Sorry about the late posting today, but I had no choice. New Zealand is due to report its interest rate decision late tonight. They’re usually the “leader of the pack,” so we will see which way they head.

There are a couple of other actions to take as well, so let’s get to them first.

Food Production Rules

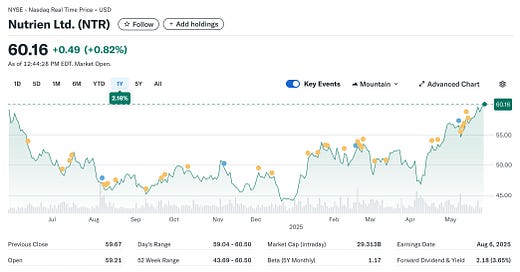

Nutrien (“NTR”) is a leading global provider of crop inputs and services, including potash, nitrogen, and phosphate fertilizers. Formed in 2018 through the merger of PotashCorp and Agrium, Nutrien is headquartered in Saskatoon, Saskatchewan, and operates over 2,000 retail locations across North America, South America, and in Australia.

In 2024, Nutrien reported revenues of $25.02 billion, a decline of 10.92% from the previous year. Net earnings also decreased by 46.42%, totaling $674 million. The first quarter of 2025 saw adjusted earnings of $0.11 per share, missing expectations of $0.31, primarily due to weather-related delays and high natural gas prices.

Nutrien offers a solid quarterly dividend of $0.545 per share, with the next payment scheduled for July 18, 2025. The company has a share repurchase program in place, allowing it to buy back up to 5% of its outstanding common shares.

Despite recent challenges, Nutrien remains optimistic about the fertilizer industry's prospects. The company forecasts global potash demand between 71 and 75 million metric tons in 2025, with supply constraints driving prices higher. Increased corn acreage in the U.S. is expected to bolster fertilizer demand.

I’m a long-term buyer of niche quality, and Nutrien has been on my list for quite a while. It should be on yours too.

Oops Leads To Opportunity

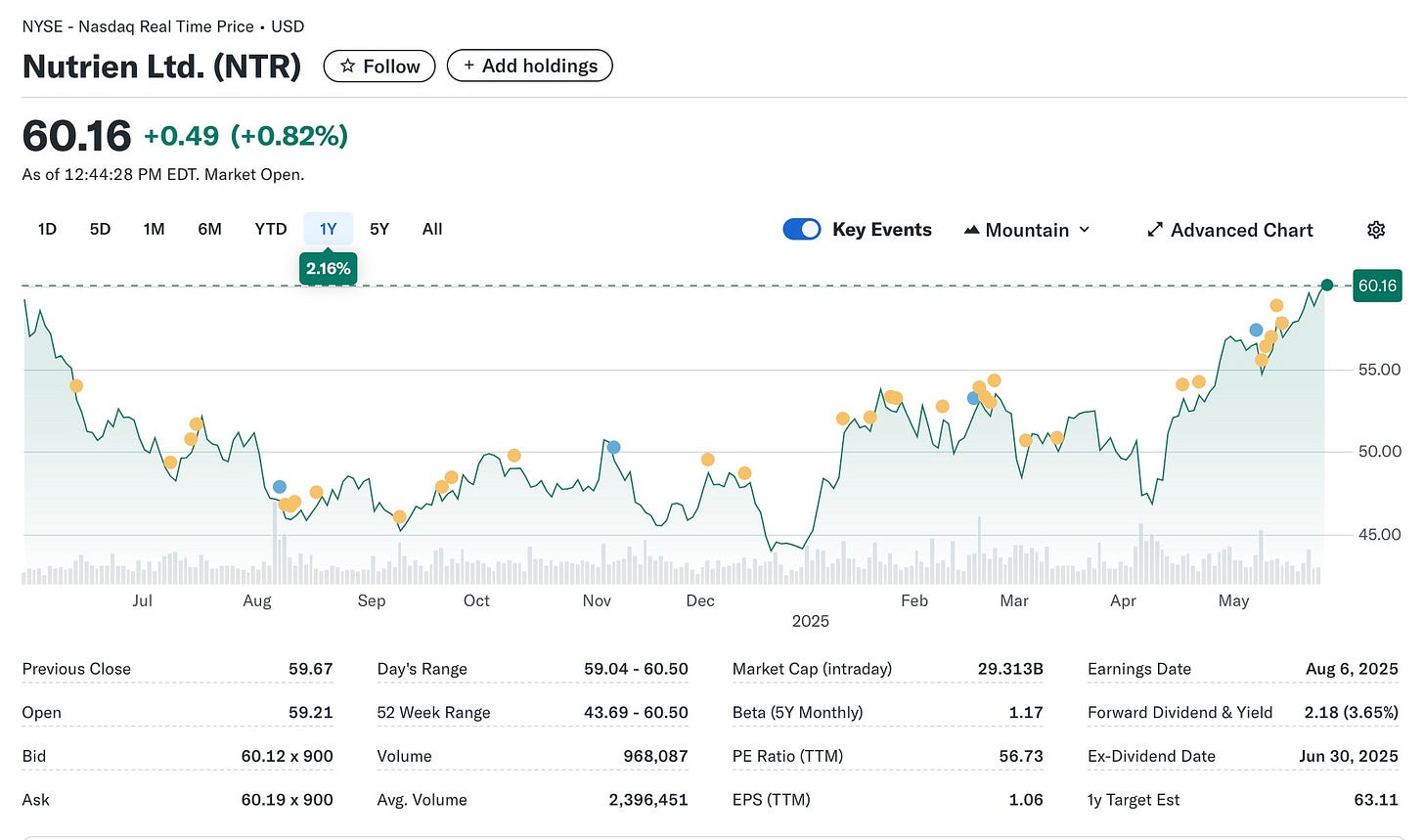

I should have lowered my trailing stop on the Yen, but I did not. Honesty works, and I’m not always right on smaller trading positions, but that leads to opportunity. I still think the Yen is heading to 125, so I added a few more short contracts as the Yen ran.

Cheap Rules

Just a bit of advice for all of you who like my overall thoughts. It seems to me that the cheaper the price of the stock, the quicker it moves. It happens. Get used to it.

It’s New Zealand Time

Rates headed lower. Is this the start of a worldwide trend? That’s what has happened in the past. Come on, history, do your thing. Rate reduction of 1/4 point. Hey Jerome, are you watching? Time to come down, eh?

Spinning Wheel is a good one. Blood, Sweat & Tears had it right years ago. Things do change over time, but history repeats itself. Trump is brilliant. Consumer confidence is on fire. It’s going to be interesting to watch as trade deals come together and he is able to raise more money for internal investment. He has a battle brewing on his ‘big beautiful bill’ between the Senate and the House, but everyone wants lower taxes, eh?