When it comes down to it, one really cannot trust Sundays either. A few ‘shots’ across the bow hit my radar screen overnight. “Out-of-nowhere” events are a regular thing in my financial life and they should be in yours. Old Yiddish quotes like, “Mann Tracht, Un Gott Lacht” has meaning in today’s world. “Man Plans, and God Laughs” surfaced this weekend with the Apple and Google joint venture on AI hitting the wires It took the markets by surprise as illustrated by today’s surging indices. How this interaction will effect a longer term perspective remains unclear. It still needs to be investigated.

Sunday nights and Monday mornings are perhaps the most active times for me market wise. It’s a good trait to possess and I suggest everyone adopt this philosophy. Today’s a good day to begin as “lots” happened since Friday’s close. While we often “preach” that you abide with our “rules”, this one is just a way of life if you want to become the “best damn trader or investor” you can possibly be. Now let’s take a look at what else is happening. It’s going to need to be quick as “time is not on my side” so here goes.

Between Friday’s Close & Monday’s Opening

Post mentioning Apple’s venture with Google both stocks rallied only to come off of their interim daily highs once the “herd” jumped in with both feet. Like always they neglected to consider that analysts were caught by surprise and will need to take a bit more than fifteen minutes to evaluate the overall scenario. Don’t be a follower of the “herd”. If anything look to go the opposite direction after they’s reacted prematurely.

China showed some life economically but hesitation remains. Year-over-year numbers for February in retail sales and industrial production beat estimates but employment overall declined so China is not out of the woods. Talk of China simply slowing down the production of Copper helped to solidify its price. That a good one for me and the seasonal copper trade I entered and spoke of about 30 points ago. I’d rather be lucky than good and the harder I work the luckier I get. Trailing stops are a “rule” followed and this trade is no different.

Japan is on the burner during our Monday night and their actions, or inactions as they may be, need to be watched and their accounting listened to shortly thereafter. Words have tremendous meaning in today’s world and I’ll be up late listening.

