Happy Sunday everyone. It’s bearable down here in the great “State of Texas” and the yard is really starting to take shape. Two more months, in addition to using child and grandchild labor, we just might finish. In any case it’s Sunday night and time for “The Week That Was & What’s Next” plus a lesson on hedging; it’s time.

Well the current S&P 500 PE Ratio sits at 25.76, overbought for certain but that does not mean it’s not going higher. The “fear of missing out” is back. I don’t see economic problems disappearing just yet but others “preach” differently, especially Janet Yellen who thinks everything is on course for a “soft landing” despite the fact that inflation remains “embedded”. I guess she doesn’t do her own grocery shopping. Interest rates worldwide are heading higher except for China; even Japan might join in this round. That’s going to have an effect on unemployment at some point. We’ll know better on Friday when non-farm payroll numbers are announced. Until then, the actual market’s direction is anyone’s guess. Oh yeah, did I mention that rates are going higher and the “prepaid” college kids are about to use the “money in their banks” to actually pay back their school loans. If anything spells “recession” taking that chunk of free cash out of the money flow should do the trick. Wonder what the administration has up its sleeve for their next political salvo.

We are also entering “earnings sweeps weeks” with prognosticators predicting that the numbers are going to come in weak. If earnings come in light more than likely the prices of equities will decrease but who knows, we’ll just have to wait and see. With that in mind and given my belief is that this market is overheated, I thought it a good time to “teach” you how to “hedge against” the downside, or the “dark side” as many call it. Markets go up for any good or even no reason whatsoever; they only go down for reason and there are many reasons on our plates for that to happen right now.

Equity Prices Are Overvalued

The equity markets are at the “edge of an abyss”. Peak earnings growth, low interest rates, consumer demand and accommodative monetary / fiscal policies, are all in the rearview mirror. The future is at best “cloudy”. As we enter earnings season, investors are taking a “this is as good as it gets” mentality from much of what I read and hear. It may be good time to hedge your portfolio against market risks with put options. Let’s take a look at how you can do that.

How To Hedge With Put Options

The actual number of put contracts you buy depends on how hedged you want to be with your portfolio. It’s a common-sense trade. Let’s assume your portfolio is closely aligned with the S&P 500. Each put option on SPY represents the “option” to sell 100 shares of SPY, the ETF that mimics the S&P 500. Let’s assume you have a portfolio of $100,000 tracking the S&P 500. Here’s a simple way to hedge your position.

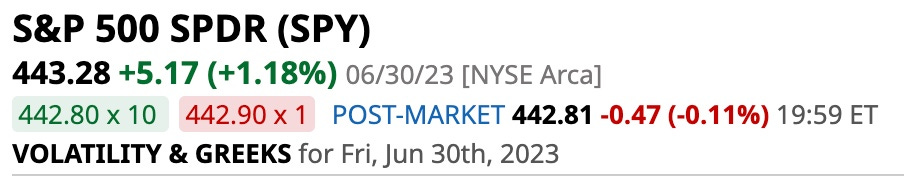

SPY closed at $443.28. An SPY September 2023 put contract with a strike price of $443 closed at $8.13 with a delta of (-0.45), meaning that every dollar that SPY falls reflects a $45.00 price increase for this contract (0.45*100 shares). Keep in mind that as the price of SPY changes, the delta of “near-the-money” options changes with it. The speed at which delta changes is called gamma, which increases as you get closer to expiration but since we’re a little less than three months away from expiration it’s excluded for this example.

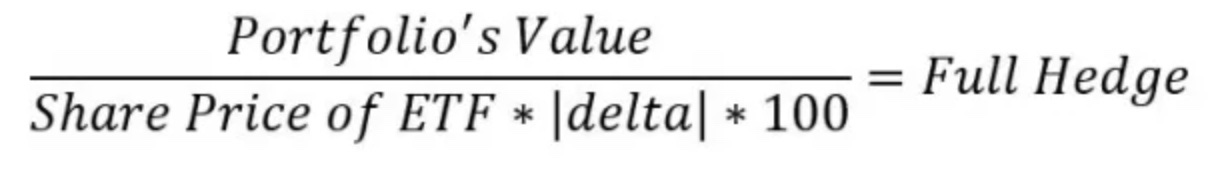

Let’s figure out how many contracts you need to purchase to hedge your portfolio; it’s time to do a little math. It is essential to understand how to fully hedge your portfolio, something you might not want to do, but must calculate to find a suitable number of contracts for your hedge.

The Calculation

To fully hedge a $100,000 portfolio at the aforementioned strike & expiration, take the value of the portfolio and divide it by the “price of the SPY” times “delta” times “100”. Your math gives you a result of roughly 5 contracts. To hedge the entire portfolio you would buy five put contracts at a cost of $4,065 plus commissions which are negligible.

