It’s supposed to get a little cooler here in Texas next week, maybe even into the 80s with rain. Will miracles never cease? Just received the first formatted copy of “The Ticker’s Bible” in my email this morning. I’m always amazed with today’s technology. Guttenberg must be spinning in his grave. Hopefully out on Amazon / Kindle by the end of the month but who knows. Trust me I’ll let you know when it’s available.

For quite some time I’ve spoken of Kazuo Ueda, Japan’s counterpart to Jerome Powell and a quintessential Japanese official. Just what do I mean by that? Have you ever had a business relationship with a Japanese partner? If you have you’ll understand that the use of the word “no” is forbidden. Respect, especially for those of whom preceded you is almost as important as making current decisions. It’s not “saving face”; it’s simply theirtheir way life and decision-making is handled.

Ueda knows what’s on his plate, he’s known that since day one of his administration. He’s starting to “loosen up” which will create a monumental shift in currency arenas when he does. I’ve been waiting to discuss a strategy, a “calendar spread” strategy to take advantage of his “getting closer” to allowing rates to increase in Japan but first let’s review his recent statement.

Ueda Signals Ending Negative Rates

Last week Bank of Japan Governor Kazuo Ueda mentioned that the central bank could end its negative interest rate policy when achievement of its “2% inflation target” is in sight."Once we're convinced Japan will see sustained rises in inflation accompanied by wage growth, there are various options we can take," said Ueda. Now keep in mind Japan wants inflation to continue. It’s just escaped years of deflation and stagnation in its economy. A little different analysis than we have here in the United States and that sets up what will be a major cyclical change between the Yen and the Dollar when it comes to fruition. It’s going to happen. The only two questions remaining are “when” and “what’s the effect”. I don’t have a crystal ball but my current answers are “sooner than not” and the Yen will “increase in value” against the Dollar.

I like to teach concepts that are based upon macroeconomic and geopolitical events. It comprises the second chapter of “The Ticker’s Bible” as being a position trader I look more long term than the fifteen minutes far too many “investors or traders” use as their timeline. I’ve been doing this for years. History repeats itself as do cycles in the currency markets. This is going to be “the big one Martha” and there’s a great way to approach the trade, “calendar spreads”.

What’s a Calendar Spread?

In this case we’re going to be looking at a long future calendar spread; we’re going to sell the December 2023 Yen future and buy the March 2024 Yen future. As defined, a Long Future Calendar Spread is buying and selling futures at set, different expiration dates. For a better definition of calendar spread click here. Investopedia does a better job than I can; we use them, you should too.

