times were over. That was temporary as it was often shortly followed by the “markets” simply disagreeing with that assessment. The term “stagflation” was coined during this period as it most certainly reflected what was transpiring. Is it happening again today? I think it is but I’m just one voice in many. What do you think?

Stagflation Defined

Stagflation is defined as an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. This combination is often particularly difficult to handle, as attempting to correct one of the factors can exacerbate another. Once thought by economists to be impossible, stagflation has occurred repeatedly in the developed world since the 1970s oil crisis.

In the middle of 2022, many said that the United States had not entered a period of stagflation, but might soon experience one, at least for a short period. In June 2022, it was argued that a period of stagflation was likely. Economic policymakers were more interested in tackling unemployment first, leaving inflation to be dealt with later.

The term stagflation was first uttered by British politician Iain Macleod in a speech he made before the House of Commons in 1965. It was a time of economic stress in the United Kingdom and he called the combined effects of inflation and stagnation a "'stagflation situation." The term was revived in the U.S. during the “1970s” oil crisis, which caused a recession. This recession downside included five consecutive quarters of negative GDP growth. Inflation more than doubled in 1973 and hit double digits in 1974. Unemployment reached 9% by May 1975

The effects of stagflation were illustrated by means of a misery index, a simple sum of the inflation rate and the unemployment rate, tracked the actual real-world effects of stagflation on a nation's people. There are many reasons and excuses for why the true effects of stagflation occur. The effects of the world are real. The ineffective nature of the world’s financial leaders is just as important.

Stagflation Versus Inflation

Whatever the explanation, inflation persisted during periods of economic stagnation since the 1970s. Even before the “1970s” period, some criticized the notion of a stable relationship between inflation and unemployment. They thought that consumers and producers adjusted their economic behavior to rising price levels either in reaction to or in expectation of monetary policy changes. We all know who make those decisions and quite often the monetary “big wigs” make the wrong choices.

Economists often argue about the root causes of stagflation. In general, the stage’s set for stagflation when a supply shock occurs, an unexpected event, such as a disruption in the oil supply or a shortage of essential parts. These “shocks” occurred during the COVID-19 pandemic with a disruption of the flow of semiconductors that slowed the production of everything from laptops to cars and appliances. Such a “shock” affected factors that make up stagflation, inflation, employment and economic growth.

Stagflation is often comprised of three primary “negatives”, slower economic growth rates, higher unemployment and higher prices. This is a negative combination that is not supposed to occur based upon the overall logic of economics. Prices shouldn't go up when people have less money to spend, right? That in a virtual nutshell is what is happening and it is obvious. How do we cure it? There is no real “definitive” cure for stagflation. The consensus among economists is that productivity has to be increased to the point where it will lead to higher growth without causing additional inflation. This would then allow for the tightening of “monetary policy” to rein in the inflation component of stagflation. It’s been tried and stagflation and inflation are still present in today’s world. It’s easier said than done, so the key to preventing stagflation is for economic policymakers to be extremely proactive in avoiding it. Unfortunately they are not which brings the 1970s back into play. In short, we’re back.

There is evidence that we are back. The best way to illustrate this is by using an old time and well respected history of “what happened”. I’ll give away my resource while hoping some of this sinks in. Sincerely folks, I do not write for my health and hope that you are not reading this for fun. Stagflation is real and we have a history of not dealing with it all that well, It seems we are repeating negative standards of how we made mistakes in the past and repeating them today. Let’s take a look at where we went wrong.

