It’s hard for me to believe that The Ticker started posting on Substack over a year ago. LinkedIn articles started around twelve months ago and now tens of thousands of you are “following” what’s written. I’m flattered and thankful.

It’s always been my objective to “give back” to everyone my 55+ years of experience in the securities industry. It takes time to determine exactly how to do that as learning to do anything the “right way” is difficult. We’ve had many thoughts over the last month or two about developing the best way to kick this off. We’re close and thank you all for your patience.

Recent Thoughts & Actions

Late last week and over the weekend what I call a “crystal ball” started to clear. I even thought about going back to Provincetown, Massachusetts to get my Tarot Cards read one more time but not everyone believes they are accurate. In today’s world, nothing’s 100% accurate but that’s a discussion for another day.

We keep our eyes and ears on twelve to fifteen factors, fundamental elements, to keep our bearings in order. Before acting in a macroeconomic, geopolitical or geoeconomic manner, we need to see at least 80% of those signals align. It does not happen all that often but clarity did appear recently so we acted.

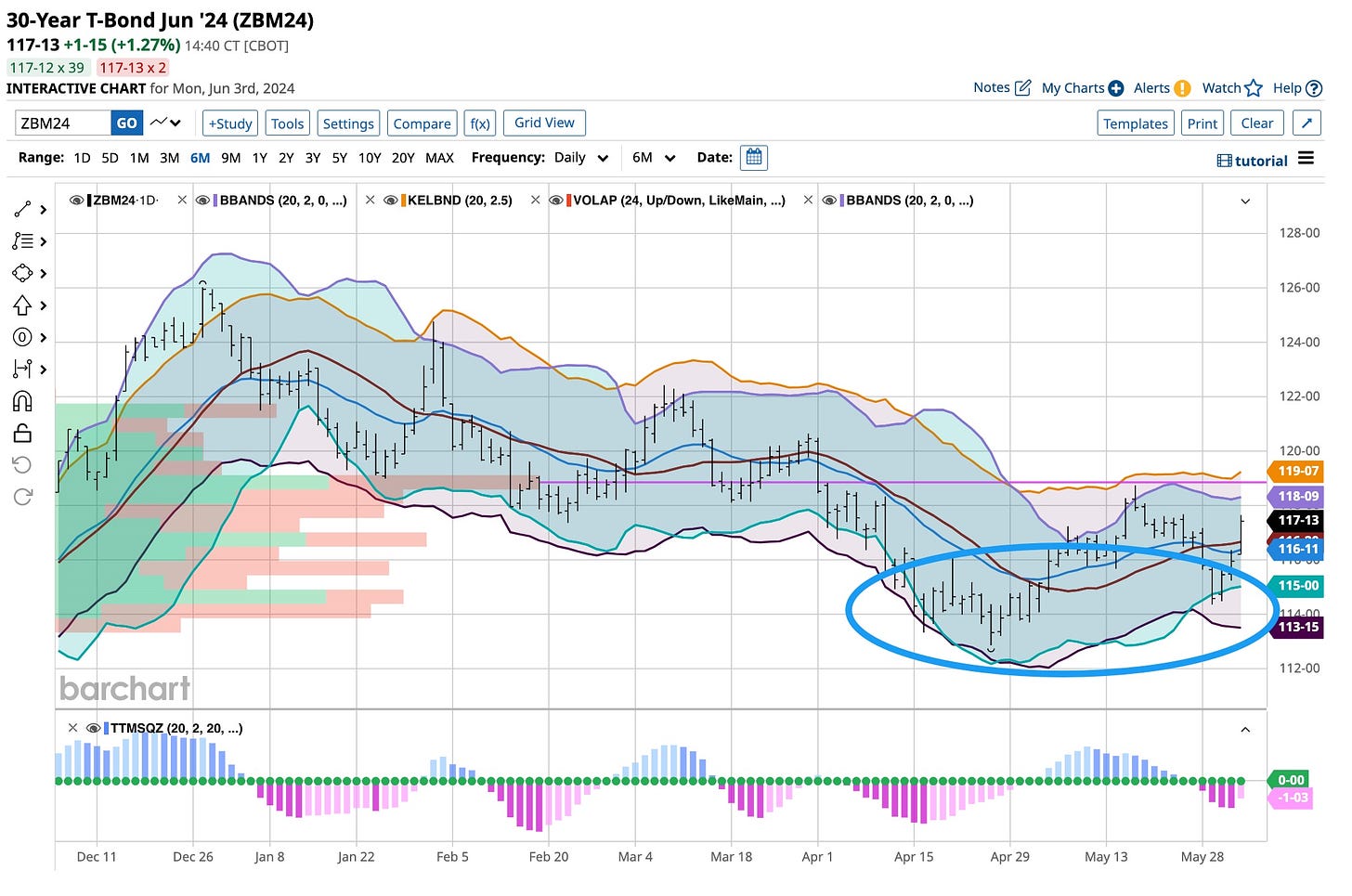

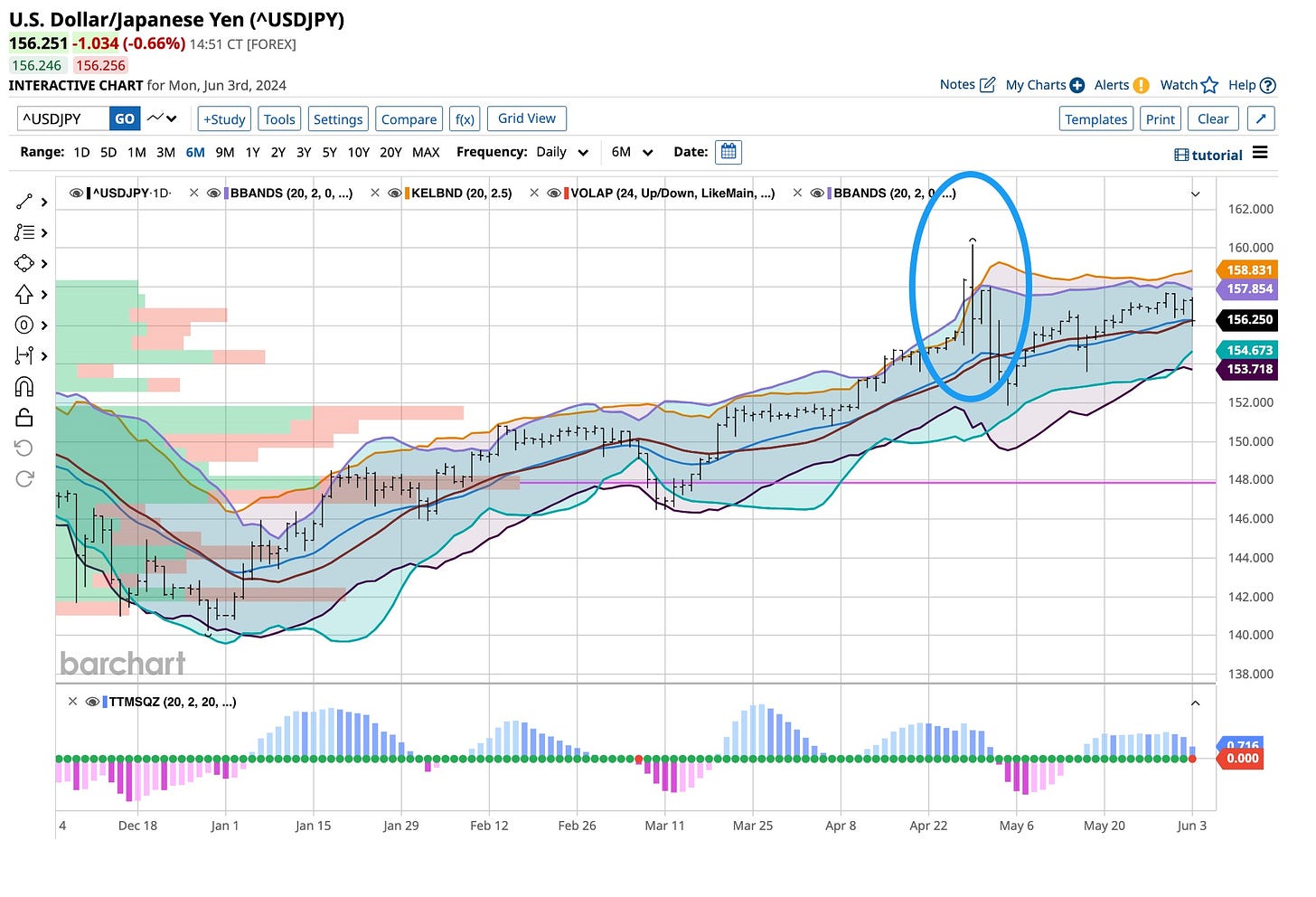

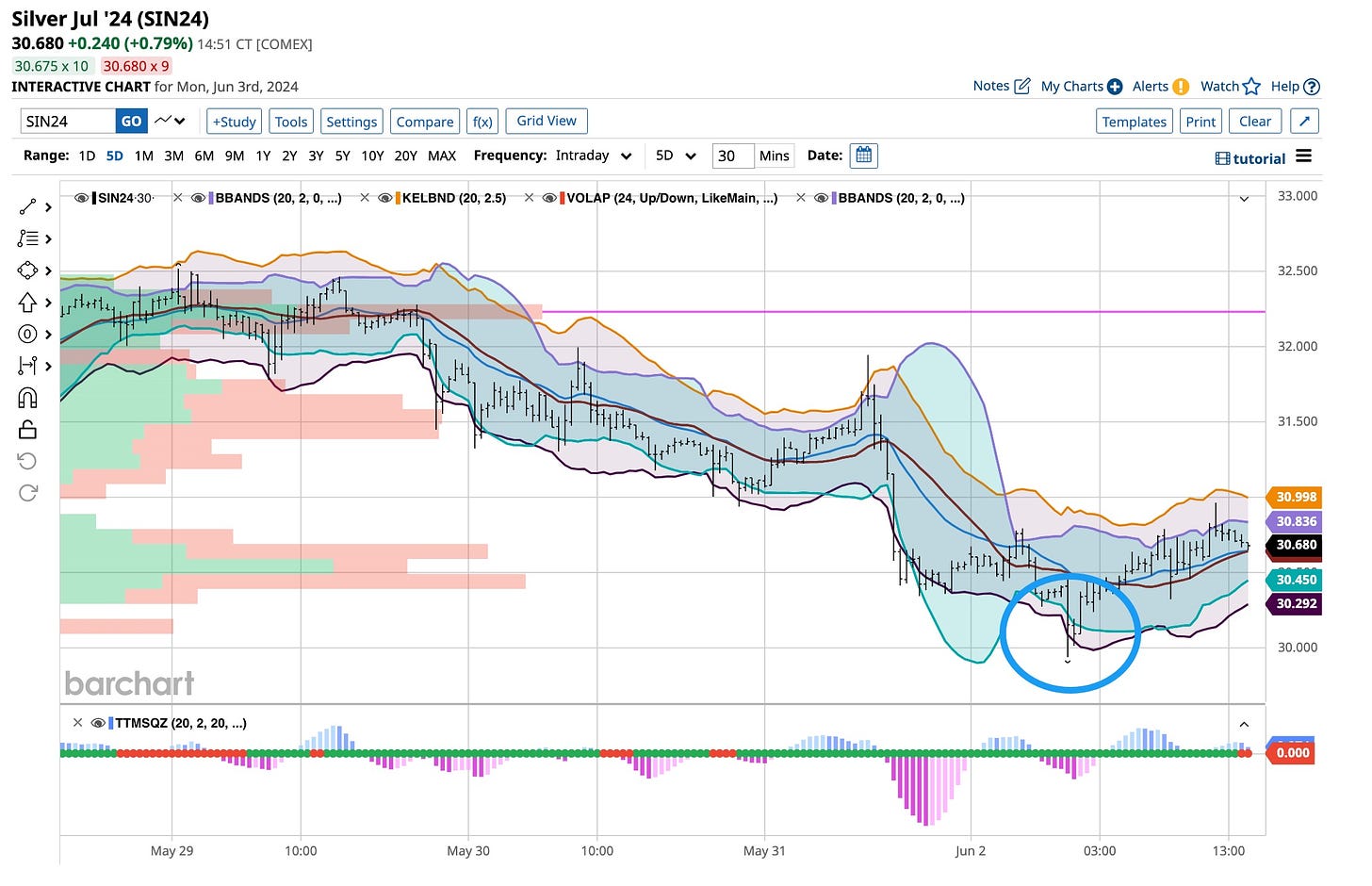

