When it comes to writing, reading and fervently listening to others I look for what I’ll call “consistency”. It’s important when it comes to picking who, what and when I look for their opinions and offerings. I realize that whomever is posting, speaking or just putting forth their ideas will be wrong from time to time. That’s expected and what I look for. I trust you are doing the same.

Over the early part of 2024 some of my own thoughts are indicative of what I look for. Face it folks, as I have often related to you, “do your own due diligence”. I am far from being perfect and it shows; nonetheless I am consistent.

What’s Stayed The Same

I am still a long term position trader, a hedger in nature and that is not going to vary. I am long anything the government puts out from bills to bonds. I’m a firm believer the U.S. Dollar will decline in value versus the Japanese Yen for several reasons, all stated clearly in past articles, they have not changed. My gold bullion holdings will remain in place in my portfolio as I’m looking for higher prices in gold to sell into. Patience is a virtue and I practice it, usually but sometimes I move a little too fast.

I’m buying up higher dividend paying stocks in favored industries as well as securities that were “taken out to the woodshed” last year. There’s a couple more that have “hit ‘ my radar screen. I’ll speak about them over the weekend in my “paid’ for article but know, I’m always going to look for this type of value. What about you? What are you looking at? Let me know as everyone’s opinion is valuable.

Where I Failed

I guess that takes into consideration the title of today’s article. I am far from perfect; that’s a good thing. That’s why I don’t follow random posters on Facebook, Instagram and especially TikTok. I consider most of them to be a “flash in the pan” as they only appear when they are right. If they were always right they would not have the time or the need to post.