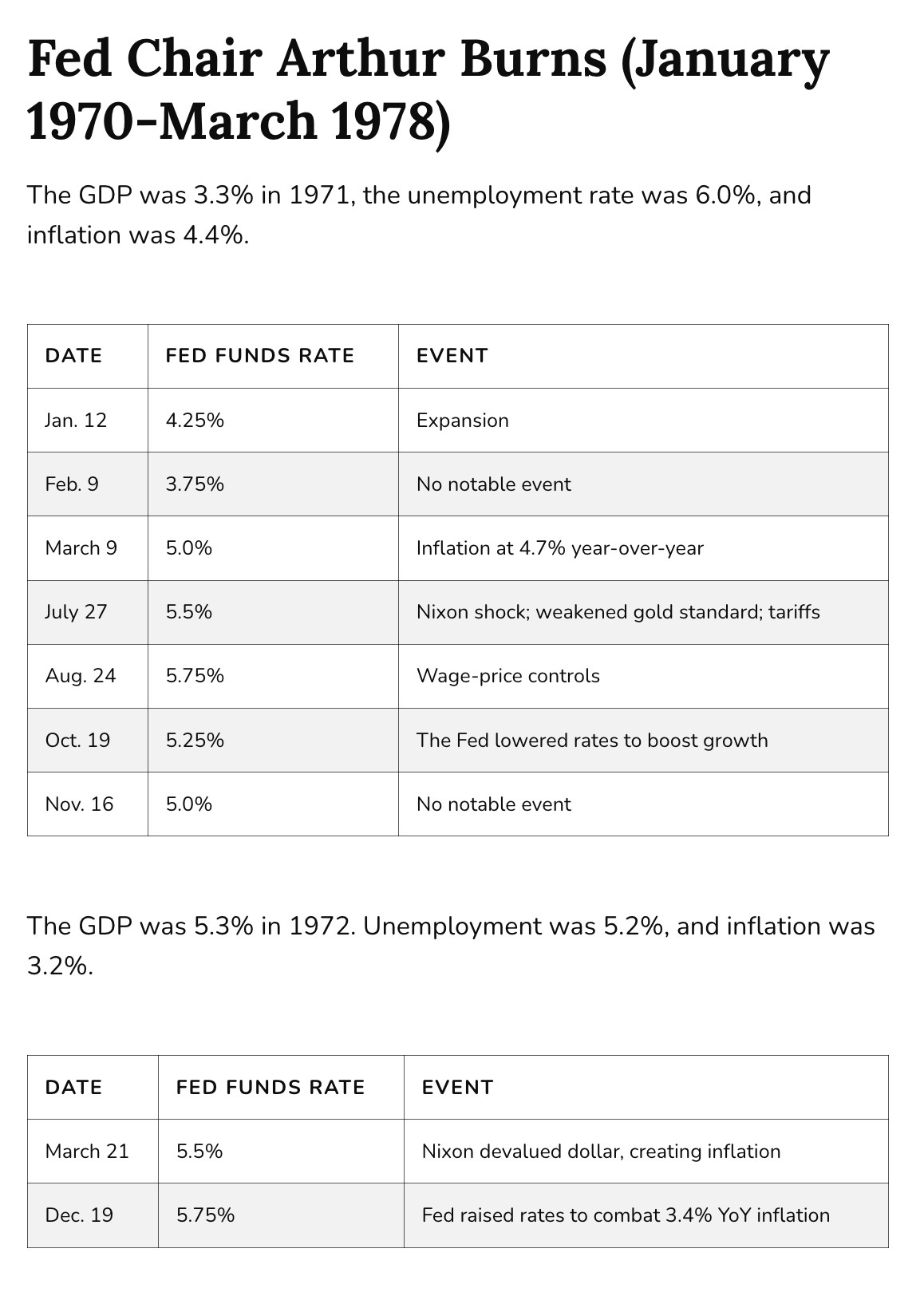

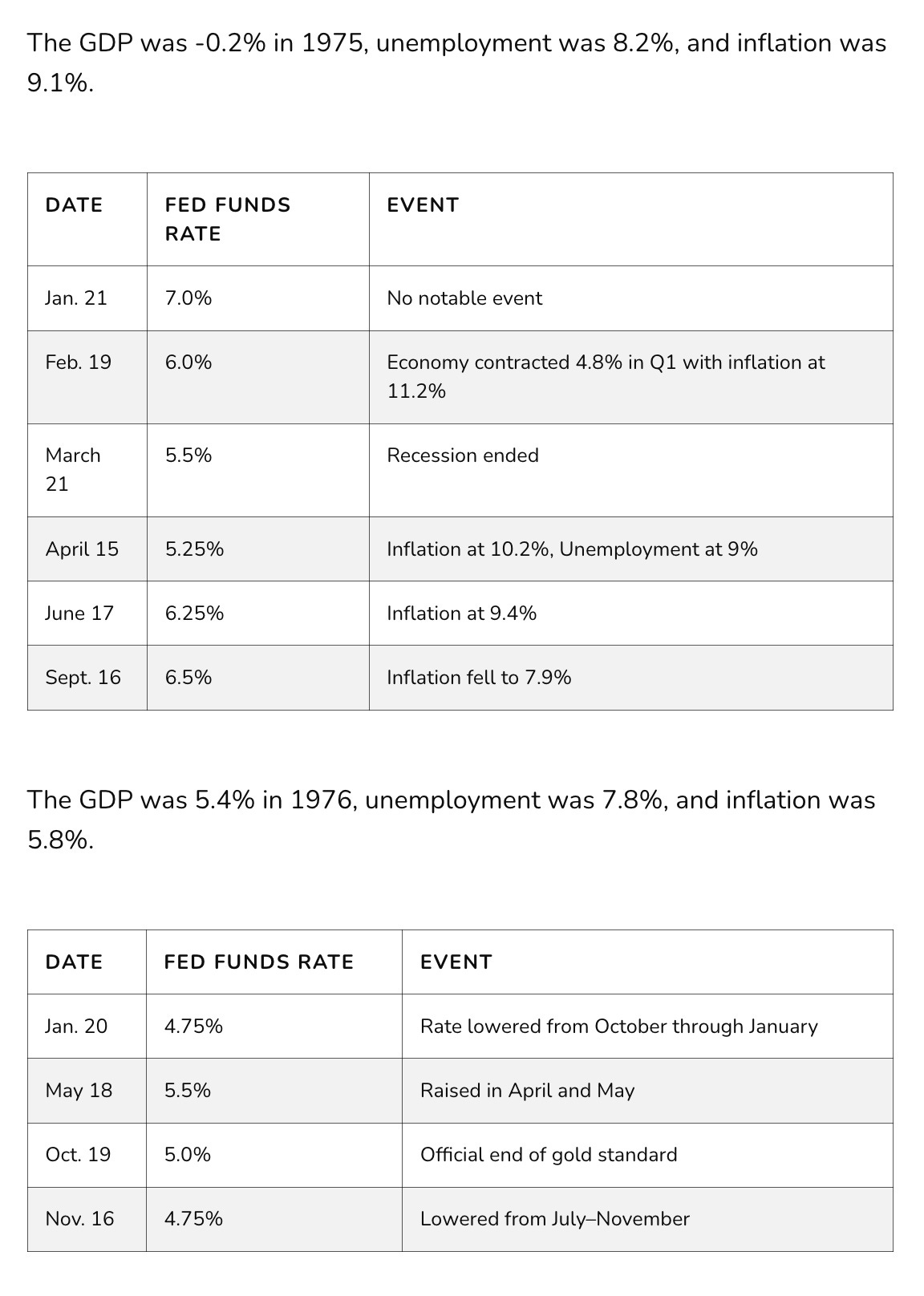

The recession to end all recessions started in late 1973 and continued throughout 1974 finally ending in March of 1975. Nixon tried everything in his power to keep wages in line with expectations but with Arthur Burns at the helm of the Federal Reserve while taking dramatic steps Nixon had nothing more than a puppet pulling the strings. The unemplyment rate soared along with inlation and the Fed Funds rate.