I’ve been long gold bullion and U.S. Treasury bills, notes, and bonds for longer than I can remember. I’m a “brand name” turnaround and high-dividend stock investor with an interest in trading futures when seasonally appropriate. Recently I have added to my long-bond position and believe it’s finally time for the carry trade to reverse and the Ye to strengthen against the U.S. Dollar. This morning, on a stop order, I added to my long position in Silver. Otherwise, I’m on the sideline other than holding covered call positions on every stock in the portfolio but I’m looking at WTI Crude Oil options.

It’s summer folks. Seasonally, the “market” does not perform significantly at this time. Quite often it does little to nothing until the Yom Kippur holiday has passed but that’s coming on October 11th this year. That’s as late as I remember that occurring. It is an election year so the November 5th date has meaning. We’re “recession” hunting or at least a softening of the economy as the consumer is tapped out. This will give Jerome Powell the evidence he needs to lower interest rates. An inverted yield curve may not have enough support behind it to turn “normal” but that’s yet to be seen.

Listen To The Big Boys

Politically speaking, there is basically one person I watch and listen to, Jamie Dimon of JP Morgan fame. He’s not a politician but he should be. I’ve been a fan of his since before the 2008 Financial Crisis. Recently he’s raised his belief that the potential for a recession is possible. I agree especially if (1) the consumer is broke; (2) rents and prices paid for real estate decrease; and (3) interest rates are lowered.

Interest rates are decreased when things are bad. There is no reason to decrease rates if things are good, right? That’s what I’ve learned over my years of experience and I’m seeing the signs of a slowdown now. How about you? Meme stocks taking center stage give me an additional reason to be concerned as traders grope for “what’s next”. There is enough reason on the table to worry about the future. We’re cautious at this time for good reason and trust you are as well.

Tina Turner made “Rolling On The River” her own during her career. We adopt it now to help make a point. It’s summer and as Gershwin said, and the “living is easy”. What we’re preaching is just that. Let opportunities find you. Quit looking for them. For all of you “traders” out there, summer is a tragic time for you. Scalpers have little to scalp and day traders win as much as they lose. Covered calls work, sitting on the sidelines works, doing little to nothing works. Go with the flow, roll on the river, and wait. I’ve found over time that patience is not just a virtue, it’s part of a master plan.