See Your Future / Be Your Future

One of the funniest films ever made was “Caddyshack”. Appropriately, at the end of this post I’ve included a short link from the movie. “Future” has many meanings. As it pertains to you or me, it’s your destiny. Investment wise, futures provide an economic tool for business planners first and speculators second; ask yourself what are futures?

Futures contracts are legally binding agreements to “buy”, go long, or “sell”, go short, an underlying, standardized asset in a transaction at a predetermined price and time in the future, usually on a specific date during a specific month. Underlying assets traded through futures contracts include physical commodities, currencies, bonds and stock indices. Futures contracts are often used to hedge against price fluctuations in the underlying asset or to speculate on the future price movements of the asset.

The buying or selling of these financial instruments, through a futures exchange, allows market participants, speculators or hedgers to offset or assume the risk of a price change of an asset over a specific period of time. The intrinsic price of the futures contract is determined by the current supply and demand for that contract and its underlying asset as well as prevailing economic, monetary and political forces.

Futures, since the days of “tulips”, provide the economic marketplace a way to hedge and diversify. Day, swing and scalp traders think futures exchanges were established to meet their needs. Despite rapid growth in futures trading due to these speculatively oriented groups, the basic function of commodities markets has remained consistent with its origin. Futures trading provides a “diversification” benefit for investors along with the ability to viably “hedge” price, supply, delivery and more.

Diversification refers to spreading investment risk across different asset classes or markets. Futures contracts are available on a variety of underlying assets including commodities, currencies, interest rates and equity indices. Futures traders, hedgers and investors are provided with the opportunity to diversify portfolios and reduce the overall event risk of their investments.

Futures contracts are great vehicles for managing different kinds of risk. Companies engaged in foreign trade use futures to manage currency exchange. Money lenders use interest rate futures to maintain or facilitate a level marketplace despite fluctuations inherent in their industry. Using futures increases the inherent efficiencies found in the underlying markets, lowering multiple, unforeseen costs of purchasing or selling most any type of listed underlying asset outright.

Hedging refers to using futures to reduce the risk of an investment. Futures contracts are used to hedge against price movements in underlying assets. A farmer growing certain commodities uses futures contracts to “lock in a price” for their agricultural crop. A manufacturer who uses natural gas to run the factory uses futures to “control and lock in” its energy costs.

Futures contracts are often used to “hedge”, offset risk, as opening positions can be “long” or “short”. The sheer number and variety of actual commodities derived and developed to accomplish this task is vast. Most traders are aware of their ability to execute trades in equity index, debt, metals, energy, currency, agriculture and more. What’s available increases every day. Keep in tune with what’s being created; that’s happening for a solid reason, there’s a demand for it just like there was years ago for tulip bulbs.

The world is changing, further increasing the demand for new commodity contracts to come into existence. Such is the case for Carbon Offsets, a sector that although still on the voluntary side is growing by leaps and bounds. In the case of Carbon Offsets, exchanges are forming to meet these needs. There will always be speculators trading new products like these, but without the need for producers and suppliers being in the marketplace for a hedge-oriented clearinghouse, chances are they would not exist.

EUREX Carbon Emissions

Let’s take a look at one of the latest, newly-minted, technically viable futures contract offered on the EUREX exchange, Carbon Emissions. Face it, climate change whether real or not is here to stay. Valid or not, we should do things that enhance our existence on the only planet we currently inhabit. Wouldn’t it be funny if our reason to populate another planet was due to an “ice age” we created by taking all of the carbon dioxide out of the air. If we fix climate the way we correct economies through regulation and governmental legislation it’s bound to happen.

