In today’s trading environment, tools of the past century are often “lost in the sauce” of modern technical tools. Day, scalp and swing traders pay close attention to every tick and their related patterns to enter and exit trades. Being a Position Trader, there are primary tools we rely upon to first determine the long term direction of markets we trade. Understand that when it’s time to enter a trade, we use the same dynamic “Order Flow” tools all traders use; we just don’t trade as often as they do.

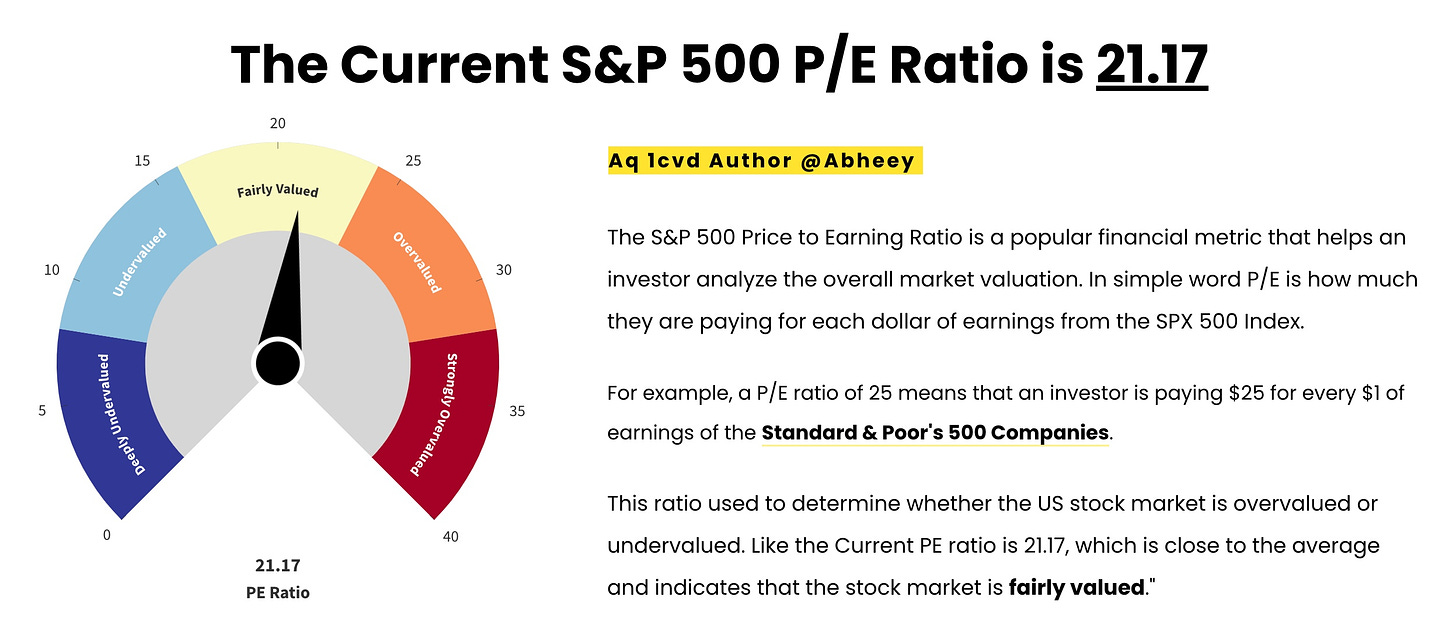

When looking at the worldwide macroeconomic environment, one of the tools we use is the S&P 500 P/E ratio. Right now the ratio suggests we are “Fairly Valued”. When the COVID-19 pandemic took flight in the first quarter of 2020 the ratio was “Deeply Undervalued” and we turned bullish. In October 2021, after every Tom, Dick & Harry became expert traders due to Robinhood and the likes appearing, the ratio became “Deeply Overvalued” and we turned bearish. We’re still there.

