Quite often, it is not following as much what you own, investment-wise, but rather it is equally important to look out for “what’s next.’’ Welcome to my weekend work. My project on rare earth element identification and development is well under way. With that in mind, I can take a look at a few interesting and potential positions.

Interesting Rare Earth Element Action On Friday

It is easy here to just cut to the chase, and that’s what I’ll do. I’m following more than twenty listed securities. Like the early days of ‘pink sheets,' most of these securities are found on the Vancouver Canadian Exchange. In other words, they are risky.

There are a couple of securities worth looking into. MP Materials (“MP”) is one, and USA Rare Earth (“USAR”) is the other.

MP Materials Corp. (“MP’) is a U.S.-based company specializing in the production and processing of rare earth materials, which are essential components in various high-tech and defense applications.

Founded in 2017, it’s based in Las Vegas, Nevada. It owns and operates the Mountain Pass mine in California, the only active rare earth mining and processing site in the United States. It focuses primarily on Neodymium-Praseodymium (NdPr), critical for high-strength permanent magnets used in electric vehicles, wind turbines, drones, and defense systems.

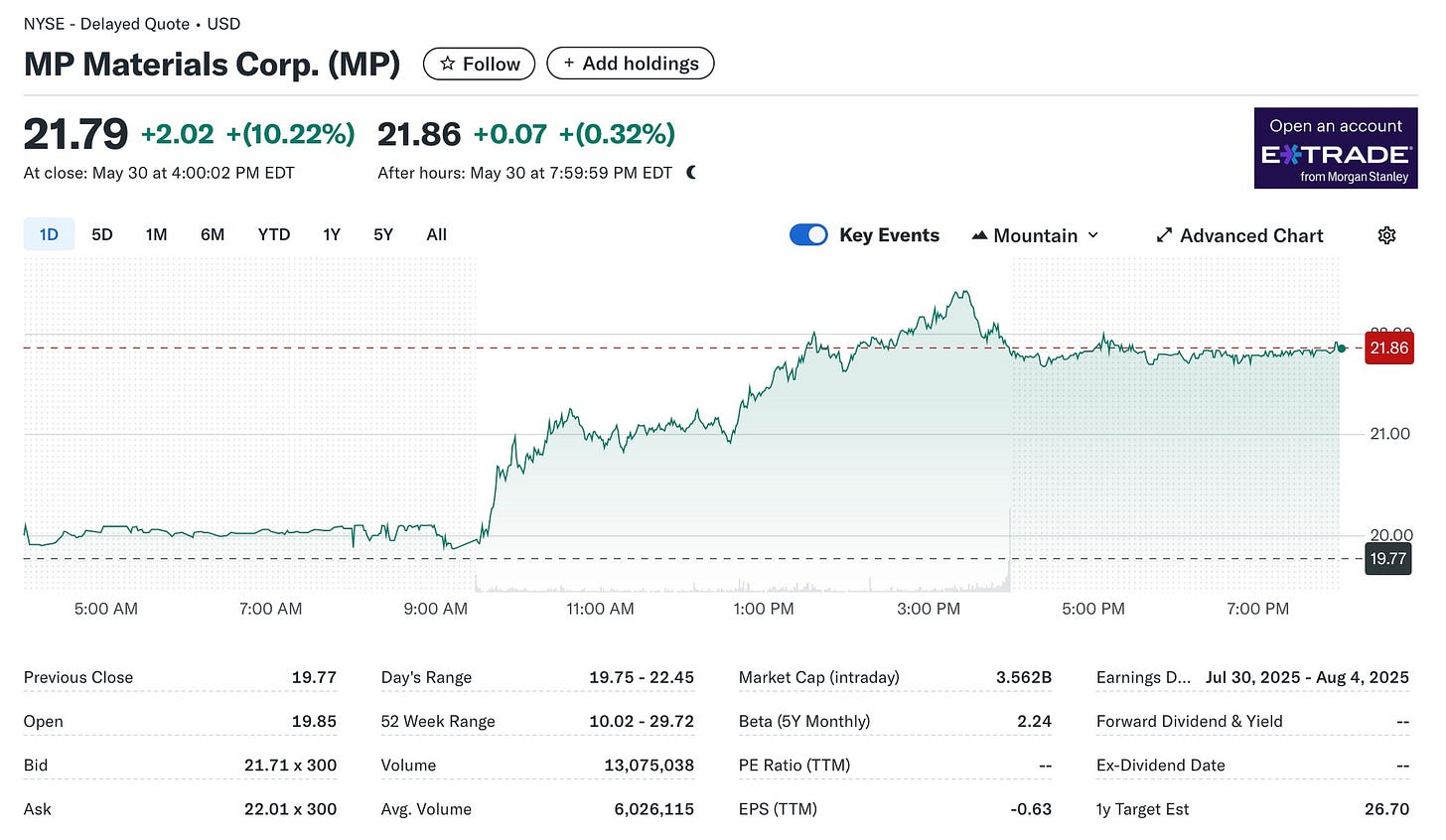

As of May 31, 2025, MP Materials' stock price stands at $21.79, reflecting a 10.22% increase over the past 24 hours. The stock has experienced a 12-month range between $10.02 and $29.72. Analysts are seeking a $27 target and rate the stock a buy. I agree, but sense with the right criteria and new it could go much higher.

It is heading towards full-scale domestic production of rare earth magnets, aiming to supply automotive-grade magnets to General Motors by the end of 2025. The company is investing in refining capabilities, including a new facility in Fort Worth, Texas, to reduce reliance on Chinese processing. MP Materials has received funding from the U.S. Department of Defense and Department of Energy to bolster domestic rare earth production and processing capabilities.

Recent Chinese export restrictions on rare earth metals have impacted MP Materials, leading to the suspension of concentrate shipments to China and necessitating a shift towards domestic processing. While it has made strides in processing light rare earth elements, it cannot currently process heavy rare earth elements like dysprosium and terbium, which are vital for certain defense applications.

MP Materials is a pivotal player in the U.S. rare earth supply chain, with strategic initiatives aimed at reducing dependence on foreign sources. The company's vertical integration efforts and government support position it favorably for solid long-term growth.

USA Rare Earth, Inc. (“USAR’) is a U.S.-based company focused on developing a fully domestic supply chain for rare earth elements (REEs) and permanent magnets, which are critical for various industries, including electric vehicles, renewable energy, and defense.

