I like “brand name” turnaround companies but do not act on every instance uncovered for a reason. Some are far better than others. I’m looking at a “stack of others” now. I am close to picking another but based on basic research it’s premature to strike.

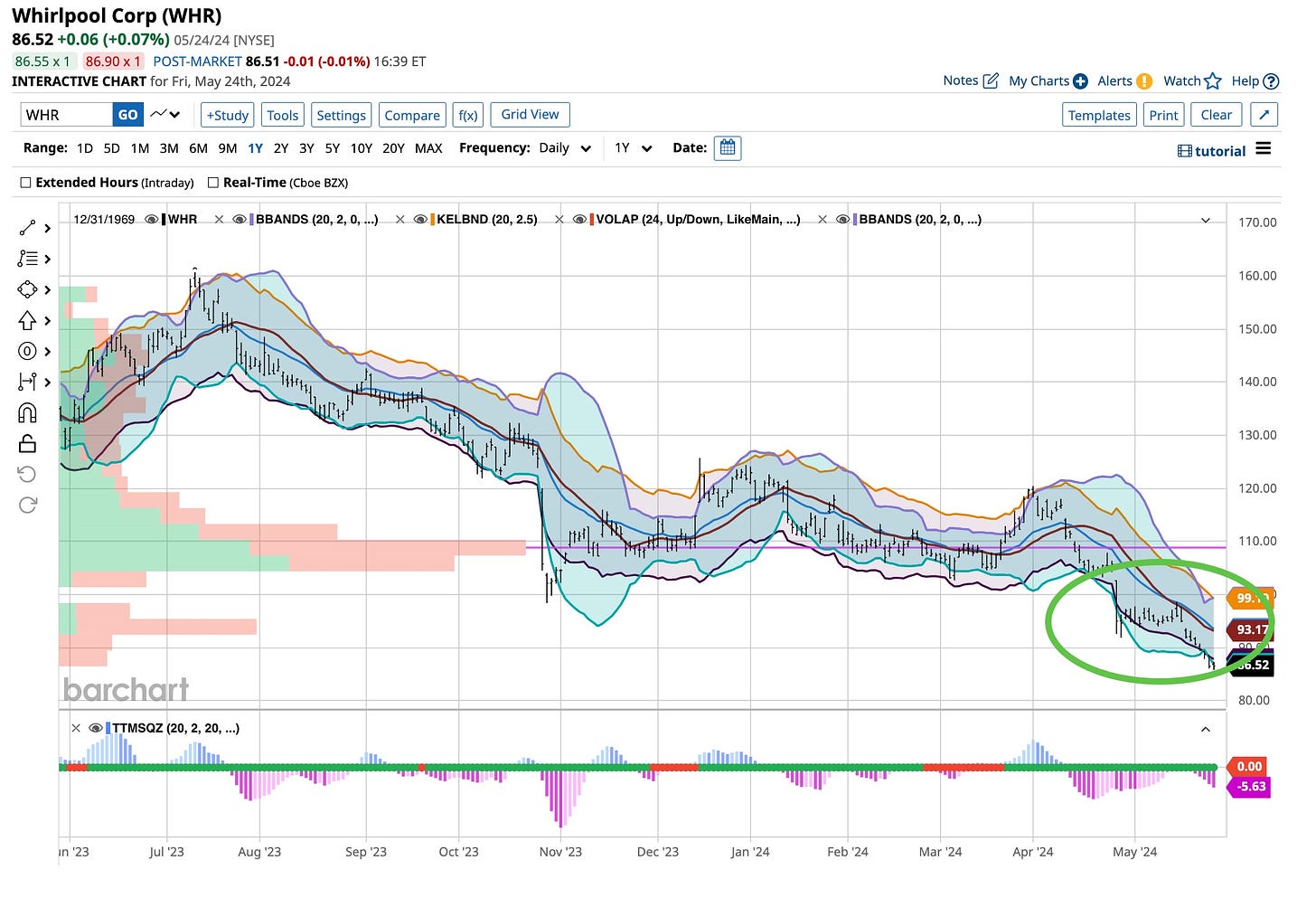

About a month has elapsed since the last earnings report for Whirlpool (“WHR”) hit the wires. Another solid poster, John Navin, has written about the stock. John is pretty good at picking stocks and telling you what’s real or fake in the markets. WHR shares have declined about 10% over the past weeks, underperforming the S&P 500.

