One of the primary benefits I bring to you is that it’s “better to keep mouth shut and let it be thought a fool than to open mouth and leave no doubt”. Words of wisdom my Dad embedded into me and the ones I follow. Other than watching Joe Biden’s press conference tonight, little has changed.

That being said remember it’s summer. The herd-seeking prognosticators are talking about their “no-miss” strategies. Half think the indices are going higher. Half think it is headed south. Flip a coin but remember, this market’s alive, like The Ticker, it has a heartbeat. On Sunday I’ll update our positions as there has been a couple of changes. I see where basic hedging is required as we get closer to Labor Day, but that will be the case regardless, so read my thoughts.

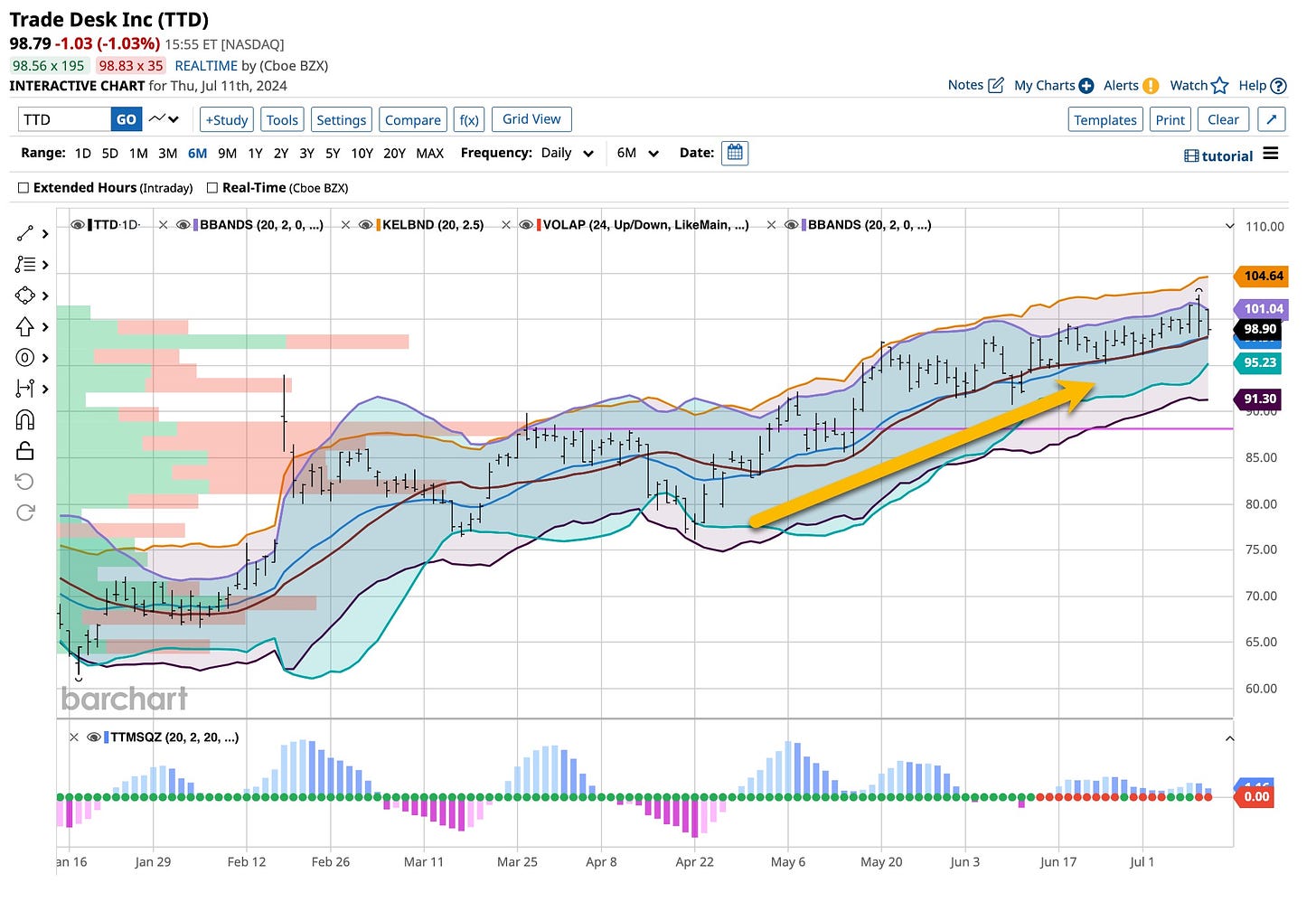

My TTD Investment

I have an affinity for “The Trade Desk” and have been on board this industry for years. As a long-term advertiser and “watcher” of what I call television, it just makes sense. I have watched this market grow with TTD taking share from Google, something that is going to continue.

I have tried to kick off a couple of marketing campaigns with TTD but I do not qualify as I’m just too small and their major clients have not been interested in my offerings. I am starting to see that change, a big inference to me. If TTD and its major clients turn their attention to users like me, floodgates will break open. That’s why I’m on board.