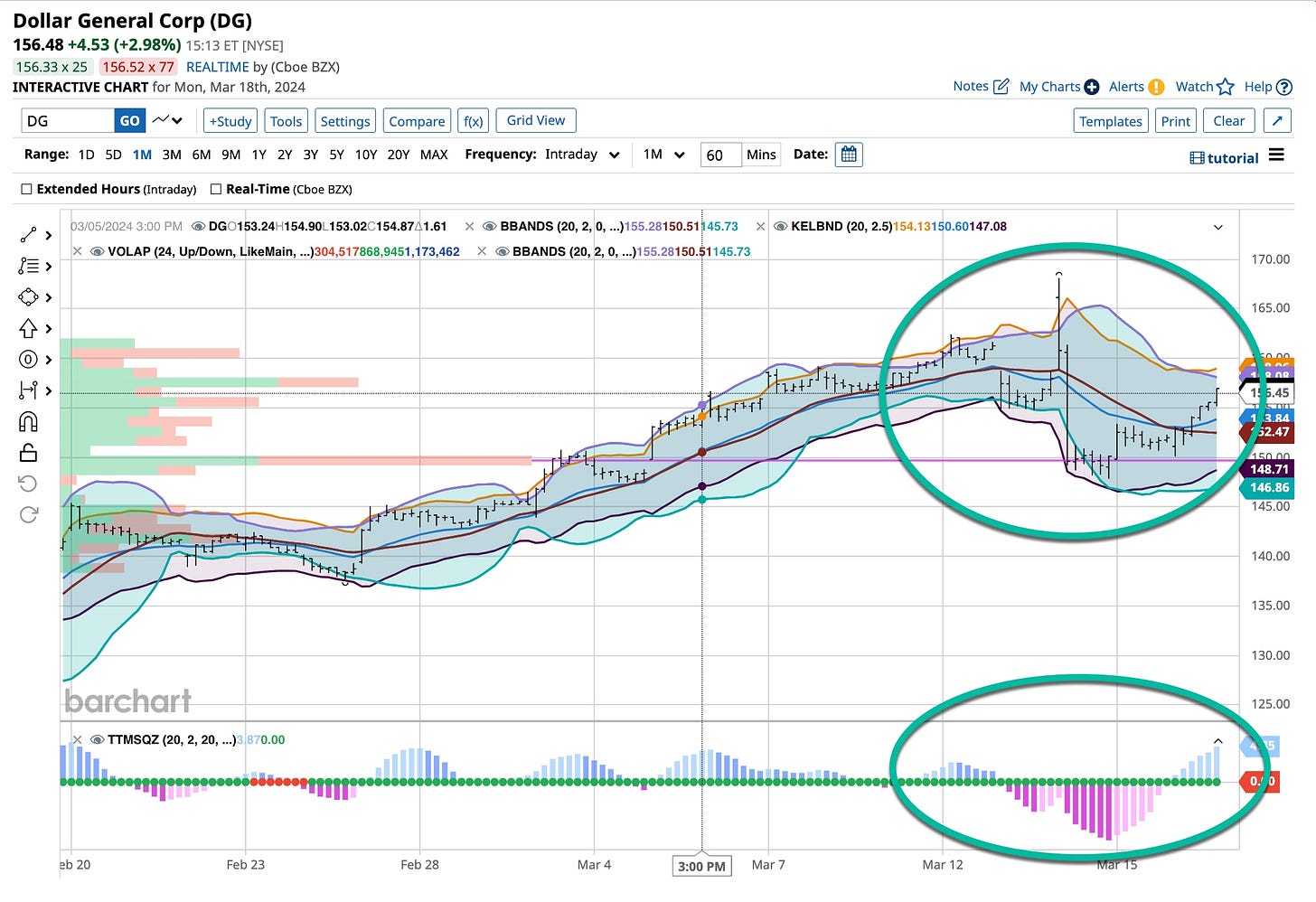

Dollar General ended up being a bit of a “non-event” and that’s how we reacted. Solid articles about Dollar General discontinuing its “self-checkout” across many locations hit and the stock reacted. We did too taking off the overall put protection and opening “short covered” calls at higher price levels using the 2024 June and September option series. Naturally those that had the highest open interest and volume were chosen. In all respects, I like their management. It’s OK to make mistakes just as long as they are corrected before it’s too late.

