Unfortunately, time is not something I have, but “drilling” patience and putting time on your side is a critical philosophy followed. With that in mind, I’ll provide a brief dissertation on why a strategy of this nature works.

Remember, I’m a long-term position investor, trader, and hedger. While many in this industry profess upwards of ten-year strategies, we tend to be a bit shorter across the curve unless appropriate.

Patience Works

Embracing patience in investing can significantly enhance your chances of long-term success. A simple strategy of holding investments for multiple years yields impressive odds of profitability. Often, the most effective investment approach resists the urge to overtrade and focus on a steady, long-term plan. When investing, doing less can often be more productive than overtrading.

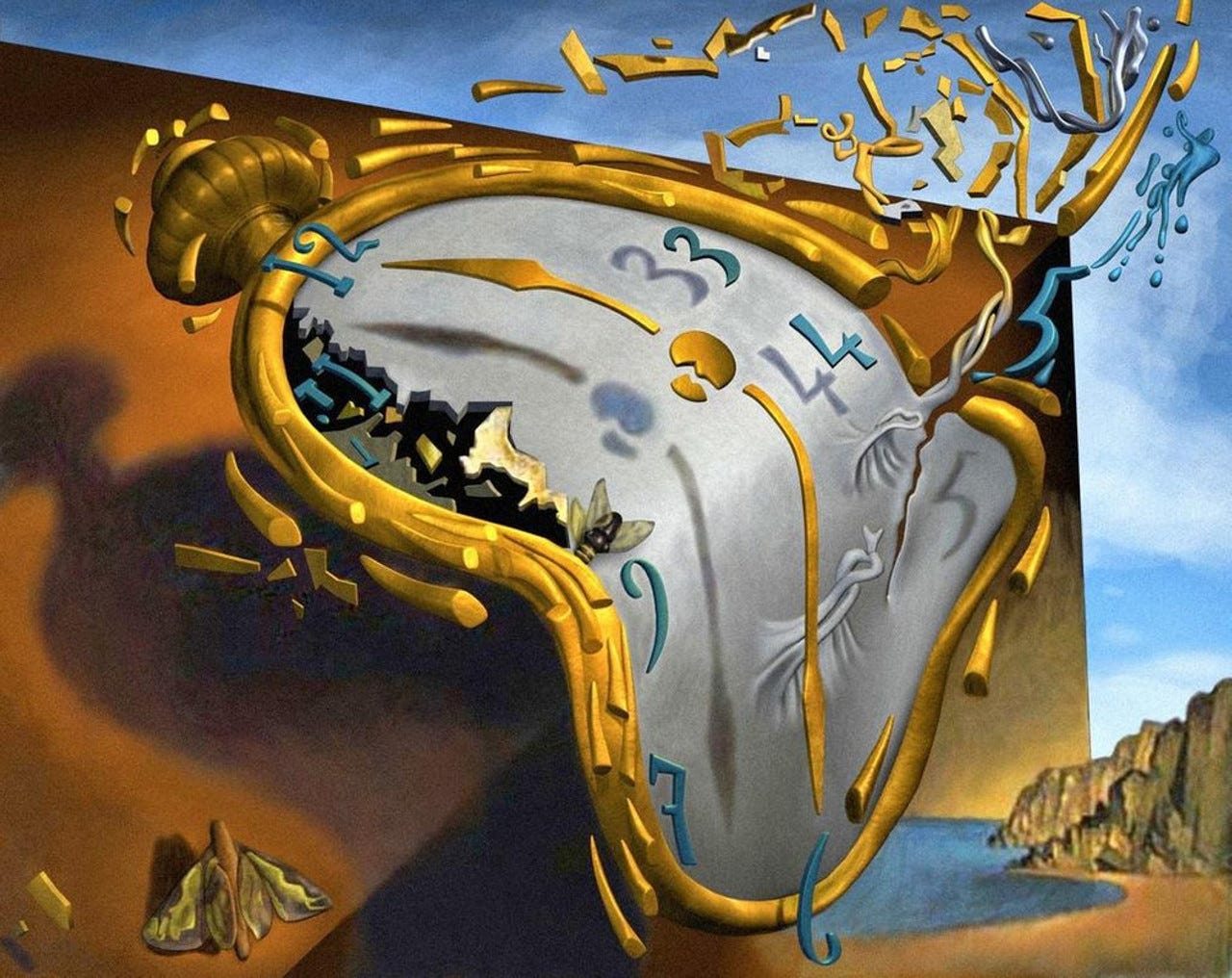

Take a look at the insightful chart below. It illustrates a key insight, the more patience we show as investors, the greater our chances of profiting.

Yet, here's the kicker, the average holding period for stocks in a portfolio is just six months. It’s easy to see why many investors end up losing money.

For a stock to be included in the S&P 500, it must meet three criteria:

A market capitalization greater than $8 billion.

High liquidity and a U.S. base.

Positive earnings in the last quarter and the previous year.

The S&P 500 itself follows a specific strategy, applying these criteria and conducting quarterly reviews to adjust its composition. Each year, about 20 stocks change. Often, investors confuse simplicity with ineffectiveness or poor performance. Simplicity can yield the best results. Unfortunately, simplicity isn’t always exciting, and many people prefer the thrill over the path to real profits. I prefer to be bored.

So, instead of chasing the latest trends or jumping from one investment to another, consider embracing a longer-term strategy. In the world of investing, doing less could result in achieving more.

Put Time On Your Side

I do that using patience, but there is more. I like to sell naked put options and covered call options for a reason. I put time on my side.

Options expire. They are time-based entities that become less valuable every day. It’s a given that the premium intrinsic to the option will decline to “zero” over time, so it’s always best to put this relationship on your side.

I sell naked put options on stocks I think will increase in price or those I am happy to acquire at prices below the current market level. I sell covered call options to increase the return on positions I currently own. If the stock blows through the option strike, I will sell it. Otherwise, I’ll take the premium received and add it to the overall returns I book on the investment.

Mick Jagger was right years ago when he appeared on the Ed Sullivan Show. Time was definitely on his side. He’s proven it by living and performing for years. Chances are if you listened to what he sang, you put time on your side as well. I’m a very boring type of trader. Those who follow me are too and understand how to put time on your side. I do not have time to waste but I want to be sure you are listening. If you are this article is second nature to you. That’s a good thing.