Tonight’s the night. Powell is done with Congress now it’s the “big guy’s” turn to do his thing, read the teleprompter and talk at the nation. I’d say he’ll talk to the “nation” but we all know better. What I wouldn’t give to be a fly dancing across the front of the teleprompter screen during a critical portion of his speech. The world is watching Joe so do a good job. Make us all proud and get through the speech without talking about Ben & Jerry’s new ice cream flavor called “Biden’s Brain Freeze”. I understand it’s your former dog Commander’s favorite because it comes with a “bite”.

Sorry folks, there’s just a few times when I really just let loose. The State of the Union is one of those times. I didn’t always feel that way but when Nancy Pelosi just ‘ripped’ Donald Trump’s speech to shreds it hit me. If she can do something like that sitting in the Speaker’s chair next to the Vice President I can launch a negative diatribe as well. I do hope he does well and redeems a little respect worldwide that he’s lost over time but down deep I hope he further reveals that another term is an obvious mistake.

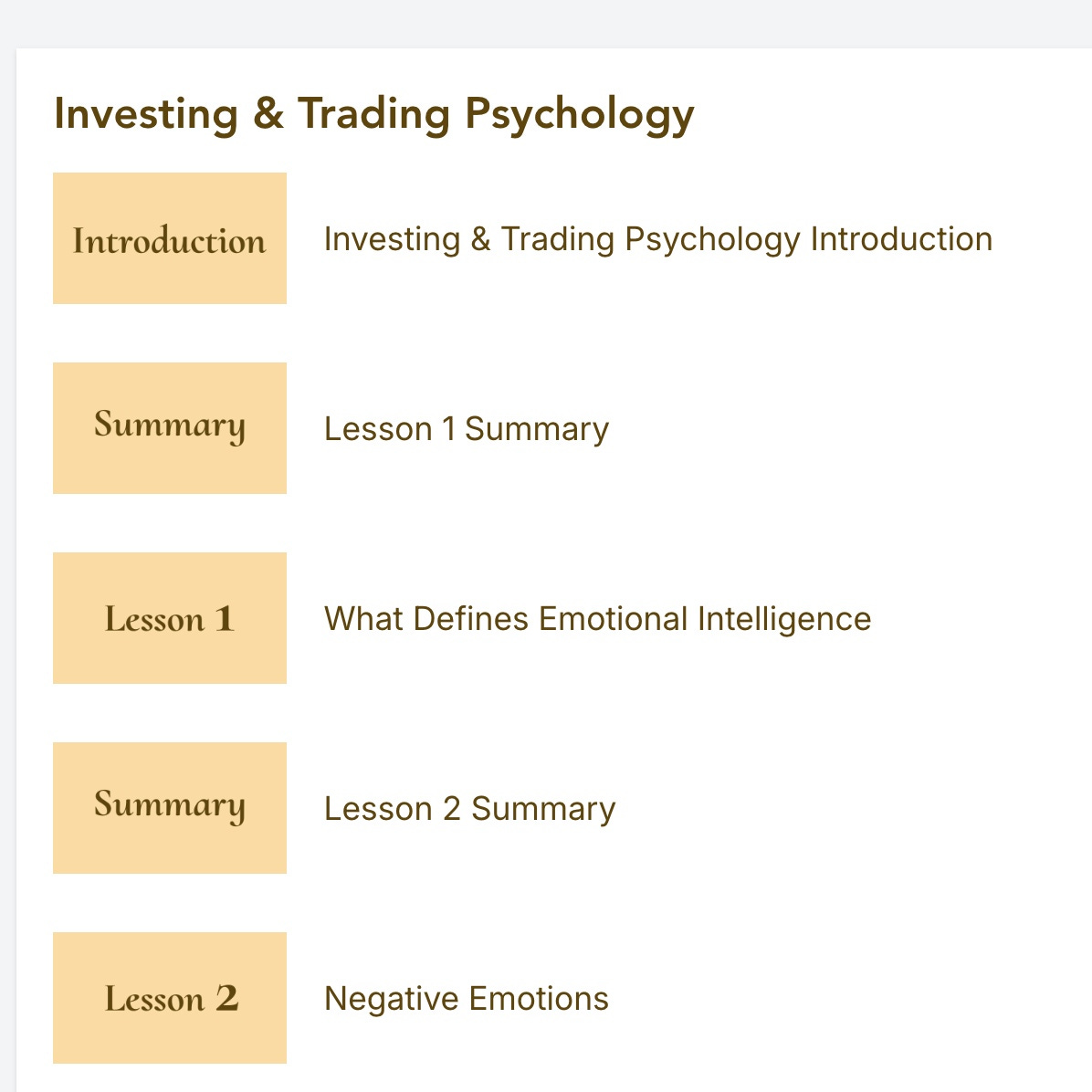

OK, enough with my satirical script, let’s get back to business. Over the last couple of days I’ve been talking about Geoeconomics and how the world reacts. It is a busy day for me as we are testing The Ticker’s course. So far so good, but it’s time to go live so we are going to “test” it live with real people. Today is an “internal” day but if I reach out to you over the weekend to ask for your assistance, please say yes and thanks. This was built and designed to teach you the “right way” and I’m sure it will.

One of my early adopters took his time to draft and submit the following article to me as it relates to how the “world” from halfway around the globe looks at it. Without any question, thank you Mahdi Nikpour for again coming through with your perspective. I appreciate your time and words and can attest to the fact that others do as well.

Oil Runs The World

The oil market can feel like a “rollercoaster ride” at times. One minute, “prices” are soaring because of some far-off conflict, the next, they're plummeting as economies slow down. So, how do you avoid getting caught up in the “riptide” and make sound investment decisions? Here's where scenario planning comes in. It is like having a map for different weather patterns at sea.

