It was a very interesting week without question. It’s kind of like being back in the late 1970s / early 1980s when it comes to the metals. If the trend continues, many gold and silver mines that have been shuttered for years are going to come back to life. Supply and demand have meaning, economically speaking, in everything we do. As prices go higher it’s only natural that the supply will increase. What exactly the elasticity of an event of this nature is remains unknown but remember, nothing goes to the moon and this is a good reason why.

We introduced The Ticker this week and the initial response has been amazing. I had a pretty good idea this would happen. What I did not understand was the “amount” of my time it would take to handle it. The third course is almost done and should be out there in a couple weeks. It’s the “mortar” that ties everything together. We are now in the process of assembling our Library & Webinar. Being sure we have a nomenclature in place that works for our students is important. A couple new ideas are being kicked about but for certain, I’m glad I took “Library Science” classes in college. Along with “Human Factors” they’ve been invaluable. You never know what you can learn until you try. Are you ready to give it a try?

Speak about trying, I’m working with Mahdi Nikpour today on an article we have been revising for quite some time now. I’m a rough teacher all things considered. I know that Mahdi will agree but honestly, he has a tremendous understanding of the markets to begin with or we wouldn’t be here. Rather than belabor you with details, just understand that Mahdi was an early adopter of what we offer. Over the last year or so I’ve watched him grow. It’s been a pleasure. That’s exactly what we do here at The Ticker. There’s lots of Mahdi’s in the pipeline. How about you? Are you next?

A Solid Collaboration

When I started reading Mahdi’s work product I saw potential. He is quite smart but I know the only way to learn is through experience. Mahdi started asking me questions last week, primarily about bonds. My “biggest and best” trades have come in the bond market. Sure, I love stocks, futures, options and more but when it comes to bonds, the U.S. Treasuries in particular, I just find myself in my element.

I shared a couple articles with Mahdi this week. He was directly asking me all of the right questions. I had no choice and besides, he was ready to learn, kind of a “take a walk on the wild side” approach so to speak. Most of what follows is Mahdi’s. I jump in at the end for good measure. Let’s see how well he did.

Take It Away Mahdi

Bond yields whisper a lot about what the big guys, the "smart money," are thinking. By following these yields across different maturities, we can gauge the overall market sentiment for stocks, forex and other asset classes. Let's break down the stories told by the 2-year, 10-year, and 30-year bond yields:

The 2-Year: All About the Short-Term Buzz

Imagine this, the 2-year yield is like the “market's temperature gauge” for the near future. When this yield rises, it suggests investors are feeling optimistic about the next couple of years. They expect economic growth to pick up, potentially leading to the Fed raising interest rates to cool things down. This optimism can translate to a positive sentiment across markets, with stocks potentially rising as companies benefit from a growing economy.

On the flip side, if the 2-year yield falls, it means investors are getting nervous about the short-term economic outlook. Maybe they fear a slowdown or the Fed intervening to prevent inflation from getting out of hand. This nervousness often casts a shadow over the broader market, potentially leading to a more cautious sentiment.

The 10-Year: The Benchmark Bearer

This is the big one as the 10-year yield is a very critical benchmark that influences everything from mortgages to stock prices. A rising 10-year yield tells a story of confidence. Investors are betting on long-term economic expansion and potentially higher inflation. This might entice them to move out of bonds and into riskier assets like stocks, anticipating higher returns there.

However, a falling 10-year yield paints a different picture. It suggests investors are worried about the long-term economic horizon. They might be seeking the perceived safety of bonds, which can happen when there's uncertainty about future growth or inflation. This cautiousness can lead to a more defensive market sentiment.

Here's an extra tip for the 10-year, pay attention to the spread between the 2-year and 10-year yields. Historically, when the 2-year yield exceeds the 10-year yield, known as a “yield curve inversion”, it's been a reliable warning sign of a potential recession on the horizon. So, keeping an eye on this spread can give you valuable insights into the market's health.

The 30-Year: The Long View

This yield reflects the market's bets on the economy's very distant future. A rising 30-year yield suggests investors have a stronger belief in long-term growth and inflation remaining elevated. This leads to a more positive sentiment across asset classes, with investors potentially seeking out riskier investments for potentially higher returns over the long haul.

On the other hand, a falling 30-year yield indicates a more cautious view of long-term economic outlooks. Investors might be “concerned” about future growth or inflation, prompting them to seek the safety of bonds. This caution can influence the broader market sentiment, potentially leading to a more defensive approach.

The Takeaway: Be a Bond Yield Bloodhound

Even if you're not buying and selling bonds on your own, understanding these yield changes equips you to be a bloodhound for overall market sentiment. By following these whispers, you can gain valuable insights into how investors are feeling about the future, which helps you make informed decisions about your investments in indices, forex and other asset classes. Remember, the story these yields tell is a powerful one, so listen closely.

And Now A Word From Our Sponsor

As a view from five-miles up, Mahdi’s scenario is on point. Bonds are perhaps the best investment tool available especially when the key philosophy relates to inflation. Past reaction, primarily in the late 1970s / early 1980s and again in the later 2000s, provides opportunity. Investing in bonds reflect those opportunities.

It is not often that I use margin but twice in the past, at points of inflection, I’ve been on board, regardless of the interest rate charged, as dramatic movements happen. Do you remember when Volcker took rates to to the moon only to quickly reverse himself shortly thereafter? I bought the long, 30-year U.S, Treasury on margin for about $570 a bond and sold it for over $800 a couple months later. I did the same thing prior to the financial crisis of 2008 with the same results.

