Sleep is not something that’s possible to schedule in today’s world. Patience however is something we abide with. As a matter of fact, patience is one of the many emotional traits successful investors and traders exhibit; especially the “long term” ones.

The following is taken directly from “The Ticker’s Bible”. If I didn’t practice exactly what I preach it would not be found in what I write.

Patience

I’m a position trader; I’m also perhaps one of the most patient persons, in every facet of my life, that you will ever meet; it works in the “investing and trading” arena. Being patient means having the ability to wait for, even delay gratification. Most people who are patient seldom become frustrated or agitated and they don’t “throw in the towel” or become angry. Patient people tolerate frustration, delay and uncertainty; they are all aware that patience enhances their performance. It’s better to wait than be wrong.

Patience signifies that whether investing or trading you have the ability to persist in the face of obstacles and setbacks. You become more resilient and persistent if you are patient as well as being more understanding and accepting of others. You will be better able to manage your emotions and act, versus reacting to difficult situations.

Instant gratification is rarely achieved. With respect to “investing and trading”, do not chase market movements. Defeat the “fear of missing out” knowing there will always be another opportunity. Not having a position is a position and you’ll never go broke taking a profit.

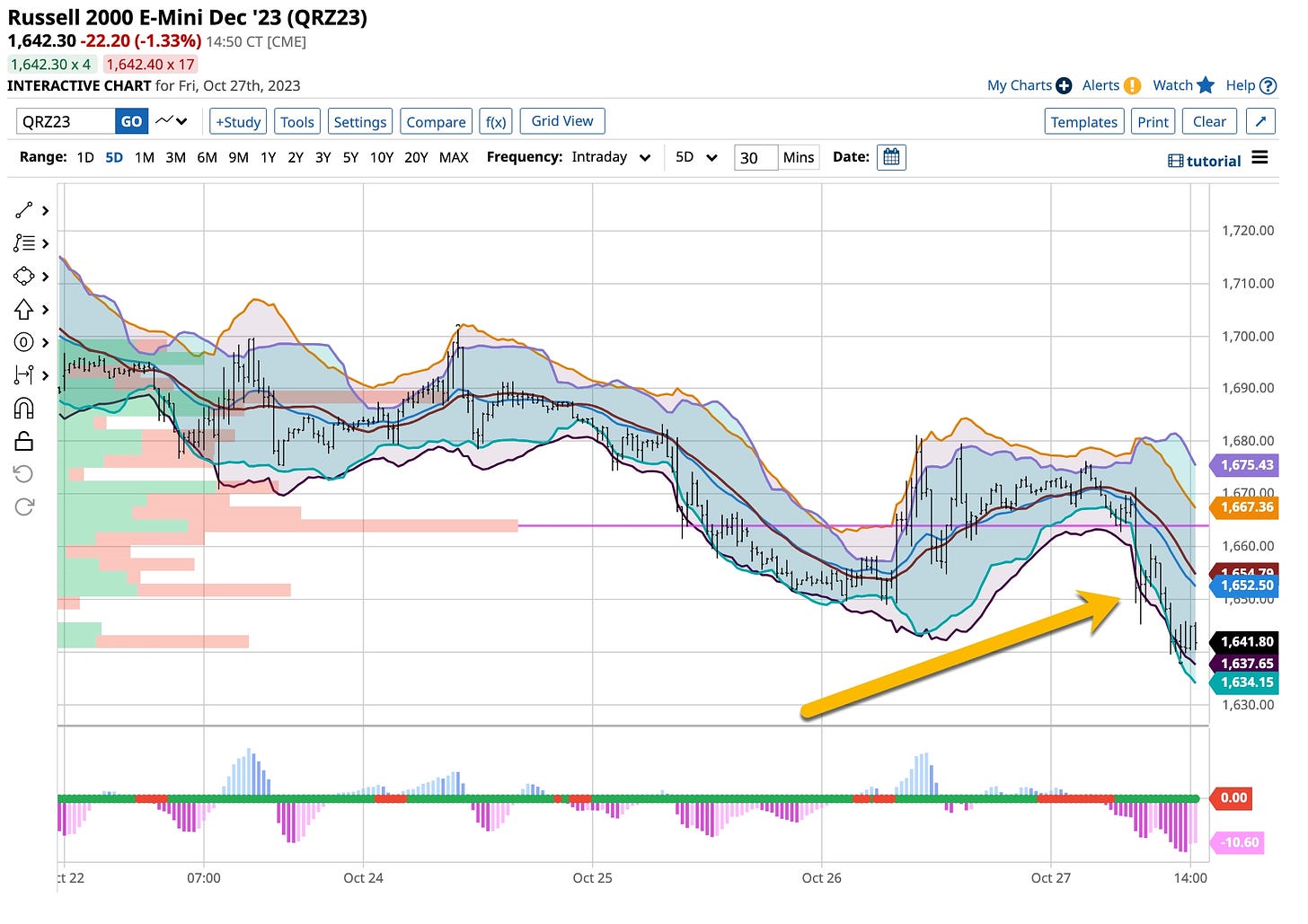

Watching the Russell “do its thing” is a great example of patience. Practice it.

You have all been patient as I continue to develop the book, complimentary course(s) on Udemy, how Substack will be handled and more. Many of you communicate with me directly. I’m looking into a regularly scheduled Zoom webinar program but I’m not sure exactly what that will be. I still manage a few clients with a bunch of money and that’s an alternative that all should consider. Chances are I’ll do some type of what is known as “one-on-one” communication but again, the size of “exactly” what you are managing is an important criteria. For now I’ll just worry about Amazon, Udemy and Substack and wait for the others to develop. Rome wasn’t built in a day and what I’m putting together, with your help, takes time. Thanks for your “patience”.

Paid for weekend coming up folks and it’s well worthwhile. I’m going to center around the usuals, macroeconomic and geopolitical matters surrounding us in today’s world. I will take it a step further based upon what those who actually “pay” for my weekend diatribe have requested. Everybody has indicators, whether they be futures, ETFs and above all equities. For years I’ve singled out “specific” industries and the equities that comprise them. While they always change over time, what’s going to hit the press this weekend is what I’m watching now. In addition I’ll breakdown exactly how I do what I do and the tools I use to do it. Not bad, eh? Sign up, it’s worth your while.

It’s still priced at $9.99 a month as I continue to learn what you want, that’s important as you know what you need, I don’t. As an aside, those who sign up will receive a copy of my book when it’s done. Those residing in the United States will pay no additional postage. I’ll keep it cheap for others around the world as what’s included in my first book is well worth reading. That’s it for now; enjoy the day and the weekend.

Just a funny cartoon to finish up the week. Hope yours was a good one. If you’ve been listening, reading and watching, it should have been. See you all Sunday night. Thanks for being part of The Ticker EDU.