The markets today reminded me of being at Kennywood Park in Pittsburgh riding the best damn wooden rollercoaster ever built, “The Thunderbolt”.

Volatility is back, the VIX is proving that out. You day, scalp and swing traders finally had a day to remember. I think more are on their way. Strap yourselves in; it’s going to be a rough ride if you’re long.

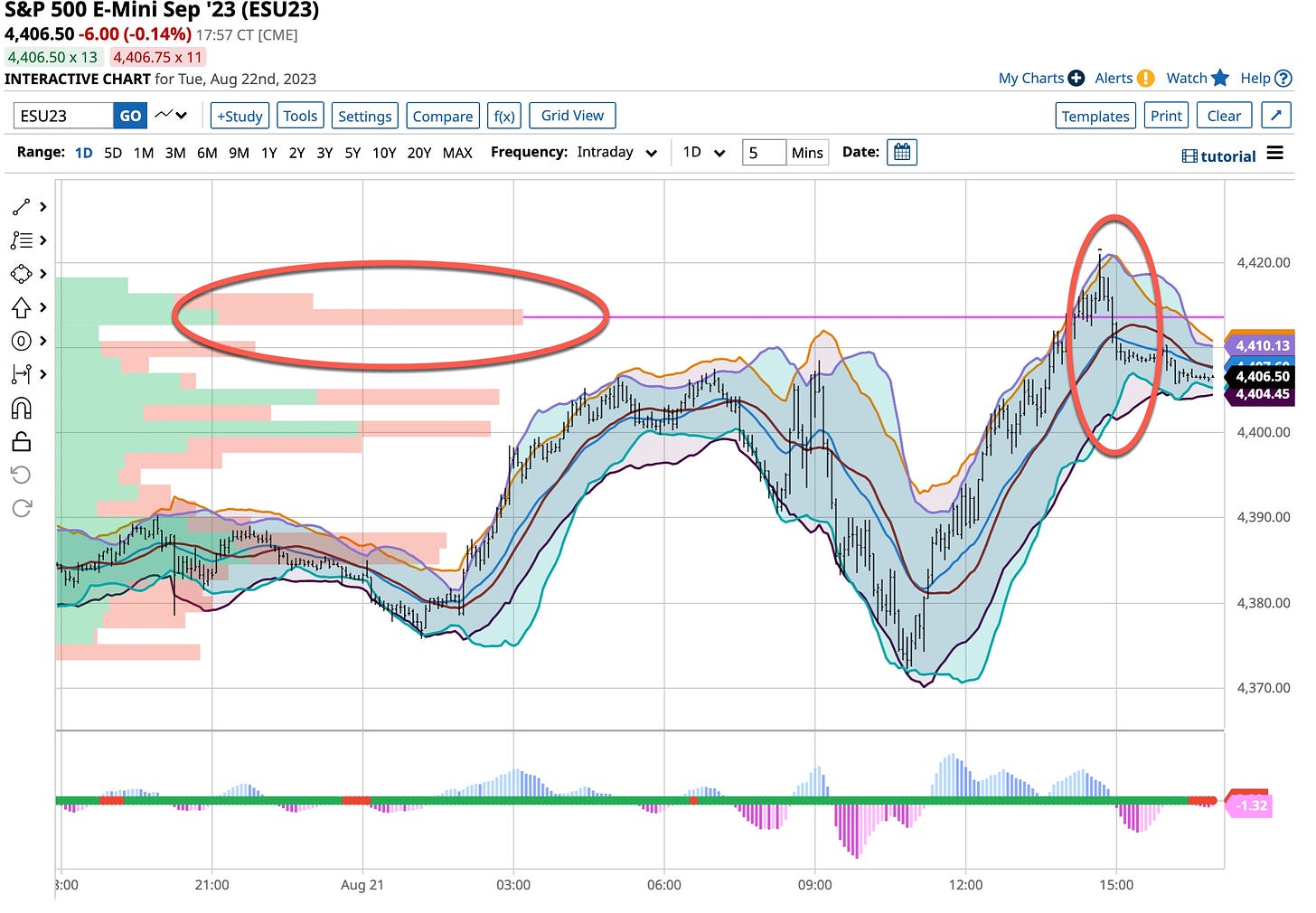

From this chart, compliments of Barchart, there was lots of selling at or around the close. Give Barchart a try, just “click here”; get a trial for free at no risk. It just might be the best ‘click’ you’ve ever made.

Powell Grows Cojones

Fed Chairman Jerome Powell is set to deliver clues on monetary policy later this week. From what I hear Paul Volcker has finally stopped “spinning in his grave". It’s about time; Paul was starting to get really dizzy. For a while it was worrisome that Powell might go in another direction, even consider raising the Fed’s target inflation rate. It seems that the best indicator of future rates, the long-bond traders, have put that to bed. I’m still a buyer of the longer term treasuries on “dips”; eventually this inflation cycle will subside. In the interim, as discussed on many sites I follow, Powell may tee up the idea of steeper longer-term interest rates. Powell is finally growing a “set of cojones”. Chairman Powell is going to see this job through, just like Volcker did.

