“Remember the Alamo!” It’s a quote familiar to any good Texan and a classic line from American history, but where did it originate? No one knows for certain who first said, “Remember the Alamo.” American and Mexican settlers, who fought together for an independent Texas, adopted this phrase as a rallying cry for Texas independence. By the Battle of San Jacinto, only a month or so after the Alamo, it was ‘common’ enough that General Sam Houston, who would become one of Texas’s first senators, and after whom the city of Houston is named, referenced it when he rallied his troops.

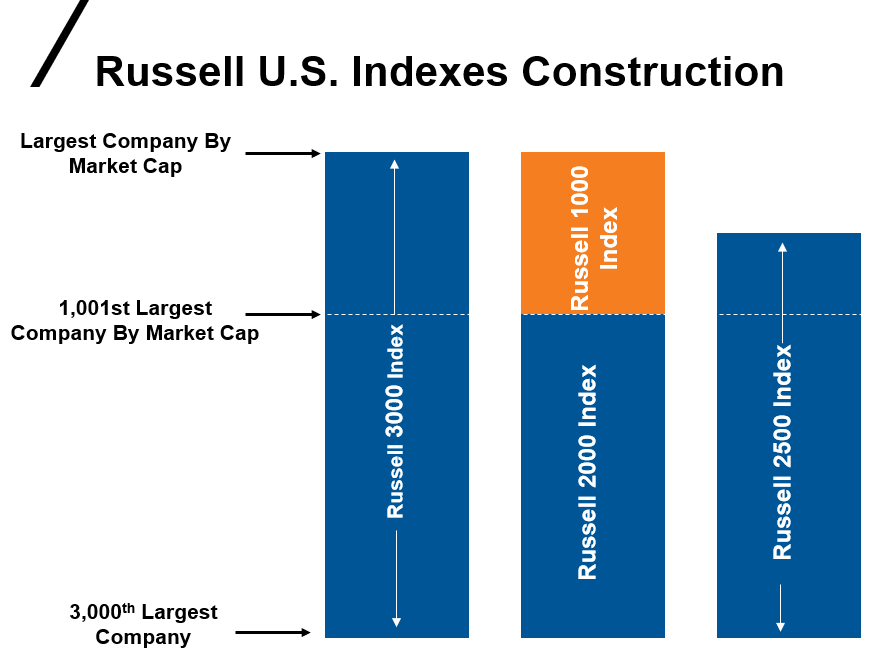

I bet Sam Houston had no idea who Frank Russell was either as he died more than a century before the Russell Index came into being. Seattle, Washington-based Russell's index began in 1984 when the firm launched its family of U.S. indices to measure U.S. market segments. Using a rules-based, transparent process, Russell formed indexes by listing all companies in a descending order by market capitalization, then adjusted for float. The top 1,000 of those companies make up the large-cap Russell 1000 Index, and the bottom 2,000, make up the small-cap Russell 2000 Index.

