Face it, splitting the week into two parts is different from what most of us are used to. It gives me a chance to deliver a little basic knowledge to the masses. It’s summer too so time is on our side. Much of what’s presented comes from “The Ticker” courses. It is my pleasure to give you a few tidbits from five miles up. Realistically, learning how to become the best damn trader or investor you can be takes time. Nonetheless, some simple methods to improve your basic performance using options are beneficial.

Acquiring Assets At A Discount

There are many reasons to use options. Most everyone thinks that options exist so the cost of speculation is reduced. That is true but it’s just the “tip of the iceberg”. People far too often look at the “buy side” in particular towards the upside as positivity rules the roost. There is nothing wrong with that but for one reason or another most forget that put options exist. Assets go down in price as well.

Better-educated traders and investors sell and write naked options for a reason. With respect to building a position in an asset, in this case, the common stock of Boeing, selling naked puts provides the acquirer with (1) a lower entry point and (2) protection.

Boeing has been identified as a “name brand” turnaround stock. Buying stocks of this nature, and looking to hold them for the “long term” makes sense. I’ve been a buyer of Boeing since earlier this year. It’s now my fourth-largest holding.

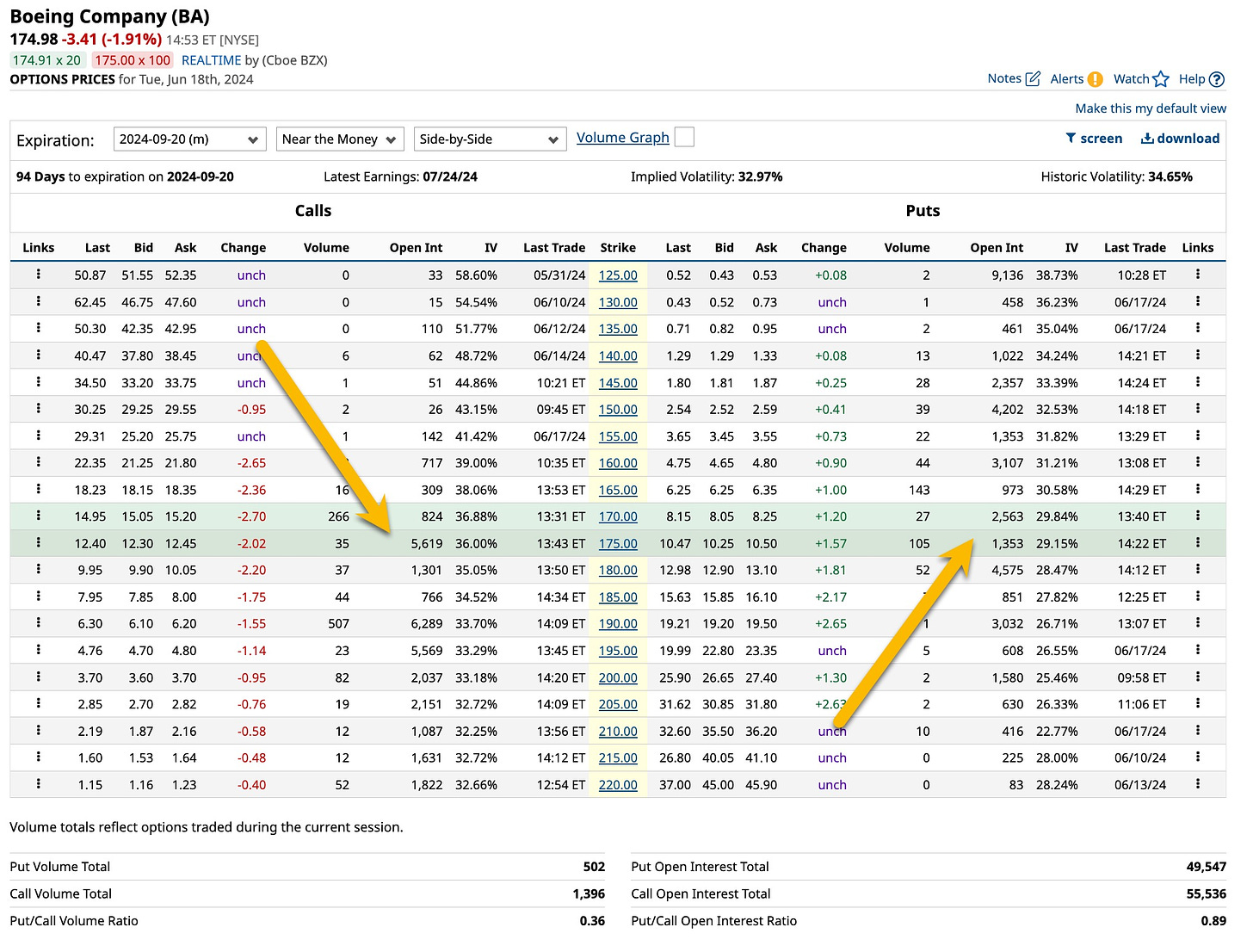

When Boeing hit my radar screen, its put options were “front & center”. Boeing stock is very popular. Its options and option chains are vast. To acquire discounted Boeing shares I sold naked puts below its then market price. Given the stock was trading at $175 a share, I actively sold 165 to 175 one to three-month put options. Remember, the margin factor came into play. Requirements illustrating my ability to pay to acquire a bunch of shares were apparent. If for some reason the stock went higher, the premium I received selling the put options, upon expiration hit my bottom line. Both events did happen. I picked up discounted Boeing shares and added income to my account when the unexercised put option expired.

I’m still doing that with a twist. With respect to Boeing, unless Warren Buffett “buys” the company with his cash horde, it’s going to trade in a range between $170 to $190. When it hits the $175 level I’ll sell more naked puts. When it runs to higher levels, I’ll be selling covered calls. It’s a standard procedure I employ when acquiring shares in a “name brand” turnaround. Give it a try. It works.