Here’s A New One

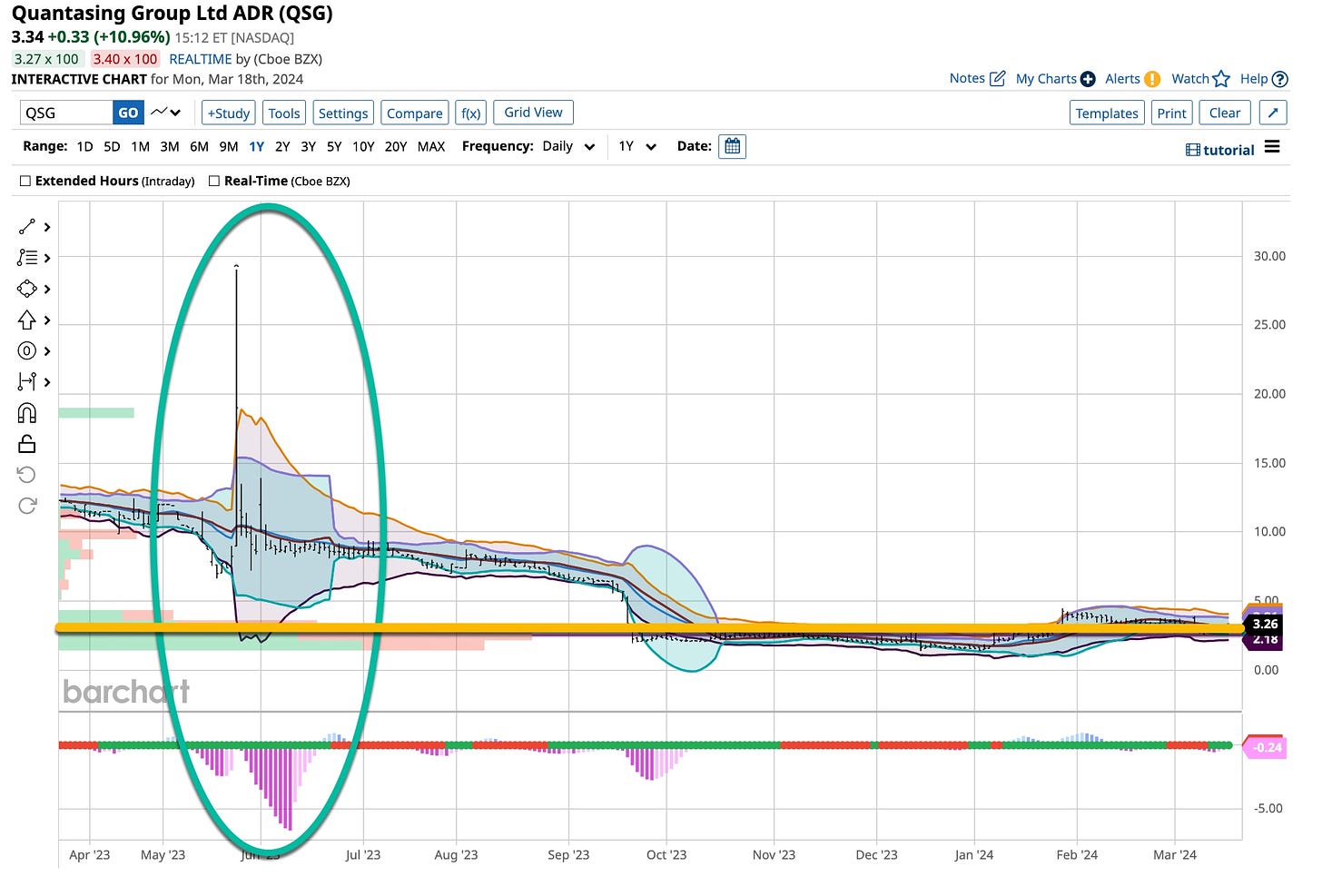

Over the weekend you got a brief summary of a few Russell 2000 Index stocks I’ve had my eyes on. It’s obvious, or it should be by now, that I research the Chinese education market as it’s on mine and other analysts’ radar, especially the analysts I follow. Take a look at QuantaSing Group Ltd (“QSG”) and buy it like I recently did when I entered a similar “story” stock TAL Education Group (“TAL”). It’s not easy to find stocks of this nature available to the public markets. QSG interests me. In essence it’s a turn around candidate and I like these kinds of securities especially at “discounted” prices.

Do your own “due diligence” on this one folks. Like many other Asian entities, it’s not an easy task which is why I depend on other world-based analysts to give me a hand. I think it makes sense to depend on others and you should too.

That’s it for today. It’s Monday and without question I’m busy. You should be too but it is best to keep it as simple as possible. While I always have my ears and eyes open to opportunities, I’m entrenched with teaching you through www.tickeredu.com. That is what I’m doing and there’s a bit of work to finish so we can help you become the “best damn trader or investor” you can possibly be. Thanks always and stay tuned.

Remember “The Mamas & The Papas”? If you are my age your answer will be a “yes”. If not. what the hell, take a listen to their “Monday Monday” video and enjoy it. They have their place in “rock & roll” history dating back more than five decades. It seems to me that nothing has really changed. Monday is an important day for me and it has been for years. If it is not in your regular “schedule” it should be. Take the time to see that weekends and Mondays become a “rule” of yours. we have for years and it works.