I’ve discovered that most readers have a propensity to understand better if the topics discussed are broken up into smaller segments. In other words, people don’t like to read as much as I like to write. Years ago The Mamas & The Papas recorded “Monday Monday” and it’s true; given the plethora of news “hitting the press” this week maybe how the week starts on Monday, in reality Sunday night, will not be reflective of just how it all ends.

Quoted from one of my first articles, “the only trait better than life’s “experiences” is the ability to precisely remember the causes and effects of prior periods & the ability to relate them to what’s happening today.” I grew up in the days of E.F. Hutton and for those of you who remember, “when E.F. Hutton talked, people listened”. They should have, just ask Dr. Edward Yardeni, as a matter of fact you can still follow the man who was a primary decision maker in what Hutton at https://www.yardeni.com . . . hi Ed.

Like most of us “old timers”, Ed is better today than he was 45 years ago. Nonetheless, major brokerage firms have always been the trumpeter of how you should be invested. Unfortunately, as we have discovered, the Pied Piper often leads you off of the cliff as internally they positioned themselves directly opposite of what they preached. If you doubt my words read about the collapse of Lehman Brothers in particular the actions of Goldman Sachs during the period in question.

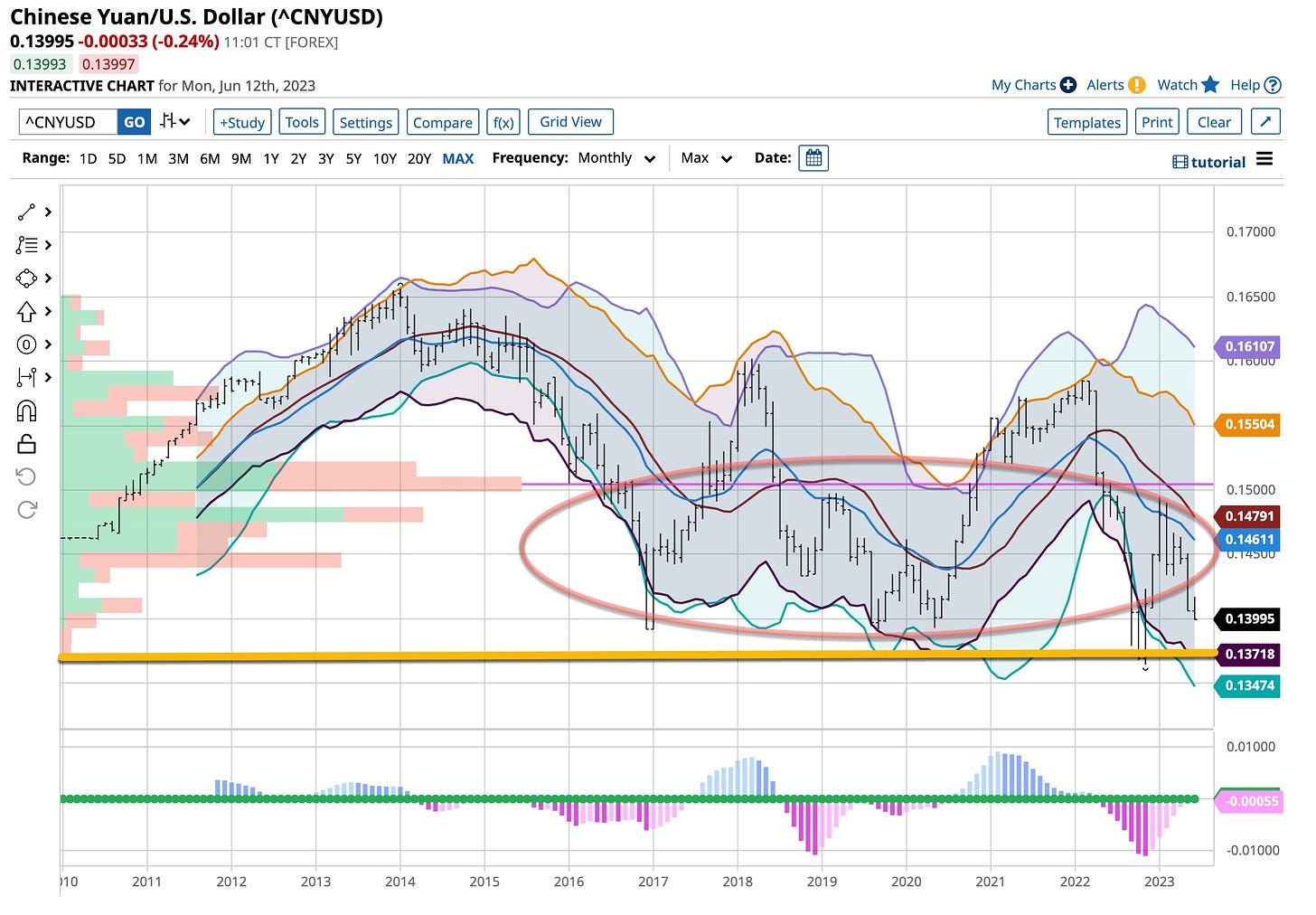

History is what it is; it’s what we learn from. Just like back then, the major investment advisory firms had to pivot and pivot they did. It seems to me that they’re about to do it again after leading its flock of “newly minted” Robinhood lemmings to remarkable heights this time with “AI” and lofty market multiples and P/E ratios that are destined to fail. They’re trying to mask the inevitable of a faltering economic malaise especially in China. Maybe the old adage should be changed to, “when China sneezes, the world catches cold”. The facts are playing out for the world’s second largest economy but to date, other than my own analysis and sources, I haven’t seen the “big boys” jump on that bandwagon. Are they so afraid of insulting their newly identified source of future revenue streams that they are afraid to print the obvious or has the “big guy” just told them not to? Who’s really in control here?

During the period post putting in a double bottom post the COVID-19 debacle the street, which so obviously misled people, cried out “the sky is falling” . . . as you will find when everyone thinks the end is near it’s usually a good time to buy. In part due to “free money” and interest rates that had been kept too low for too long, the street jumped on the upside wagon when the markets recovered from the COVID decline. Albeit being a little late in coming, it was time for the street to rebuild its image, the first of the “Saving Face” prognostications even you newbies have been victimized by. When markets exceeded preset lofty goals they proclaimed “it’s going to the moon” and the ‘Robinhooders’ almost took it there. It didn’t make it to the moon, did it?