If the market decreases, especially if it goes down quickly or even “crashes and burns” as people come to their senses, the price of the put will increase essentially offsetting the decline of your portfolio. In any case, you just bought “insurance” for a premium of roughly a little more than 4% of your portfolio’s value enabling you to sleep a little better, at least for the next couple months. Remember you bought the put option. All you can lose on this transaction is the amount of your purchase price of $4,065.

Hedging With ETFs: A Cost-Effective Alternative

Once used primarily as a substitute to mutual funds, exchange traded funds (“ETFs”) enable investors to accomplish several different financial objectives: (1) invest across sectors; (2) participate in niche markets; and (3) to allocate money across asset classes like stocks, bonds, currencies, real estate, and commodities. You can also use ETFs to hedge other related positions. Let’s look at a couple strategies with ETFs that protect or hedge investor portfolios from different risks.

Hedging has historically been limited to the using derivative-based securities, futures, options, and related securities. Because the mechanics of the pricing of the derivative based securities are based on advanced mathematical formulas, like the Black-Scholes options pricing models, hedging has often been left to large, sophisticated investors. With the availability of ETFs that’s changed for the better.

Exchange-traded funds are often used for hedging purposes.

Buying “SH”, an inverse S&P 500 ETFs ,hedges against negative market moves.

The ability to purchase and sell small increments of ETFs appeals to smaller investors with limited access to hedging because of large “minimum” requirements necessary to execute traditional protective strategies. There are many ways individual investors can use ETFs to hedge portfolios today.

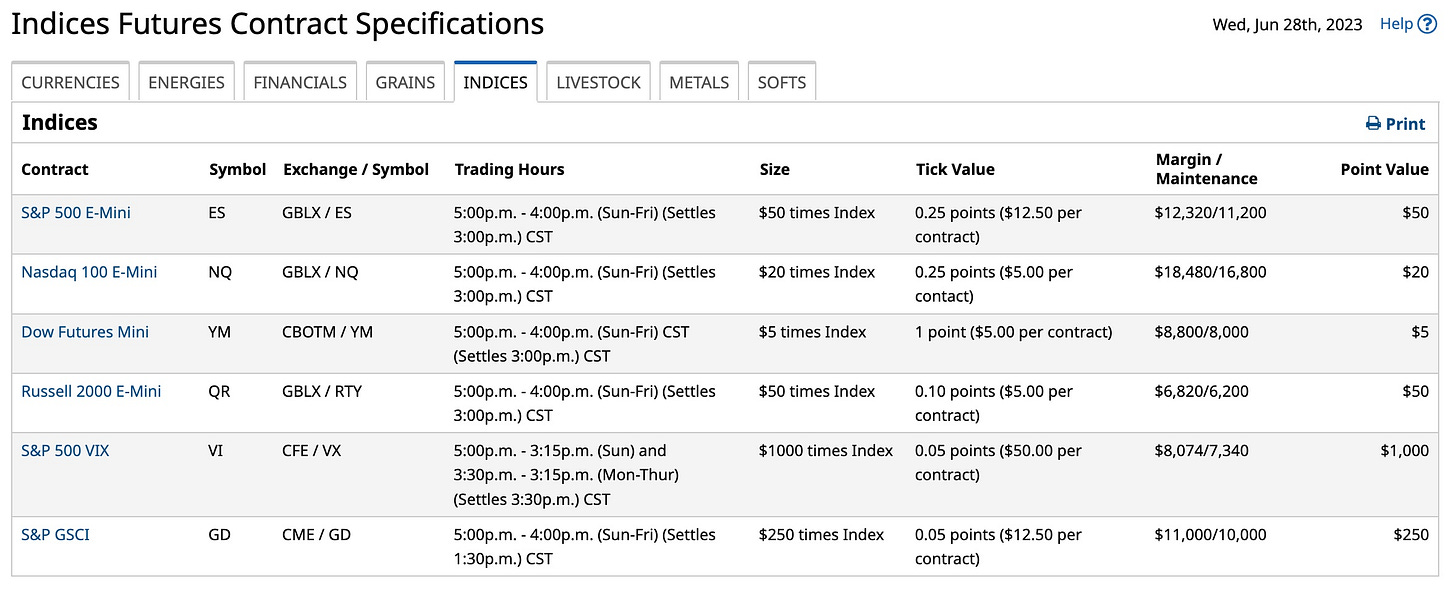

Investors often use futures and options to hedge their positions in stocks and bonds. One of the most common and actively traded tools for the equity market, for example, are S&P Index futures, which are used widely by large institutions, including pension funds, mutual funds, and active traders. We’ll discuss using futures to hedge portfolios in the following section.

