Well the first thoughts that crossed my mind post the CPI release was “damn, I wish I had placed that trade”. Yesterday I talked about buying out of the money put and call options, letting the markets run in one direction, harvesting the winner then waiting for markets to reverse. Well that happened; then it was time to start listening to and reading what others were reporting as to the reason why.

I was impressed although I’m sure it will be short lived; their time frames are far too short. Those “in the know” were actually starting to see the “forest through the trees”. When the Federal Reserve lowers rates economic conditions are usually not very good. In reviewing historically the “real” recessions we’ve been through in the past 50 years it becomes apparent; it’s much easier for the Fed to print more money than to extract it from the economy. Again, that’s in “real” recessions not “man-made” ones like our political, banking and corporate leaders have subjected us to for the last 15 years.

If all Powell had to deal with was rebalancing the flow of money to stabilize economic conditions he’d be out there playing more golf. He’s not and for good reasons as well. He’s stuck trying to solve not one but two totally “man-made” economic catastrophes; dropping rates then maintaining lower rates for far to long to “save the banks” in 2008 then flooding the system with far too much “free” money as we muddled through the “pandemic”. It’s ironic when a casualty of recent tightening actions, to return balance to an out-of-kilter monetary system, creates havoc. In essence, the banks, you know the ones we had to save in 2008 are once again the victims of today’s solution; circular reasoning at it’s finest, eh? Somebody, some day is going to write about the decline of the United States when we substituted government regulations and oversight instead of the application of good old capitalist ideals.

Today however, some rational prognosticators are taking to the airwaves to “report” on the inherent danger of a recession on the horizon. Where have they been? It’s been there for years but through abusive, continual governmental waste and overspending, we have kicked the recessionary can down the road. Hopefully the party is over but the solution didn’t arise from just raising interest rates; it came from the realization that earnings are not going to be good for perhaps an even longer period of time due to our “man-made” actions of just printing too much money for far too long. Maybe the banking system is in more trouble than we think or we are going to default in our governmental obligations. Regardless of why, everyone’s talking about recession.

