Matrixed "What Ifs" Abound

Beam Me Up Scottie There's No Intelligent Life Here

Taking the weekend off to finish up reviewing “The Ticker’s Bible”, watching a few games and asking for that one more year of inscription, allowed me the time to catch up on my reading. I’ve never seen more uncertainty, overlap of disjointed opinion and outright Alfred E. Neuman “what me worry” type contradictions. I’m now convincing myself that everybody’s is just reporting on what they believe and reporting on key indicators that support their own stories versus interpreting the potential “what if” effects of the actions that may be taken based upon prior mistakes.

Sorry Alfred, there’s lots to be worried about. More so there’s even more to be worried about as these clowns we have serving in Congress and the administration are geared up to stay in office versus solving the dilemmas they’ve created. If watching them does not convince you that government, as displayed, isn’t “smoke and mirrors” then I have some beachfront property for sale that’s only under water half of the day.

I’m an equal opportunity “basher” when it comes to legislators and administrations, on both the Federal and State levels, that simply don’t get it. The evidence is clearly in front of them but for one reason or another they just don’t perceive the implications of the decisions they have and will continue to make. With that in mind, let’s look at a couple decisions that are on the table and the “what ifs” that emerge depending upon how they are acted upon.

It’s Interest Rate Decision Time Again Worldwide

Bad enough we have to listen to prognosticators who like day, scalp or swing traders are looking for what our Fed will do like they’re sitting in a casino. I like Powell much more than anyone since Volcker but this is an election year and politics have a way to alter everyone’s decision making outcomes.

If it wasn’t for a yield curve predicting “gloom and doom” the only logical action to get inflation out of the system would be to raise rates in each of the next three to four meetings but that’s not going to happen especially before an election. By holding rates at prior levels Powell sends a message, spoken about by many over the recent months. It’s easier to accept embedded inflation at rates almost double the target rate of 2% than it is to “do the right thing”. I’ve believed this is more or less the decision the powers that be have come up with but they don’t have the “cajones” to say it out loud. Take a look at prices you’re paying for everything and tell me what’s come down in price. Can’t do it, can you? Are you happy about that? Are you ready to watch prices continue to rise from already inflated levels for the next couple years because that’s what’s coming.

In the same breath, we’ve shut down the “money supply” in such a way that only the rich, i.e., the one’s that can afford to pay off credit at now exorbitant levels, remain in the market. I started warning about this last year. What’s going to happen when those lines of credit run out. It’s simple, people will turn to their IRAs and retirements to get a few more bucks to buy that new phone or to take the vacation they deprived the last entitled generation of enjoying as after all, that’s just keeping up with the “Jones family”. Maybe that will stop when they’ve drained their retirement to pay for food.

We’ve created a supply / demand problem not just with money but with the perception of “needing something now”. I don’t think the solution to curing that problem is on the table at the next Fed meeting but it’s one the heart and soul of this country should be looking at. Otherwise, just like the end of the period known as the “Roaring 20s” we’re heading for another Great Depression brought to you by “cheap money” being available for far too long. At some point we’re going to have to bite the bullet; why not now?

So we are looking for a way to quell inflation while another country across the Pacific is looking for a way to create it. Japan has created the same problems as we did only in the inverse; they want prices to rise. In an extremely closed economic model they have essentially controlling their bond and equity markets for decades. Once we began to raise interest rates we made their efforts easier. All they had to do was to keep their rates at zero but it’s finally caught up to them. Who the hell wants to earn nothing on their money when they can pick up a secured 5% on U.S. Treasuries? Not even prople and institutions from Japan are keeping their money “at home”. Most think that China is the largest holder of our debt but they’re not; Japan is. China has had a need to sell treasuries and gold to maintain a fragile economic system that’s ready to cascade into the precursor of another financial crisis or worse.

So what does that mean if we raise our rates. Sure, we’ll eventually “whip inflation” but the rest of the world will suffer if we don’t have the “money supply” to buy the products they manufacture. A bit of a “Catch 22” eh? It’s one that fueled the Great Depression as well with nationalistic tendencies outweighing global outreach. It was just like the Titanic with “every country” for themselves. Is that happening again? It damn well right is only this time there’s more than one “world order” to deal with. BRICS is not going away; as a matter of fact it’s just getting started.

