One of the topics covered in Ticker EDU classes is “rebalancing”. It’s a rule and it’s a directive. In other words, it’s a “must have” in your plan and a method that keeps all portfolios in balance. It’s easy to follow and just makes sense. Let’s take a look at how you can become a “master” rebalancing expert.

Rebalancing is Essential

Rebalancing equities in a portfolio refers to the process of adjusting the allocation of stocks or equity-related investments within a portfolio to “bring it back” to its target asset allocation. Over time, the value of individual assets in a portfolio can change due to market fluctuations, causing the “portfolio's asset allocation” to deviate from its original intended proportions. Rebalancing aims to restore the portfolio's desired risk-return profile and ensure that it remains “aligned” with the investor's objectives and risk tolerance.

Rationale for Rebalancing:

Maintaining Risk Levels: Different asset classes, including equities, have varying levels of risk and return. Rebalancing helps control portfolio risk by preventing an overweighting in “higher-risk assets” when their prices rise disproportionately relative to other assets.

Preserving Asset Allocation: Rebalancing ensures that anyone’s portfolio maintains its intended asset allocation strategy. This strategy is based on factors such as investment goals, time horizon and risk tolerance. Over time, without rebalancing, market movements can cause the portfolio to drift away from its target allocation.

Capturing Opportunities: Rebalancing provides you opportunities to buy undervalued assets and sell overvalued ones, potentially enhancing portfolio returns over the long term.

Discipline and Strategy: Rebalancing instills discipline in the investment process and helps investors stick to their “longer-term” investment strategy, rather than succumbing to simple emotional reactions to short-term market fluctuations.

Methods of Rebalancing:

Time-Based Rebalancing: This approach involves rebalancing the portfolio at regular intervals, such as quarterly, semi-annually, or annually regardless of market conditions. Time-based rebalancing ensures a disciplined approach to portfolio management but may result in unnecessary trading costs if markets have not significantly deviated from their target levels.

Threshold-Based Rebalancing: With this method, the portfolio is rebalanced whenever the actual asset allocation deviates from the target allocation by a certain predetermined threshold. For example, if the equity allocation drifts more than 5% from its target, rebalancing is triggered. This approach reduces trading frequency but requires more active monitoring of the portfolio's asset allocation.

Combination Approach: Some investors use a combination of time-based and threshold-based rebalancing strategies to capitalize on opportunities while also maintaining discipline.

Implementation Considerations:

Transaction Costs: Rebalancing may involve “buying and selling” securities, incurring transaction costs such as commissions, bid-ask spreads and taxes. Minimizing these costs is essential to preserve portfolio returns.

Tax Implications: Selling appreciated securities may trigger capital gains taxes. Investors should consider tax-efficient rebalancing strategies, such as using tax-deferred accounts or prioritizing actual rebalancing through new contributions or dividend reinvestment.

Asset Allocation Review: Periodically review the portfolio's asset allocation strategy to ensure it remains appropriate for the investor's financial goals, risk tolerance and market outlook.

Monitoring and Evaluation:

Continuously monitor the portfolio's asset allocation and performance relative to its benchmark or investment objectives.

Evaluate the effectiveness of the rebalancing strategy over time and make adjustments as needed based on changing market conditions or investment goals.

In summary, rebalancing equities in a portfolio is a fundamental aspect of portfolio management aimed at controlling risk, preserving asset allocation, capturing possible opportunities and maintaining investment discipline. By implementing a systematic and well-thought-out rebalancing strategy, investors can enhance portfolio stability and potentially improve long-term investment outcomes.