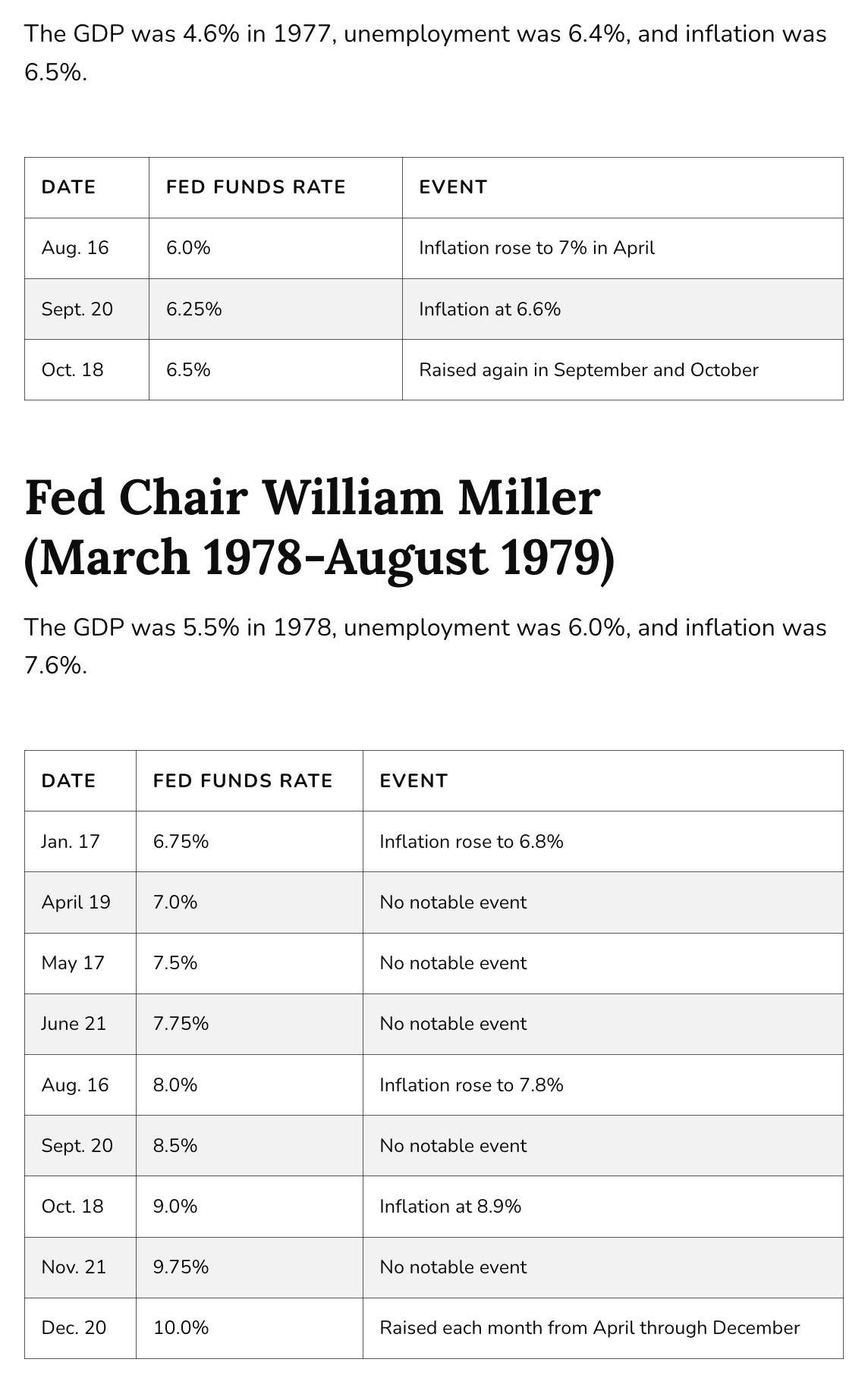

Thinking the worst was finally over and that everything was now controlled, the Ford administration stuck with Burns. So did Carter and that was a big mistake. Inflation did not really “go away as hoped and unemployment remained higher than targeted. In any case, the puppet Burns was still pulling the strings but Carter knew a change was necessary.