Currently I’m positioned strongly across as U.S. Treasury segments and have been in this trade for over two years. If someone is going to pay me a “risk-free” 5% in my IRA accounts, especially Roth IRAs, I’m on board. I have yet to apply margin to the trade as recession, although predicted throughout has yet to materialize for many reasons. I’m a patient person so I’ll wait.

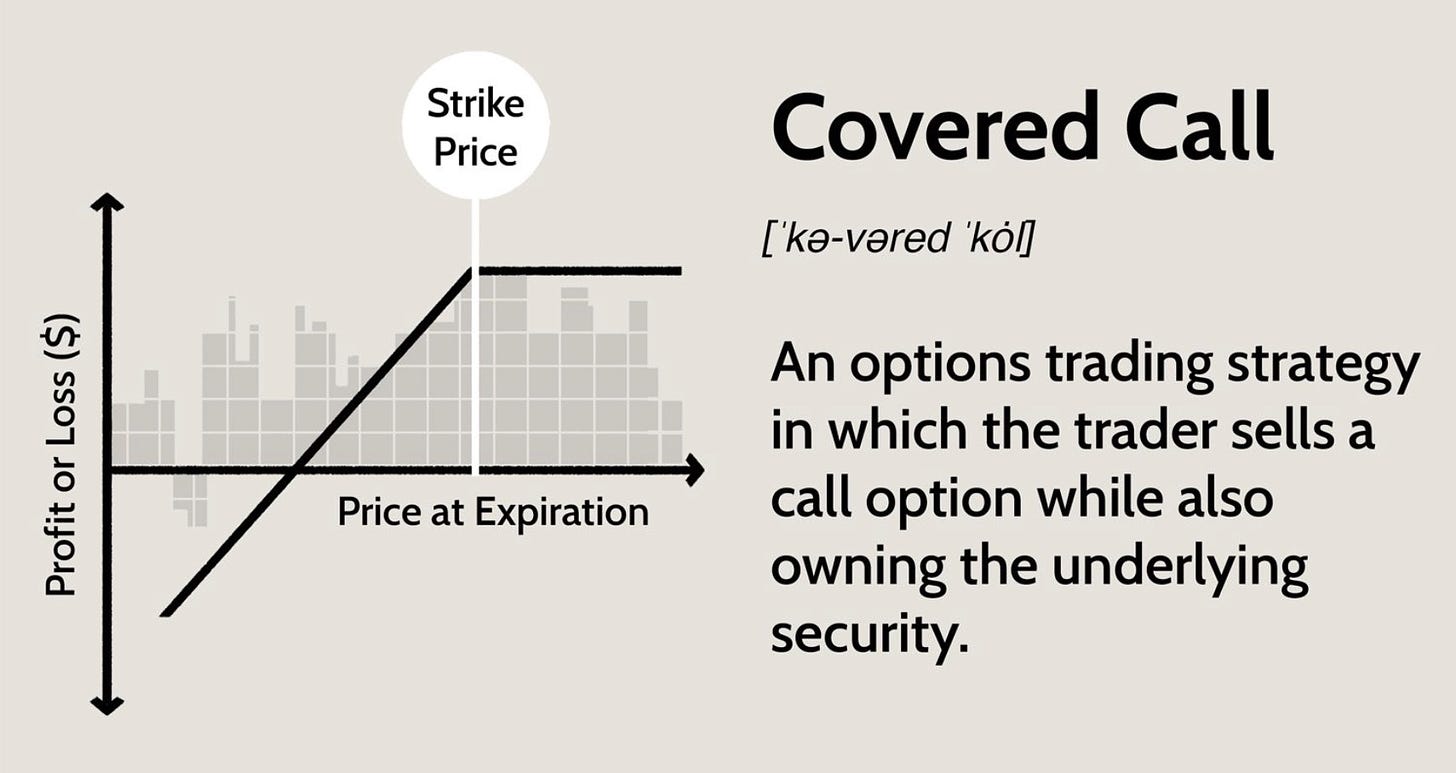

Otherwise, today was a decision day. I sold the Disney puts, essentially purchased for “free” and doubled my money. Disney has run higher recently so I also sold covered calls, the 2024 June 140s and put time on my side. Gold has been fun, has’t it? Silver too along with copper. While I would expect consolidation in these metals, other than a “blip” or two, it seems that the “herd” is on board so it’s a “hurry up and wait” time. My WTI 2024 August 100 calls have tripled in value since purchase. I sold one third of the position on open. The rest are “free” and like everything else I hedge, I’ll wait. It seems there’s more that will “hit the fan” in the Middle East so let’s watch it happen.

As far as other stocks in the portfolios managed, it’s a good time to be covered. Often I’ll look to enhance returns when these stocks and the markets have performed. Being a “bottom fisher” has its benefits and adding “income” by selling covered calls works, especially in Roth IRA accounts.

There’s more but for now it’s time for me to get the third course completed. The first two are available on The Ticker and we thank you for your interest in our introductory offer and our “1-on-1” tutorials. If you sincerely want to be the “best damn investor or trader” you can possibly be, start with the courses then contact me for the “1-on-1”. It has worked for all that have subscribed and I’m sure it will work for you.

In honor of an “out-of-nowhere” event in the northeast today we bring you Carole King and “I Feel The Earth Move” under my feet. Fifty-three years ago she came out with this version. Funny how time flies when you’re having fun. It’s been a good life and giving back to you all has made it even better. I turn 69 tomorrow and that’s an accomplishment. Yes, I know more today than I did when I started and that’s a good thing. I still learn something new every day, how about you?