It’s an “end-of-the-month” Friday in the summer. I would hope that most of you will be doing something else. I’ve got a forward-thinking article set to run on Sunday so my “plans” are set. Today I’m just going to drill a few things into that area between your ears that are musts.

You must know yourself, your abilities, skills, and risk temperament. You must have a plan. You must stick to your plan. Remember, there are three types of positions in this market, long, short, and flat. Far too often traders and investors fail as they forget that “flat” works. Most fail because they try to do too much. Operate within your ‘abilities’ and your rate of success will increase.

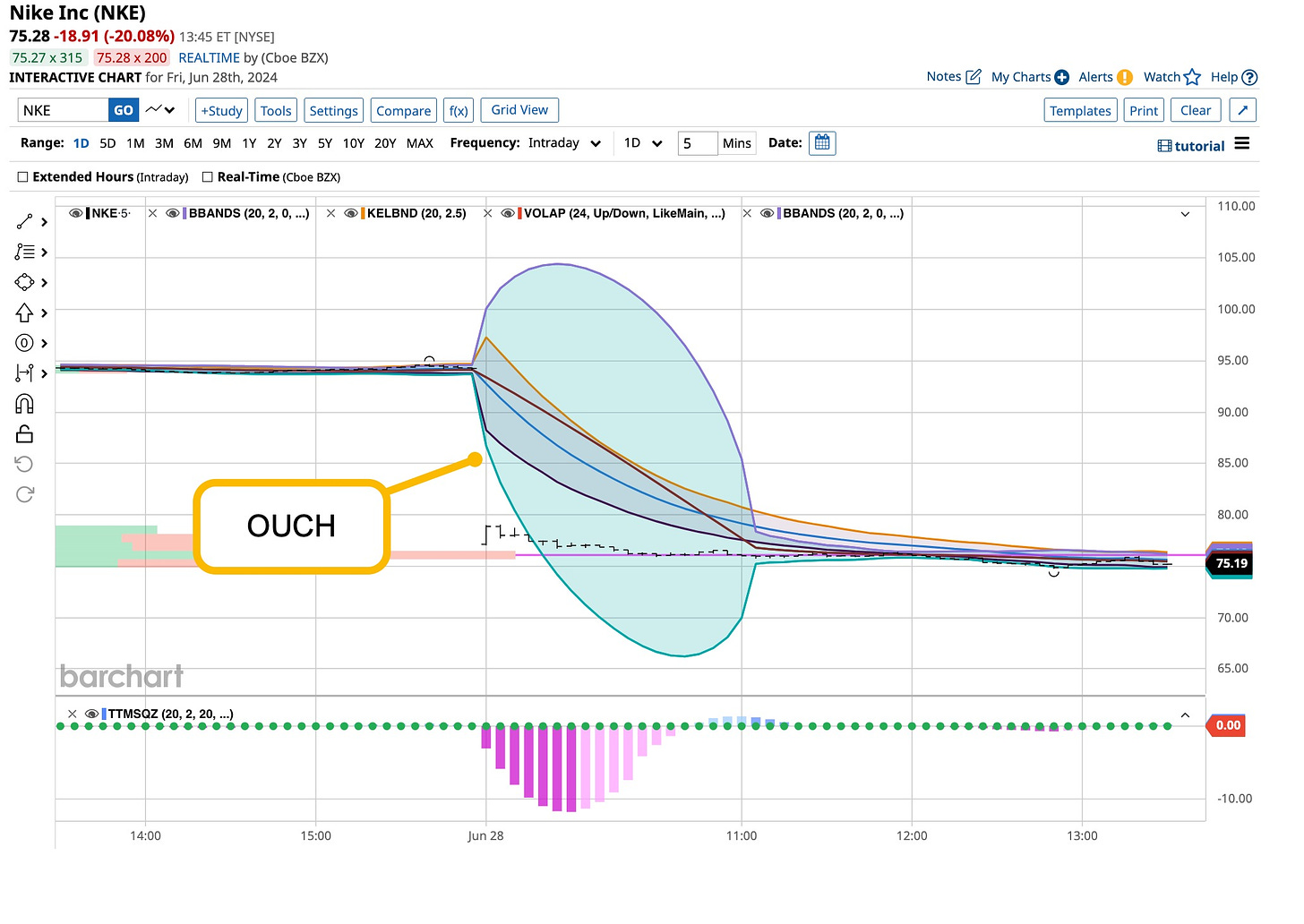

Nike Has A China Problem

Many think I pulled a “rabbit” out of a hat with my option trades on Nike yesterday. I just stuck to my plan. In doing so I not only preserved the almost 10% upside inherent in my Nike trade, but I more than doubled my upside by buying shorter-term “at-the-money” put options and selling “covered” longer-term call options. I still hold both of these positions.

It wasn’t luck or chance. It was the plan and I stuck with the plan. This might seem a bit boring to many, it is but boring works. I’ll fill you in when I take action next week on what undoubtedly was one of the best hedge positions I’ve acted upon. For now, it’s time to talk about what else happened last night and this morning.

