Unlike the Rolling Stones, time is not on my side today but getting you all started into the world of basic spreads is so let’s jump right in. I trust yesterday’s article has had a chance to sink in. More than likely, for this “Dollar General earnings report”, you are only going to need to deal with a “covered call” or “protective put” scenario but it is always a good time to learn about the basic bull, bear, calendar and vertical spreads. We’ll start with basic definitions of each type of spread then conclude with examples that best relate to Dollar General.

Bull Spreads / Vertical Spreads

A bull spread is an options trading strategy that involves the use of two call options or two put options with different strike prices but having the same expiration date. This strategy is employed by investors who are bullish on the underlying asset and expect its price to rise. There are two main types of bull spread strategies, the bull call spread and the bull put spread.

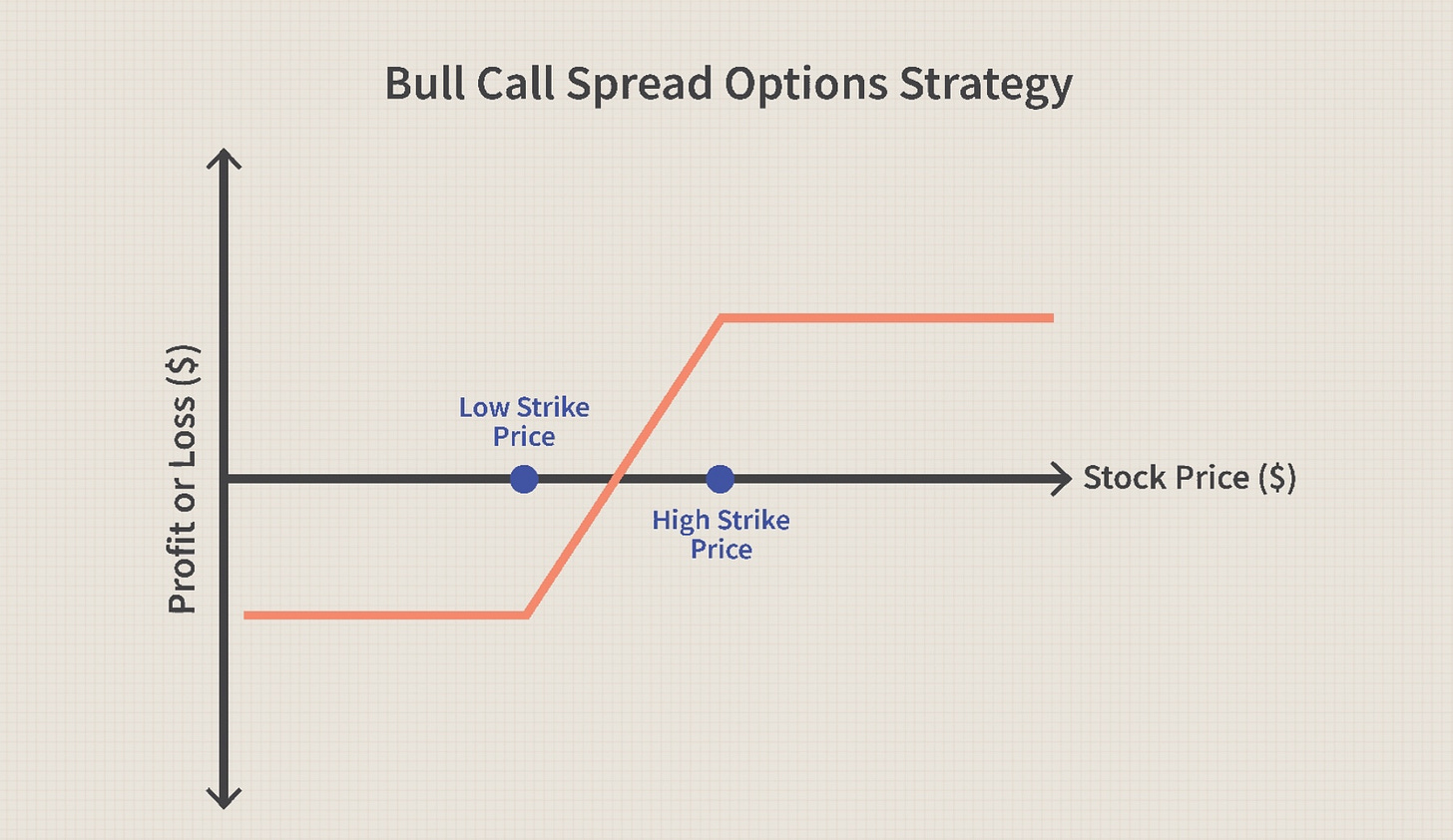

The objective of a bull call spread is to profit from a moderate increase in the price of the underlying asset. To initiate the position one would buy a lower strike call option and simultaneously sell a higher strike call option. There is a limited risk and limited reward. The maximum loss occurs if the underlying asset's price falls below the lower strike price at expiration. The maximum profit is achieved if the actual price closes at or above the higher strike price.