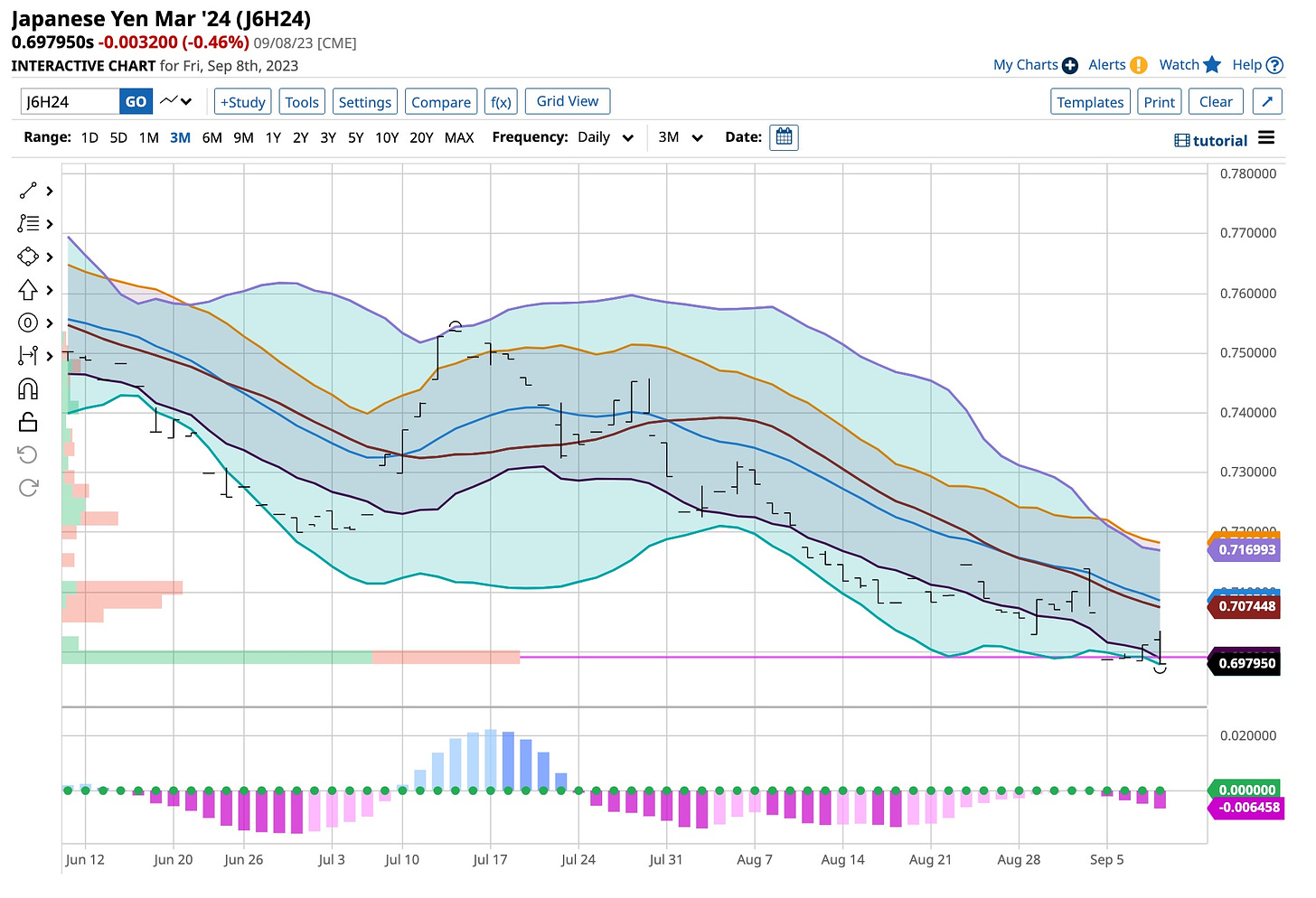

So what we expect is that the March 2024 future will increase in price faster than the December 2023 future. Here’s a couple charts that illustrates where they are currently priced:

December 2023 Futures Contract

March 2024 Futures Contract

So from Friday’s closing prices we’re going to sell the December 2023 at 0.687350 and buy a March 2024 at 0.697950, a difference of 0.010600. It is our expectation that this difference will increase. That happens if the December 2023 goes down or the March 2024 goes up. It’s consistent with the belief that Ueda is closer to pulling the trigger on higher rates.

Again, this is not a short term, “you’re in you’re out” trade. It’s one that will take time and one we’ll revisit over the next couple months to evaluate whether we were right or wrong. I’m currently long the Yen but have near term put protection in case I’m early and wrong. When currencies change cycles they often last for years. For me it’s worth the risk but I’ve been doing this for 50+ years. I’m looking forward to this one as I’ve “seen this movie” before and I like the ending.

Time for a “shout out” to someone I respect; you should too. His name is John Navin and he posts some pretty good stuff. Check out his Substack site and also follow him on LinkedIn; I do.

Well, enough for a Saturday afternoon. Busy week coming on this side. Might even have the time to get outside and take care of a neglected yard. Hell, everything’s just brown down here. If you want “green grass” you’d be best advised to just use paint. Best to all as always and thanks for your continued interest. I love what I’m doing and trust you do as well.

Let’s end today with The Rolling Stones and “Time Is On My Side”. That’s just what a calendar spread is all about; putting time “on your side” while reducing the risk at the same time. There’s so much to teach and so much to learn, that’s what 55+ years will do for you. I’ll try to fill that “space between your ears” as quickly as possible but keep in mind, if you want to learn how to invest and trade the “right way” this exercise is a marathon, not a sprint. Book is out soon, thanks for your patience.