The best teacher is experience. With more than 55 years of “hands on” experience in this industry the best teacher I’ve had is learning from my mistakes. Losses are going to happen. Appreciate them when they do as they’re the best learning tool you’ll have. That being said let’s dig into a “short term” trading method I utilize with the existing positions I hold, how to identify them and how they benefit you in the “long term” too.

Spikes Are Your Friend

I don’t trade in the “short term” often but as discussed, when an opportunity presents itself I act. Normally it’s available to me as I monitor the major positions I hold. In my book “The Trader’s Bible” I highlight monitoring. You should too. Here is what I look for, more often than not, as a guideline with respect to active positions.

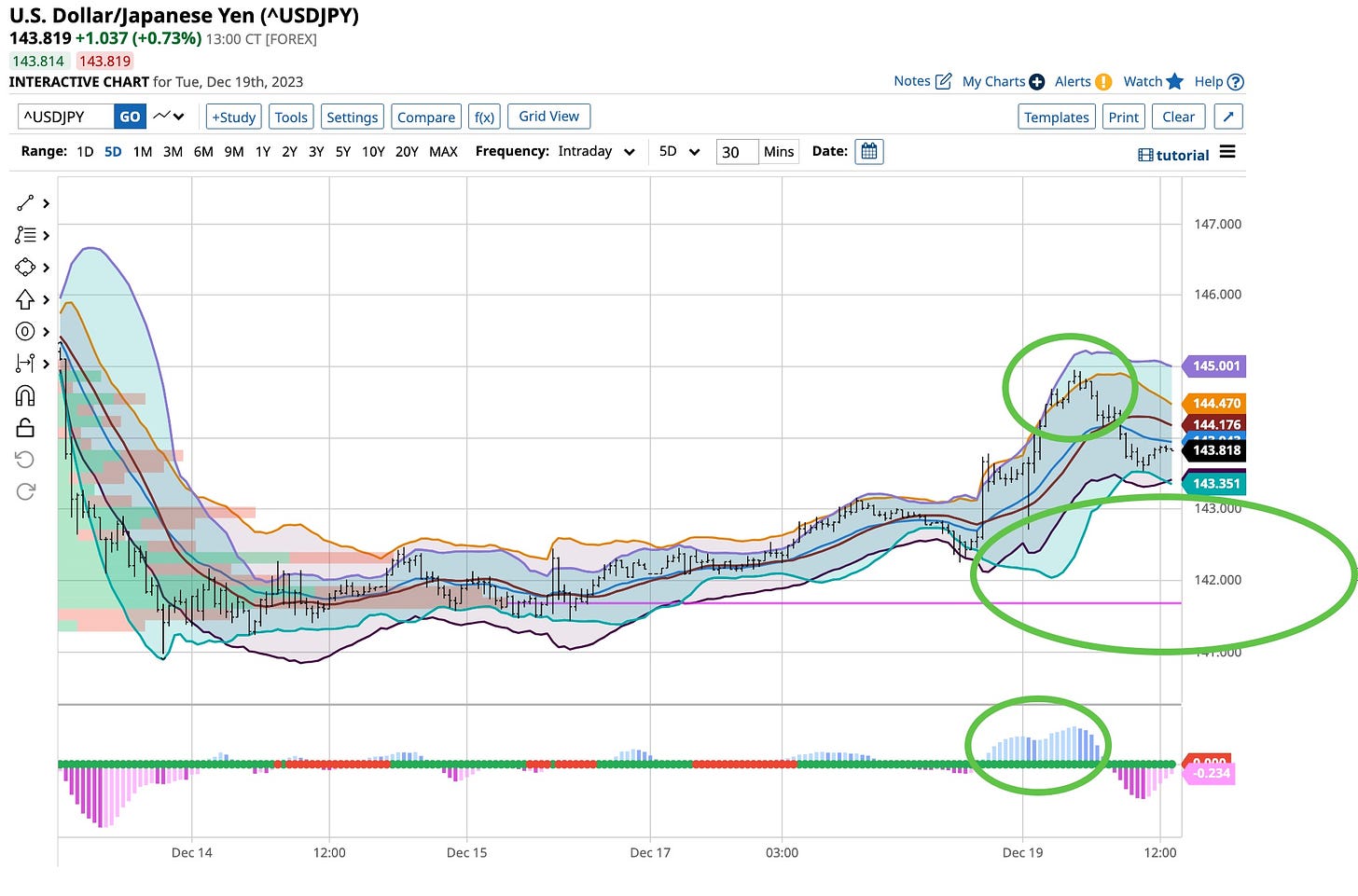

Earlier today I summarized Japan’s monetary decisions and what Governor Ueda had to say. That’s a good place to start.

I think the Yen is heading back to the 125 level. We got a “break” over the last couple weeks and those patterning their investments and trading on my words should be very happy. I know I am.

I talked about Japan’s then upcoming decision and my expectations were met; Japan left the rate unchanged but Governor Ueda’s statements told a big story of “changing” times. I listened and if you had as well you would have acted as I did.

When the rate announcement was made, everybody and their brother and sister, the “herd” as we know them thought the worst was over and the Yen was going to reverse and head back to the 150 level. Thank you “herd”, you’ve given me an opportunity to add to my position and that’s exactly what I did albeit further into the 2024 framework.

Looking at the above chart, the short term Yen bounced above the 145 level then Ueda took to the airwaves. Guess what happened? That’s right, like always the “herd” was on the wrong side of history and the upside trend basically disappeared.

Given my years of experience, after a drought in watching the major indices run much higher for all of the wrong reasons, they’re on my radar screen again . My “indicator” is higher prices in the major indices together with an increasing “VIX”. I’m long the March 17 VIX calls so I’m ready for a change in direction as are many who think the “herd” is wrong like it usually is.

