We live in a time of uncertainty. Differentiated positions exist and proliferate upon us as we review the opinions expressed. What do you believe? Why is one opinion often more important than another? The answer is simple.

Most people want to have their own beliefs reinforced. It is similar to how we react to the selected news channels we follow. Those believing one source will suggest others are just “fake.” In our daily operation, everything is followed. No one knows what is going to happen. All predictions are important but like others we are biased.

We have had a successful half-century of being right far more often than we’re wrong. That’s important. It also makes us biased, but since we are rather conservative in our investment, trading, and hedging philosophy, doing less than others is normal.

How About That Dollar

A lot hinges upon the Federal Reserve this week. Will the “powers that be” reduce the base interest rates by 25 or 50 basis points? I do not know, and face it, neither do you. In many ways, reasons to do either are valid, but reactions need to be moderated.

We’ve been short the U.S. Dollar against the Yen and will continue to build upon that position. The interest rates in the United States and Europe are heading lower. Expect Australia and New Zealand to follow as Japan hints at raising theirs.

What About The American Elections

I’m not one to make predictions, but the markets seem to believe Trump is in the lead. I do not like either candidate, but I find fewer flaws with Trump than I do with Harris. At least I know where Trump stands versus the “word salad” responses put out by the Harris campaign. People are smart, and without a defining plan, the Democratic Party wants you to buy into hope and change. It may have worked in 2008. but in today’s real world, people want facts, not dreams.

Trump’s platform is not without problems. As the Dollar decreases, the real “cost of tariffs” will come into play. Inflation is here to stay, and the only effective way to deal with this problem is to “drill baby drill” and reduce regulation. It would be nice if the “printing of money” would decrease, but both parties seem reluctant to do that. It is the money supply that prevents recessions, and reductions in debt creation are a sure-fire way to bring about economic downside. Maybe that’s what we need.

Waiting For The Secondary

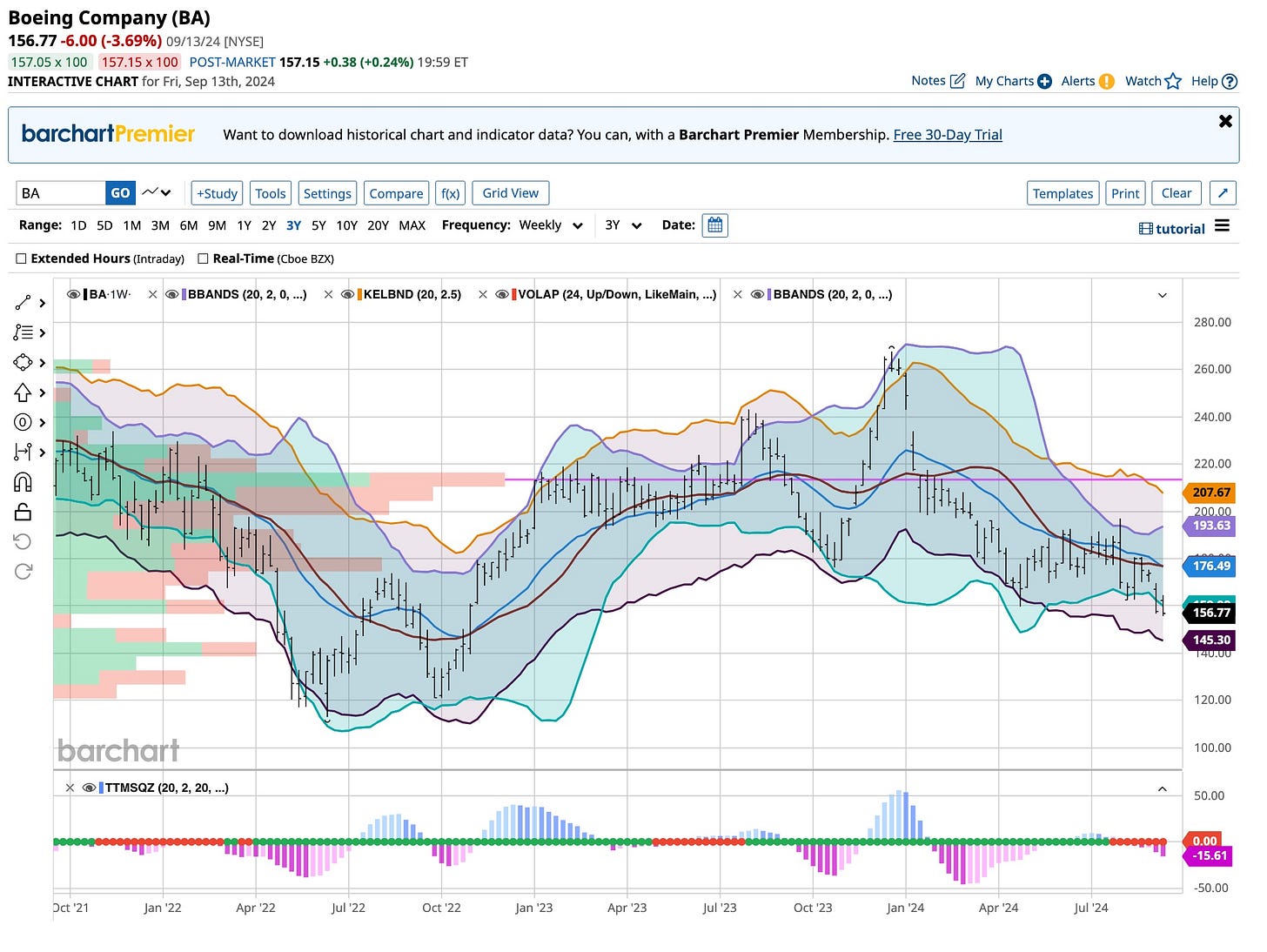

I’m a long-term, skillful buyer of Boeing. Over the last week, it has become apparent to me that the strike raises the chances that Boeing is going to need to raise capital. I know that the turnaround is only going to take place when revenues increase but like all companies, money to pay current bills is imperative.

With that in mind, I fully anticipate that Boeing is going to need to hit the secondary market for cash, and if this strike continues, they are going to need to do this sooner. I have my eyes on this situation and lots of powder dry to take advantage of it and hope all of you do too.

I knew him as Cat Stevens. Despite his becoming “Yusuf,” to me, he’ll always just be “Cat Stevens.” Fae it, he’s more prophetic than not. It is a Wild World out there, and you have to keep your eyes and ears open. Rates are coming down, but without the changes suggested, inflation is not. The worst economic times I remember happened in the 1970s. It was called “stagflation,” and that is what I see on the horizon. I’m one to listen and read everything possible, and the “talking heads” I follow agree. How about you?