ETFs like ProShares Short S&P500 (“SH”) move inversely to the S&P 500 Index and are used instead of futures contracts to initiate “short positions” in stock several different markets. Some of these “inverse” ETFs are leveraged and are more “volatile” than the overall market because the funds are designed to move two times or three times more than the overall market.

While the mechanics of using short equity ETFs are a bit different than using futures, buying short ETFs enables easier access as a means to the end. The share price of the inverse fund increases in value if the underlying stock market falls, and its increase in value offsets the losses incurred by stocks within the portfolio.

For a full hedge of your $100,000 portfolio you could purchase 7,204 shares of SH ($13.88 x 7,204 = $100,000). SH is a single inverse ETF and it moves opposite (-1X) the S&P 500 so it should nicely offset much of the move in your underlying stocks, equity ETFs and related holdings.

Hedging Equity Positions With Index Futures

Stock index futures are often used to adjust your exposure in the market. They provide a way of increasing or decreasing your market exposure without paying an “arm and a leg” in transaction fees. There are usually margin maintenance requirements you have to deal with but commissions are really cheap. We’ll discuss maintenance margin later after we’ve calculated the number and type of contracts necessary to effectively hedge the position.

An investor who picks “good stocks” but has no opinion on the future direction of the market still can hedge the market. Let’s assume we’re working with the same investor with a diversified portfolio of $100,000 that closely tracts the S&P 500 and he wants to hedge the market for the next three months. To effectively hedge, most investors use the CME futures contracts on S&P E-Mini (September 2023 (“ESU23”)), which is $50 multiplied by the index. The September 2023 futures price is $4,488.25 so one contract is worth $224,412.50, a little higher than the $100,000 we’re working with. Nonetheless let’s continue; there are some good lessons to learn from this exercise.

The calculation to determine the approximate optimal number of contracts to hedge follows: Divide the $100,000 portfolio value by $50 times the $4,488.25 futures price. The result is 0.4455. I don’t remember placing an order for a “fractional” portion of an index future but by using S&P E-Micro contracts, the CME’s made it possible. Damn the CME knows how to “mint money”.

Instead of dividing by $50 divide by $5, the “micro” multiplier for S&P 500 contracts and the result is 4.4560 contracts. Again, I’ve never placed an order for a “fractional” portion of any contract so the choice becomes yours, sell 4 S&P E-Micro (September 2023 (“ETU23”)) and hedge less than the $100,000 in the portfolio or sell 5 and protect a bit more than $100,000. The easy part is done; let’s deal with margin maintenance.

The current margin maintenance to hold an S&P E-Micro contract overnight is about $1,125.00. Before you enter an order to sell (“hedge”) these contracts you will deposit a minimum of $5,625.00 into your commodities account; might want to deposit a couple more bucks in there in case the position goes against you. Clearinghouses are good at its reducing their risk. The underlying value of the S&P E-Micro contract is $5 times $4,488.25 or $22,441.25. They are only asking you to deposit $1,125.00 or roughly 5% of its nominal value. The “house” wants you to “maintain” that “5% cushion”. They’re not your banker; they just facilitate your trading, for a fee.

Interested in opening a commodity account and working with the best broker I know? Then give Kevin a shout out at Stage5. The best words to describe Kevin and Stage5 are honest, ethical, service oriented and available. Hedging or speculating, Stage5 is the firm I use and where I refer those who ask.

I’ve been involved in the “world of futures” for 50 years. I started as a “hedger”. Most traders I know, the day, swing and scalper types are speculators. I started hedging in 1973 for a client of my Dad’s who owned a few “burger” franchises. They bought cattle futures to offset any dramatic increases in the price they paid for hamburger. It’s fun to speculate but “futures exchanges were not created for speculation”. While it may seem that’s the case today, when you take into consideration the sheer number of products that can be hedged on the exchanges and businesses who rely on “fixing” their prices to run their businesses, you’ll better understand. Hedging is a “win-win” situation; speculation is more akin to “gambling”.

Hedging is one of the courses I’m drafting at The Ticker EDU and it’s complimented by courses in Futures, Options, ETFs and thanks to you many more, 24 to be exact so far . I’m pretty much working almost around the clock to take what’s “in my head” and put it “between your ears”. A few of the courses should be on the table by the end of July, maybe sooner if I can learn how these “newfangled editors” work or if someone puts 27 hours into each day versus the current 24 hours we’re accustomed to..

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Kenny Rogers’ “The Gambler” is “inversely” appropriate for today’s post. All things considered about 10% of speculators are successful over time. Hedging is a “win-win” proposition. If you want to guarantee success in today’s markets invest in the CME as clearinghouses make money every time you place an order. That’s why I’m a hedger, and a damn good poker player as well. Have a good week and thanks for reading The Ticker. Don’t forget to tell your friends.