This weekend is special to me but I’ll leave those thoughts for Sunday. This week did turn out as expected and I hope all of you enjoyed doing something else. I caught up on my reading and listening, both of which sent a mixed message as expected.

Trump took to the Bronx. Whether he’ll have the same effect as Ronald Reagan did in 1980 remains to be seen but it was nice to see some “unity” for a change. It makes no difference to me what color your skin is, a distinctly different tone than what a few of my ancestors believed. Change is important but it takes time. Everything good takes time, remember that.

What I’m Looking At

Nothing has changed in this portion of my world, it just got a week older. It’s expected this week but the next couple weeks could very well be different. Stock portfolio-wise, a couple of “covered” options expired worthless and they were replaced with a similar set of two to four-month calls as summer is upon us. Here in Texas temperatures are rising and the days are getting longer. Good thing there’s air conditioning, eh?

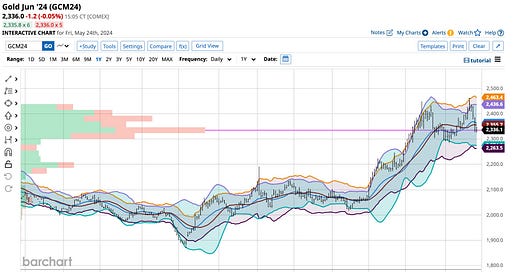

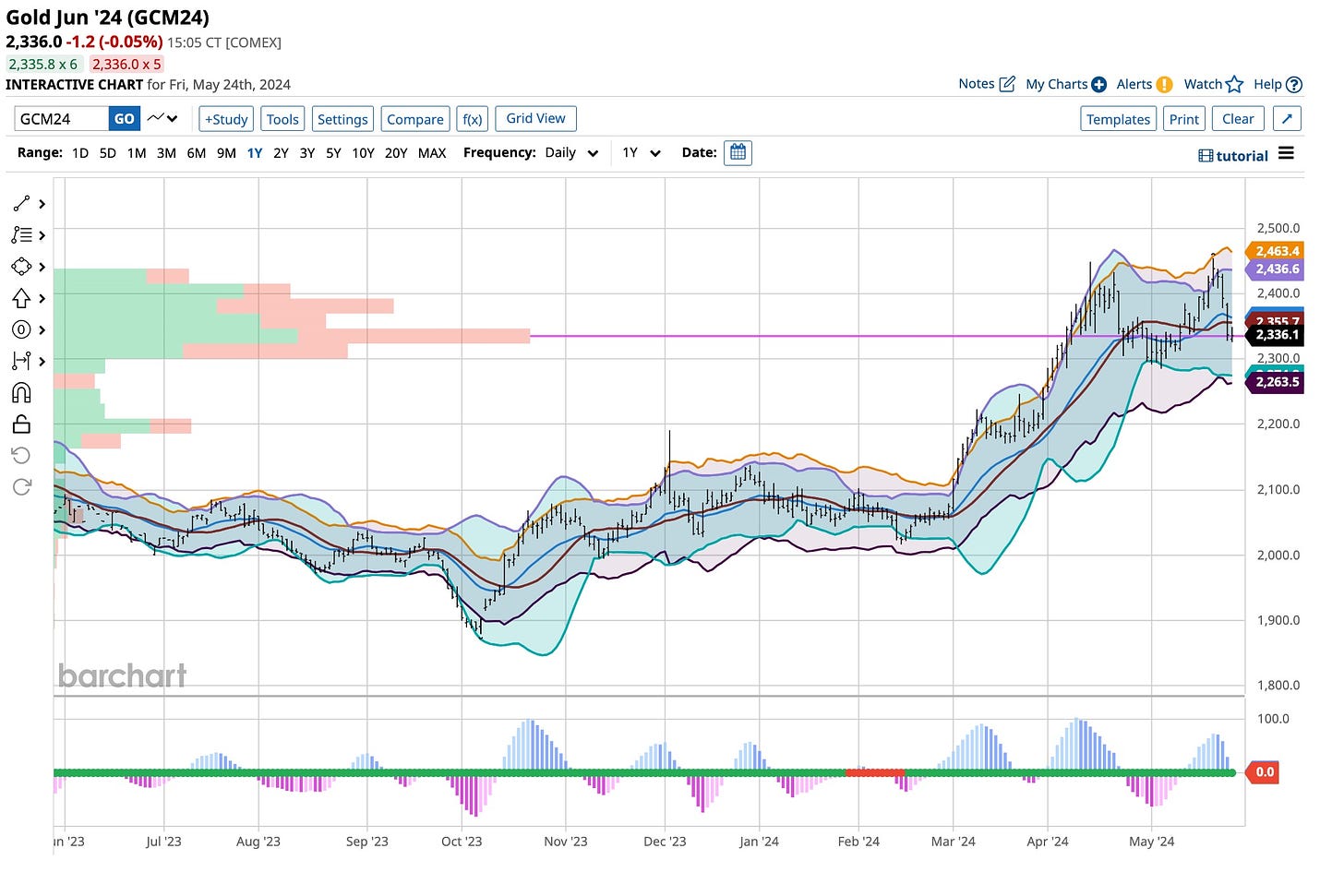

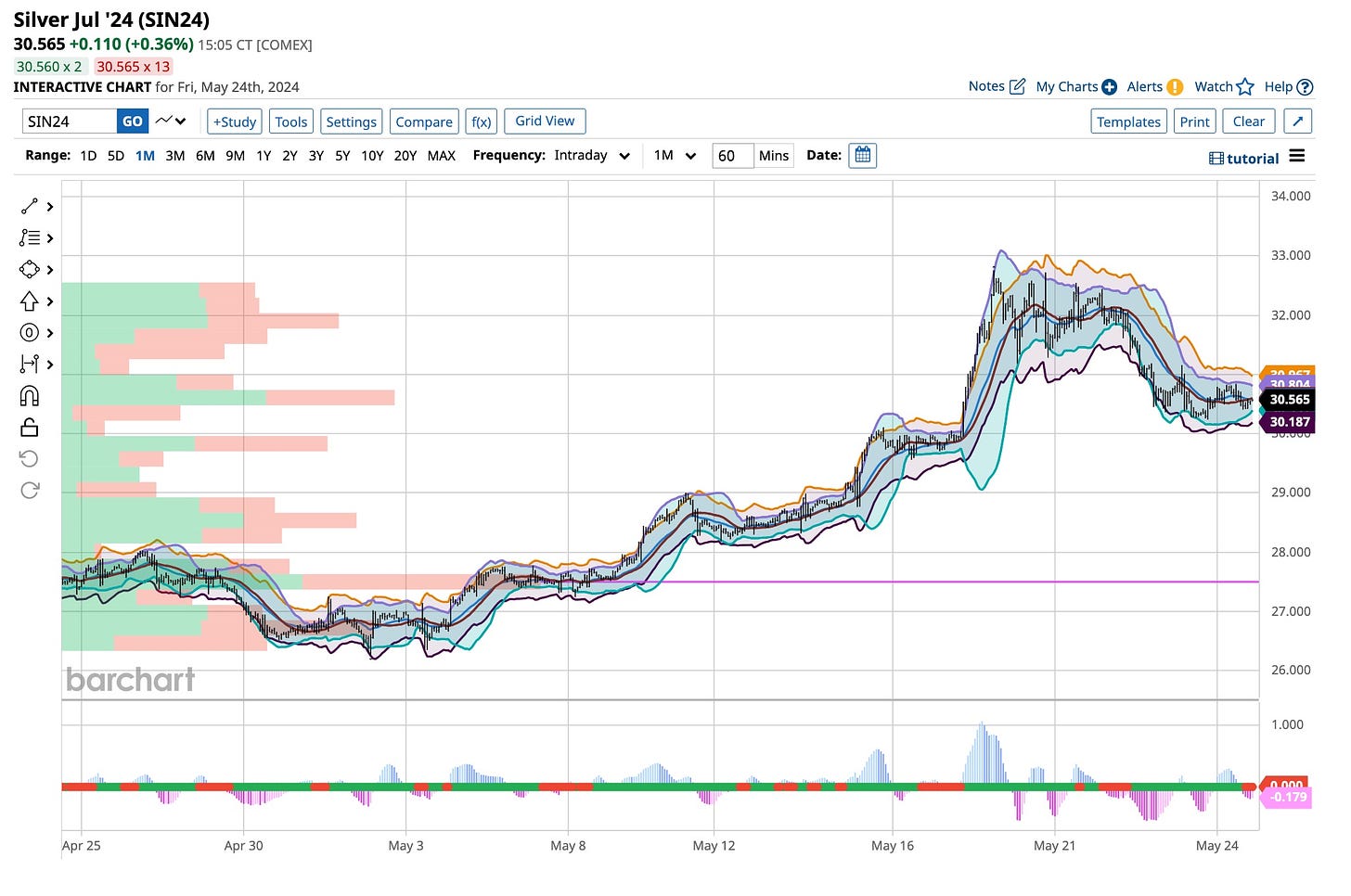

The metals reached their apex and consolidated. That’s a good thing as nothing goes up forever. Many investors and traders remain negative on the name-brand metals but that’s always the case. From what they preach, the Federal Reserve needs to take rates higher but they remain in the minority. The timing for a reduction in rates appears to be later than not but we’ve endured this premise for months if not years. I do not have a functional “crystal ball” so I’ll just sit back, watch and wait.