Rebalancing Actions I’ve Taken

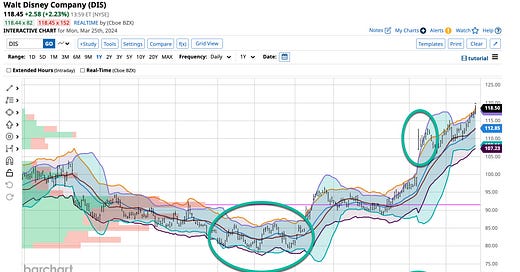

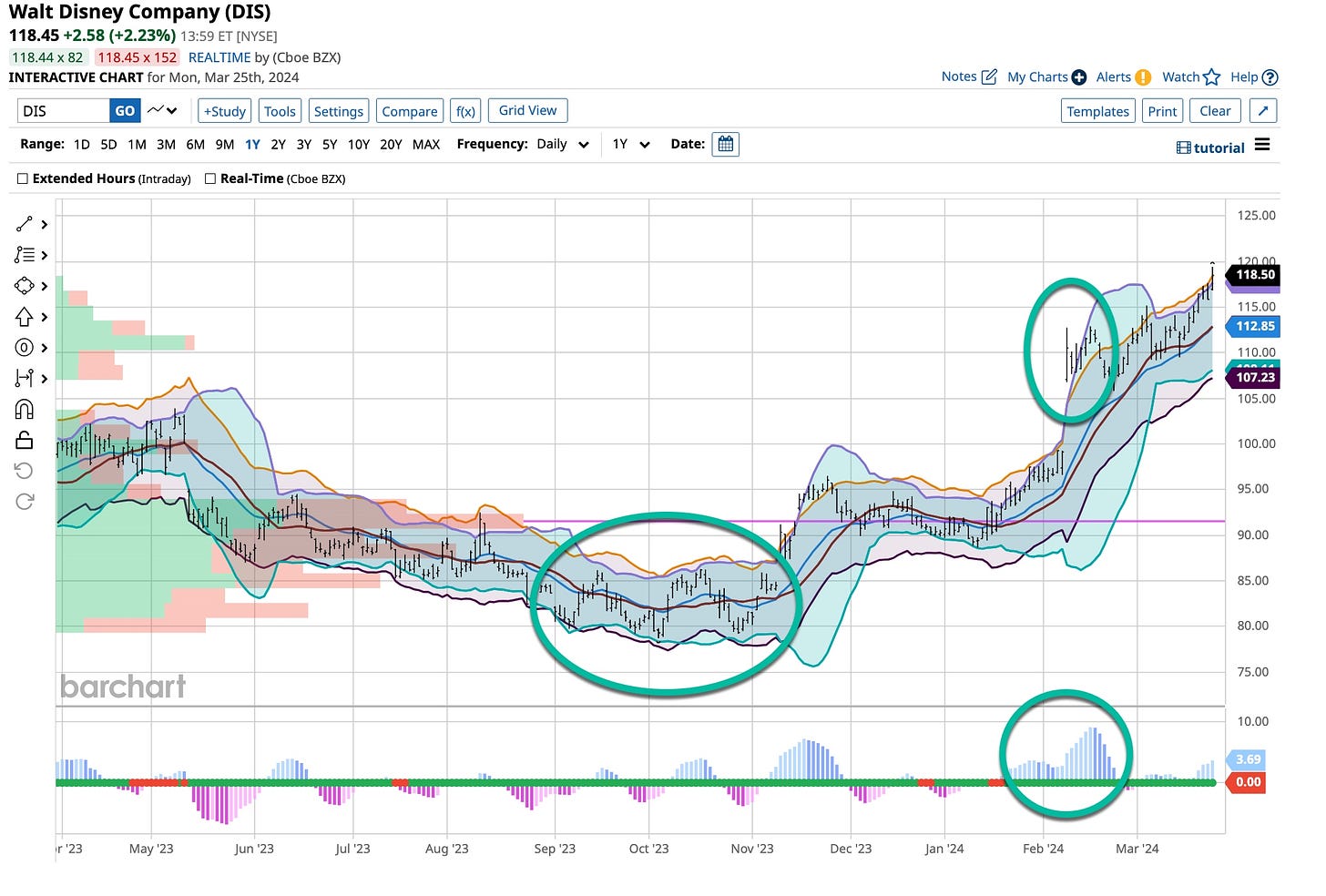

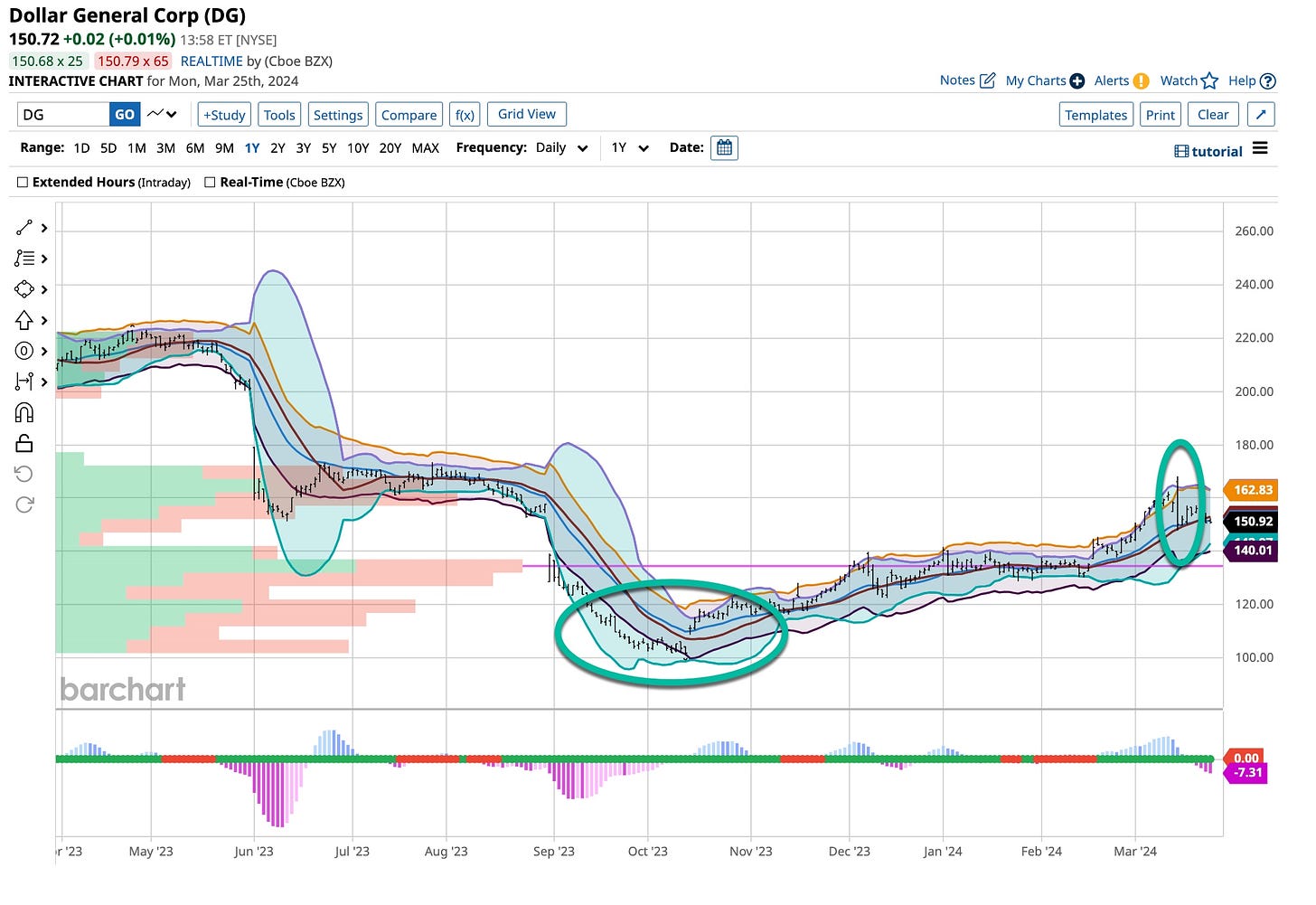

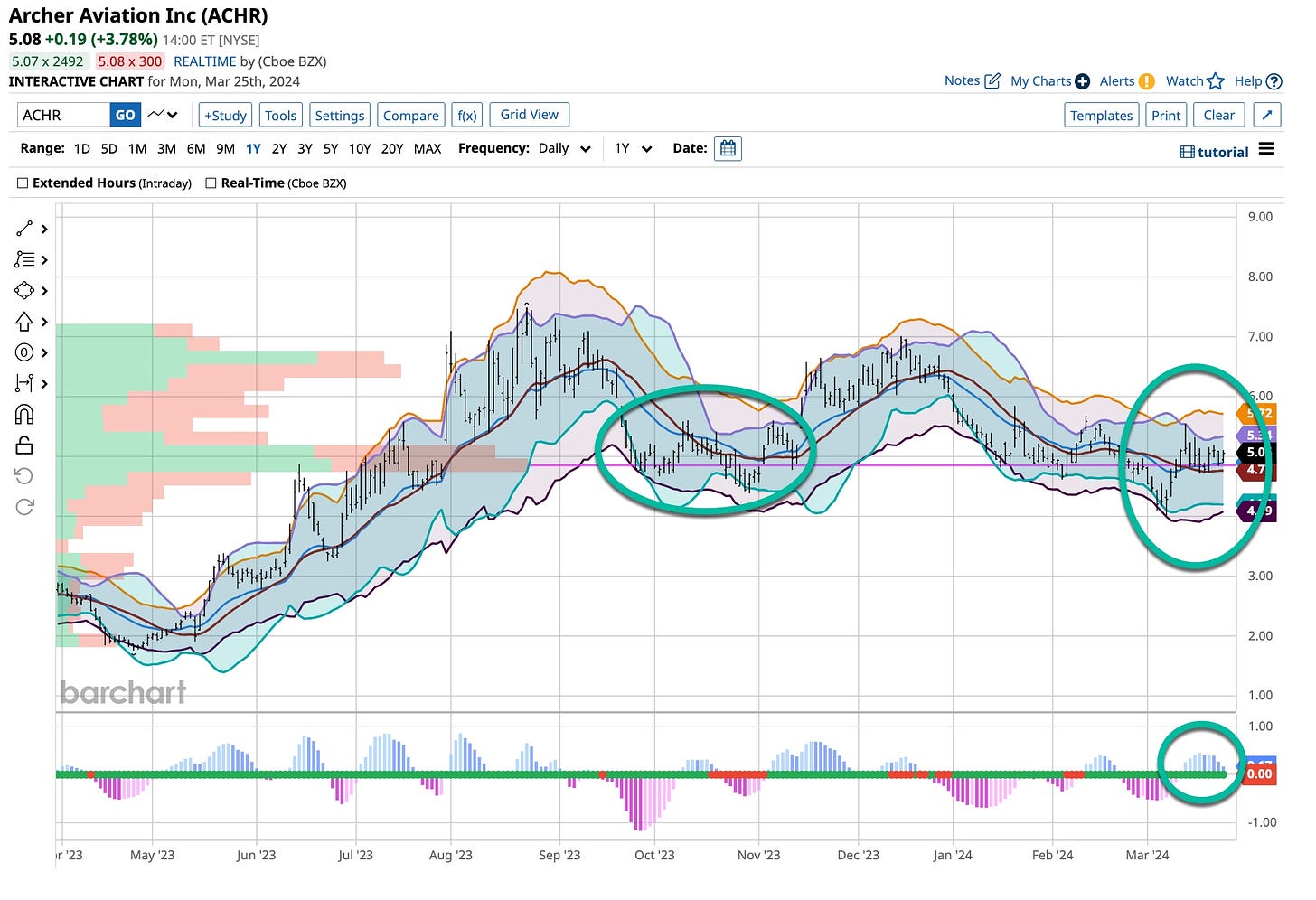

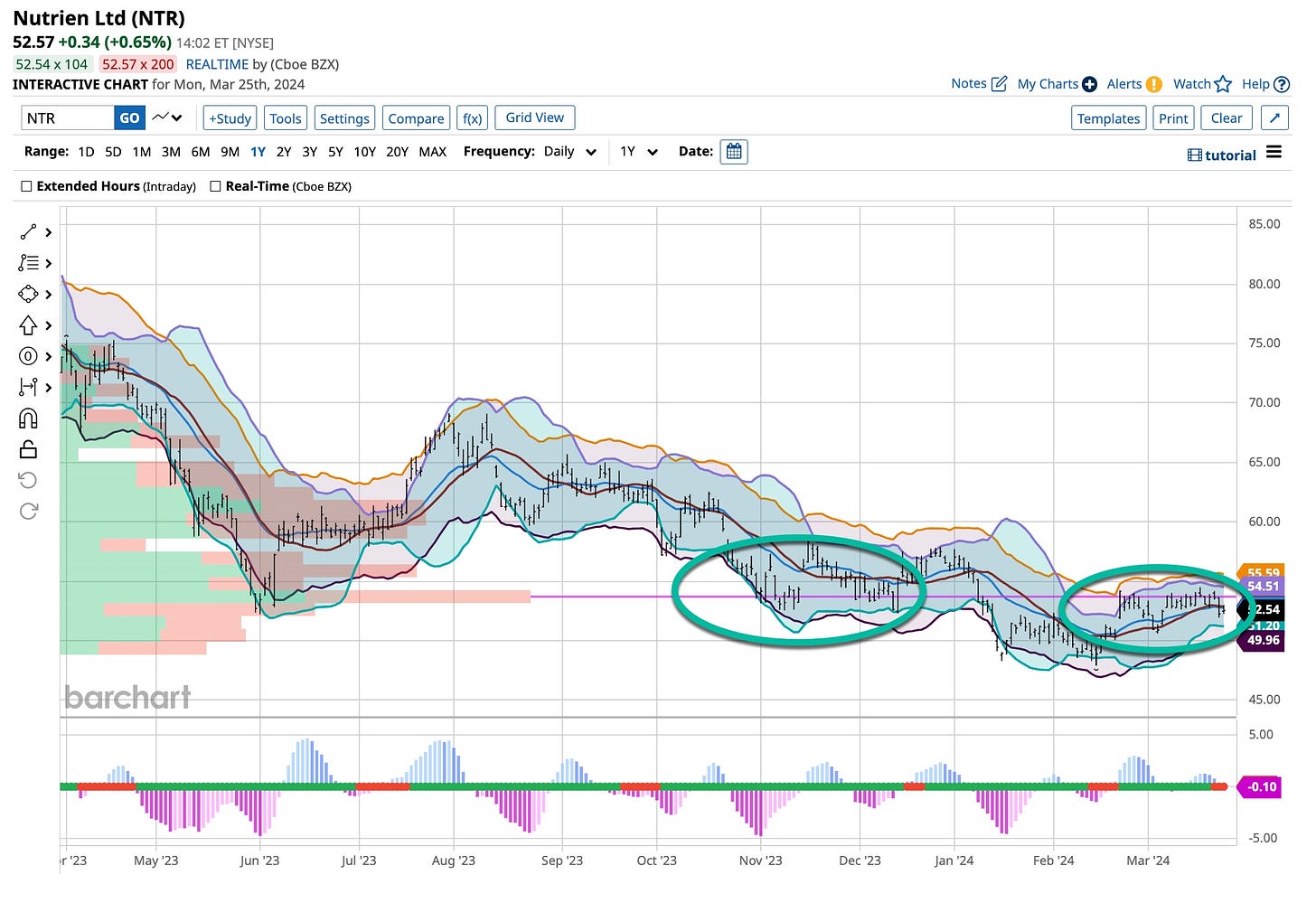

The first thing you need to rebalance a portfolio are stocks that have gone up and a few that have gone down. I’m up almost 50% in the shares of Disney remaining in my portfolio and about 30% in the shares of Dollar General I still own. I am down about 10% in my Archer Aviation and Nutrien positions so the stage is set to rebalance.