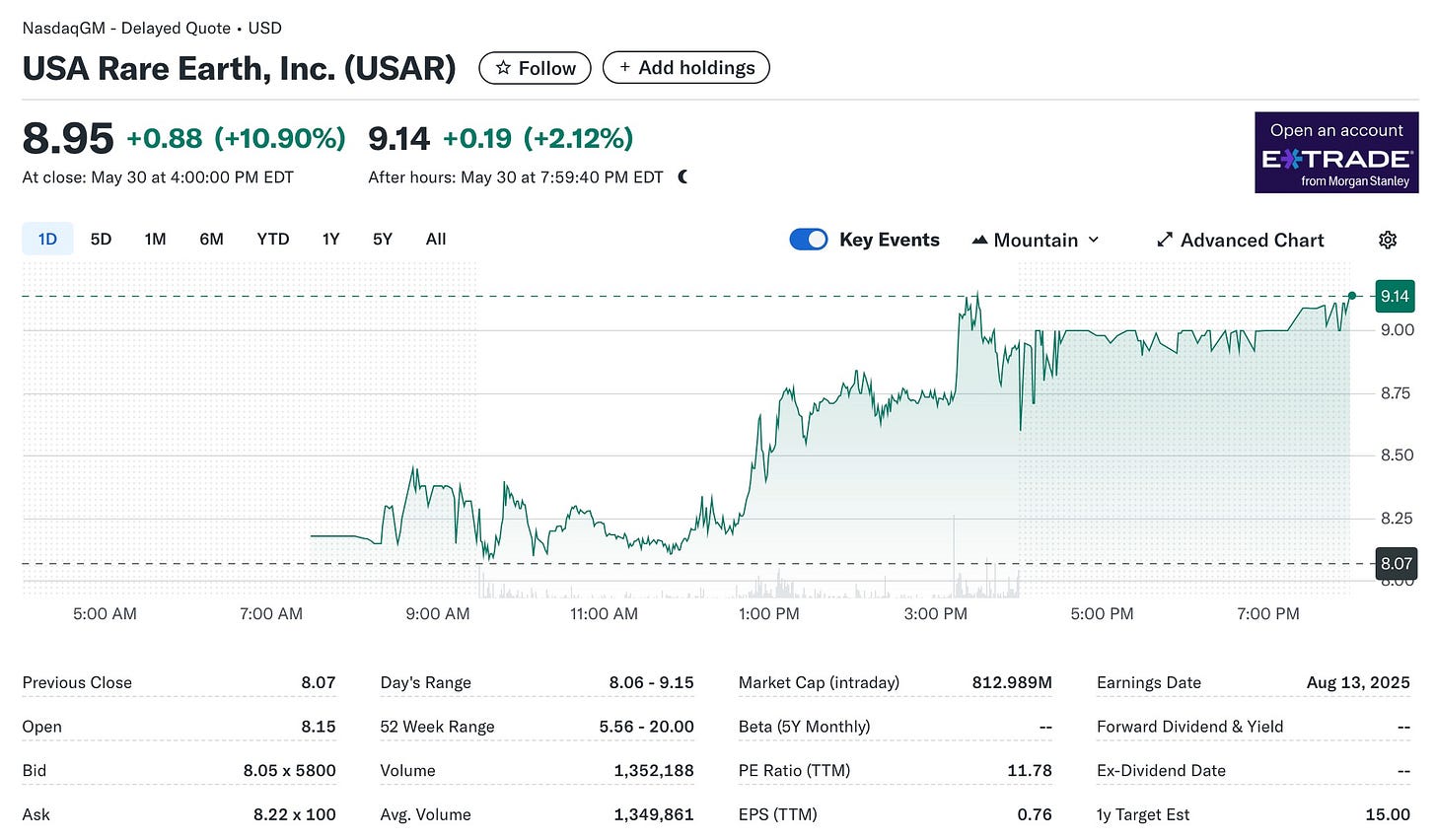

Founded om 2019, and based in Stillwater, Oklahoma, its top project li located near Sierra Blanca, Texas. This deposit contains 15 of the 17 rare earth elements, along with lithium, gallium, beryllium, and uranium. Its goal is to establish a vertically integrated U.S. supply chain for rare earth elements and magnets, reducing reliance on foreign sources, particularly China. The stock experienced a significant surge of 76.9% in April 2025, reflecting increased investor interest in domestic rare earth initiatives.

In March 2025, USA Rare Earth went public using a merger with Inflection Point Acquisition Corp II, debuting on NASDAQ under the ticker 'USAR'. In January 2025, the company produced its first batch of rare earth magnets at the Oklahoma facility. In January 2025, USA Rare Earth produced dysprosium oxide at the Texas Round Top deposit. In May 2025, USA Rare Earth signed a Memorandum of Understanding with PolarStar Innovations for the delivery of U.S.-made neodymium magnets. Recently, in May 2025, the company announced the closing of a $75.0 million PIPE financing to support its operations and expansion plans.

USA Rare Earth aims to become a leading domestic supplier of rare earth elements and magnets, addressing national security and supply chain concerns. As a relatively new entrant in the market, it faces significant challenges toward scaling production, technological development, and market competition. The company's operations are influenced by U.S. government policies aimed at reducing dependence on foreign sources for critical minerals.

Sounds pretty good to me, so adding a small position at this level makes sense. This is one hell of a growing industry, especially if regulations can be minimized. China does it, so why can’t the US?

I wonder if Marilyn Monroe would still be talking about ‘diamonds’ in today’s world, or would she be seeking something else. I hear the lab-grown gems are taking market share. So are the rare earth elements. They should be. They are in demand, and that’s growing. Time to search underwater for these newly patented gems. You can keep all of the gemstones. I’ll take the rocks.