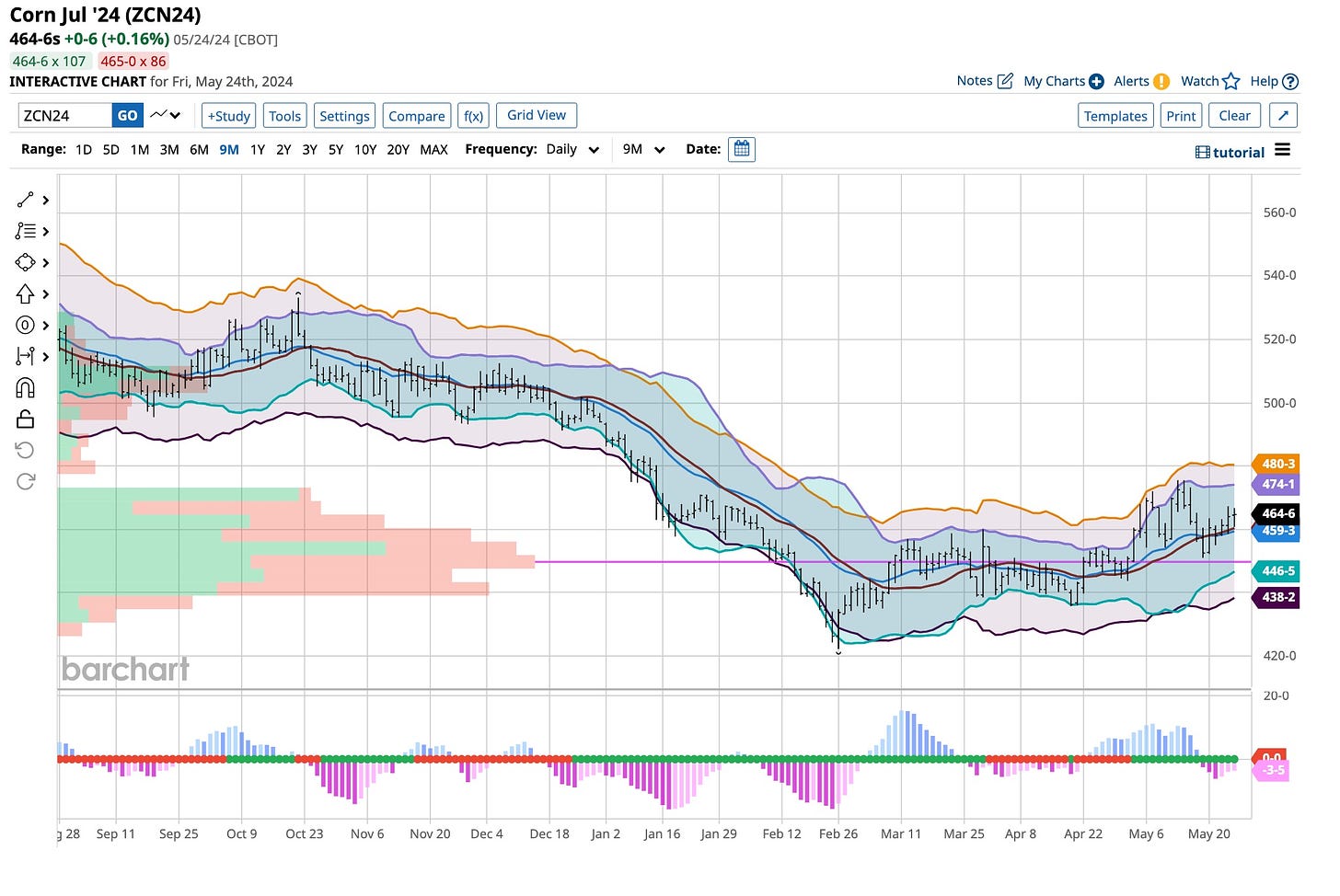

Being a seasonal trader and hedger it’s the time of year when most grains become just targets of my attention, especially corn. The planting season is behind us now it’s time to follow their growth, exactly how much Ethanol is being produced and what’s being exported. It’s a numbers game augmented by “paid” research. It’s not cheap but in my world, especially in the corn markets, it’s essential. It’s not information I can share on a direct basis but you’ll know the actions I take in my posts. For now, I’m long corn.