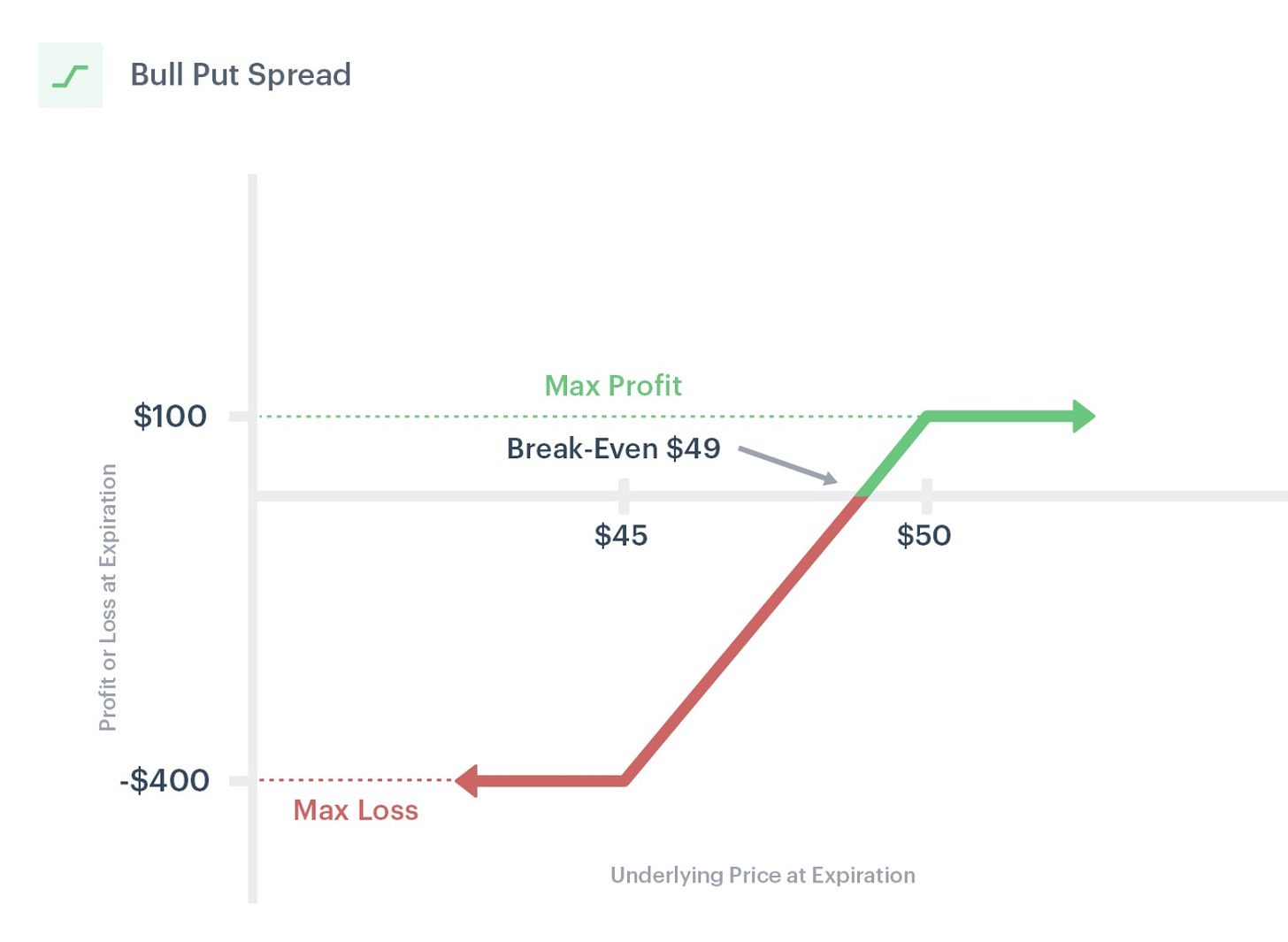

The objective of a bull put spread is to profit from a moderate increase in the price of the underlying asset. To initiate the position one would sell a put option with a higher strike price and buy a put option with a lower strike price. There is a limited risk and limited reward. The maximum loss occurs if the underlying asset's price falls below the lower strike price at expiration. The maximum profit is achieved if the price closes at or above the higher strike price.