It fits all of the criteria necessary for me to make “WHR” a “brand name” turnaround, so I looked at what Zacks had to say. WHR beat Zacks Consensus Estimate by $0.17, which was down 33.1% year over year. Net sales of $4,490 million beat the estimate of $4,405 million but declined 3.4% year-over-year. Excluding the unfavorable impacts of foreign exchange, net sales were $4,446 million, down 4.4% year over year.

Whirlpool also issued guidance for 2024. It forecasts net sales of $16.9 billion, a 13.1% decline from a year-ago actual with an EBIT margin of 6.8%, only slightly higher than the 6.1% reported in 2023. I’m not thrilled as cash is king and Whirlpool isn’t hitting my parameters. Others, including Zacks, are underwhelmed as well

Whirlpool has a poor Growth Score of F, however, its Momentum Score is doing a lot better with a B. Following the exact same course, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy. Overall, the stock has an aggregate “VGM” Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Estimates have been broadly trending downward for the stock, and the magnitude of these revisions indicates a downward shift. It’s institutional ownership is on the skids as well. It's no surprise to me that Whirlpool has a Zacks Rank #4 (“Sell”). I expect a below-average return from the stock in the next few months but it is one I’ll keep my eye on for certain.

Despite its 12.25 P/E ratio and its 8%+ dividend yield, as all consumers cut back, the appliance maker’s 2.28% net profit margin scares me. Always do your own work as I am nit always right. I’ll be the first to tell you when I’m on board but for now I like iy here on the sidelines on this one.

