I first want to thank all who reached out as related to my tribute to my Dad yesterday. Y’all made me feel good especially you Toby. Dad was an only child and loved having you and your sisters as his cousins but as he related to me, you were more like real “sisters” to him.

Something else that will make me feel good is revealing to you the “informational” tools we use in doing our work, analytic, technical and simply deciding what to write about. It’s nothing more than what John Naisbitt illustrated to me in his 1981 book “Megatrends”. Buy it; better yet read it; the advice provided still works today.

The following list of resources provide me much more than knowledge. They give me a matrix-like template of what’s currently “trending”. Think about just how important that word is to every social media site you use or visit. I just identify what’s “trending” then based upon the task at hand, research and investigate the trend. The resources I chose to use are the most “looked at” by the flock considered to be active traders and investors. This means these resources get the most “eye balls”. So going about things the way I do, my work product sorts for the best trends that get the most eye balls. In addition, while many of these sites do cost money, several, or at least parts of others I use, are free. Free is good especially to those of you just getting started. “Click” on a few and decide for yourself.

Resource Websites

When the timing to invest or trade is ripe, I basically employ a cross sectional analysis geared towards what I’m looking at. What does that mean? After dissecting all of the current “buy” and “sell” recommendations for equities, ETFs, futures and derivatives related to these categories, those appearing on the majority of the sorted resource lists are the ones I investigate further. I’m blessed to have access to some major investment house’s “privately managed portfolios”. Trust me, they’re the best resource to confirm my selections but I can’t share that information with you unless of course you ask me to recommend they manage $10.0 million or more of your assets. That’s how I get my access. I will, from time to time, share a few of my final “picks” like NTR and REGN. I’m usually a little early but a recent pick, SMCI, is now a 3X bagger; that should keep you listening and coming back for more, right Paul?

When deciding what to write about then publish I do pretty much the same thing with a slight caveat; I care greatly about the source. It’s not easy to separate the wheat from the chaff as far too many people, who write and publish, have been paid to advocate or “plug” their recommendation. Years ago we called that a “pump and dump”; today we call it “fake news”. I seldom follow those freelancers, my process usually filters them out as quite often they’re usually the only ones writing about their selected topic and do not trend.

Another factor that drives me nuts is the disparity in the information relied upon or quoted by the writers. When I see multiple people, all on the same side of an issue or recommendation, quote or cite inconsistent information I laugh, then naturally step aside. More often than not when I assemble my matrix of research I’ve got a good idea about what I’m going to write about before beginning. At that point it’s really quite easy; assimilate factual evidence that supports and disagrees with my predetermined direction, weigh its validity then present all sides. I might be biased but when I write I’ll justify why. I dignify the alternative position with my own, usually an historically based inference then let you, the reader decide what action to take. I’ve been known to throw in a bit of sarcasm as well from time to time as there is “truth in sarcasm”.

The world of AI has come into play on the search side as well. Far too many writers do plagiarize one another in today’s world. I recently read an article that used 90% of the contents of one of my recent posts. While others might have been taken aback I just considered it a compliment; after all some of the information comprising my article did come from the Internet; but I did the original research before drafting it. It’s a lot of work to handle AI sequenced searches. Throughout the years, searching the “old fashion” ways has become more difficult with most search engines more interested in selling “ads” while politically and socially biasing results. If anything, in using AI as I do I’ve at least removed the “ads” but the political manifestation in my search results remains clear; Big Brother is watching and telling me what to think and it’s going to get worse before it gets better, I hope it gets better.

OK, enough for how I do my work. Please, compete with me; I’d love to hear that you have discovered a better way to handle any part of this task. Now back to what’s going on in the macroeconomic, geopolitical world as it’s regularly reviewed with our tools night after night, day after day.

Thursday’s economic numbers came in as expected. The one that caught my attention was the interest rates paid on 4-week Treasury bills that rose from 5.37% to 5.75% an increase of 7%. Makes sense to me. If there’s a problem raising the debt ceiling short term paper is at the highest risk of not being timely “repaid”; in fact it’s first in line.

Another cross index divergence that’s caught my attention is the same one that help to trigger my going short the Russell Index in late October 2021. It started yesterday with the Russell giving up its early morning gains then closing lower. This trend is continuing today exacerbated by a 1% upside move in the S&P 500. The Russell, the index comprised of middle market banks and growth oriented companies, who need access to capital more so than the “mega cap” entities, at the time of this writing is down more than 1%. This is not a good technical signal for the bulls. Keep in mind these indices can turn on a dime but the die is cast; we have a “lose-lose” outcome on our hands. I hope our legislature enjoys it Memorial Day holiday break. I hear Biden’s going to serve up more “pork” at his beach house barbecue; Hunter’s cooking.

Trade wise I’m looking for a short entry point on NVDA. Any parabolic movements in anything are unsupported. It’s the same old story; everyone just keeps on buying as it’s fashionable, especially to the “newly minted” Robinhood traders. Then, all at once the buying stops and the old adage reappears; “sell . . . to who”. I’ll keep you in the loop. It is a great company but this run is overcooked.

Because of you, those early adopters of The Ticker EDU, time is fleeting but thanks. Our thanks go out to Barchart as well as they’ve adopted us. They’re going to form the foundation of how we teach “what we use & how we use it” but like anything else, it’s all on a learning curve. Back to the “curve”.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

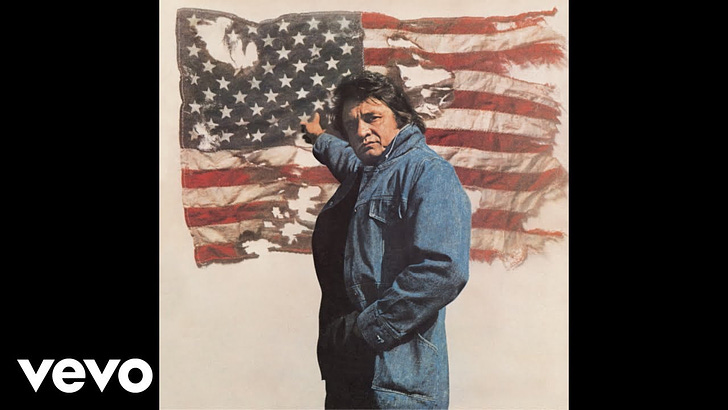

Remember this is a week for reflection culminating Monday with Memorial Day. I regret never seeing Johnny Cash in concert but certainly enjoy what he left behind, especially this one. Best to all and thanks for taking the time to follow us.