What a game, eh? The Phoenix Open where Taylor came back to beat Hoffman in a playoff was as well but face it, no one reading this watched a golf tournament. Only I did. I watched the Super Bowl too and without a doubt it was one of the best football games ever played. Too bad either team had to lose but in the end, Andy Reid, Patrick Mahomes and the Chiefs came through.

Nonetheless, that’s why I’m a little late getting this post out tonight. Forgive me, I’m a human being and the Super Bowl is a way of life, especially for me having grown up in Pittsburgh. Yeah, that’s right the town with the “great football team”. Six rings, count ‘em all and hopefully there will be more.

During my days in this industry I’ve pretty much seen it all. In particular, I spent a lot of time on the “regulatory” side and identifying “pump and dump” schemes happened more often than not. In the past they were easy to identify. I remember one case when a broker sent out a couple hundred letters telling half of the recipients to buy IBM and the other half to sell it. Email notifications about “news” and “guarantees” were easier to spot as well but nothing was simpler than policing Long Island. During the days of the bucket shops, pump and dump schemes ruled the roost. Those were the days, eh?

Today’s Pump & Dump SPACs

Just when you thought the SEC had a good handle on fraud a new “form of investing” has sprung into existence, a Special Purpose Acquisition Company (“SPAC”). This is a company without commercial operations. It’s usually formed to raise capital through an initial public offering (“IPO”) to acquire or merge with an existing company. Also known as blank check companies, SPACs have existed for decades. Recently they have seen their popularity soar.

SPACs are commonly formed by investors or sponsors with expertise in a particular industry or business sector, and they pursue deals in that area. Called “blank check companies,” SPACs provide IPO investors with little information prior to investing. Investors in a SPAC IPO trust that promoters are successful in acquiring or merging with a suitable target company in the future. However, there exists a reduced degree of oversight from regulators and a lack of disclosure from the SPAC, burdening retail investors with the risk that the investment may be overhyped or even fraudulent.

Returns from SPACs may not meet expectations offered during the promotion stage. Strategists at Goldman Sachs noted in September 2021 that of the 172 SPACs that had closed a deal since the start of 2020, six months after deal closed, the median SPAC had underperformed the Russell 3000 index by 42 percentage points. I’ve never bought into an investment of this nature. I probably never will. With my industry background I still look and watch. Recently one has been promoted on LinkedIn, Fibrobiologics.

It’s my job to teach and impart upon you what I’ve learned over my lifetime. It is also my responsibility to give you a “heads up” when I see something wrong. Well this one is very wrong and its promotion never should have been allowed on LinkedIn.