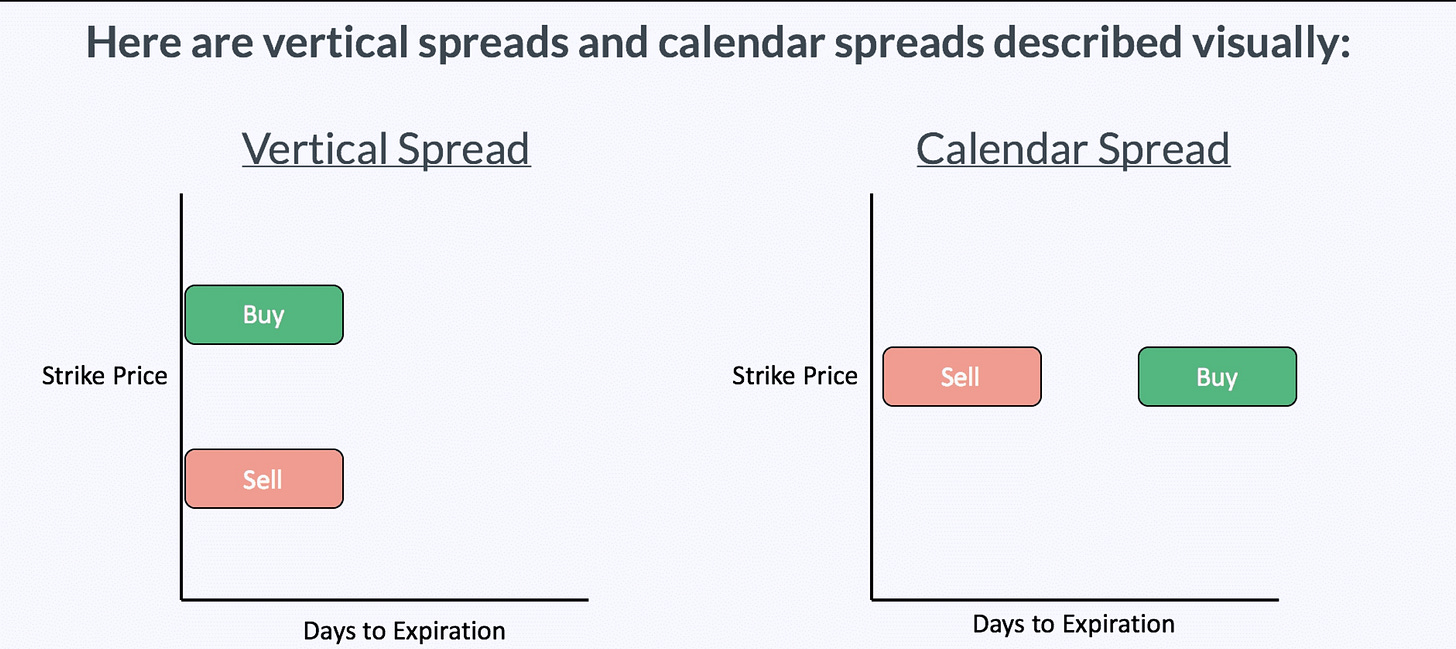

Bull spreads are a type of vertical spread, where options with different strike prices are used. They are used when an investor believes in a moderate price movement in the underlying asset. Transaction costs, bid-ask spreads and the actual price of the underlying asset can impact the overall profitability of the strategy. The limited risk and reward nature of bull spreads make them suitable for investors seeking a more conservative approach to options trading.