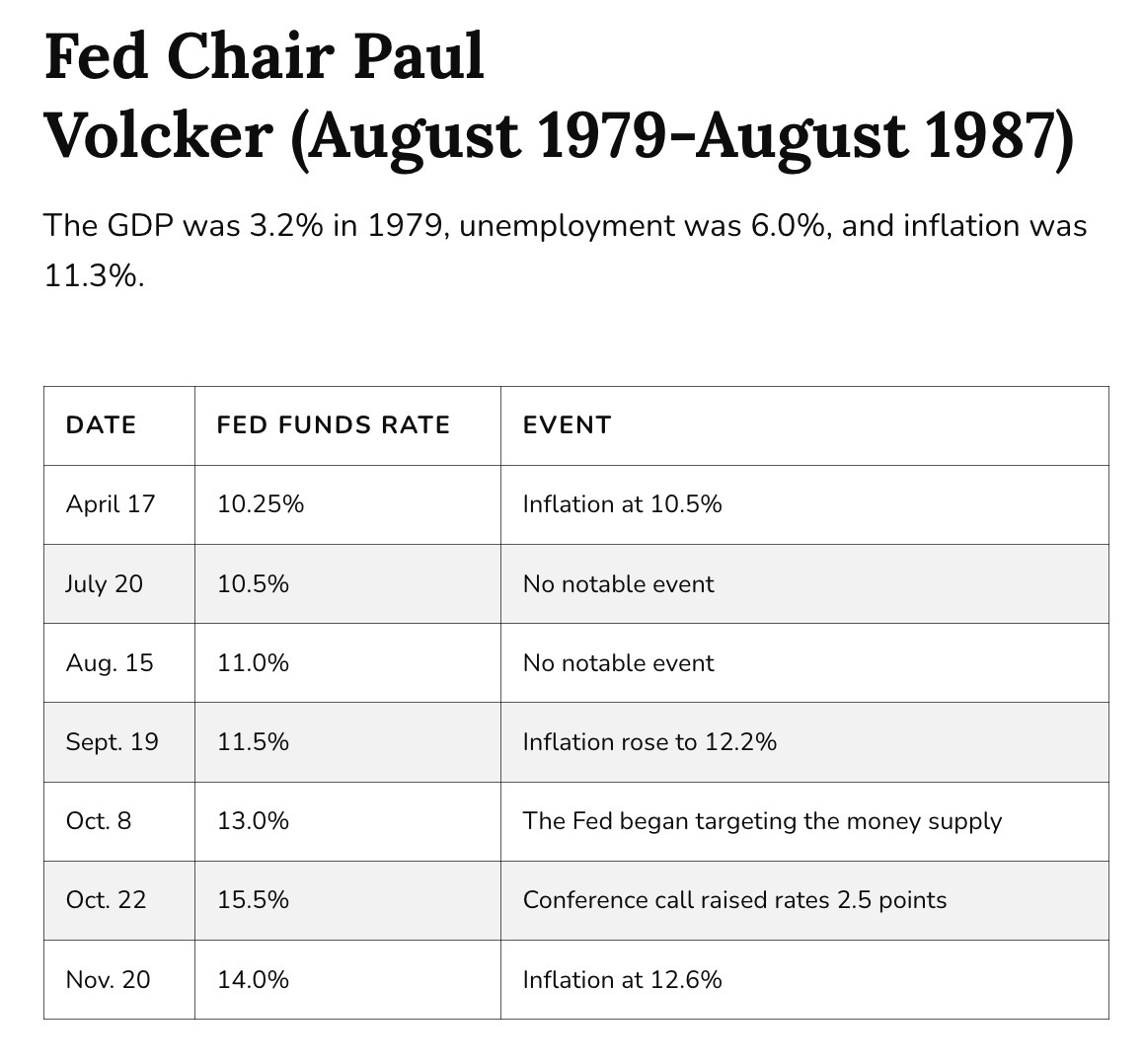

When inflation began increasing Carter brought William Miller into the Fed in March of 1978 but bhe only lasted un August 1979 when Paul Volcker was appointed to jump in and replace him. Jimmy Carter did ake a good decision hiring Volcker who, in my opinion is the best overall Federal Reserve Chairman we ever had.