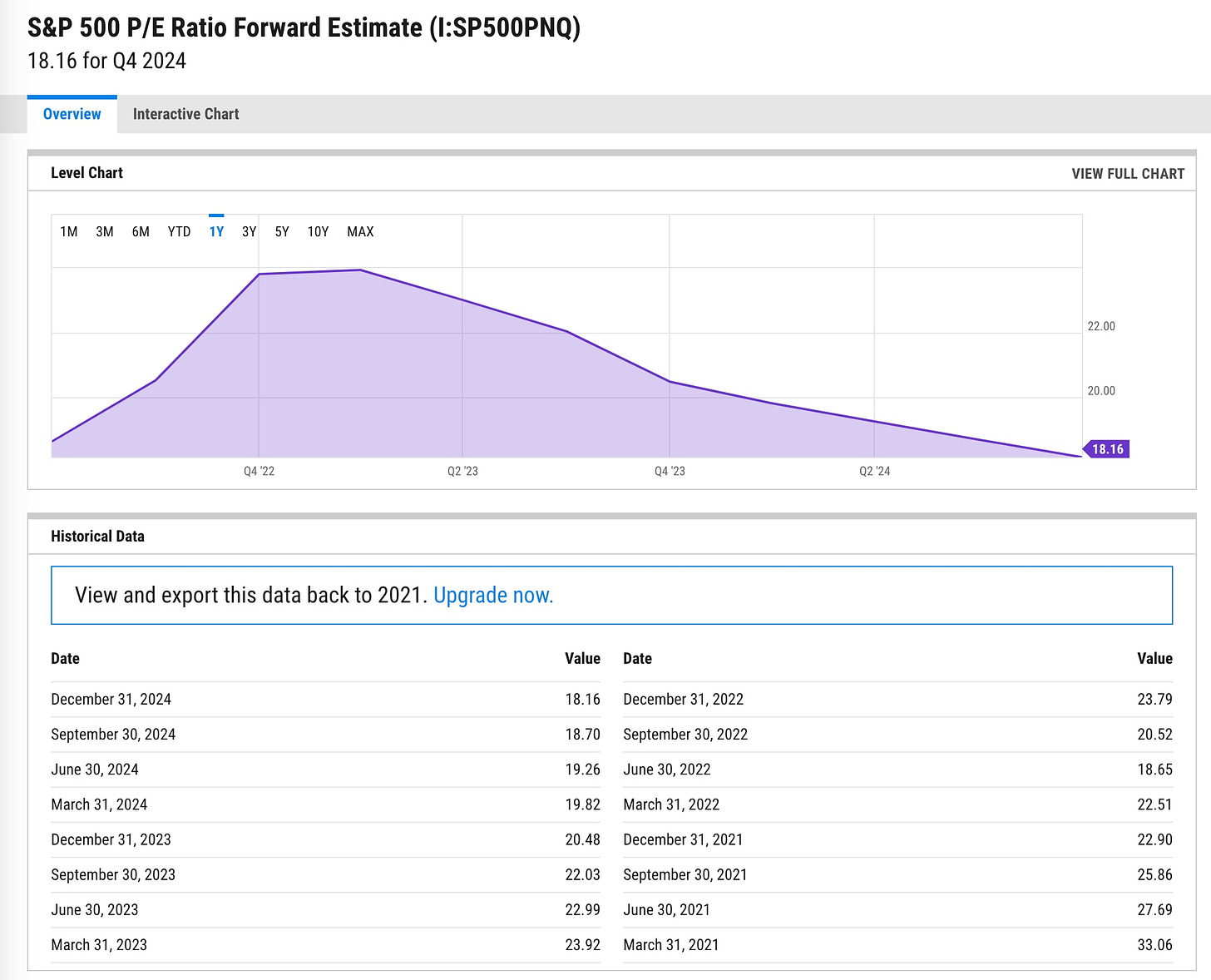

One of the reasons for remaining bearish is the S&P 500 P/E Ratio Forward Estimate. Upon first glance it may appear that this number suggest we are heading towards the “undervalued’ segment of the curve, a correct observation but there’s more to this static number than meets the eye. The question becomes how undervalued we’ll get.

We are about to enter “earnings season” and the numbers are about to change. We expect earnings to disappoint. Keep in mind that estimates have been reduced by the big brokerage firms. This allows corporations reporting to “beat their numbers” but once reported the effect on the forward ratio will remain negative; reported earnings reflect a static number that when calculated doesn’t take into consideration the prior reduced estimates were exceeded. They are just lower.

We next believe that forecasts, forward statements of reporting corporations will be negative. We’ve all been patiently waiting for the ‘recession’ to start and without the shenanigans of the Biden administration and the Federal Reserve as related to the latest banking crisis, it would have happened. But there’s no hiding from the effect of higher interest rates, drained liquidity and more worldwide chaos going forward. With that in mind we’re looking for the ratios to slip further.

Are they going to hit numbers seen during the pandemic; perhaps and if they do we’ll be back on the bullish side. Could they drop below those levels, yes and that’s why we remain bearish, taking advantage of short term “the worst is over”scenarios”. When those patterns appear we “short the upside wick”. in other words, when the markets go up parabolically, usually intraday, we’re going to open a short position. Unlike most of you we’re probably going to hold that position for more than 15 minutes, quite often overnight or longer. Sure, we use the same tools as you to enter and exit the trade; we just don’t trade as often.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at dzimmer@substack.com so we can further help.

Looking to learn how to trade futures? Want to trade futures with someone else’s money? Click here https://blusky.pro/?via=david and find out why everyone is talking about The U.S-based BluSky Trading Company.