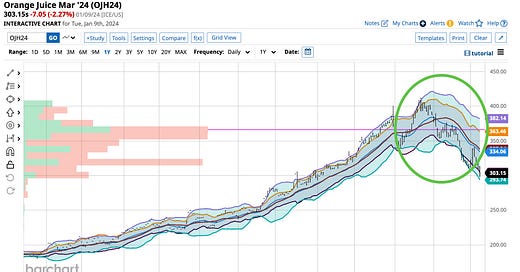

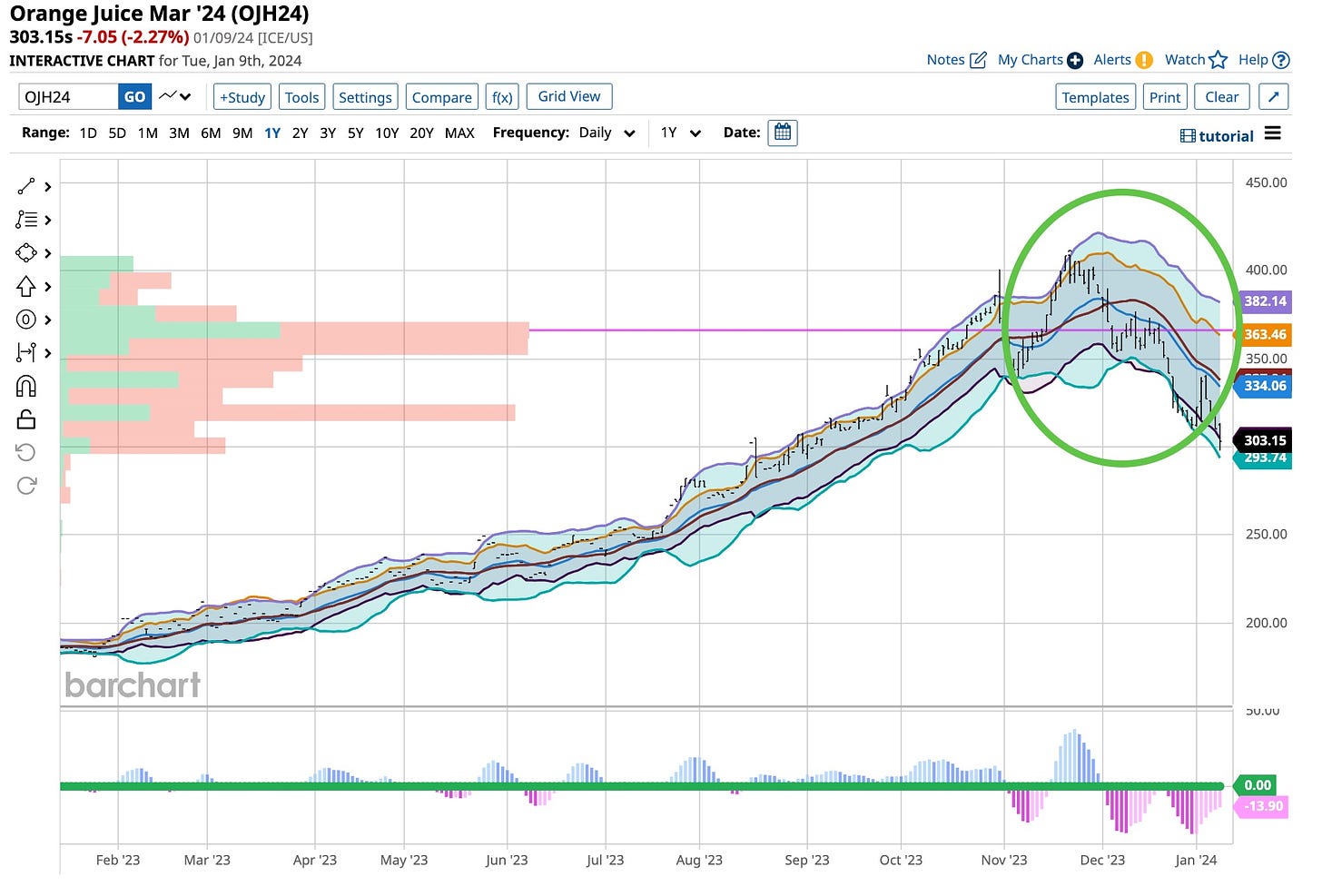

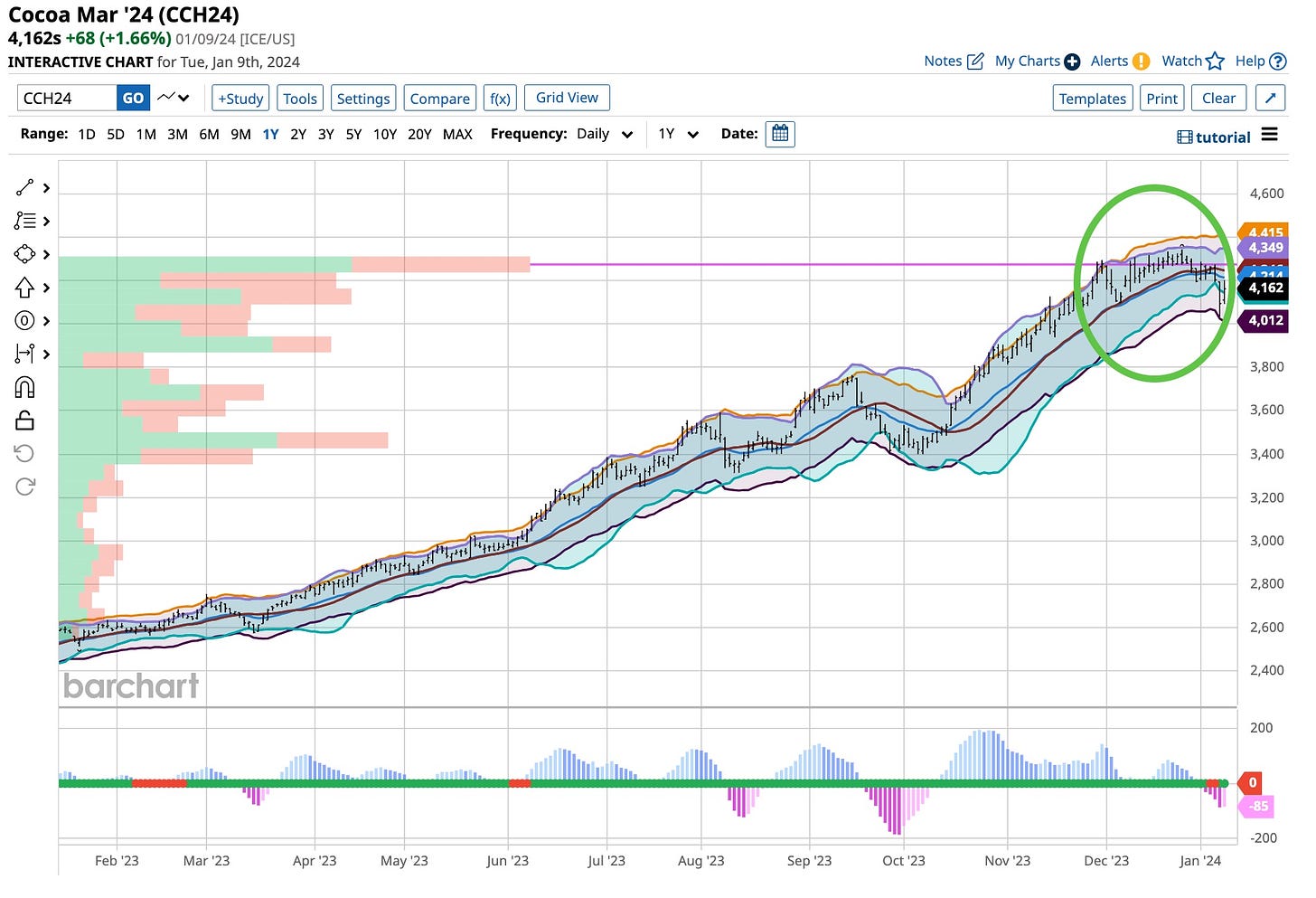

I was too soon to get out of the Orange Juice and Cocoa trade. Oops, I’m human and I should have stayed longer but I remained consistent with my trading philosophy, I use trailing stops and after an initial profit I was stopped out of both. It happens but as I preach, “you will never go broke taking a profit”.

So shoot me. It’s good to be wrong from time to time. I had been watching both and I saw the downside, I was just too “chicken” to hang in there even after Sugar showed a downward move was well on its way.

What bothers me more than not was my move out of oil into the VIX calls. Yes, I’m still buying the 2024 June VIX 18 calls at a lower level than prior. As Allan Meltzer, my dear professor, friend and mentor often said, ”what a fool I’ve been”. Now Allan only said that when a student made an “absolutely incorrect averment” in his class and he did it in a way to teach. Well let me teach you something. I never should have looked at the volatility index. I should have been happy to move away from oil and stick with my positions. Saudi Arabia proved me right on my oil call and they set the stage for how future price changes in the price of oil will happen, internally in the Middle East.

Well you win some and you lose some. Over the next three to six months it seems to me that the VIX will rally and I’ll get out even but for now, it’s a losing position and one I need to manage,

Back to the basics folks. I’m halfway done with the Udemy courses and they are great, if I must say so myself but in reality, since I’m the one putting them together, well you understand, right? Four down and four to go then you will tell me what I missed and a bit about what you like. Until then my best and realize, I’m not always right but I am a very consistent person and will always be.

Now all of you remember Luther Ingram, right? Well I do and it fits today. “If Loving You Is Wrong” I don’t want to be right . . . I do want to be consistent. Think about it, it’s good to be wrong every now and then. Everybody does it, only those that deny it happens are the ones to be wary of. Consistency is important. Risk is “obvious” in all forms of investing. Reducing systemic risk, eliminating the thoughts that push you in wrong directions need be removed. Sometimes it’s just best to “sit on your hands” and do nothing and that’s where I blew it.