I could turn blue in the face discussing this topic. With that in mind, it’s best to use a real-world example of how to utilize put and call options when managing a long-term position.

I Like Boeing

If you are a “regular” reader of this thread, you know I’ve been a proponent of brand-name turnaround companies. Go back almost a year ago, and you’ll find my first post. Nothing has changed. Revenue is the secret, but there have been numerous economic signals over the last three-quarters that dictated my decision-making process.

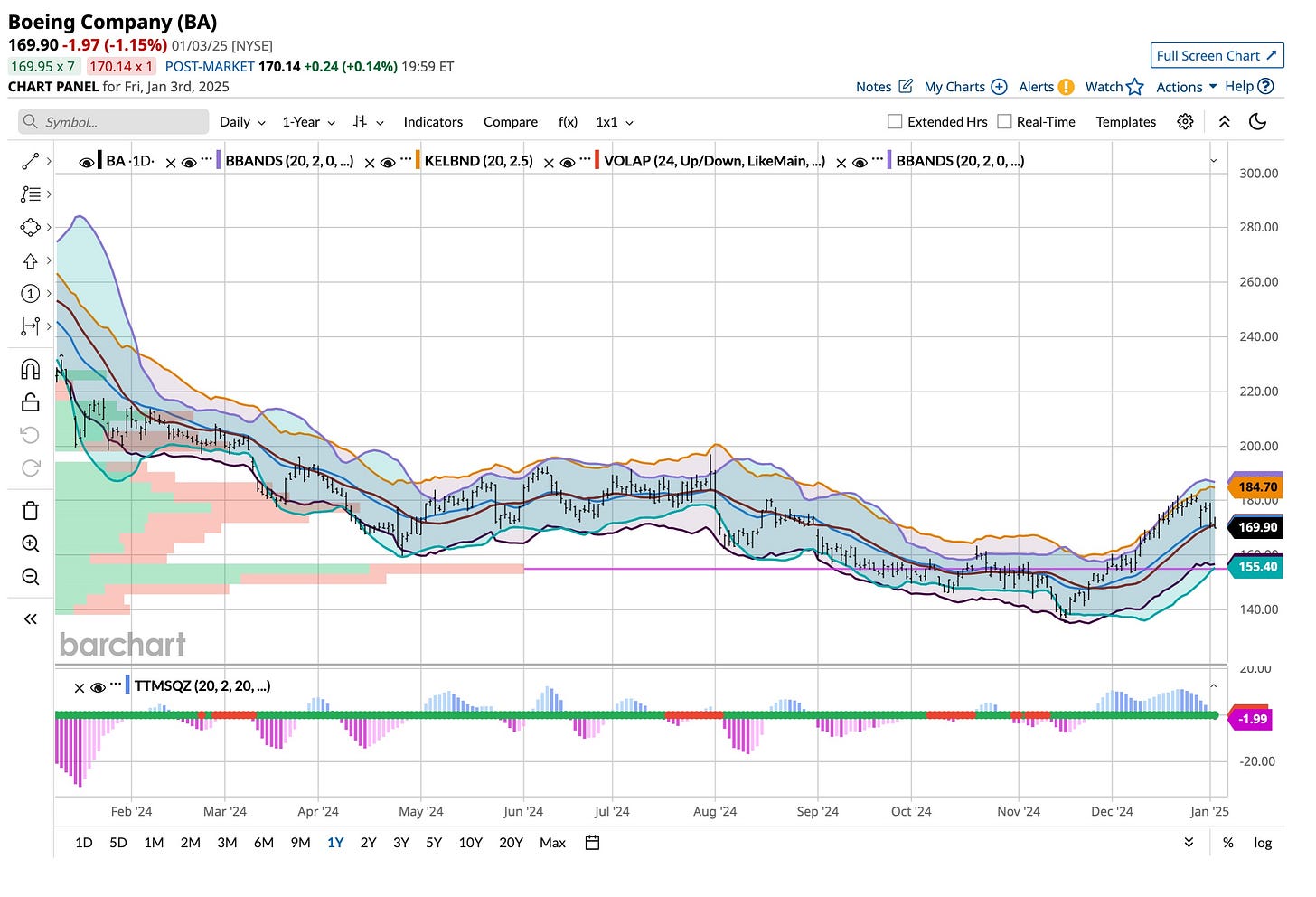

I started buying Boeing exactly where it is priced today, about $170 a share. It’s a basic turnaround, folks, and that takes time and energy to be successful. If I did not use any options, both puts and calls, I would be even on my initial entry. I’m up over 25%. Let’s take a look at how that happened.

I’m a macroeconomic analyst, and to me, that means watching revenue streams. There is no question that Boeing has been hit by all sides, geopolitically and economically, by the powers dictated by political and world opinion. It is also a world leader making our lives possible, it makes and sells airplanes. Face it, problems exist, and by putting a bit of time on your side works wonders.

I did not expect Boeing to simply return to its old “all-time” highs overnight. No, it’s seldom possible for any equity to do so. I believed that selling covered then naked out-of-the-money call options, starting with the “$190” series, made sense. In addition, it was my belief that Boeing was going to change upper management and take a look to the marketplace for funding when the bottom was apparent. That’s what happened.

So, while waiting for this all to “hit the fan,” I kept on selling covered and extra calls while I aggressively sold out-of-the-money naked puts. When Boeing announced its last round of financing, I bought many more shares, covered my naked out-of-the-money calls, and sold in the money naked puts. Now, it’s time for the revenues to start.

Time worked for me as options expire. By selling puts and calls, I put time on my side and it worked. I’m doing the same thing with Ford and Nike; they’re next. Good stock investments and futures are key to my portfolio as much of it is held earning 5%+. I’ve hit quite a few ‘winners’ over that last year from SMCI to MSTR, from buying longer-term calls on the VIX to enjoying the winter season trading the “widow-maker”, our friend better known as Natural Gas. You can do it too after you check out “The Ticker’ which should hit the markets in the next few weeks. Keep watching and thanks.

The Zombies had it right years ago. It’s the “Time of the Season,” so take advantage of it. I like Trump, but I’ve lived long enough to realize that everything good takes time. I do not see anything different this go around. It took “Reagan” a couple of years to affect change from the Carter days. No difference here, so put time on your side. You are going to need it.