Wicks & Candles & Spikes Oh My

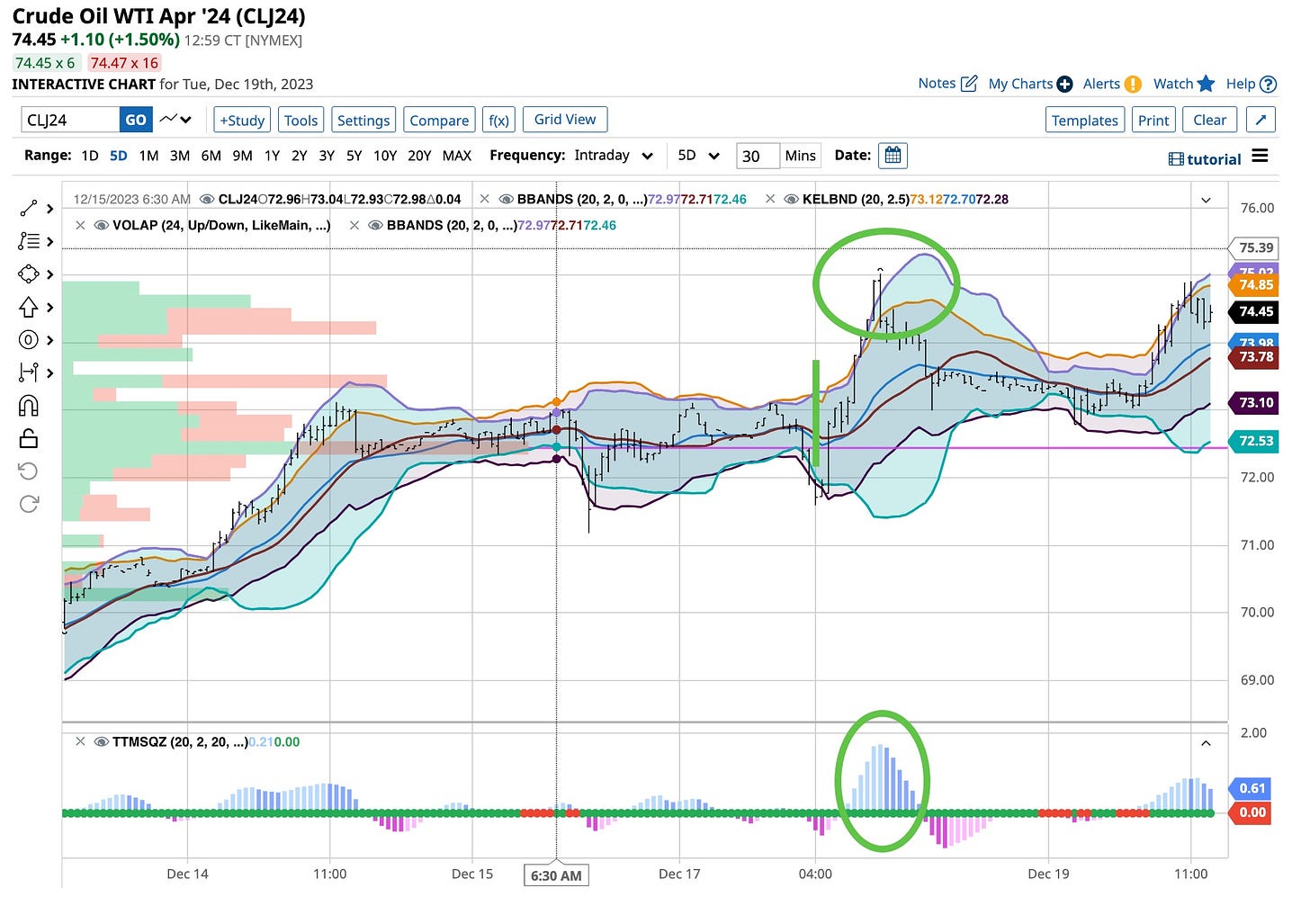

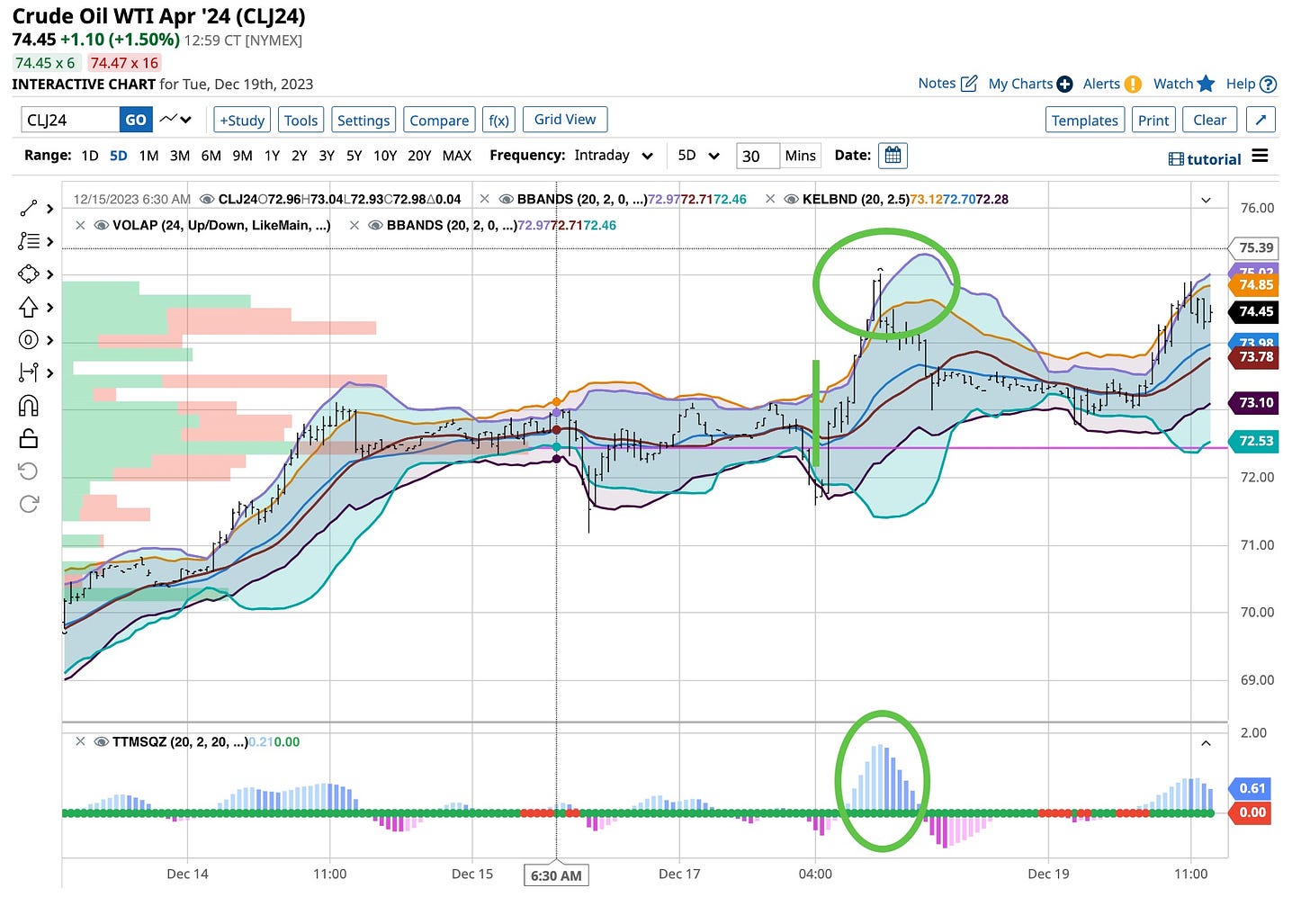

You would think a move on the Yen as experienced was enough but in reality it was my “second” move. Over the weekend I noticed that the energy complex was getting a bit more active. I’ve been a believer in going against the “herd” for years. As the price of WTI declined and everyone predicted it would go lower I bought up the 2024 WTI July 85 calls like there was no tomorrow. I’m “large” in the contract with an average price below $1.00 a contract. Not too shabby, eh?

For weeks, since the problems in the Middle East emerged I’ve been talking about the Strait of Hormuz. While my overall thoughts were correct I was a little off course with my direction. I forgot about the Bab-el-Mandeb between Yemen and Northern Africa but the world as we know it did not. Silly me but like everyone else, I learn every day. You should too.