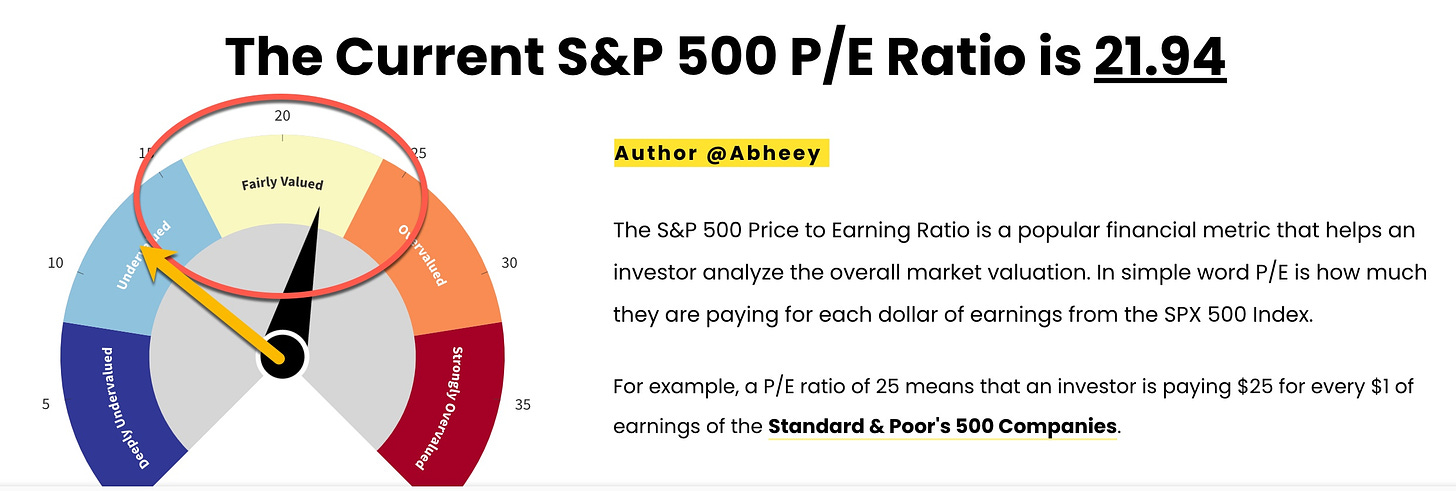

A primary indicator of “fair value” in my world is the S&P 500 P/E Ratio which sits today at 21.94. I use this and it’s cousin’s “future” P/E ratio as a foundation of most of my market entry and exit decisions; I’ll be a buyer around the “15” level. In the 1970s, I bought around the “5” level but back then “10” was considered high. Imagine that, we even have inflationary effects in these historical S&P 500 P/E Ratios.b Could be the “Robinhood” gang has had yet another effect on the sanity of the markets.

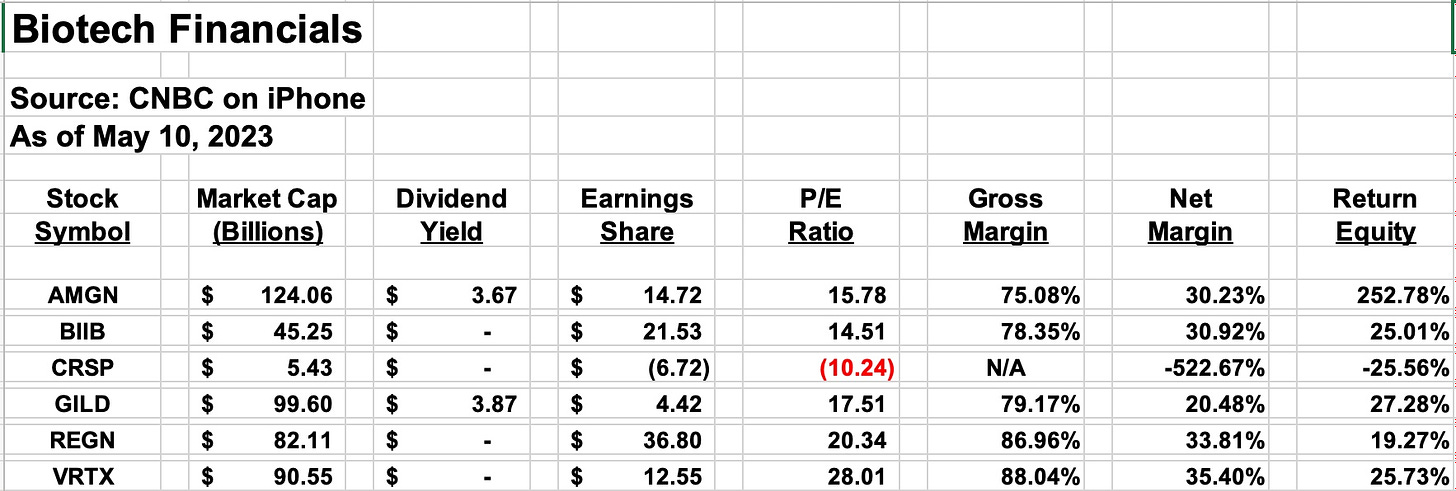

Enough about today; in this transient “what’s happening now” world, the debt crisis and who knows what else is on the horizon, will hit the headlines and speculators will take hold and make their plans for at least the next fifteen minutes. The Trader EDU is busy putting together the tools we use and how to teach them to you using one of our favorite industries, Biotech, as an example. Yesterday we posted a few technical charts. Hopefully you noticed that they were long term in nature as Biotech stocks are normally long-term animals. Taking you a step further into our investigation and what we intend to assemble into aa actual course follows:

Directly From My Cell Phone

Compared to years ago, when the best resources we had was Value Line, the amount of information you have in your “pocket” is limitless. The information in the above Excel sheet originated from CNBC, one of the sources readily available for your use. It’s “free”, at least the version used in this case was free. Here’s but a couple additional tools being considered as I develop the best way to illustrate to you “how I do it”:

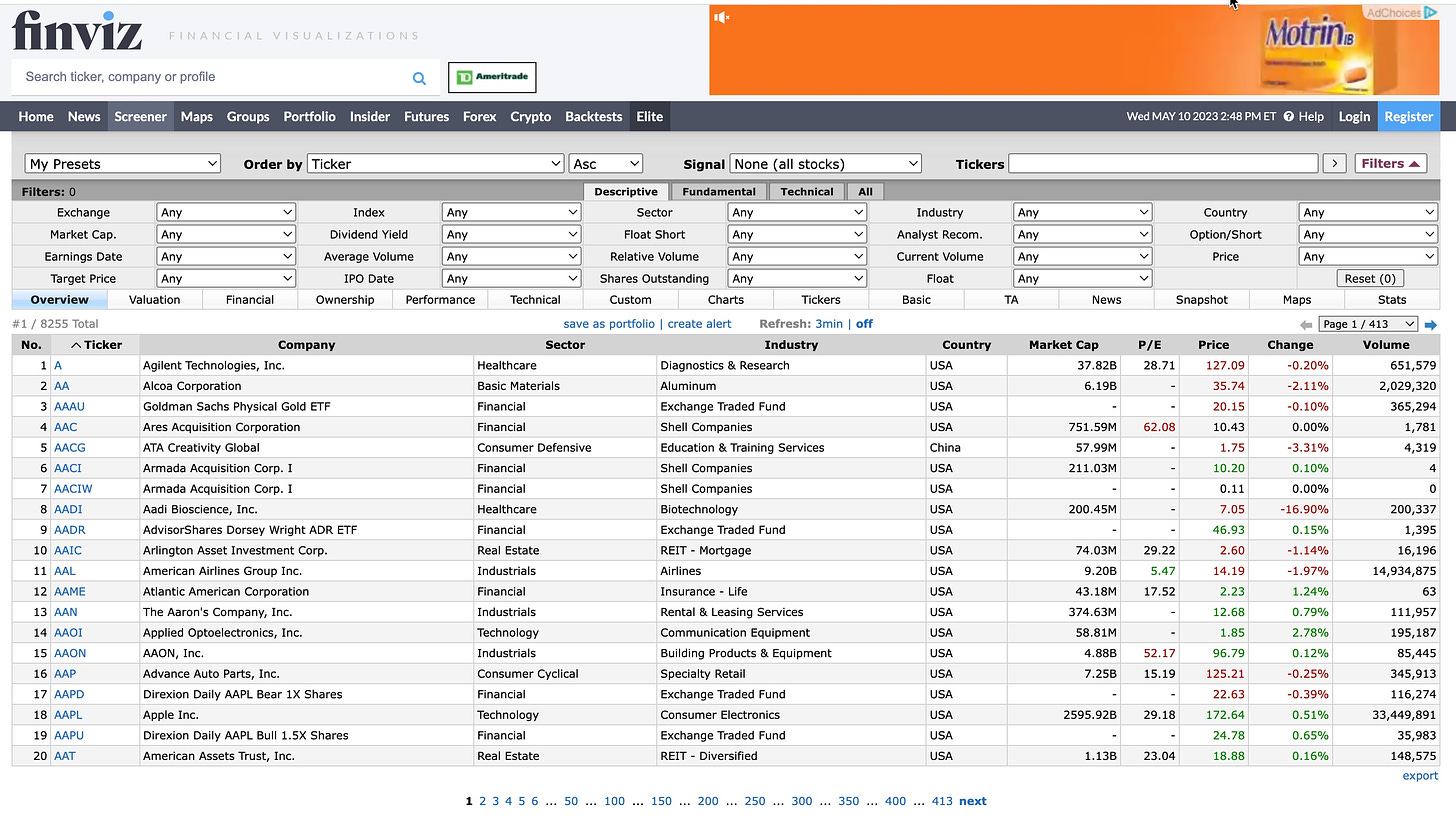

Finviz Screener

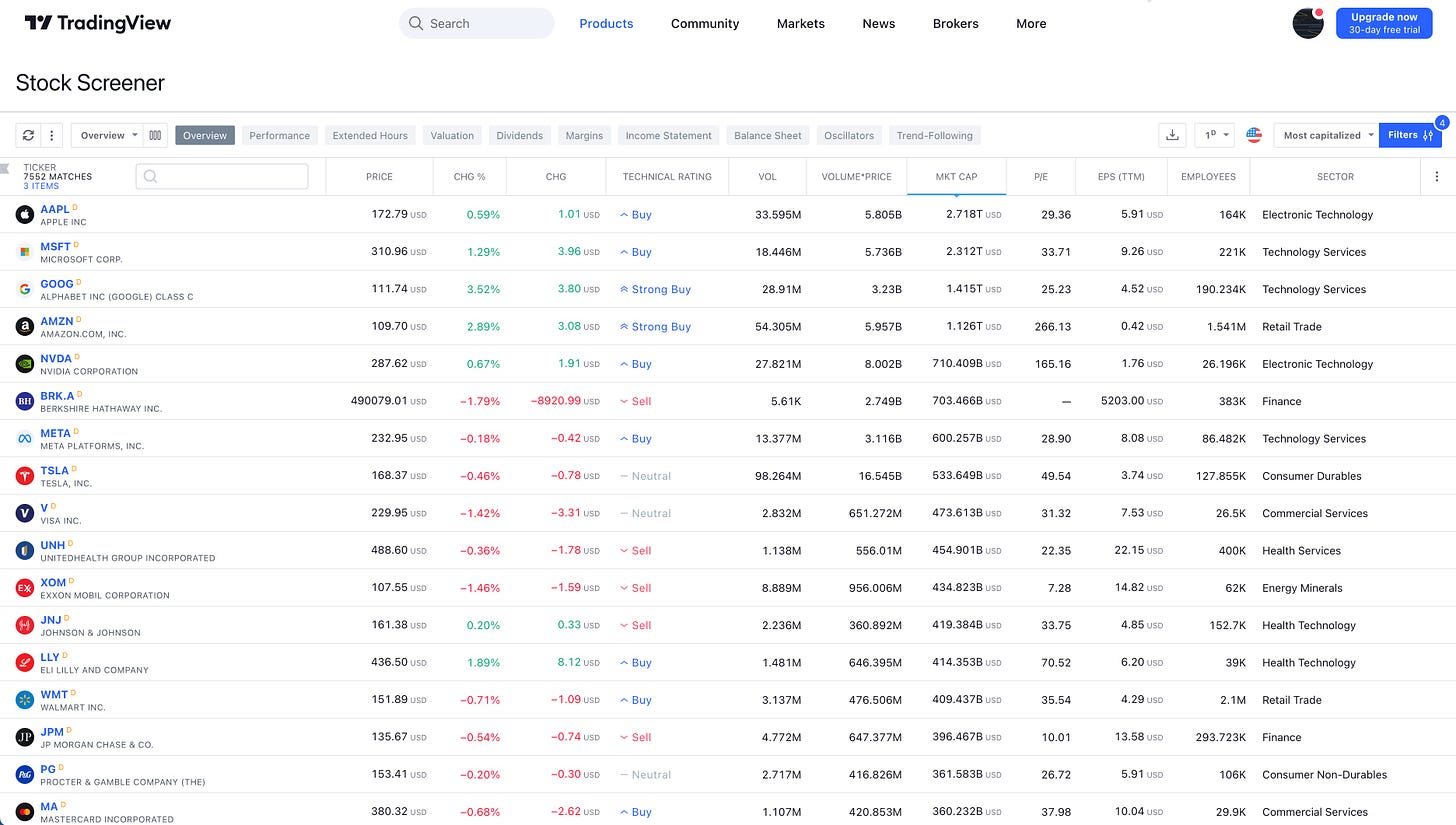

TradingView Screener

I’m more familiar with Finviz as I’ve used it for years. Both of the above examples are “free” with each offering upgrades for additional amounts. It’s up to you to determine what works best for you. It’s up to me which one works best to teach from. It’s taking me a lot of time; so far your response has been tremendous and appreciated, thanks. Shooting for kicking this all off next Tuesday and Thursday but it’s Mother’s Day this weekend and that comes first.

There’s much more to come from The Ticker and our developing educational side The Ticker EDU. Stay tuned and as always, let me know what you want to learn; I listen.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

I thought this was a good time for my favorite Queen song as it’s true, “I’m Going Slightly Mad” . . . for many reasons . . . how about you?