It’s more interesting than not from the political side; I guess Powell isn’t interested in seeing another “four years” of the current administration ruining the country. Action keeping rates “higher for a longer period of time” sets the economy on a path towards below-trend growth coupled with an inflation pace that is in a sustainable downward trend. Deflation is not good for earnings; China doesn’t care, why should we? Do you wonder where that “soft landing” speech Yellen made a month back went; chances are she probably just ate too many “mushrooms”. Seems to me those holding long equity positions are about to experience a “dose of reality”; it’s about time, eh? Fundamentals do matter and profits decrease in deflationary periods.

Then There’s China

Xi Jinping’s rewriting of the Chinese economic playbook needs a revision. Investors are leaving, the yuan’s tumbling and China is becoming a larger world “risk factor” for the entire global economy. Some have called it a “ticking time bomb”. Fuse is lit.

Their economy is slowing, consumers are downbeat, exports are struggling, prices are falling and more than one in five young people are out of work. That’s not good, is it? Country Garden Holdings Co. is about to default, shadow banks are following as well. That’s not good either but both events happening at the same time tells me that China is about to follow our pathway of the Great Recession of 2008. The “party” is over. The question is which “party”. Xi’s been in office a little too long, eh?

Maybe Xi is looking to copy what’s known as “Japanification”. Price data is showing a deflationary trend. Falling prices are both a symptom of weak demand, and a drag on future growth as households delay purchases, business profits fall and real borrowing costs rise. We’re heading in the same direction. Corporate earnings wise, trouble’s on the horizon and these problems could encompass the rest of the developed world too. The “grass is always greener” on the other side. This time however, the “woke” world treating climate change as a top priority has turned the ground brown and no one has enough “water” to bring it back to life. Are we experiencing the Great Gatsby years of the “Roaring 20s” as they ended? You know what followed; let’s not do a repeat.

Macroeconomic / Geopolitical Book Excerpt

As a position trader, after I examine what going on between my ears, the next step is to examine what’s going on “around the globe”. Here’s an excerpt. Let me know your thoughts and thanks. Your opinion is important to me.

Interconnections Between Macroeconomics & Geopolitics

There are significant interconnections between normal macroeconomic factors and geopolitical events. Changes in geopolitical dynamics can have a profound impact on macroeconomic variables shaping economic conditions. Macroeconomic factors can influence geopolitical dynamics and shape the outcomes of geopolitical events. Here are some key interconnections between these two realms:

Trade & Economic Relationships

· Geopolitical events, like trade wars, sanctions or political conflicts, disrupt relationships.

· Disruptions lead to major changes in importing and exporting patterns that affect macroeconomic indicators; GDP growth, employment and inflation.

· Macroeconomic factors, economic growth / recessions, influence geopolitical dynamics by impacting a country's economic power, competitiveness and its trade relationships.

· Strong economic growth can enhance a country's geopolitical influence, while economic crises can weaken it.

Resource Availability & Energy Security

Geopolitical events that impact the availability or control of key resources, such as oil, gas or minerals, have profound economic consequences. Disruptions affect most energy prices, production costs and trade balance, impacting global macroeconomic stability and economic growth.

Macroeconomic factors, such as energy demand, resource scarcity or technological advancements, influence geopolitical dynamics. Countries decide to compete or to cooperate based on their energy needs, resource capabilities or efforts to reduce dependence on specific resources.

Capital Flows & Investment

Geopolitical events influence capital flows and investment decisions. Investors react to these geopolitical risks by reallocating investments or adjusting risks. Changes in investment patterns impact a country's currency exchange rates, financial markets and macroeconomics.

Macroeconomic factors, core interest rates, economic growth or policy stability, can attract or repel foreign investments. Countries exhibiting favorable macroeconomic conditions attract more capital inflows, which shapes their geopolitical standing.

Policy Responses & Economic Impact

Geopolitical events trigger policy responses from governments and central banks. These responses include changes in fiscal policy, monetary policy or trade policies, all aimed at mitigating the economic impact of geopolitical shocks.

Macroeconomic policies, interest rate adjustments or fiscal stimulus, can influence a country's geopolitical position. Expansionary fiscal policies usually benefit a country's economic standing and influence its negotiating power in geopolitical matters.

Market Sentiments & Investor Confidence:

Geopolitical events significantly impact “market sentiments” and investor confidence. Heightened geopolitical tensions can lead to market volatility, risk aversion and asset price fluctuations.

Macroeconomic factors, economic indicators, monetary policy decisions or financial stability, shapes investor confidence and market sentiments. Stable macroeconomic conditions can contribute to a positive investment climate and reduce vulnerability to geopolitical risks.

Not bad, eh? Just being true to what my objectives are, helping you be the best damn investor or trader you can be. Who knows, the whole book might even get done while I still have hair. Everyone will learn at their own pace. If you pick it up the first time, great if not email me at david@thetickeredu.com so I can further help. Let me know what you think about the excerpt, I’m all ears.

Cat Stevens wins today with “Wild World”. It is a wild, wild world out there. News is traveling at the “speed of the Internet”, one of the reasons I’m up most of the night. I have always been a “night owl”; I was raised by cats. That’s when they “rule the roost” and had fun. For me it’s how I get ready for the morning open to the US markets. Back to writing for me. You see there’s a lot of “stuff” crammed between my ears that needs to make its way between yours. One book done, four to go, just like the Bible; I hope it helps make you the best investor or trader you can possibly be. Best to all as always.