Bear Spreads / Vertical Spreads

A bear spread is an options trading strategy designed to profit from a decline in the price of the underlying asset. It involves the simultaneous purchase and sale of two options with the same expiration date but different strike prices. There are two main types of bear spread strategies, the bear call spread and the bear put spread.

The objective of a bear call spread is to profit from a moderate decrease in the price of the underlying asset. It’s implemented by selling a call option with a lower strike price and simultaneously buy a call option with a higher strike price. There is a limited risk and limited reward potential. The maximum loss occurs if the underlying asset's price rises above the higher strike price at expiration. The maximum profit is achieved if the price closes at or below the lower strike price.

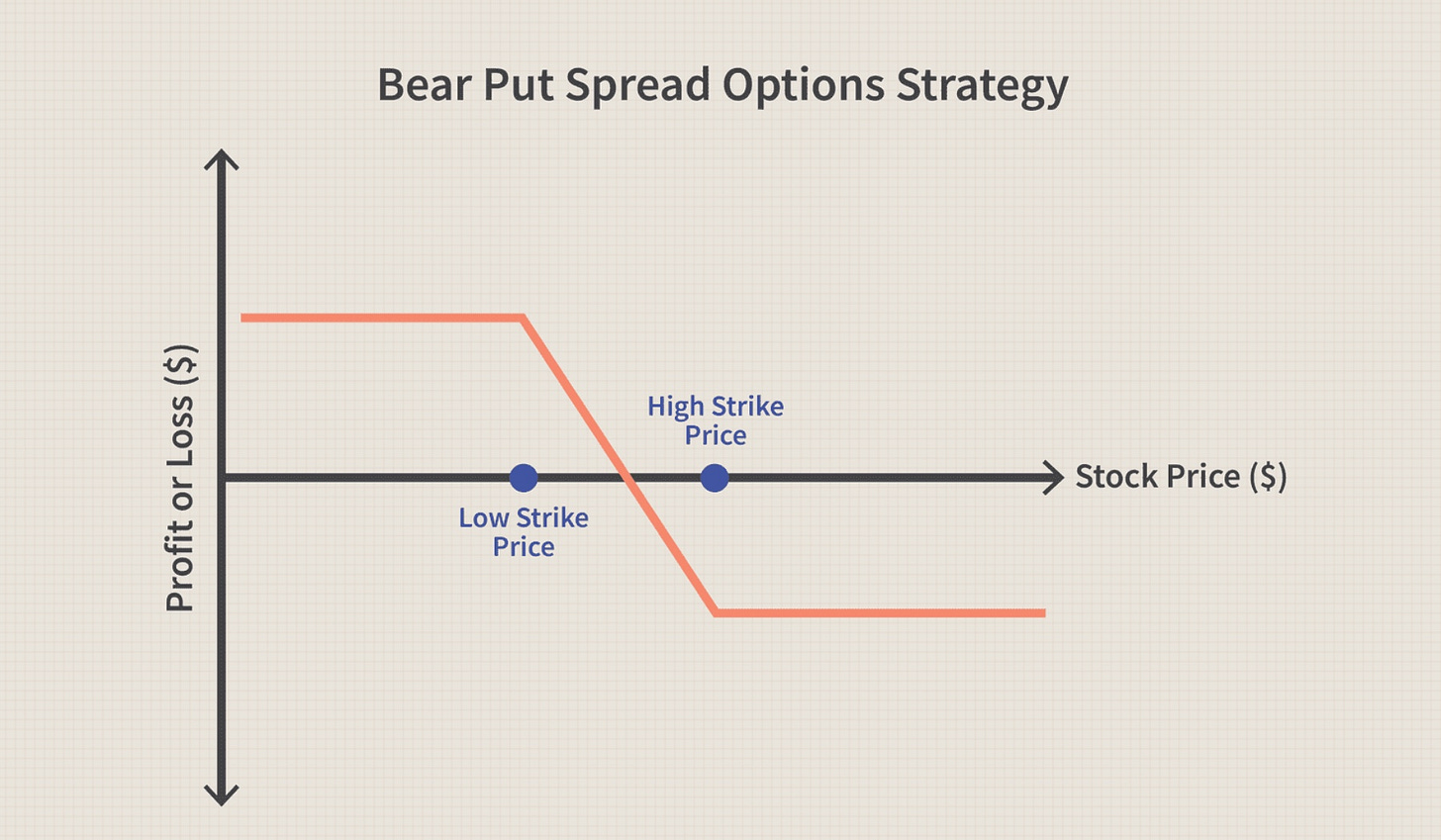

The objective for a bear put spread is to profit from a moderate decrease in the price of the underlying asset. It is implemented by buying a put option with a higher strike price and simultaneously sell a put option with a lower strike price. There is a limited risk and limited reward. The maximum loss occurs if the underlying asset's price falls below the lower strike price at expiration. The maximum profit is achieved if the price closes at or above the higher strike price.

Bear spreads are a type of vertical spread, where options with different strike prices are used. They are used when an investor anticipates a moderate decline in the price of the underlying asset.Transaction costs, bid-ask spreads and the actual price of the underlying asset can impact the overall profitability of the strategy. The limited risk and reward nature of bear spreads make them suitable for investors seeking a more conservative approach to options trading.

Calendar Spreads

A calendar spread, a time spread or horizontal spread, is an options trading strategy that involves the simultaneous purchase and sale of two options with the same strike price but different expiration dates. This strategy capitalizes on the difference in time decay between the two options. There are two main types of “calendar” spreads, the calendar call and the calendar put spread.