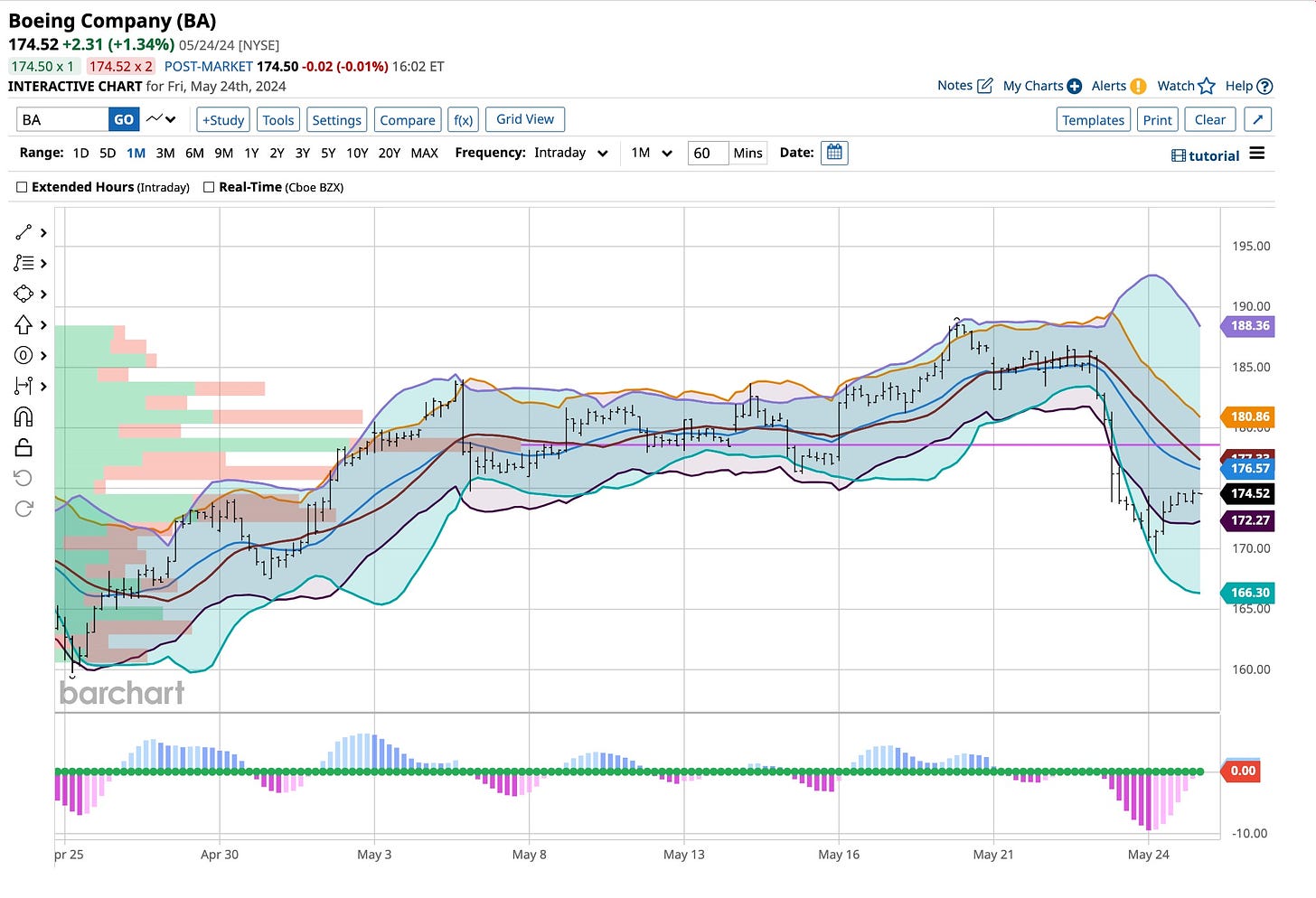

My interest in Boeing only grows. Part of me wants it to go lower before it goes higher but that’s me. I have lots of firepower in the Roth IRA accounts I manage. If the stock heads lower I’ll be forced to buy more as my naked put options get exercised. That is a good thing but remember, I have cash reserves, almost 15% of the portfolio, earning a cool 5%+ just waiting to be put to use. Consistency and balance work.

Otherwise, there is more especially when it comes to “what’s next” but you are going to have to wait for that until we’re done enjoying our Memorial Day cookout. Nothing has changed dramatically but it’s not “easy” to drill that into most heads. Summer is a time to sit back, watch, and listen for what the later months will bring. The Hamptons will be busy as will the seashores but that’s where the “big boys” on the “street” head. Lots of news comes from their vacation spots so I’ll have my ears open.

My Dad would celebrate his 96th birthday today. It’s hard for me to believe that he last graced this earth almost ten years ago. I think about him every day. That “saxophone” and “licorice stick” play on as he was always recording something. I’ve held on to the 2004 Lexus LS430 we shared because it has a functioning cassette deck. Sometimes I’ll just sit in the garage and listen to the big bands, piano players, and jazz he recorded. Dad made decisions in his life that made my life better and were detrimental to his own. I guess we all do that but when I play recordings of our annual holiday parties I can see what he was meant to be; a musician with a heart of gold. Love you, Dad.