Again, a busy couple of weeks ahead of me as a client is opening a new franchise and I’m doing my best to get The Ticker up and running. Then there’s the better half who is ready to file taxes so I’ll be brief but concurrent with my plan.

Trailing Stops Work

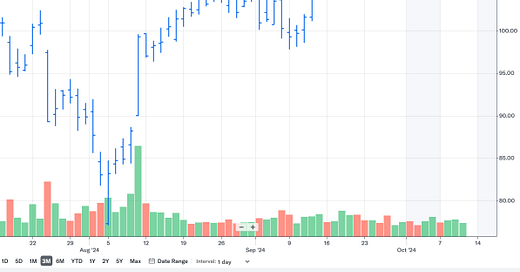

Just a couple of examples here, but rest assured, there are more. The first one is one of my favorites, the Trade Group (“TTD”), where I have an average cost of about $85. It’s my second entry into this stock. I made a killing post-Covid-19 as investors around the world discovered this one.

It’s a political time, and they are well geared up to take advantage of it. Are you on the streaming side of the television explosion? I am and the Trade Group is what I would call the leader in its field. I’ve got trailing stops on this one but I expect it to go higher so they are not close to the current price.

Then there’s the JP Morgan influence. A while back, their analysts took a broad look at the defense industry and came up with one stock, Lockheed Martin (“LMT”). While I have an affinity for JP Morgan, I’m not one to always do what they say. In this case, I took down a bunch of shares based on their recommendation. I am up more than 33%, and happy with trailing stops that lock in a 25% gain.

Time On My Side

Again, some things never change. I’ll put time on my side as often as possible. Sure, from time to time, I’ll jump on a few long call option hedges, but my heart lies in the obvious, option premiums disappear.

I like to sell naked put options below current market prices. It’s a great way to pick up a few shares if the trend goes against me. If not, I just add the premium received to my overall upside.

I do the same on the upside. Once I’ve accumulated a few shares, I’m always looking for ways to increase my return. Selling covered calls is a great way to accomplish that. I’ve done it to perfection with LMT and TTD and look forward to using this strategy across the board.

Stick To Your Plan

When it comes down to it, with The Ticker’s fundamental, brick, and mortar strategy of investing and trading the “right way,” we’ve been able to teach what we preach. I’ve had a good time sharing these thoughts with you here on Substack and LinkedIn and more is coming together on The Ticker. Stay tuned, and thanks for waiting.

I can’t begin to count the number of times I’ve seen James Taylor live. CSN is still my most often attended concert but Taylor is close. The secret of life is taking advantage of the passage of time. I enjoy it as option premius disappear. It’s a given and just as certain as death and taxes. When the markets are volatile, premiums expand. Keep in mind that the “herd” is usually wrong. Take advantage of their lack of timing and sell when they buy and buy when they sell.