Right before the rolling top starting with the Russell Index in November 2021 all you heard from the street was that their target multiples were too low, they declared that Aldous Huxley was right and we were entering his “Brave New World”. Problem was we were not entering that world but what the hell, the “big boys” on the street were making a fortune and looked to figure out how to keep the rally going. Similar to the “end of the world” scenario being trumpeted at the bottom of the COVID downside, everyone was long at the top. By now you should know the drill, when the ‘herd’ is all going in one direction it’s time to reverse course. It’s easy to make that statement but in reality it’s a tough one to follow, especially for the “newly minted” crew.

Old “macroeconomic” timers like me saw the handwriting on the wall. Periods of far too much free and low priced money was ending. Inflation was rightfully about to rear its ugly head; it did. It’s was really a simple observation; too much money chasing too few goods; difficulties in the supply chain moving products to market coupled with a political masturbation last seen in the Carter regime and like the title says “times they are a changing”.

So naturally the ‘big boys’ saw this happening and got everyone out of the markets; yeah right. More like they themselves got out but what they continued to preach on the street was ‘damn the torpedos full speed ahead’. Just like during the Lehman days; the street sold while telling the lemmings to stay the course suggesting at times that the already lofty multiples were not just here to stay; they were going to expand. That didn’t work for companies like SNAP and probably will not work for a plethora of AI related high flyers. When are they finally get it right and put their clients’ interests ahead of their own?

So here we are, entrenched in the first real bear market seen in more than a decade. Given the Fed was not only late to the interest rate rising party, they have decided to use recession, however it’s defined, to damper inflation. It ain’t going to work as they cannot control deflation and China is already leading that curve. The street however is doing its best imitation of ‘Saving Face’ lowering multiples, target prices on stocks and more; acting in their usual inept way predicting the absolute worst numbers they can justify so when the future earnings are reported they’ll beat these estimates so the “flock” will think that the economy’s performance is better than thought.

The times may indeed be a changing but just how these investment advisors operate simply do not. So remember, when publicly, in unison they say the sky is once again falling step in and start buying debt free, cash flow strong, best-of-breed securities. Chances are internally they are already doing just that.

Hope you enjoyed this post. Back to the usual grind, building The Ticker EDU. Going to be an interesting week. I’ll be taking a couple online courses on Barchart as like you I’m still learning so I can teach better. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s embedded in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

“Monday Monday”, don’t trust that day. It’s a brand new week with lots of decision, economic reports, commentary and more coming in the middle of summer when day, scalp and swing traders are looking for second jobs as what made their trading easier is also “on vacation”. Don’t worry October’s coming; there will plenty to do then.