The objective of a calendar call spread is to profit from a “neutral to slightly” bullish outlook on the underlying asset. To implement a calendar call spread one would buy a call option with a longer expiration date and simultaneously sell a call option with the same strike price but a shorter expiration date. There is a very limited risk and limited reward. The maximum loss occurs if the underlying asset's price makes a significant move in either direction. The maximum profit is typically achieved if the price closes near the strike price at the expiration of the short call option.

The objective of a calendar put spread is to profit from a “neutral to slightly” bearish outlook on the underlying asset. To implement a calendar bear spread one would buy a put option with a longer expiration date and simultaneously sell a put option with the same strike price but a shorter expiration date. There is a limited risk and limited reward. The maximum loss occurs if the underlying asset's price makes a significant move in either direction. The maximum profit is typically achieved if the price closes near the strike price at the expiration of the short put option.

Calendar spreads benefit from time decay, as the longer-dated option typically loses value at a slower rate than the shorter-dated option. This strategy profits from a stable or moderately trending market, where the underlying asset's price remains close to the strike price. It's crucial to monitor the position as expiration approaches, as the impact of time decay on the short option becomes more pronounced. The changes in implied volatility can affect the value of the options in a calendar spread.

Definitions are important when it comes to learning the terms and identification of a strategy or two or three or more as they relate to options. Options are very useful for investors or traders interested in “hedging” their positions, reducing their overall cost and seeking opportunities in the markets using what is known as a “derivative”. Let’s take a look at how these basic strategies would apply to Dollar General today.

Dollar General Here & Now

Before jumping into a few words about “spreads”, I had a “Good-Til-Cancel” (“GTC”) order at $162.50 in to sell a few more shares of Dollar General. It got close but did not hit the number. This is important as I did not change my “plans”. Rebalancing your portfolio regularly is important especially when securities you have invested in move higher. Keep that in mind and always stick to your plans and rules. Now lets look at what Dollar General and its options did today.