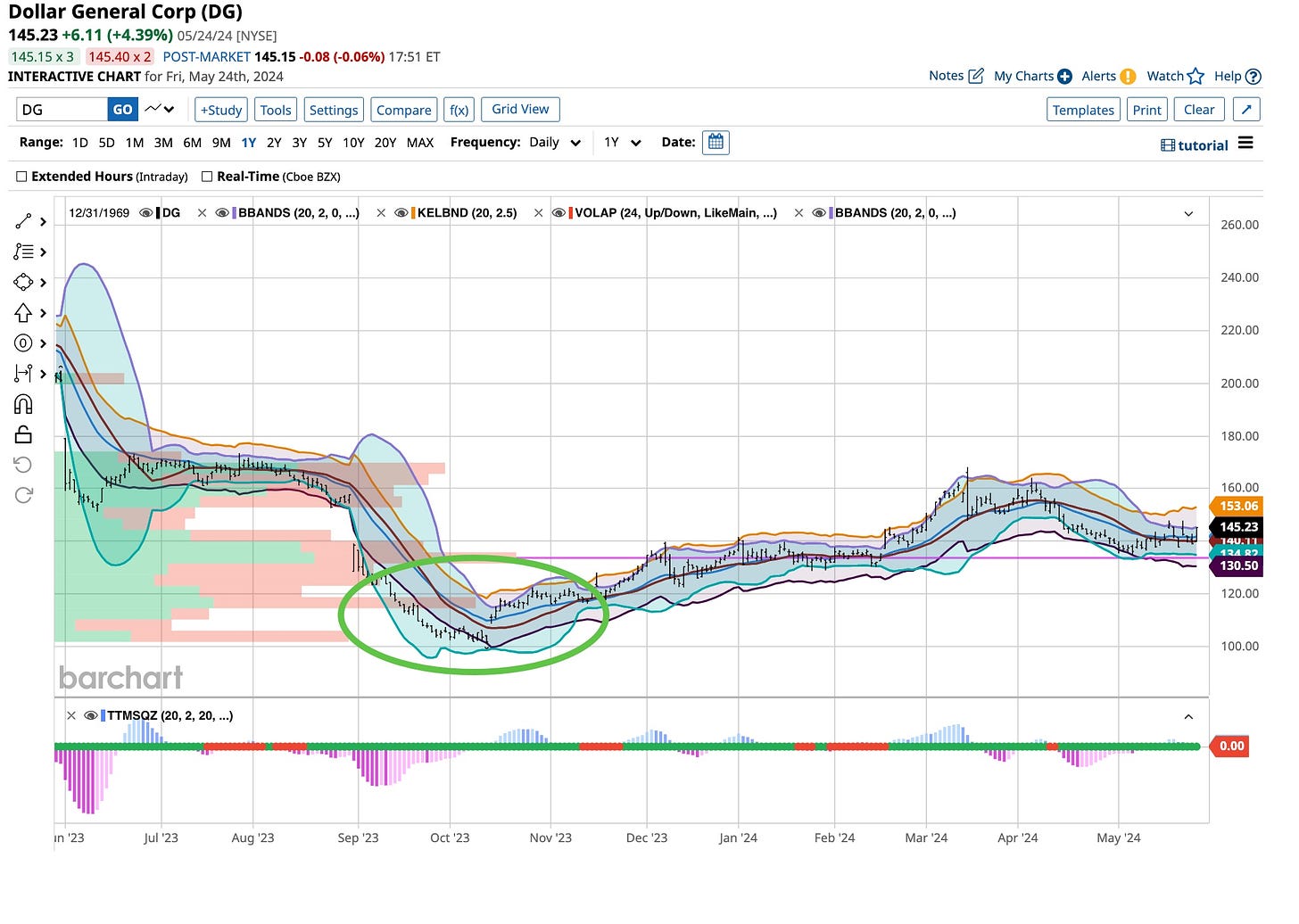

Dollar General Reports Earnings

On May 30th Dollar General will report earnings. Whisper estimates call for a slight beat number-wise but with the past in the rearview mirror, the future is where all of the attention will be. It should be but far too many people just look at the numbers.

Dollar General is a solid “turnaround” stock I’ve owned and worked with for a while. Nothing goes “straight up or down” and decisions to hedge that happening rule my decisions. In the past, I’ve been able to enhance my performance by selling “covered calls” against my long position. All of the options I’ve sold have expired worthless augmenting my overall net return in the stock. When recent options expired I lowered the strike price but held with a two to four-month expiration date. It’s just the way I manage risk and I’m a realist and change takes time.

I’m a true hedger when it comes to earnings reports and this one is no different. I will always do my best to balance out risk and capital outlay. I have a couple days to decide and I’ll take advantage of that time. Nonetheless, I’ll probably sell some “near term” “out-of-the-money” call options and use the proceeds to purchase protective puts just in case the “street” decides to beat up Dollar General’s price.

I can teach this methodology until I’m “blue in the face” but it’s my plan. Consistency is my watchword and something I practice. I don’t have a crystal ball that’s 100% right and neither do you. I’d rather be safe than sorry. You should too.