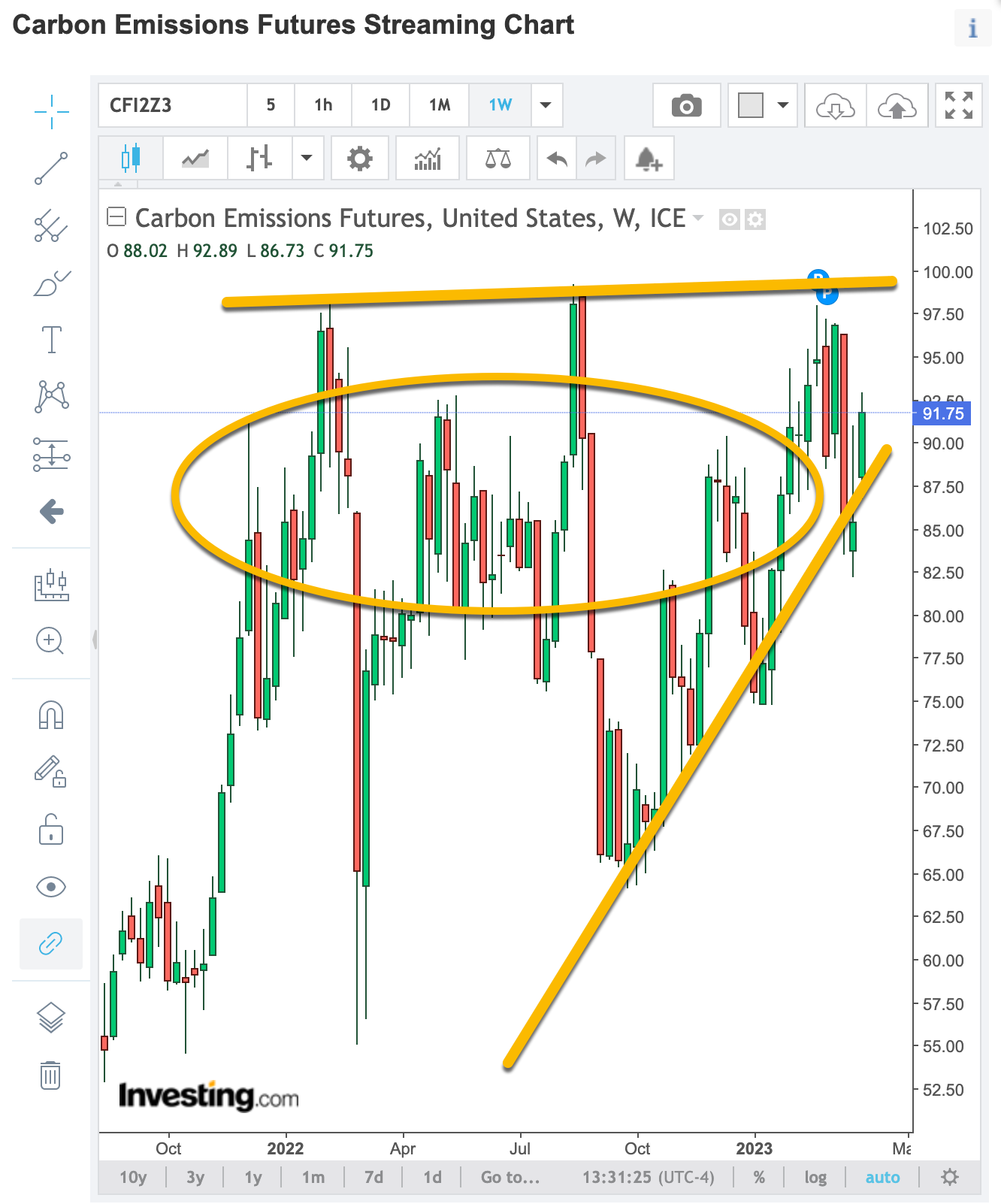

Weekly Carbon Emissions Chart

While I employ “modern” Order Flow technical tools remember, I’m an old timer. Fifty years ago, when I earned my ‘trading stripes’, bar and point-and-figure charts were all we had (not to mention the expertise of technical guru Joe Granville). In the weekly chart an ascending triangle is forming. There is a concentration around the €90 level and resistance around the €100 area. The open interest is increasing on the long side and the underlying currency valuation of the Euro (€ / EUR) versus the dollar is heading higher. The chances of a breakout above €100 is increasing; confirmation will come from continued interest in the contract expanding daily volume.