The news surrounding this area just took on a life of its own. International oil tankers and many other vessels were coming under attack by the Iranian-backed Houthis. The Red Sea became a “no-go” zone for shipping. The price of WTI oil skyrocketed higher once the word got out. Here we go again with the “herd” folks. Listen. look and learn as it’s not the last time you’ll see this type of pattern, especially at the beginning of a holiday week.

Oil spiked overnight but that was expected. It was very hard to exit 10% of my option position when that happened but I never figured I’d buy them back at a “discount” at the end of the day. It happens, I’ll call it luck and as I’ve said, the harder I work I find the luckier I get. Two ears and two eyes work. You need to know what you’re looking for and not be afraid to “pull the trigger” when it happens.

So give me those spikes, wicks and candles. I’m ready for them but this experience did not happen overnight. I takes time, it takes reading my first book “The Ticker’s Bible” as well as following me on Substack and LinkedIn. I’m not always right but as a hedge trader I seldom get hurt.

Back to the Udemy courses. It’s all coming together from this end. There’s so much to teach and so little time to do it. Remember, learning how to invest and trade the “right way” takes time; it’s a marathon not a sprint.

Back at you with an old time favorite, R.E.M. and “It’s The End Of The World As We Know It”. It’s not folks. Sure volcanoes are “erupting” in Iceland but Iceland can deal with it. We have problems around the globe but more than likely with a more forceful administration we can handle it. Lower prices, well I’m not so sure of that. People are still spending tomorrow’s dollars, oil and transportation costs remain the target and there’s no end in sight to our immigration problem. Take a stand and make your voice heard and vote. The future is your choice. Let’s make the “right”one.