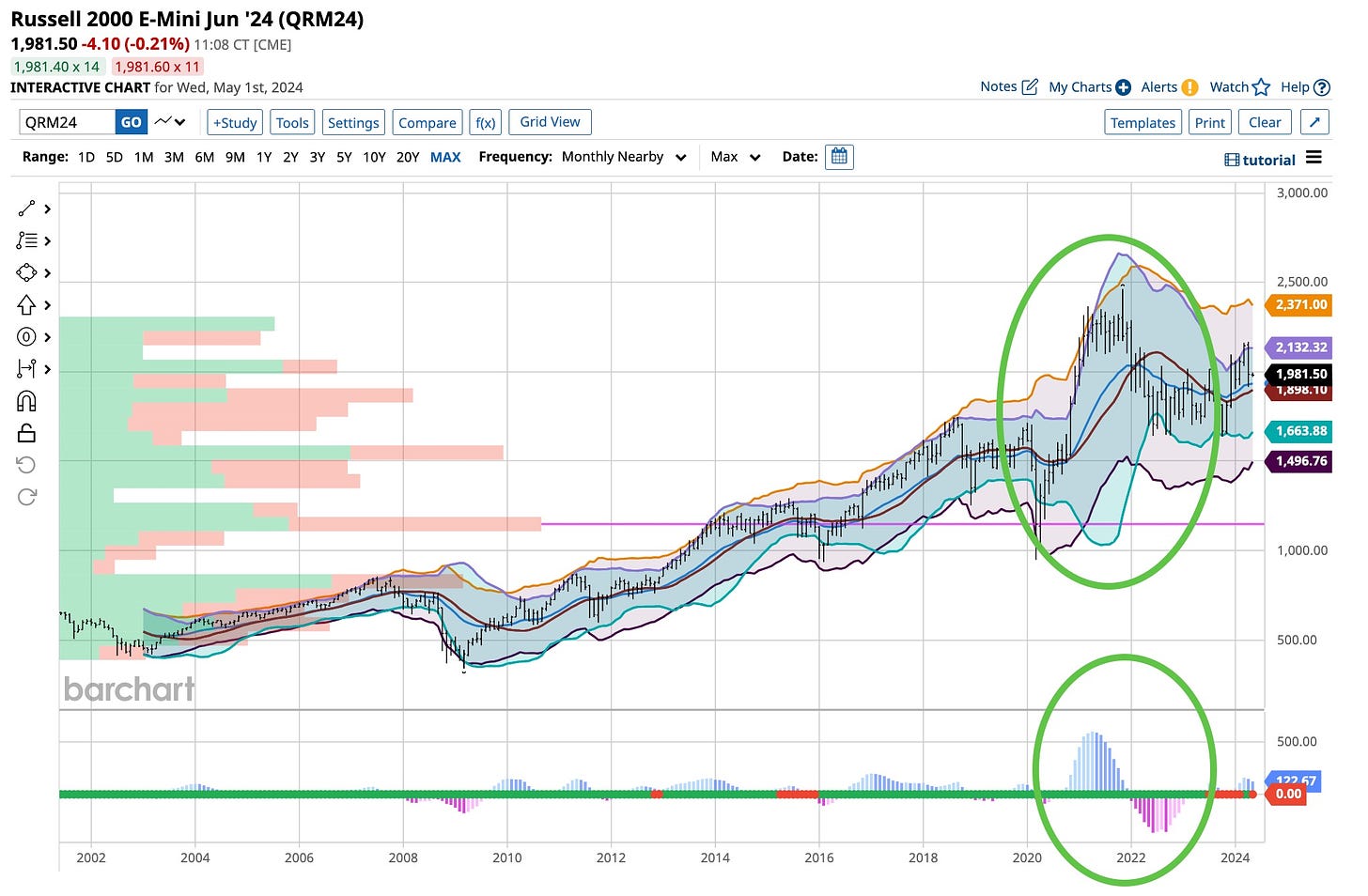

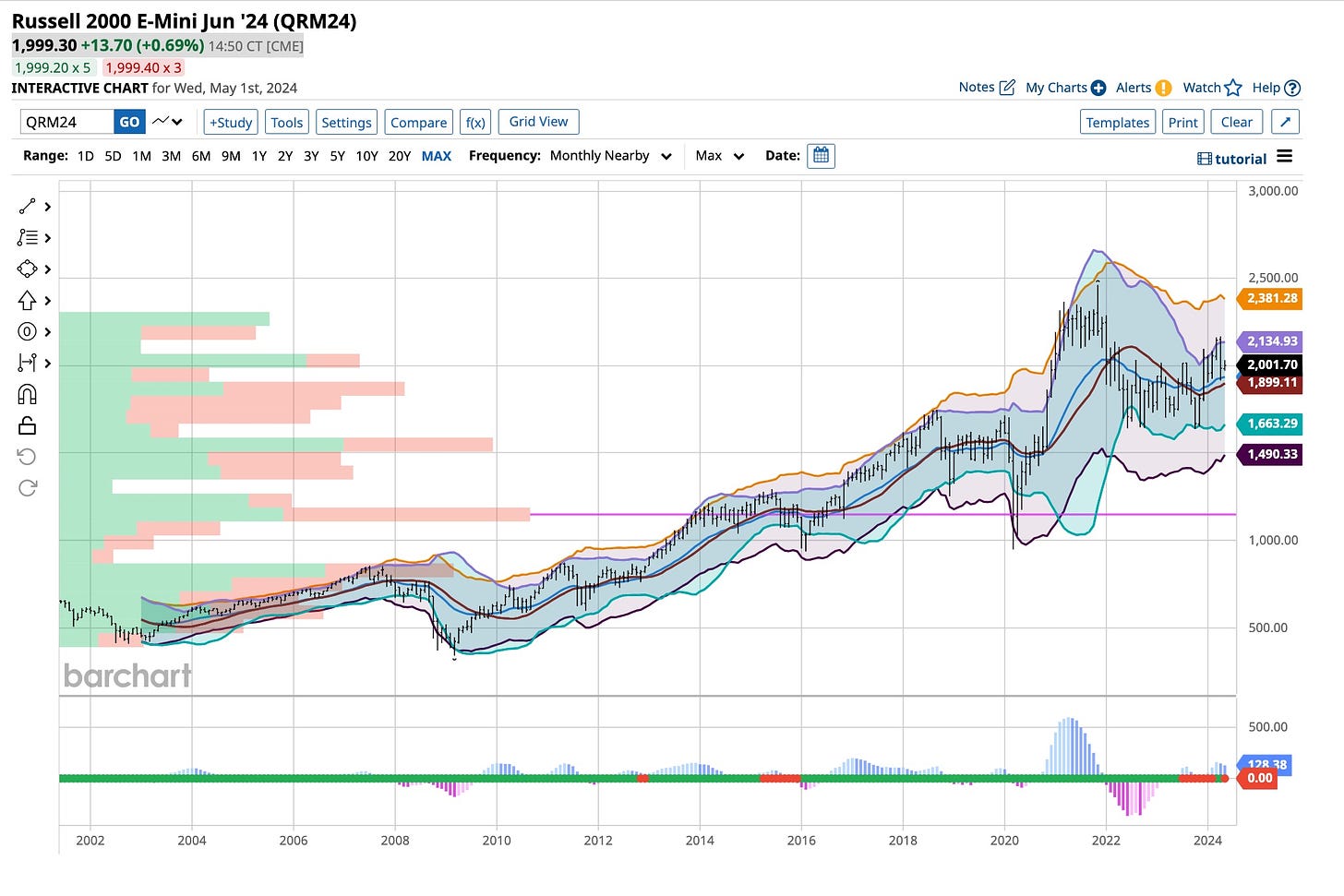

It matters not. What matters to today’s investor, ‘wanna be’ analysts is that the Russell 2000 topped in the final quarter of 2021 and has not revisited those highs since. Given the Russell 200 Index is well respected for “leading” the markets higher and lower, it’s more than simply worrisome that it’s failed to exceed, even approach previous highs.

What History Tells Us

I go back a little further than most and predate the Russell 2000. Like many I was an early adopter of the average as it told me something other indices did not. It gave me an indication of what interest rates were going to do.

Historically speaking the early 2020s were perhaps the best indication of “what’s next” as the index soared ahead of others then crashed back towards reality, its mean, only to be stuck in “never neverland”. Today it’s like watching Peter Pan not being able to get out of its own way. Why do I say that?

Go back to my premise for following the index. It’s a precursor of the general market’s movement. Face it, smaller companies need money to grow. When the money’s ‘cheap’ the underlying stocks perform better. When money’s “expensive” the trend lower. So right now they are stuck right in the middle. Try as they must, the “powers that be” on the street sought to increase the number we live by, the ‘S&P 500 P/E Ratio’. In concert they thought it should be higher, in essence looking to make an adjusmtent that most of us fundamentalists thought was a “bogus” attempt to disguise the obvious negative effects of inflation. It didn’t work well but then again, the index although dramatically correcting didn’t go back to its “mean” level.

I’m not certain what the Federal Reserve will to do, especially during this presidential election year, but something has to give. The Fed will first need to make adjustments to their 2% inflation target but I sense they’ve already done that. Secondarily, Jerome Powell is going to start thinking personally, does he want to do the “right thing” or is he interested in the total economic good. Regardless of what “actually” transpires, the movement of the Russell 2000 will tell us. Like me, keep watching.