From my use of put and call options about ten days ago, I have more than enough cash on hand to by more Archer Aviation and Nutrien at these levels. in essence what I am doing with these two securities is “dollar-cost averaging”, a solid strategy I advise for all as market timing is a fallacy. By definition “dollar-cost averaging” is the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of a security. What I am doing in “rebalancing” my portfolio by selling a piece of my winners and putting that amount into my losers is similar but not exact. I trust you get a good idea that it works and you make it part of your plan.

Remember, investing and trading is common sense. Start with a plan and stick with it. If you are having a problem putting together a plan contact me at info@tickeredu.com and we’ll put one together. While you are at it take a look at the courses offered on site at www.tickeredu.com. I’m interested in making you the ‘best damn investor or trader’ you can possibly be and it starts with our three courses and our “1-on-1” tutorials. The opinions of our clientele are in. They find our offerings effective and more than fairly priced besides you get me “1-on-1”. What could be better, eh?

So email me and let’s get started. There is a lot to learn and if you are like me you will learn something every day. My best to everyone as always and enjoy your holidays.

I’m setting “Peabody & Sherman’s Wayback Machine” to 1982 and bring you a classic. It’s The Fixx and “One Thing Leads To Another” and from our experience it’s true. It has been a true “labor of love” putting the course together for your benefit. It’s been a project that’s taken me five times as long as I thought it would. It started with a book, “The Ticker’s Bible” but people like you don’t read. So I thought, what about a video based course. Well, the third course of three is just about ready for your enjoyment. So are we with “1-on-1” tutorials and more. With thousands of followers telling me what they wanted I had the obligation to listen. Thank you for your opinion and guidance. I appreciate each and every one of you.