From time to time, I do my best to bring you the opinion of others. Between you and me I do my best to ensure what’s written comes from the perspective of those living in different, sometimes controversial parts of this globe. Today’s thoughts came from an early adopter of mine in Iran, that’s right people, Iran. In my opinion, it’s damn good and kind of makes me wonder who is really in control there. It also makes me wonder why people seek to unearth differences versus develop mutual solutions.

What Mahdi Nikpour Thinks

First of all, so you will all realize what’s posted, with minor corrections made for set up and grammar, comes directly from Mahdi, I’ll include the first couple sentences he wrote. He’s real and is available to all of you on LinkedIn. Connect with him and tell him that “The Ticker” sent you. Ever little bit helps, eh?

“Hi everyone! First of all, I want to express my gratitude to David for his wonderful work and for inspiring me to share my thoughts and analysis with you. So, let's get down to business.”

Scenario based decision making is a powerful tool for trading in financial markets. It involves creating and analyzing different outcomes of a situation, and choosing the best course of action based on the expected risks and rewards. By considering various scenarios, traders can anticipate potential opportunities and threats, and prepare for them accordingly. We all heard that it's wise to have a “Plan B” strategy, right?

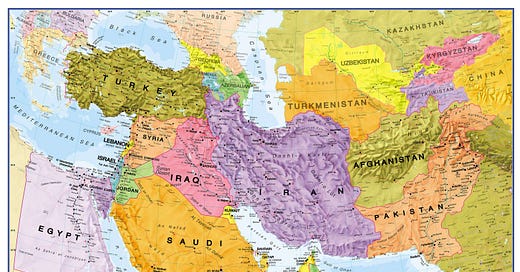

The “Middle East” is a region of great geopolitical and economic importance, and its stability or instability has significant impacts on the global financial markets. In this essay, I want to analyze the possible impacts of two scenarios: a calm Middle East and a more war-torn Middle East, on the U.S. dollar, crude oil, bonds, indices and gold. I’ll take into account the “market expectations” of interest rate cuts, the risk of recession and the U.S. presidential election.

Scenario 1: A Calm Middle East

In this scenario, the war in Gaza ends with a ceasefire and political solution, Houthi attacks on maritime traffic in the Red Sea ceases, and the tensions between the U.S. and Iran ease. This would reduce regional instability and violence, and create a more conducive environment for trade, investment and diplomacy. A soft landing occurs and everyone gets a happy ending.

The possible impacts of this scenario on the financial markets are:

The Dollar would weaken, as the demand for safe-haven assets would decline, and the “Federal Reserve” would have more room to cut interest rates to stimulate the economy and avoid a recession.

Crude oil prices would fall, as supply risks and the “geopolitical” premium would diminish, as global oil demand would remain subdued due to the slow economic growth.

Bond prices would rise, as lower interest rates and lower inflation expectations would increase the demand for fixed-income securities, especially from all of the investors who seek stable returns and diversification.

Indices would rise, as lower interest rates and an improved risk appetite would boost the stock markets, especially sectors that benefit from the lower oil prices and the higher consumer spending. In particular these are transportation, retail and technology. AI will take these companies and more to the moon this year.

Gold prices would fall, as lower interest rates and the lower geopolitical tensions would reduce the appeal of gold as a hedge against inflation and uncertainty.

Scenario 2: A More War-Torn Middle East

In this scenario, the war on Gaza between Israel and Hamas escalates, the Houthi attacks on maritime traffic in the Red Sea intensify, and the tensions between the U.S. and Iran worsens. This action would increase the overall regional instability and violence, creating a more “hostile and unpredictable” environment for trade, investment and diplomacy.

The possible impacts of this scenario on the financial markets are:The U.S. dollar would strengthen, as the demand for safe-haven assets would increase, and the Federal Reserve would have less room to cut interest rates to avoid a hawkish backlash and a loss of credibility.

Crude oil prices would rise, as the supply risks and the “geopolitical” premium would increase. Global oil demand would remain “resilient” due to the limited alternatives and the strategic importance of oil.

Bonds prices would fall, as higher interest rates and inflation expectations would decrease the demand for fixed-income securities, especially from those investors who seek higher returns and growth opportunities.

Indices would fall, as the higher interest rates and the lower risk appetite would weigh on the stock markets, especially the sectors that suffer from the higher oil prices and the lower consumer spending, like energy, manufacturing and tourism. Although AI & the “Magnificent Seven” would probably keep their rally due to advancements in AI technology.

Gold prices would rise, as the higher interest rates and the higher geopolitical tensions would increase the appeal of gold as a hedge against this inflation and uncertainty.

At the end no one has a “crystal ball” to predict what happens next but a wise investor or trader should consider different scenarios and act accordingly.

What can I say Mahdi, people from all around this globe we call “Earth” make more sense than they are given credit for. I sincerely appreciate your words and thoughts and sense our readers do as well. I thank you for taking your tie to voice yourself.

While Simon & Garfunkel made this song popular, it was Pete Seeger who wrote “Last Night I Had the Strangest Dream”. Think about it folks, we just posted a dissertation from Mahdi Nikpour, someone but for Linkedin we wouldn’t know. Shame on us. Why has it taken so long for Americans to realize it’s a big world out there. Understanding where to invest worldwide for me is based upon where the “big boys” put their money and frankly, they, like Warren Buffett are usually right. Nonetheless, take a look at the article posted and realize, we’re not different from each other, regardless of where we live. If you are like me you have to wonder what we’re missing on this planet.