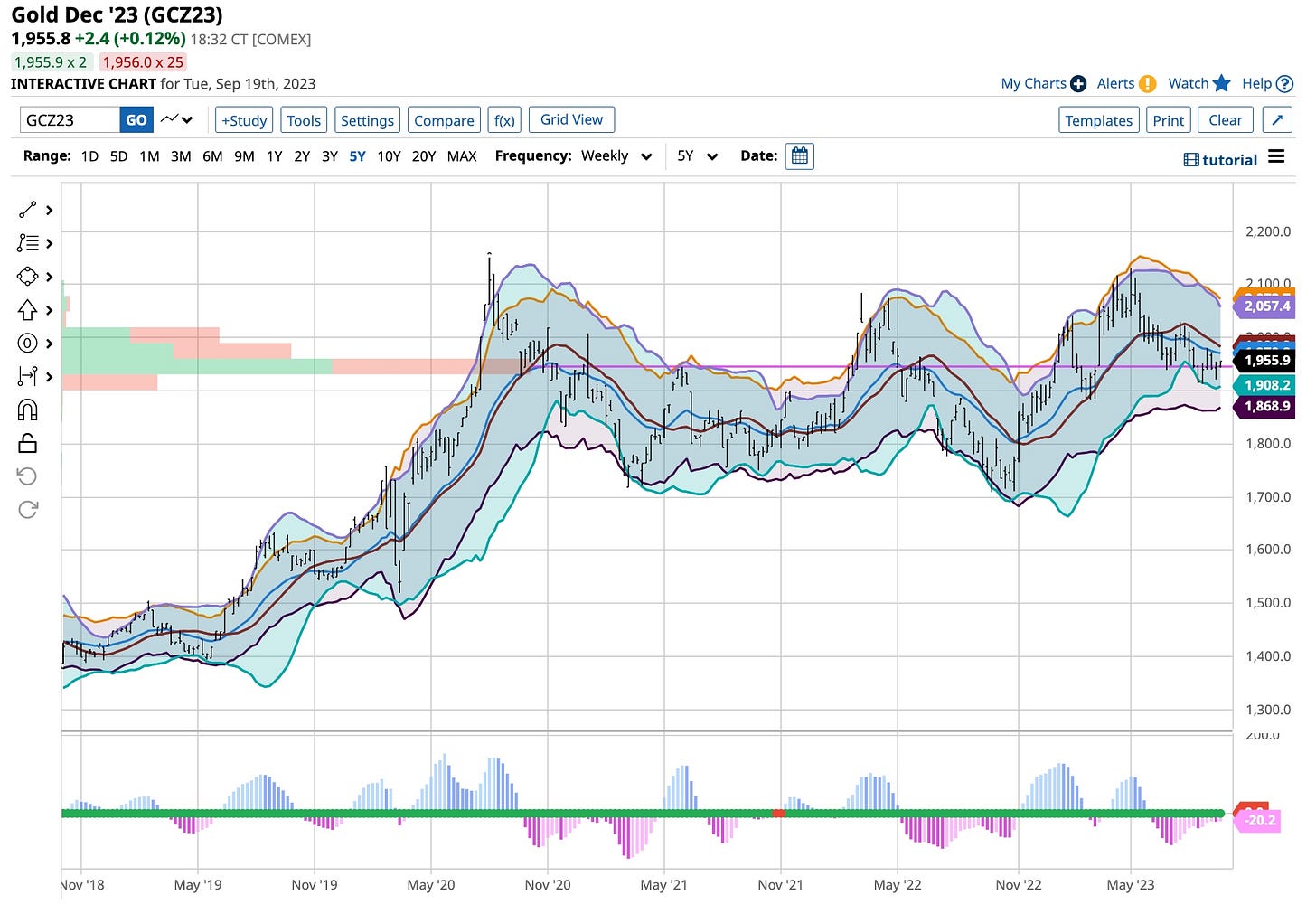

I have the solution however and it comes from a prior Fed Chairman now sitting on the cabinet as Secretary of the Treasury, Janet Yellen. She’s obviously still “eating the mushrooms” as today she signaled full speed ahead, Bidenomics is working, you need not worry about the auto strike, just prepare for a “soft landing”. So you ask what’s the solution? Eat more mushrooms, as a matter of fact start growing and exporting them to the world as there is no solution. I’m not trying to be facetious just want to put a lid on the crap that most others are telling you. We created this big mess and it’s not one that’s going to be “swept under the carpet” or magically solved with a magic wand like so many others. I think it’s time to finally start buying gold.

Back to putting the finishing touches on “The Ticker’s Bible” then doing a final proof read. It over 350 pages and unlike the real first book of the bible it’s not just chiseled in stone or written in Hebrew on parchment. I look forward to your comments.

By the way much like here I’ve been adopted on LinkedIn. I’m overwhelmed by talents from around the globe. Look me up there and connect.

Hard to imagine that Star Trek turns 60 in 2026. Is there really intelligent life here? Probably and we’re about to find out. If not, beam me up Scottie.