Commodities Are Alive & Living

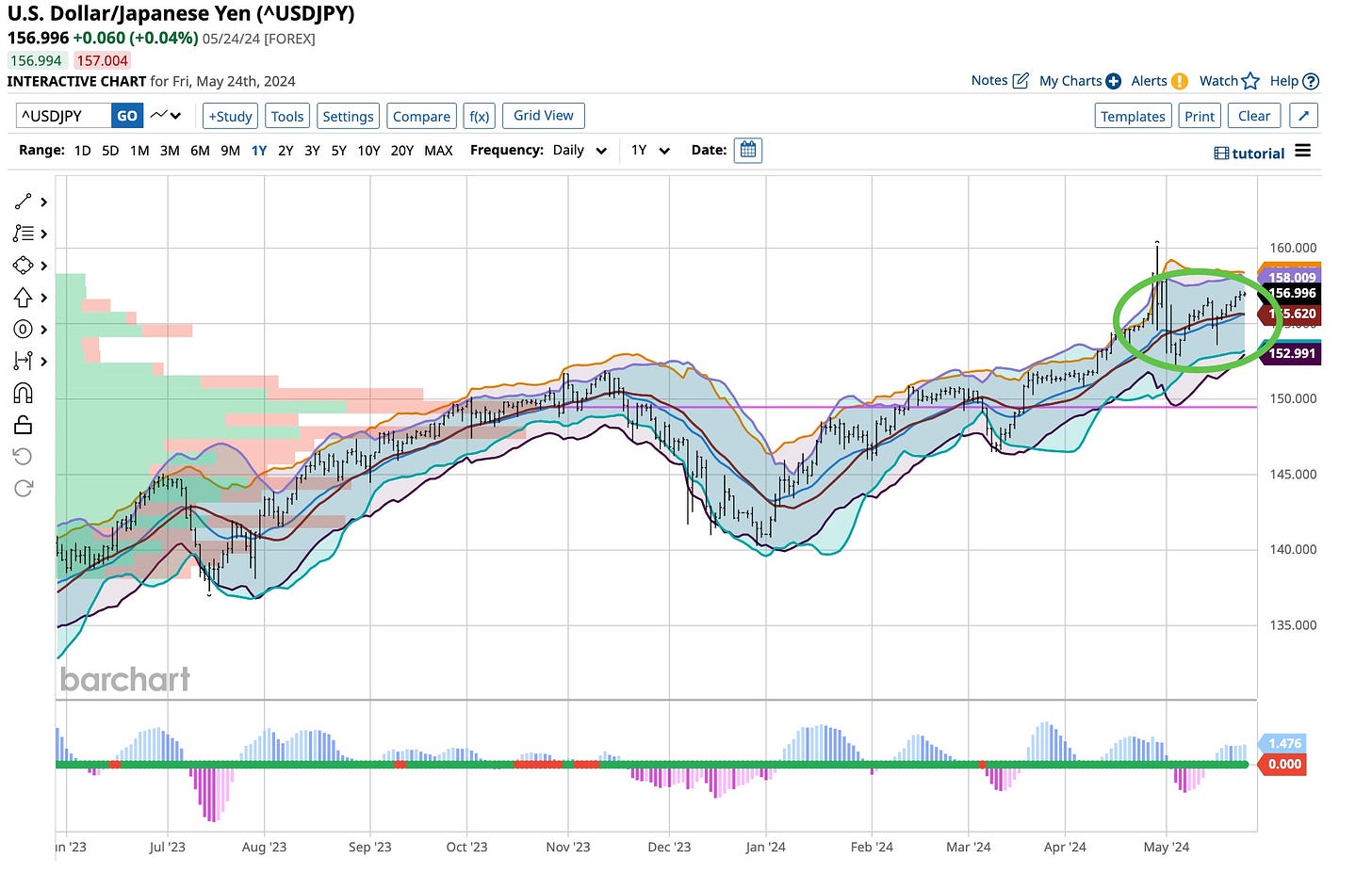

I read a lot. I listen a lot too. For years I’ve heard everything. Interest rates are coming down, no interest rates are going higher. The Dollar is going to be replaced, no it’s as strong as it’s ever been. Who do you believe? Right, no one, just has a plan to address the uncertainty that exists and keep watching, listening, and learning.

Patience is not just a virtue, it’s a necessary part of being consistent. In the Roth IRA accounts I manage, earning 5%+ on cash and the U.S. Treasury ETFs I hold in these accounts make me happy. Holding gold bullion is a great hedge regardless of the up and down performance gold exhibits. This basis allows me to look for “turnaround” candidates, speculate internationally with “big boy” guidance, and utilize my favorite, seasonality, to pick which future to trade next.