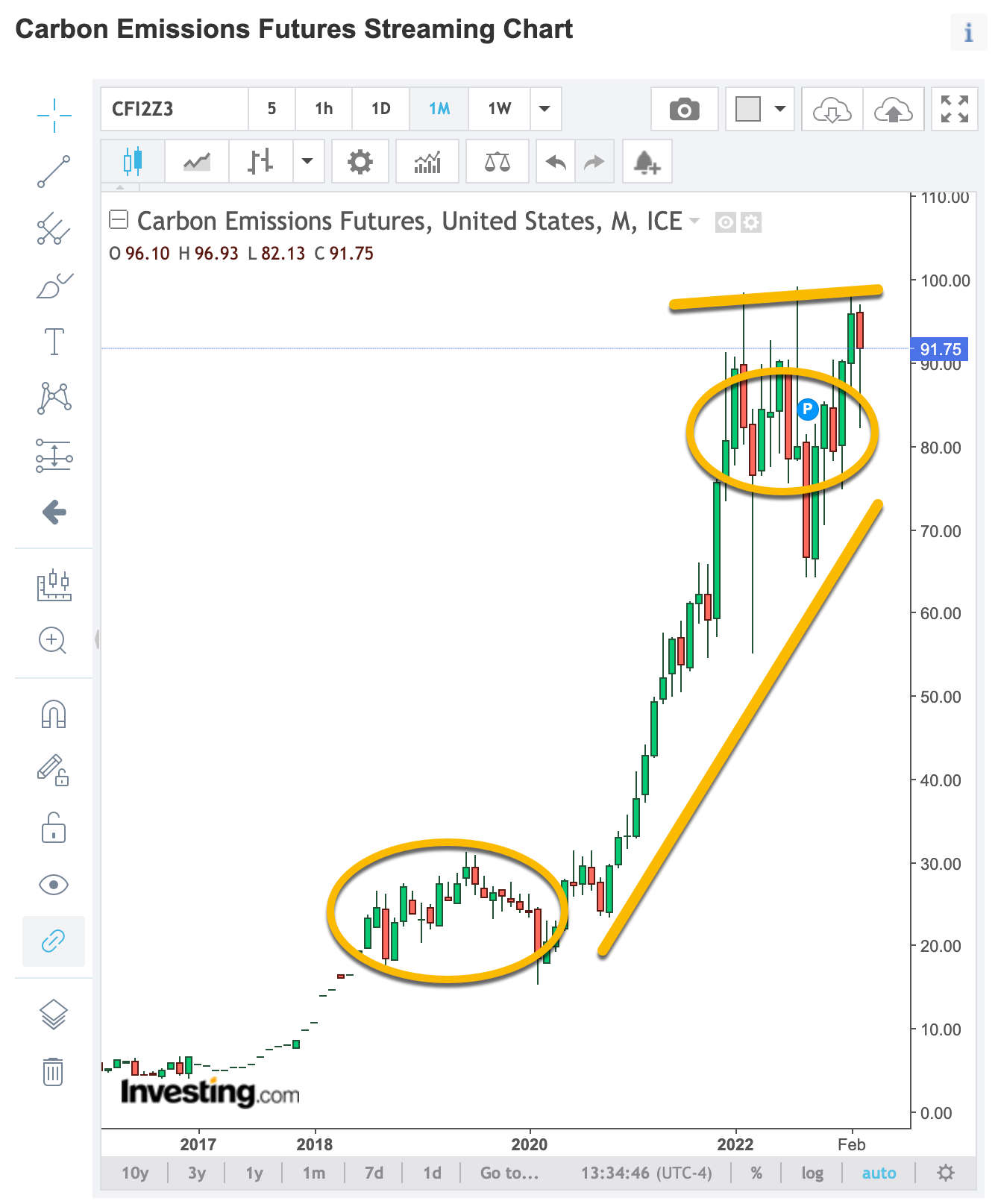

Monthly Carbon Emissions Chart

Newly minted contracts take time to gain notoriety coupling hedger and speculator interest. Remember, corporate hedger participation is currently voluntary. Assuming the “woke” climate changers will continue to proliferate and legislate worldwide, the utilization of Carbon Emissions contract to offset the business risk will exponentially explode.

So there you go; be honest with me, how many of you knew that a Carbon Emissions contract even existed? Fifty-five years after my introduction to futures, at the age of 68 I killed two birds with one stone here today; (1) futures were designed to reduce risks in the marketplace and (2) ancient technical analysis, when applied correctly, is still a viable way to identify futures contracts “unknown” to indices speculators providing an alternative to the ES, NQ, ZN or other trading vehicles the rely upon.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at dzimmer@substack.com so we can further help.

Looking to learn how to trade futures? Want to trade futures with someone else’s money? Click here https://blusky.pro/?via=david and find out why everyone is talking about The U.S-based BluSky Trading Company.