Over the last several years I’ve had the pleasure, as well as the challenge, to work with Niels Koops and now Daniel Chavez. With the assistance of colleagues far and wide, we’ve developed Tradrr, an integrated Order Flow platform designed to both identify and enter trades from online with a educational bias geared towards teaching traders how to become the best damn trader they can be. A daunting task, yes; but thoroughly rewarding, absolutely.

Over my life, other than trading equities and futures, my core skill revolves around the identification, development, building and refinement of emerging business ideas from scratch into viable entities. With Tradrr I’ve finally been able to combine my core skill together within an industry I love; trading. If you love what you do in essence you are never really working. I’m blessed to be part of Tradrr and thankful at the same time to give back to those who can benefit from my experience and steel trap memory; as long as that may last; better type faster.

Despite Tradrr emphasizing Order Flow trading, with volume profile, footprint, depth of market and their related tools, over time we’ve identified the overall general impact macroeconomics brings to the trading equation. As we embark upon the “education” side of Tradrr, we’re going to kick off with a couple regular weekly installments we’ve designed to bring the tools I use to “position trade”. “The Week That Was & What’s Coming” on Sunday nights is designed to both review “what’s transpired” as well as to provide insights into “what’s expected”, something I do between Thursdays’s closing bell and Sunday night’s opening.

In addition, on Wednesday’s, after the close, we’re developing a series of what we call “Why Wednesdays” designed to provide a general educational basis of the tools we’ve assembled to make you the best damn trader you can possibly be. Keep watching this site for our formal announcement so you don’t miss out on when we kick it all off.

Additionally, while we think we know exactly what you want us to deliver and present, as any good, experienced business person will tell you; it’s the “market” thats tell you what it wants . . . and we’re all ears. We look forward to receiving your input and in particular what you believe will help in your trading ventures. We have two ears wide open to making “what’s coming” what you want.

I’ve got a busy “honey do” Saturday on my hands today. With rain expected in the area tomorrow the grass needs cut and the mulch needs to be spread. It’s a good balance to have and living life in this manner keeps me happy. Remember, as a young 68 year old; my Dad became a broker when I was 13, while it’s time for me to ‘give back’ to all of you what’s in my head, I still have to take care of me and despite a constant fight with crab grass, someday I’m going to win that battle. It’s not always pretty but like trading a beautiful lawn and yard is based on history . . . and history, unchecked, unfortunately repeats itself; as such I recommend buying Home Depot stock.

Everyone learns at their own pace. If you love everything we’re about to put forth first time through, great but if not email me at dzimmer@substack.com so we can further help. Hope you join us with what’s coming and if you have any suggestions on how to grow a perfect lawn, let me know.

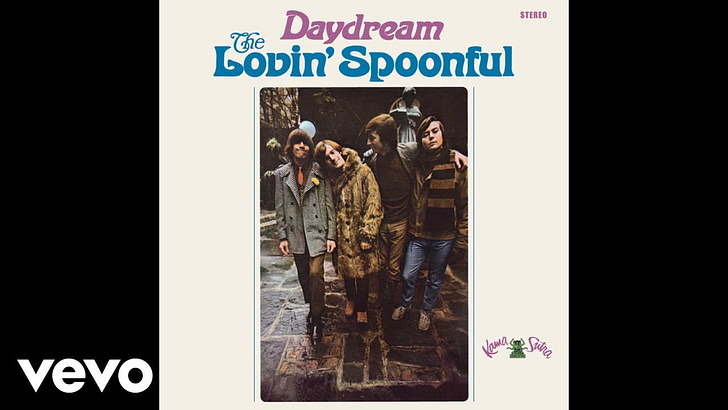

Here’s one from days gone by . . . hope your life is as good as mine . . . take the time to smell the roses or the cut grass . . . there’s more than just celebrating a winning trade.