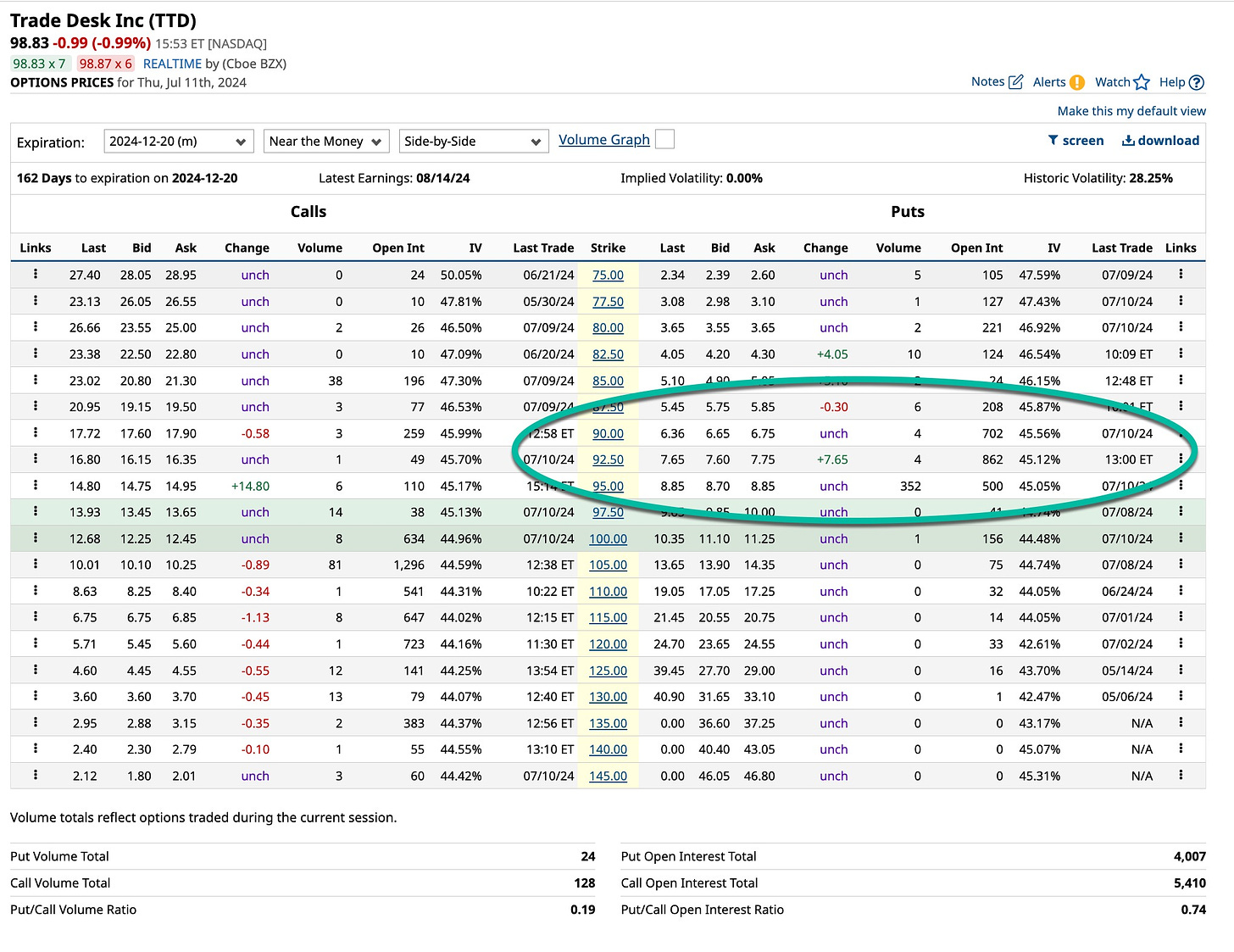

I’m doing my basics after accumulating a significant position a while back. I’m selling naked puts, primarily in the 2024 December put series, and buying shares on dips. It’s a little difficult to buy shares as there are quite a few “analysts” who agree with what I’m witnessing.

There’s Gold In Major Miners

History is the best teacher. I remember when “Volcker” righted a sinking ship back in the 1980s. I remember when hedge funds were just that. The operators would ‘buy’ the best of breed and ‘sell’ the laggards. In today’s far too “speculative” world, a couple of prognosticators say it’s time to buy the miners. I respectfully disagree.

The second and third-tier miners have been just that for years, latecomers. They can’t monetize their assets. The big boys can as diversification and corporate management are important. The second and third-tier entities will make money as precious metals go higher but then what? If they act as they did in the past their stock prices will hit a “glass ceiling” as they turn their payoffs into cash that benefits shareholders. In other words, they are going to take care of their own like they always have.

If you have watched this thread you’ve seen me make more than 50% of silver futures. I prefer buying the base metal, not those that mine it. I’m a long-term hedger in gold and will reduce my holdings as the precious “metal” hits higher prices but I’ll always hold 5% in my accounts. It just makes sense as you never know what the future brings.

On the profit-oriented side, I’m back in Silver, counting today’s upside, my trade is up about 10%. I’ve added selling 2024 December put options and I am using the proceeds to buy December 2024 out-of-the-money call options. Interest rates have to come a bit or Powell is going to be faced with a real recession. AI is starting to have a real effect on the unemployment rate and it’s only going to continue.

See You Sunday

It’s summer. You hear a little less from me as I don’t want to bore you even though I am a little more boring than not. I’m consistent and those following me understand I practice what I preach, patience. I have a plan and I stick to it. You should too.

In 1970 Mungo Jerry released “In The Summertime”. His message was clear then and it is clearer today. People go away during the summer. From the continent to the rest of the world traders and investors take vacations. I do to a degree but with my AI and related tools I don’t miss a trick. The simple fact, is there are fewer “tricks” to report on. Life goes on, it’s just a little slower. That’s fine with me and should be for you too. It’s OK to take a break. It’s often better to do nothing, a plan we follow. Seasons often change but if sitting on your hands is part of your plan, enjoy summer and get ready for the fall and winter.