Reality Surfaced

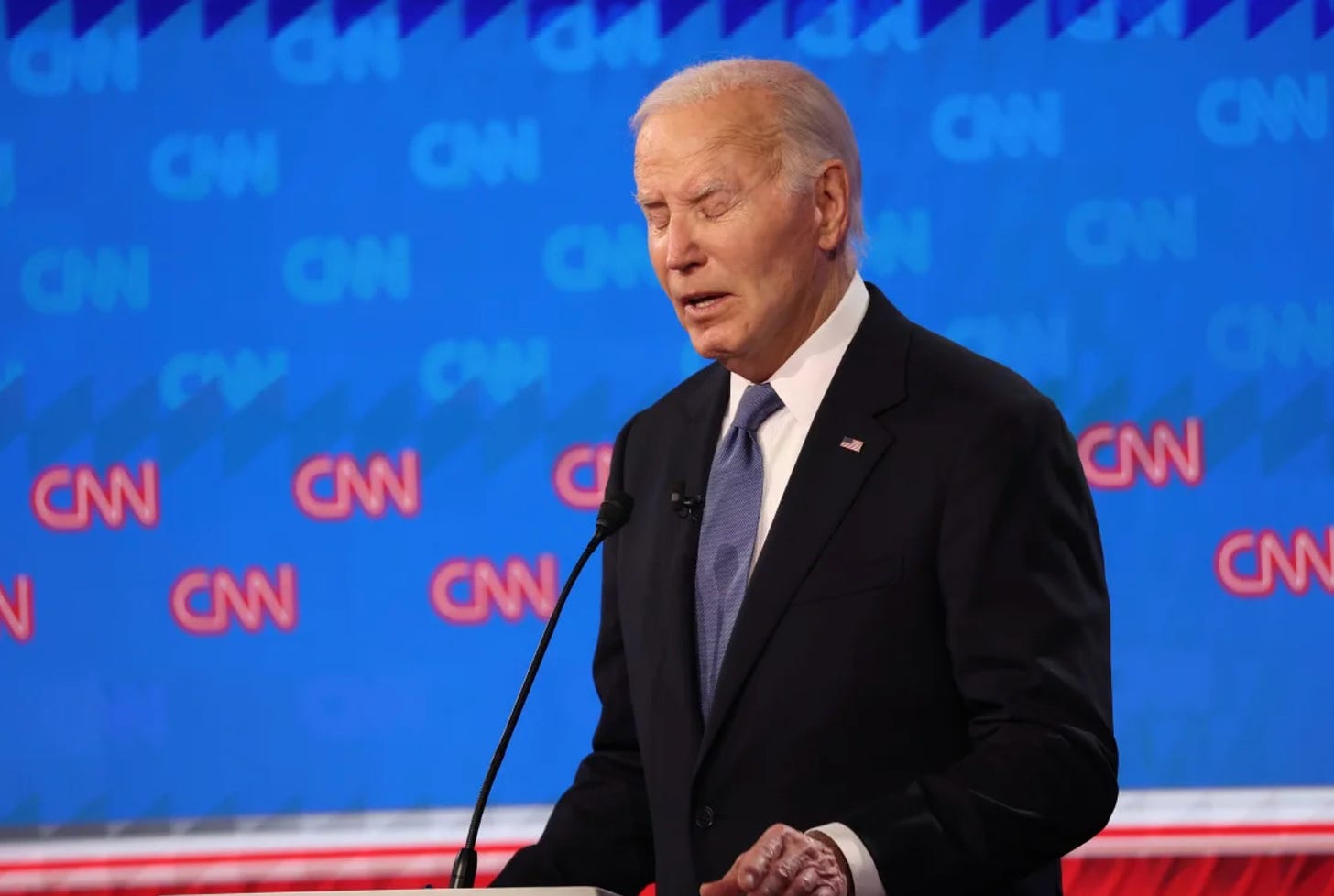

If you were not watching and listening to the “Presidential Debate” last night, shame on you. What the hell were you doing? I felt bad for Joe Biden but I felt worse for our country. Neither candidate offers 100% of what I’m looking for but Trump offers more.

The Democratic party has its work cut out for it but one debate does not fulfill overall decision-making obligations. I had a cold last week too. I don’t think it mattered too much and I certainly didn’t broadcast it. The “problems” run deeper than a sniffle or just a sore throat. It’s above my pay grade so I’ll just keep watching and listening.

Inflation Remains

Congratulations, the exhibited rate of inflation didn’t increase. I guess that’s the good news. The bad news is that inflation persists. I am a firm believer in watching futures trade, diligently doing my grocery shopping and always studying the Federal Reserve. I see it all, not just the “numbers” as presented. I “live” it and you should too.

Nonetheless, consumers are tapped out. An inherent problem we face domestically is the “herd” mentality we succumb to. It’s not just in the way far too many pick stocks, no it’s deeper than that. Consumers are herd-like when it comes to spending money as well. It’s coming closer to when they’ll pivot away from buying everything yesterday to simply buying nothing. That’s what the Federal Reserve is waiting for, hoping for. The rate of inflation coming down depends on it, real decreasing “money supply” depends on it, and above all, lower interest rates rely upon it. For now, just sit on your hands.

Remember folks, it’s summer. The Zombies figured it out years ago with their hit song “Time Of The Season”. There are times when you should do less. Often less is more in today’s environment. Have a plan. More importantly, stick to your plan. No one’s will be right every time. It’s impossible but it is possible to limit mistakes. Give it a try and trade and invest less. Do nothing more often and realize, cash is your friend especially when an opportunity finds you and you have the capital available to strike