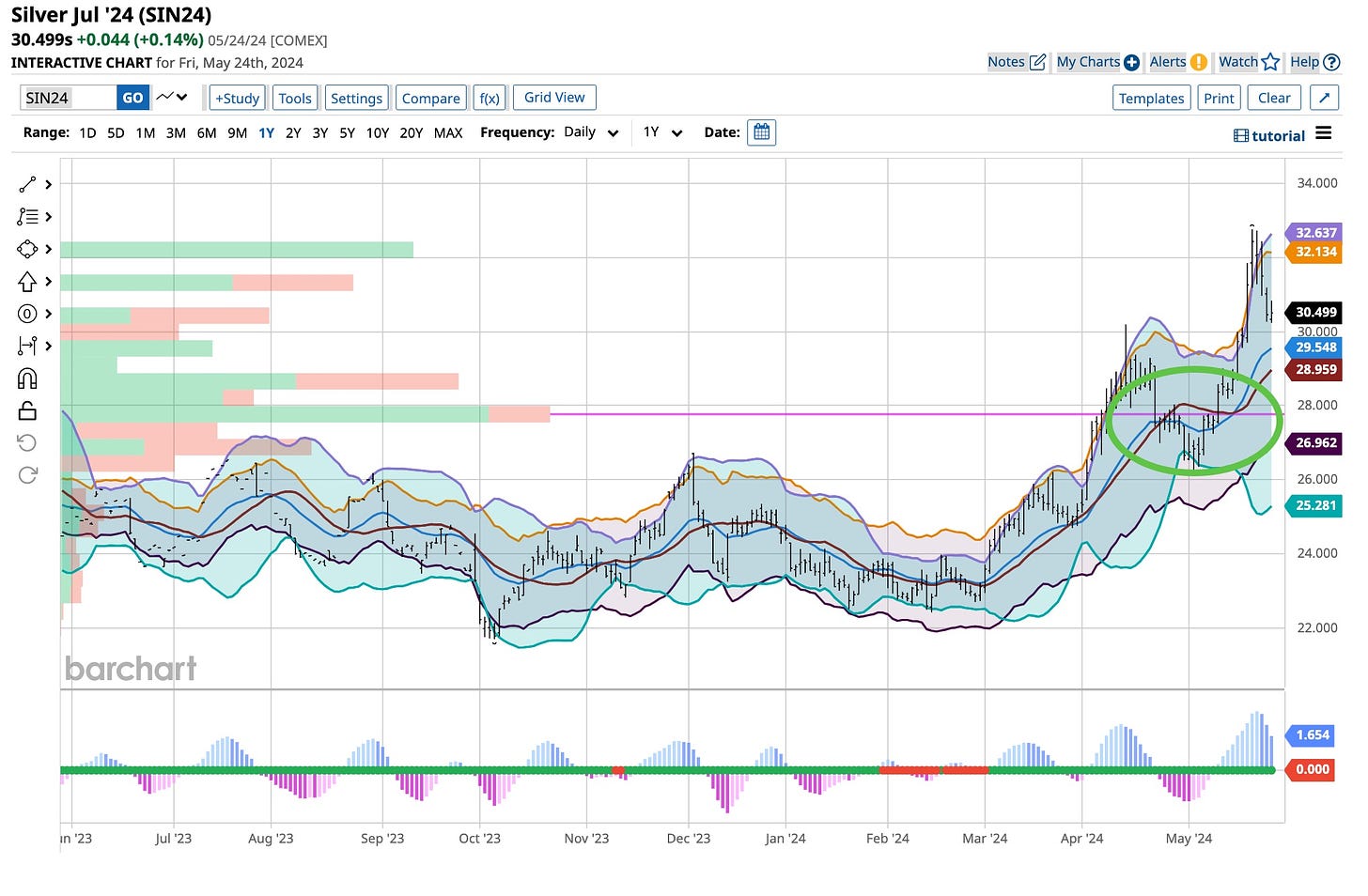

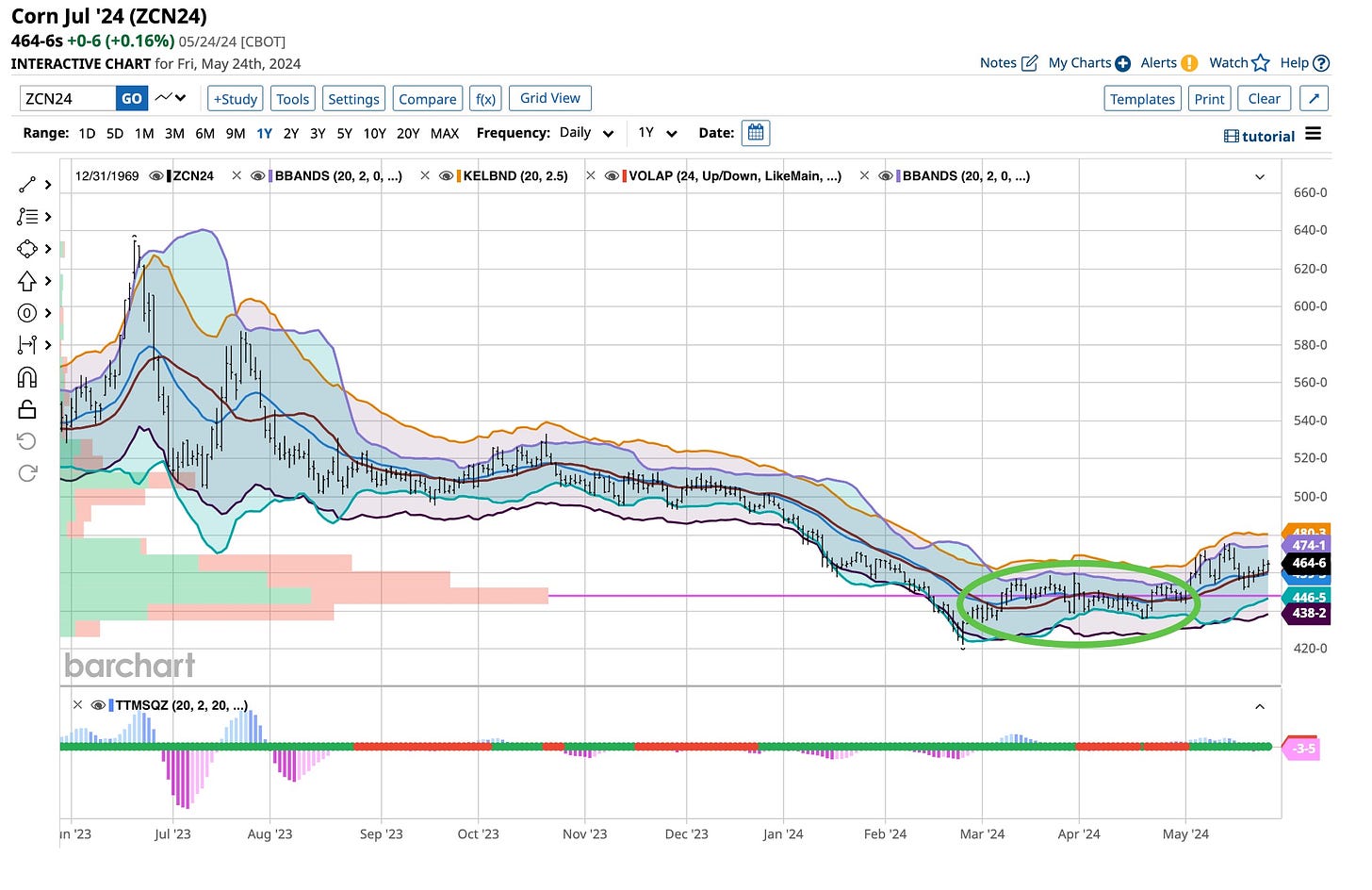

I’m long corn, silver, copper and watching the Japanese Yen. “Trailing stops” in place to protect my profits in both corn and silver and they pay off. I’m long copper again from slightly below $4.80 and trailing stop worked beautifully there. In a $3.80 trade, I’ve booked more than $1,20 in profits. Watching inventory reports and realizing that the metal trading atmosphere will be volatile is critical. It costs “money” for the right information. When it comes to copper and corn I’m happy to pay the price.