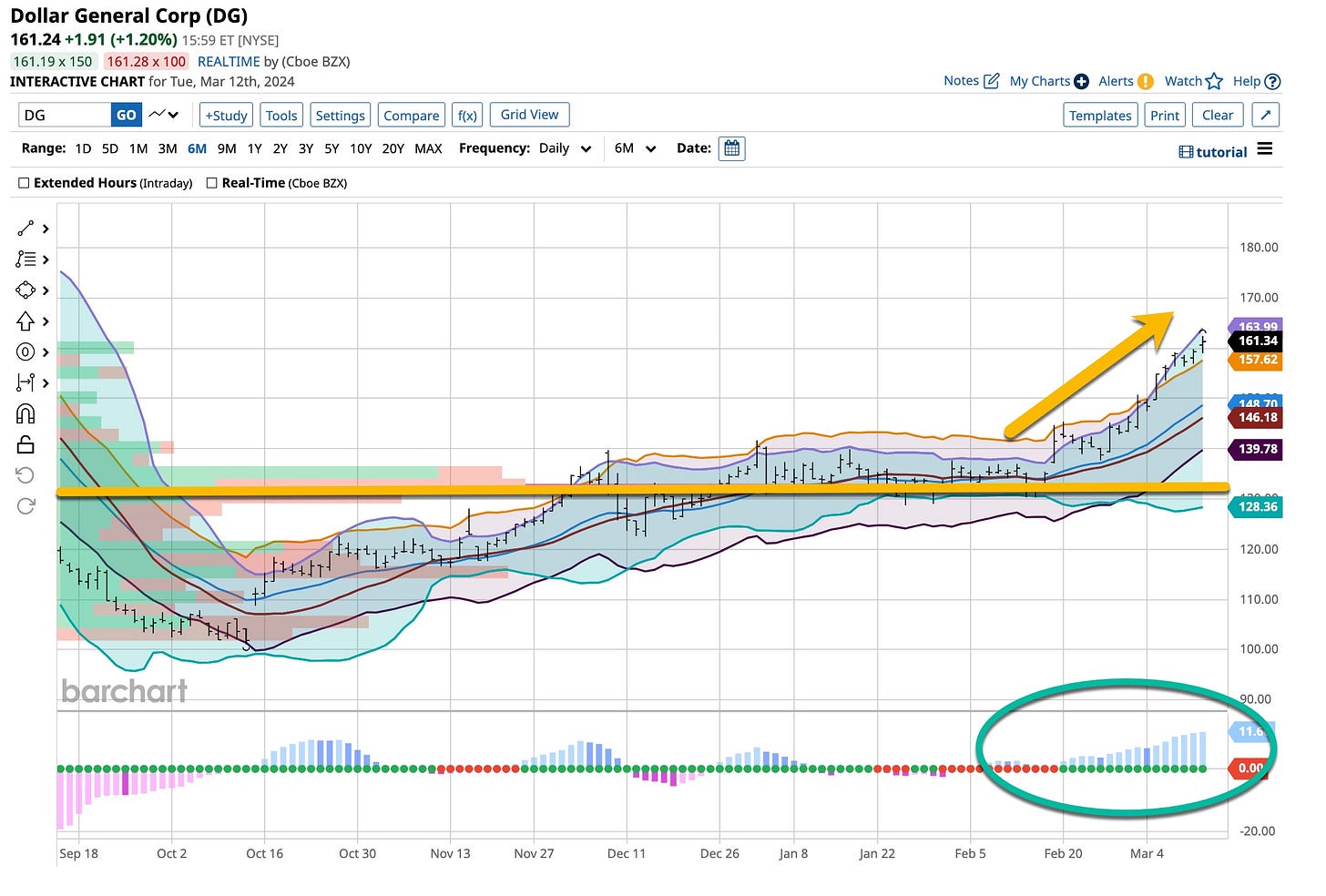

Up, up and away, about 2% higher when you take into consideration the aftermarket trades but who is counting. The market had a mostly good day despite the fact that a few of the “inflation” numbers were higher than anticipated.