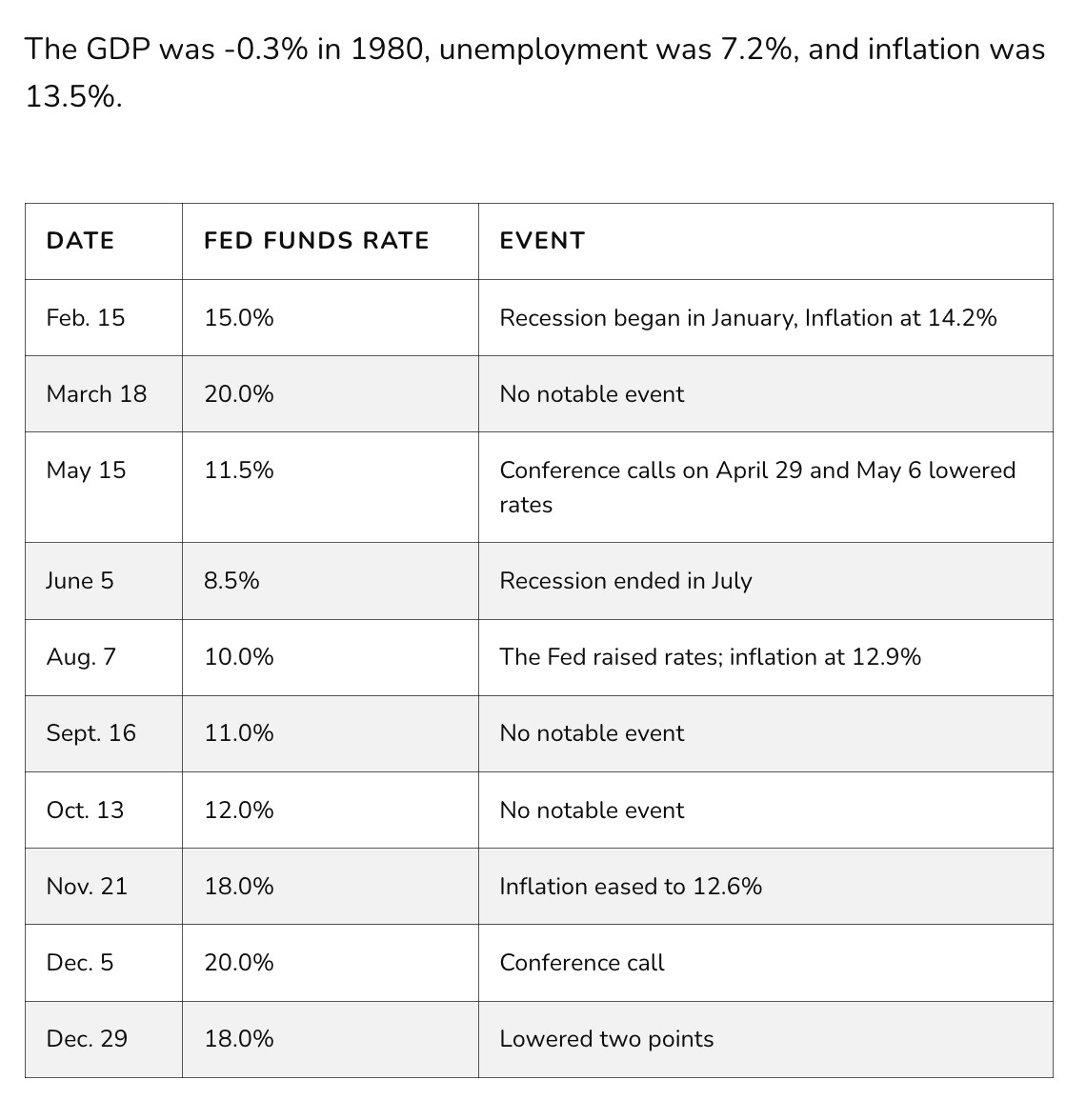

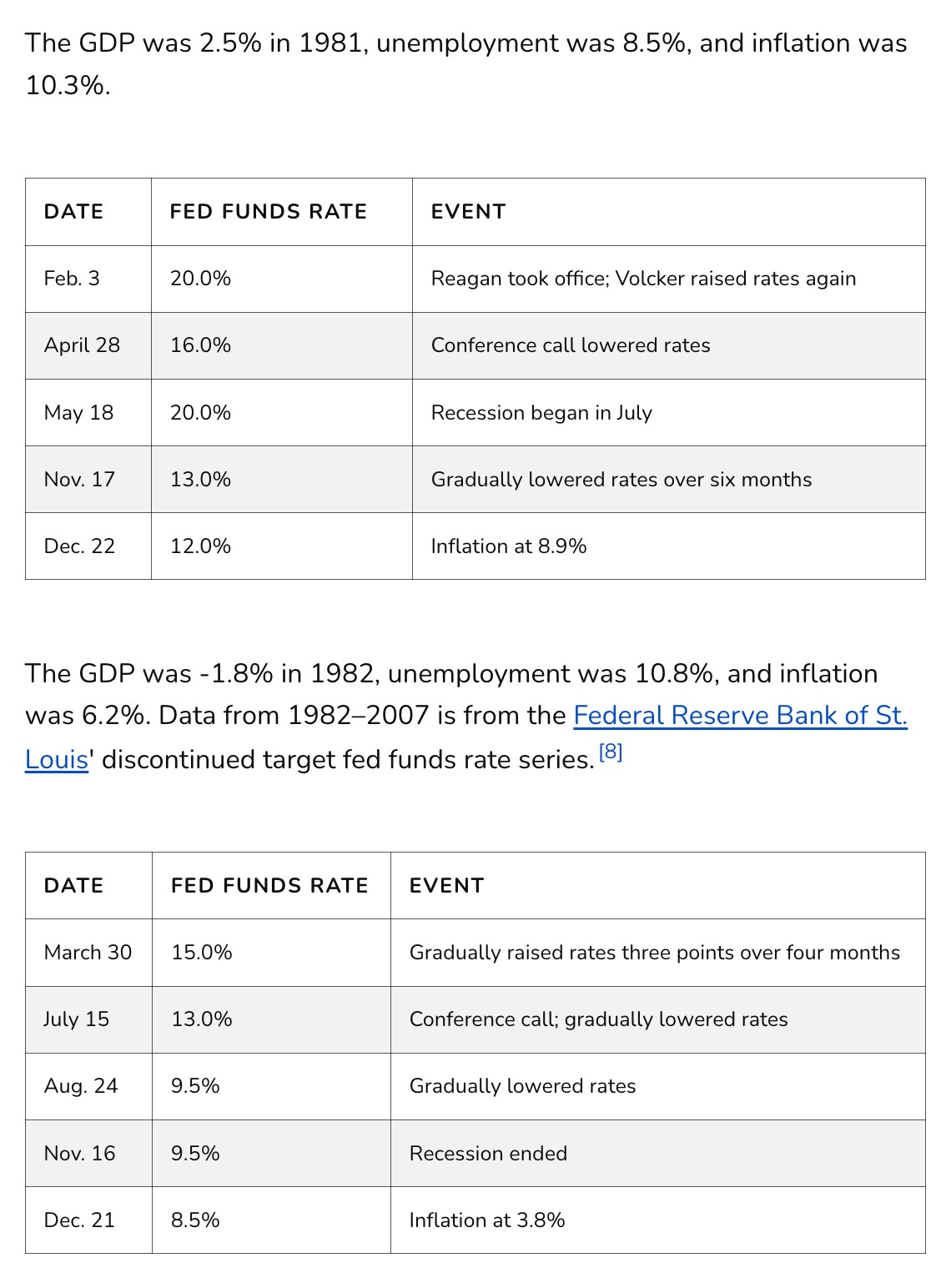

Volcker was “blessed” by the overall actions of President Ronald Reagan, Treasury Secretary Donald Regan and the United States Congress. He knew the fight was to bring inflation down but in reality, Volcker understood that the real problem was a stickier one, “stagflation”. Because the Reagan administration was able to fund the middle and lower class with a tax cut, Volcker was able to solve both problems. In today’s world, although I have the utmost respect for Jerome Powell he does not have the same tools as did Paul Volcker. He has a “stagflation” fight on his hands but the ability to lower taxes and preserve the middle and lower class economic structure is just not available.

In short, get used to “stagflation” being the true reason behind what the problem is in in today’s world. No one ever knows whether stocks are going to head higher or crash. We do have the ability to look backwards into “history” and see that different ways to treat the problem exists. What we can’t determine in this case is if we are treating the problem correctly. My best assessment is that “stagflation” is here to stay and that it is the primary problem Powell needs to deal with. So far, keeping interest rates higher and milking money supply out of the economic system, works. In any case it is going to take time and at best these markets are going to become a bit more “rangebound”. That suits me well. How about you?

Not much new on this side. I did pick up a couple more 2024 May Copper contracts and will hold them and everything else as this all plays out. Courses are done and I am waiting on the UPS driver to deliver my book. You have all been great waiting for me to go “public” with everything. Soon, I promise and I trust you will like the results.

Do you remember “Poltergeist - The Other Side”. As stated therein, “They’re Back” and from what I see they are, especially the “stagflation” problem. Look, history left unchecked will repeat itself. All of the criteria were in place in the 1970s and once again apparent post COVID-19. It happens, get used to it and quit thinking that we have the ability to cure it any faster than we did prior. Are interest rates eventually going to come down, yes. Is the U.S. Dollar eventually going to weaken, yes. More than likely gold is going higher so I’m patient. You are too waiting for me to get my product out. I hope you are as patient as I am investment wise and happy to just sit back and wait.