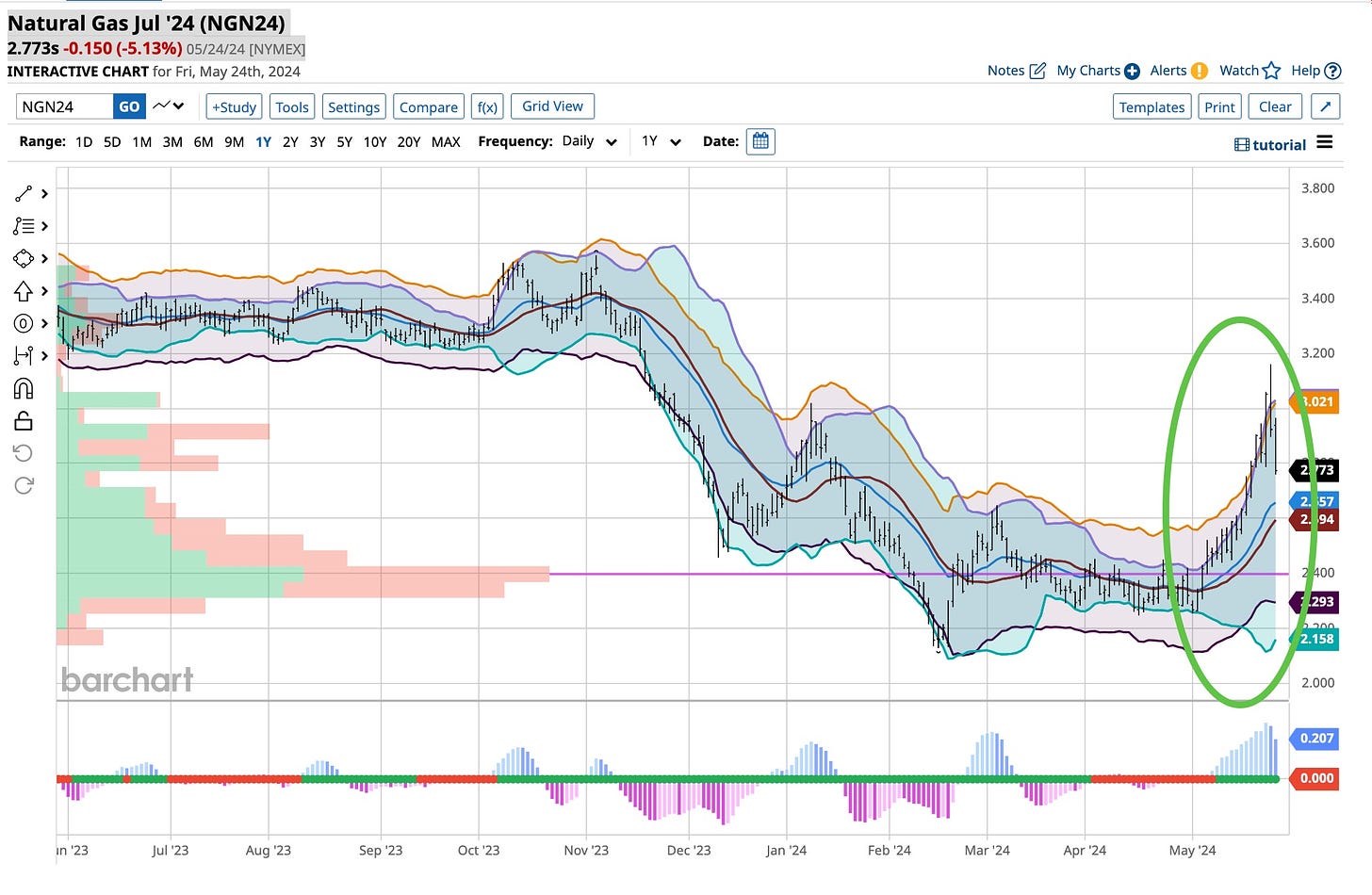

Summer is upon us. Seasonality-wise, I only trade the “widow maker”, Natural Gas as the winter months approach. Maybe I’m wrong or maybe I’m right but certainly I am very consistent. Natural Gas “prices” have moved up recently but I’m happy to watch. You can’t hit them all but you can learn from experience. Give it a try, it works.

We’re starting to tell the world that we exist. It is a daunting task as tens of thousands of people, just like you, are following. Rome wasn’t built in a day but recently we have seen a dramatic increase from everyone who wants to learn from us. Keep your eyes open for an email where we’ll be offering a $99 limited-time offer to join The Ticker and get more information right “from the horse’s mouth”. I’m still going to post here on Substack and LinkedIn. If you are interested in what action I’m “currently taking” then you’re going to benefit from taking us up on our limited-time offer, it’s priceless.

You might have heard this one playing on the radio years ago. I certainly did but more often than not it was playing on my Dad’s record player. He and my grandfather loved Louis Armstrong. I did too. From his humble upbringing, it was obvious that he was on a mission. I saw him live in Pittsburgh and remember the effect he had. Humility was his watchword. All he sought was to entertain and that’s exactly what he did. I have the desire to teach. I trust you want to watch, read, listen and learn. To relate the years of experience from between my ears in a logical, useful manner takes time. It’s a marathon folks, not a sprint. My best to all and remember, it’s a “wonderful world”.