One thing for certain you have learned about me is that if “nothing” is new, you’ll hear nothing from me. That works for me, and undoubtedly, it works for you too. If not by now, you would be following someone else.

Nothing is good, boring is good, and being on the “right side” is better. We’ve been there in the VIX call world and the debt market as we shorten maturities. We are not done with hedging, but it is common sense. We’re not done buying “beaten up “name brand” stocks or those whose underlying financials we like. There’s more but let’s go “one by one” as we discuss what we’re doing.

I Like The Trade Desk

There are always stocks to buy. Here’s one on my radar that I’ve been accumulating.

The Trade Desk delivered strong results and guidance, with revenue growth rates higher than expected, positioning it well for momentum into 2025.

The company's innovative advancements in areas like CTV and retail media have led to robust revenue growth, but macroeconomic challenges and competition pose risks.

TTD is priced at 26x forward EBITDA, considered fair in today’s world but with limited upside potential compared to others.

There I go again, always hedging but keep in mind, this company has “Google” in its sight and chances are, with the Trade Desk’s superior, cost-effective marketing, they are going to control this space.

Name Brand Stocks Work Too

Some things simmply do not change and my investmment style is one of them. I like to buy good stocks when they are getting beat up. I buy when the “herd” sells and do what I do best, wait.

Boeing

A new CEO tpp the helm of the Boeing Company this week. He is tasked with turning around an aerospace giant besieged by safety lapses, by production mistakes and basic delays, and by massive financial losses.

“I’m excited to dig in,” Robert “Kelly” Ortberg said to Boeing employees as he walked the factory floor this week in Renton, Washington, where the company assembles the 737 Max jetliner.

Ortberg took over a day after the National Transportation Safety Board wrapped up a contentious two-day investigative hearing on Alaska Airlines Flight 1282, the Boeing 737 Max plane that had a door plug panel blow out in mid-air shortly after taking off from Portland last January.

Every company has pitfalls from time to time. The key to Boeing’s turnaround will be revenue related. There is talk of a secondary issuance of stock so keep that in mind. It is going to take time for this one to perform and again, I’m happy to wait selling just selling naked puts below the market and covered calls against my position as the stock rallies over $190 a share.

Disney

After years of major losses totaling in the billions of dollars, Walt Disney Co.’s overall streaming business reached profitability for the first time ever. Third-quarter results, however, were tempered by weakening demand at the company’s key parks unit.

I made close to 50% on Disney as it ran from $80 to $120. Just like The Terminator” I am back.

Amazon

Amazon is a unique business powerhouse, seemingly turning everything it touches into gold.

Intrinsic value calculation shows AMZN's stock is undervalued by 26%, with a low end target price of $203. I think it is going much higher.

Amazon has tremendous potential to capitalize on three major megatrends of the

modern era.

Give Me High Dividend Stocks

BCE

BCE Inc. is a Canadian telecommunications and media company, and there are many reasons why investors might consider buying its stock:

BCE is one of the largest telecommunications companies in Canada, providing services like wireless, broadband, and media. It has a dominant market position, which gives it a competitive edge in the industry.

Telecommunications companies often have consistent revenue streams due to the essential nature of their services. BCE benefits from stable demand for its internet, wireless, and television services.

BCE is known for paying a reliable and attractive dividend, making it a popular choice for income-focused investors. The company has a history of maintaining and gradually increasing its dividend payments over time.