Use More Ethanol & Eat More Corn

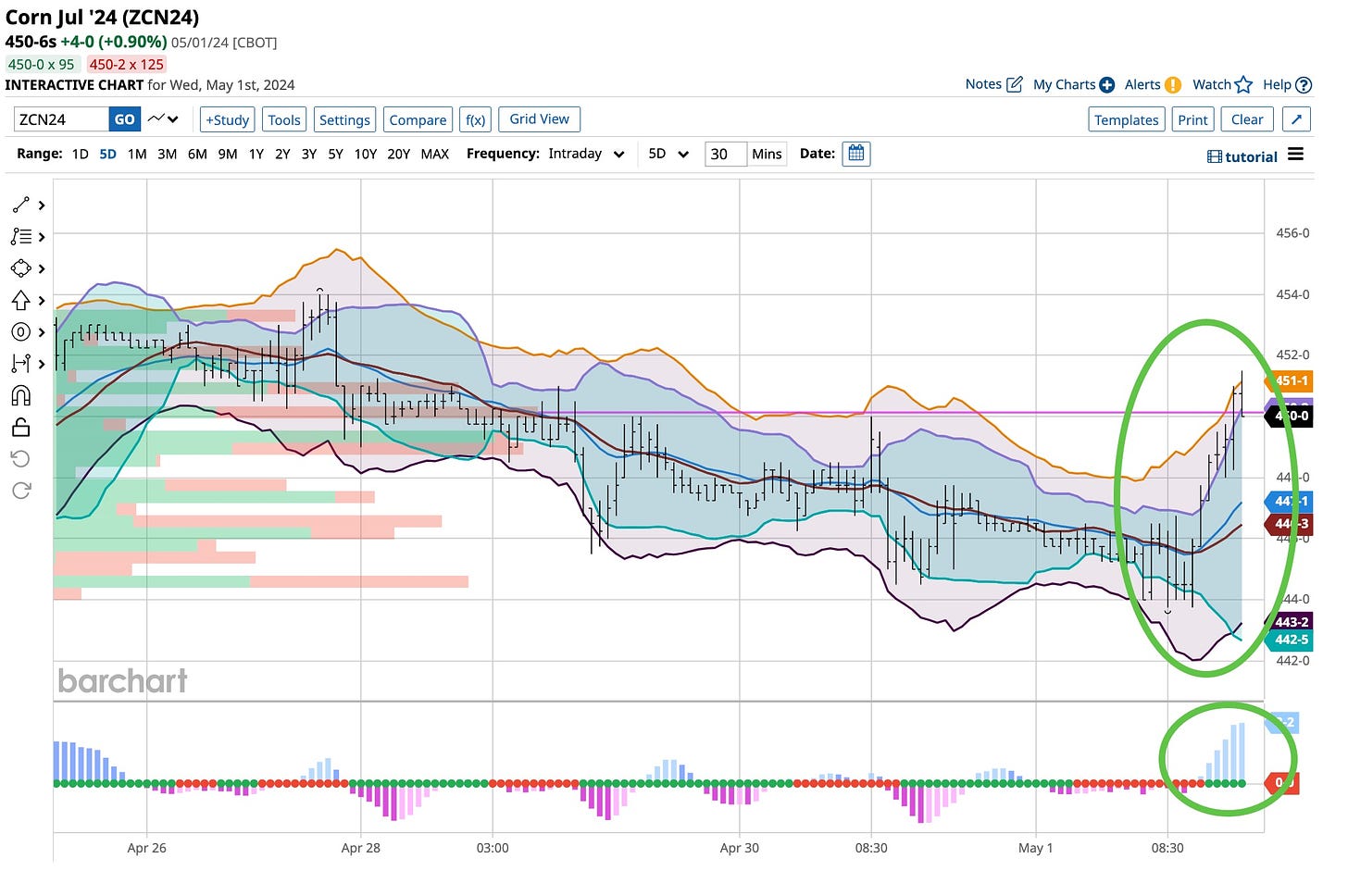

It’s picnic and driving season. I’ve been a corn buyer and have a “couple” points in the trade so far. Other technicians differ from my own and that’s OK, they’re technicians first whereas I’m a fundamental macroeconomist first. Seasonality makes a difference and so does free cash on the export side for those buying what our farmer’s grow. It’s early in this trade and the season but so far so good.

So have you checked out The Ticker Free Community? If you are a paid member here on Substack you can comment on what I write, that’s by design. Over the next weeks to months, Mahdi Nikpour is going to send you an email and invite you to join with us in The Ticker Free Community. Jump on board and post your thoughts just like others who’ve discovered the “free” site. You’ll learn from us as we regularly post there. Even better, you’ll learn from each other and that’s important. Join with us as we grow and thank you for helping us achieve our goal of making you better.

Pink Floyd put on great concerts. I know, I attended many of them. If anything their songs took you to a place where you had to think about what surrounded you. Today we do the same thing but far too often we forget the perspective we exist in. Changes are more frequent than not but in reality little is different than before. In 1975 Pink Floyd released “Shine On You Crazy Diamond” in it’s “Wish You Were Here” album. I kind of wish you were all here with me on the same level. I have a way of thinking that is consistent and historical in nature. The “mean”is important. More so it’s an overall philosophy that drives me, history repeats itself and the more you’ve experienced the better off your decisions will be.