Protect Your Profits During Earnings Season

The last thing I ever want to do is give back profits. I take pride in being right. Giving it back is a mistake which is why I use “trailing stops” and when earnings are reported put and call options.

None of the stocks in my portfolio will be reporting earnings anytime soon. About six weeks ago I published a couple of articles about Walt Disney and Dollar General. My profits in both were solid, 50%+ and 40%+ respectively. Nothing goes straight up. The markets, for everything not associated with “AI” were topping. Interest rate decreases were on hold and the potential for wider worldwide conflicts were apparent.

I sold shares of each before earnings and hedged the rest. By hedging, I bought “puts” and sold “calls”. I bought near-term “at” or “in” the money puts and sold longer-term call options “at” or “out” of the money. What I received for the call options paid for the put options. I essentially spent nothing to protect myself.

I still own both securities but not as many shares as I started with. Both securities went down and I exercised my put options reducing my holdings. What remains for both is in “good hands” and I’ll continue to sell more calls as those currently expire.

Options are simple when used correctly. Many have asked me privately about options and how to learn how to use them. That’s a two-way street and why we suggest you all start with The Ticker courses. If you want to learn more then ask about The Ticker’s “1-on-1” tutorials. There’s little I cannot teach and I love options. You will too.

Like Freddie Mercury sang, “Don’t Stop Me Now”. Believe it or not folks, it’s been two years since I started working on The Ticker. Just figuring out exactly what you wanted was difficult. You want everything in my 55+ years of experience presented to you on a “silver platter”. Sorry, it’s not going to happen. It takes time, especially if it’s beneficial and effective. So I started writing and you liked it. My thoughts were then adopted on LinkedIn. Now I have people asking me for more. Start with “The Ticker” and join us during our introductory special. Act today as our normal rate of $247 is coming back when our introduction is finished.