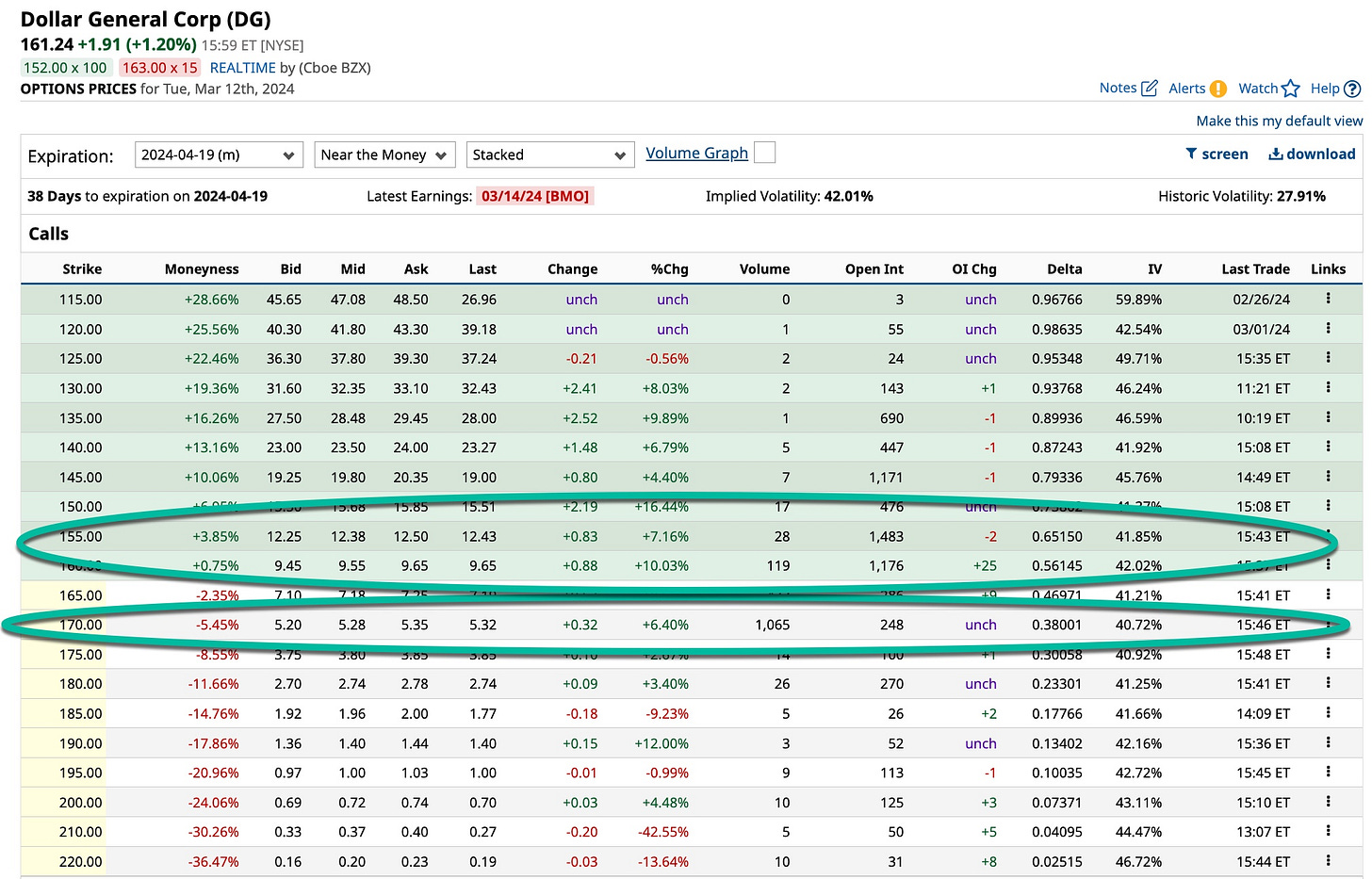

Dollar General calls and puts acted as they should today. Here’s where they closed for the 2024 April option series. Please take note, I’ve “circled” a couple strike prices so I can help you get a better, yet simple understanding about “spreads”.