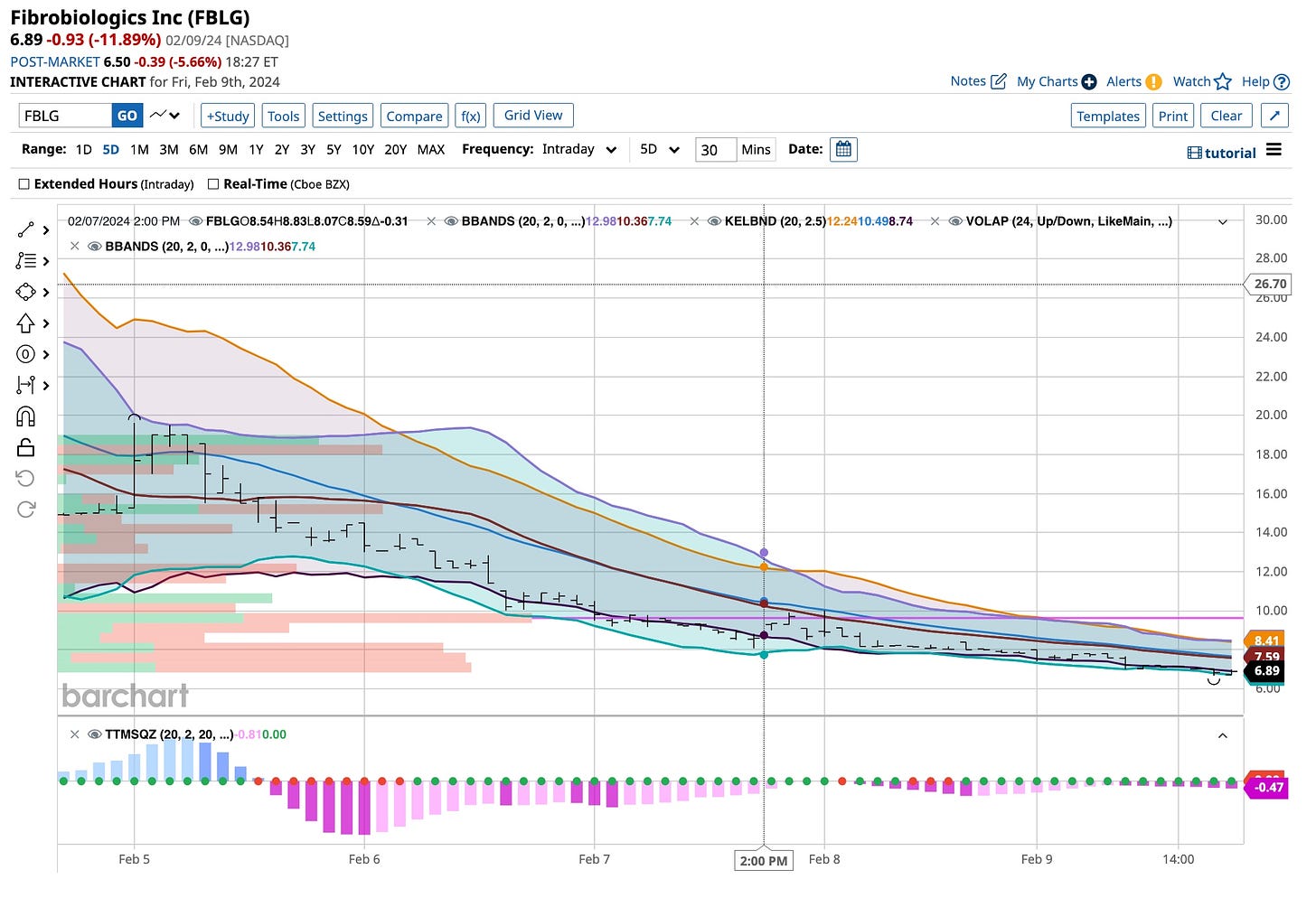

Fibrobiologics (“FBLG”) in my opinion is an excellent opportunity to teach. I’ve been following it and a few other SPACs for quite some time. The reason is simple as going short these “monsters” when an investor is able to “borrow” shares to short without it costing an “arm and a leg” is a good strategy. Remember, one way companies in this industry make money is by “lending shares” of a SPAC to short for an set percentage return. In this case the “fee” was far too high despite its “negative” performance. The risk was greater than the expected return despite the dismal performance of FBLG.

I’m not posting today to tell you that “short sellers” make lots of money. “Regulatory” wise this segment of the industry is where I’ve made my mark but I can’t really talk a great deal about it for several reasons. There’s lots of people in this industry who have used short selling to decimate competitors. Many more have fraudulently operated in ways that harm the general investing public. They’re the ones that are assembling the SPACs you see in the markets today. That’s another reason I watch them as sometimes as is often said, good “investigators” never die; we just keep on watching.

So shame on LinkedIn for publicizing this demonic monster. Shame on the exchanges and the SEC for allowing this form of investment to exist. Take this as a warning. Stay away from this garbage but in the same breath be aware that they exist.

Well, again, great game. I hope everyone enjoyed watching the Super Bowl as much as I did. I wish a few more of you had watched the playoff in the Phoenix Open but know a few more of you will watch Tiger Woods next week in the Genesis Open. He doesn’t have what it will take to win but face it, it’s fun to watch, hope and pray that he does.

That’s it for tonight. A good night of sleep is on my schedule. Last week with Cocoa a bit crazy was enough for me. The only thing I’m doing is getting ready to announce a teaching course or two and keep buying the Yen versus the Dollar. Best always and my sincere thanks to all for reading, listening and above all being patient.

“Lions And Tigers And Bears”, oh my. Maybe Dorothy and her friends from “The Wizard Of Oz” should add in another moniker, “SPACs”. It’s a scary world out there folks. Face it, I’m just here, loaded with experience to keep you safe. Listen to when I do my best to do just that. It’s our objective to teach. Sometimes that means we keep you away from things that are “bad”. SPACs are seldom good for you unless you are a short seller. I am a short seller but unless I can borrow shares to sell cheaply enough I pass. You should too all ways around when it relates to SPACs. Remember, you have been warned. Best always and enjoy the week.