Right now, the oil market is experiencing some interesting events. There's good news and bad news. On one hand, demand for oil is starting to slow down, especially in big countries like the United States and China. This is partly because the factories aren't ordering as much stuff, which means less need for energy to make things. On top of that, there are those pesky “geopolitical tensions” bubbling away in the Middle East, like the conflict between the “UK and the Houthis” messing with shipping in the Red Sea. Remember that war in Ukraine? That's still a factor too. And to make things even more interesting, many central banks are thinking about raising interest rates to fight inflation. This could slow down economies even further, putting an additional damper on oil demand.

But here's the recent twist, despite these headwinds, oil prices just got a shot in the arm. Why? Well, a couple of things just happened. First, data from the U.S. Energy Information Administration (“EIA”) showed that stockpiles of crude oil in the U.S. actually rose less than expected last week. This surprised the markets and it boosted confidence, sending prices up over 2%, above $79.50 per barrel, nearing a four-month high! This is the sixth week in a row that stockpiles have increased, but the “smaller-than-expected” rise suggests demand might be holding up better than anticipated.

Secondarily, there are some positive signals from policymakers. Federal Reserve Chair Powell hinted that the Fed is in no rush to cut interest rates, which helped to reassure investors about future economic activity and potentially higher demand for oil. On the other side of the globe, Saudi Arabia, a major oil producer, unexpectedly raised prices for its crude oil, suggesting they see a “stronger market” ahead. This follows OPEC+'s decision on Sunday to extend production cuts until the end of June, further tightening supply and supporting prices.

Geopolitically, the situation remains complex. While a full-blown war disrupting oil supplies is not the current scenario, simmering tensions around the Middle East and around Red Sea shipping lanes add a "geopolitical premium" to the price of oil. This means that even minor disruptions could cause prices to “jump” significantly higher. Additionally, the ongoing war in Ukraine has highlighted Europe's “dependence” on Russian oil and gas, prompting them to diversify their energy sources.