Let’s look at the call side first. Remember, the volume and open interest are important factors to consider when initiating a position.In this case, I am looking to buy either the 2024 April 155 or 160 call and sell an equal amount of the 2024 April 170 call. This is considered to be a ‘bull spread”. The expectation for doing this revolves around the belief that Dollar General is going higher. The amount paid for the lower priced call is somewhat offset by what was received for selling the 2024 April 170 call. As defined in our discussion, the maximum profit is achieved if Dollar General closes above $170. The risk is that it closes below the price paid for the lower priced 2024 calls but here is the good news. The most you can lose is the difference between what you paid for those lower priced calls less the amount you “received” for selling the higher priced, “out-of-the-money” call. You are not going to “break the bank” if your strategy is the right one but you’re not going to “go broke” owning just the stock if you’re wrong.

Now let’s take a look at the put side. I’ve circled the options with the highest volume and open interest just like I did with the call side. It’s a rule I follow and you should as well. Since my strategy has not changed and it’s believed that Dollar General is going to head higher, the “position” option wise is reversed. In this case, since we think the stock is going higher, we buy the 2024 April 160 put and sell an equal number of let’s say the 2024 April 145 put, maybe even the 140 put as it’s open interest is pretty high. Regardless, the objective is a rising stock price which in this case is a good thing. It is important when dealing with puts in this manner is that you want them to decline in value. Since puts increase in value when the price of the underlying asset decreases in price, ask yourself what happens if the underlying value increases? That’s right prices decline.

I can’t tell you that I’m looking at either of these scenarios with respect to a position in Dollar General. Nonetheless, it is important that you gain knowledge as to how the option world works. again, we do it best in the one-On-One online tutorial world as it is a lot to learn. Consider joining with me and over time you will learn this but always keep in mind, becoming the best “damn investor or trader” you can be is a marathon, not a sprint. If you treat it differently you are going to be disappointed. Now let’s take a quick look at what’s called a calendar spread. For that exercise, let’s take a look at a few 2024 June option series calls.

I’ve only circled one here, the 2024 June 180 call. There’s two ways to initiate calendar spreads. You can buy the near term call and sell the longer term call or you can buy the longer term call and sell the near term call. It’s a good idea to “get to know” your margin clerk before you get started as requirements are going to come into play.

If you think the stock is heading higher you are going to buy the lower priced, nearer term calls and sell the higher priced, longer term calls. If you think it is headed in the opposite direction, consider doing the same just exchange the type of option to “puts” instead. Again, in this case, I’m not really looking at a complex strategy but it’s always nice when you have an opportunity to teach from reality If you want to learn send me an email at info@tickeredu.com and we’ll design a tutorial that works for you.

It’s easy, right? No it is not and believe me I know it. At this point there are a couple rules to utilize. First, know what direction or strategy you expect the underlying asset to head. Second, understand what you can afford to lose. Never, I repeat never exceed that amount, it is not worth it. Third, monitor and watch your position, the “Greeks” and more. In other words learn from your actions. Fourth, take our courses on options and digest it. Follow the posted Substack messages and when you’re ready, contact me at info@tickeredu.com to do a One-On-One online tutorial.

Join in with the thousands who have followed these rules in the past and become the “best damn traders and investors” they could be but remember, tis journey is more of a marathon than a sprint. It 55+ years and counting for me. Hopefully it will be a litlle shorter for you but remember, I learn something new every day. It’s time for you to do the sae and thanks always for your patience.

When I tell you that I learn something “new” every day I’m telling you the truth. I also want to be sure you understand that learning how to become the very “best investor or trader” possible takes time but remember, all of the good things in life do. Remember when you were learning how to count numbers and doing your “ABCs”? It’s easier in today’s world to do that versus when I learned how years ago. Be thankful for what is known as the “online” and “Internet” world. It’s a gift that keeps giving. Just like what we propose you do here, take the time and determine what you do not know and what you want to learn then email me at info@tickeredu.com and together we’ll figure out to meet your goals just like “phonics” did years ago with their “ABC Song”.