There’s Gold In Hedging Oil

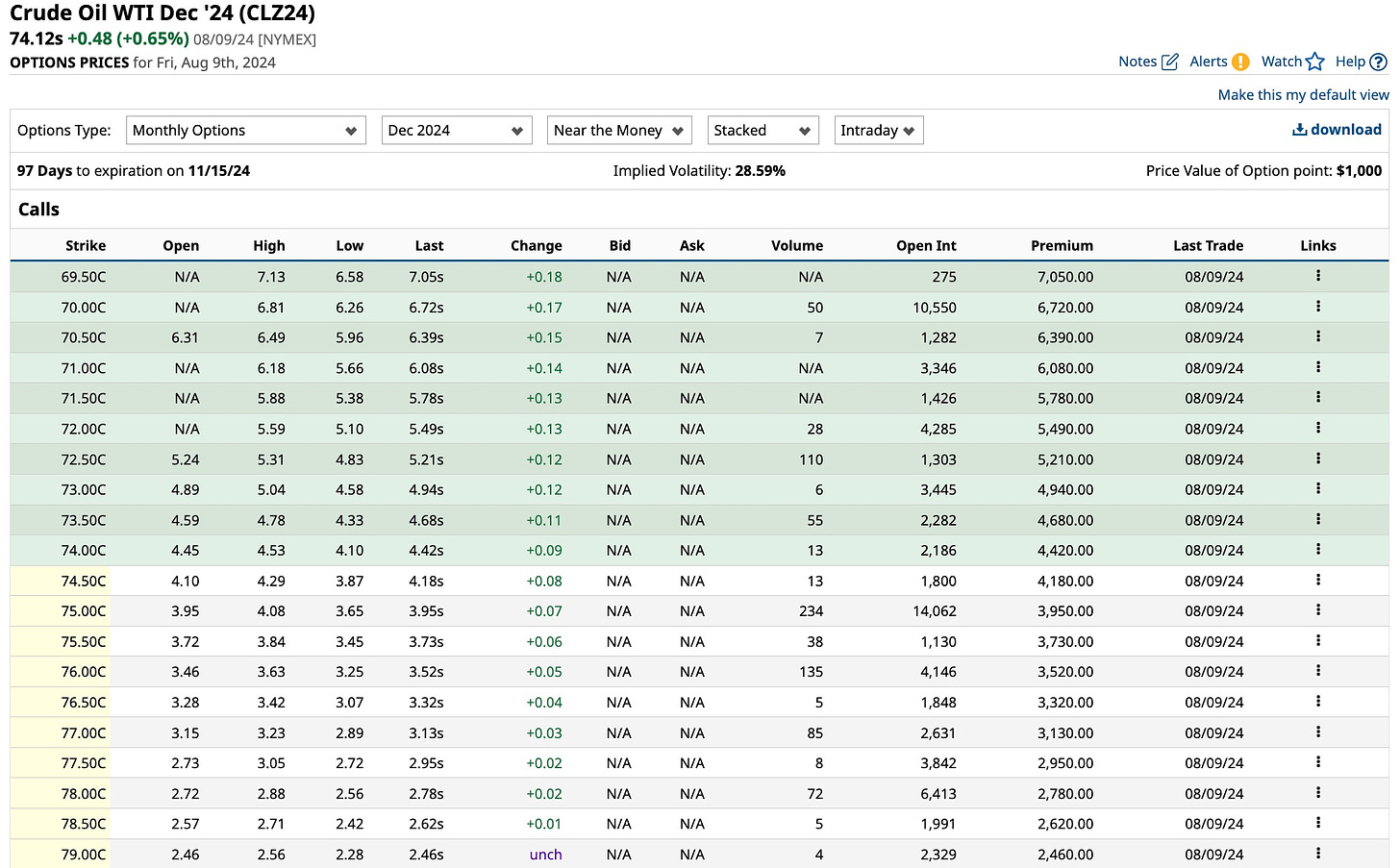

Just like I made a small fortune buying longer-term VIX call options over the last few weeks, I am doing the same with WTI Crude Oil call options. This gives me a hedge in case the economy is not as bad as I think it is. It also gives me a hedge in case of a World War III scenario as oil rises when events of this nature come to fruition.

Changes Coming With The Ticker

It’s August and for me that’s a time to reflect on what’s happening, both on the world of investments and in this case The Ticker. Times they are changing. Stay tuned and I will have more on these changes at The Ticker as we head into fall.

I find it amazing that the Rolling Stones are still out there performing. Without a doubt time is on their side. Me too. Patience is a virtue and if you do not have it, my sense is that you end up on the losing side more often than not. I’m boring and that is a good thing. If you are part of the “herd” you know what it’s like, getting in at the top and out at the bottom as you simply get “scared”. That’s why few traders ever make a dime. I make money because I have a long-term plan and I stick with it. That is what position trading is all about. I hope you are listening.