Red Sea Squeeze: The Middle East conflicts continue and attacks by the Houthis in Yemen have disrupted crucial shipping lanes in the Red Sea. This “vital” waterway carries roughly 12% of global trade traffic, including a significant portion of crude oil destined for Europe and Asia. The fear of further disruptions has forced most major shipping companies to reroute vessels. This adds significant distance, time, expense and more to their journeys. This translates to higher transportation costs, pushing up the overall price of oil delivered to Europe.

Europe's Rightward Shift: The rise of far-right political movements in Europe, with their often more nationalistic stances, could further complicate energy security. These parties may advocate for “increased domestic” production or stricter energy policies, potentially leading to supply chain disruptions and higher prices. This adds another layer of “uncertainty” to the already volatile market. This could lead to an increased demand for oil from other producers in the short term, but also may accelerate the transition towards renewable energy in the long run.

Additionally, the U.S. may ban Russian oil imports further tightening supply and push prices even higher. However, such a move could also backfire, leading to a “price” war between major oil producers and potentially harming the global economy. So, what is in store for the future? Well, nobody has a “crystal ball”, but we can look at different scenarios:

Scenario 1: Stuck in Second Gear: Imagine the global economy just kind of puttering along, not growing much but not collapsing either. Production cuts from “OPEC+” along with geopolitical tensions would likely make oil prices go up slowly but keep prices from moving up too far. Geopolitical tensions might simmer, but hopefully wouldn't boil over.

*Investment Strategy: If this scenario seems most likely, you might want to hold onto your existing oil investments, especially if the companies involved are “financially” strong and can keep their production costs lower. Think of it like holding onto the railings on a slow-moving boat, steady but safe. You could consider using “hedging” techniques, financial life jackets that help protect you from unexpected waves.

Scenario 2: Brace for Impact: This scenario is just a nightmare situation, a full-blown recession that slams the brakes on oil demand. The market would be flooded with oil nobody needs, sending prices crashing. Even OPEC+ wouldn't be able to put a stop to the slide. Geopolitical tensions could make things even worse.

*Investment Strategy: Here, you would need to act fast. Reduce your “exposure” to oil companies or maybe even shift your investments towards companies that don't rely as heavily on oil prices. This is akin to jumping off the boat before it gets swamped and swimming towards something more stable. You could try some “short-term” trading, which is like riding the waves themselves, potentially profitable but also super risky, so only do this if you know what you're doing. Most do not so be careful.

Scenario 3: Black Swan Event: This scenario involves something out-of-nowhere”, an unexpected and dramatic happening, like a major attack on international oil facilities. Suddenly, there's not enough oil to go around, and prices go skyrocketing. This could hurt the whole world’s economy, not just the oil industry’s.

*Investment Strategy: In this scenario, you would need to react quickly and decisively. Think about shifting your portfolio towards ‘alternative’ energy sources or companies that benefit from high oil prices. Imagine just grabbing a surfboard and catching that huge wave. It could be a great ride, but you need to be prepared to wipe out too. Also, having a good cash reserve is like having a life raft, it allows you to wait for the crazy wave to pass and then jump back in the water when things calm down.

Not too shabby from half way around the world, eh? I’ve hedged this outcome with a few VIX calls but now, with the “big guy” taking center stage I’m looking at the 2024 August Crude Oil $100 calls for less than half a buck. It’s a cheap hedge against what could be a nasty outcome. Regardless, I’ll be talking on a “paid” basis on Saturday and Sunday. I’ll leave my commentary until then and get back to the basic of making sure the course is ready for your eyes. Here’s a sneak peak.

Just like you did with Jed and the “Beverly Hillbillies” in the 1960s lisrten to what the real story is. Finding oil controlled their lives in a more haphazard way than not but it does happen. It’s not something anyone can depend upon. There’s only one thing you can depend upon, yourself. That’s right, you are in control of your own destiny. But for you wanting to improve your skills you would not be here. If not for you wanting to be the “best damn trader or investor” you can possibly be you might be reading some fly by night’s blog on TikTok. Nope, you are here and so am I just looking to be sure that you learn the “right way” but face it, striking oil like Jed wouldn’t hurt, eh?