In perhaps one of the greatest speeches ever, Robert F. Kennedy, Jr. not only set the record straight, but he smashed it into pieces over the heads of the Democratic Party. I'm afraid I have to disagree with him on many issues, but he clarified his positions.

Kennedy spoke openly and honestly regarding the actions of the Democratic Party. In his address, supporting Trump was a critical portion, but more so, just being able to raise the inequities he faced should be enough for all voters to see. I’m not sure if all he said will sway those dedicated to voting for the Harris-Walz ticket to change. I do believe those with an open viewpoint will find it difficult to support Democrats.

There remains time before all of the votes will be made and counted. What happened this week will influence the outcome of the results. It is going to be an interesting two months.

Watch The U.S. Dollar

What goes up must come down, right? I have a pretty good idea about how currencies react to macroeconomic and geopolitical events. The U.S. Dollar can go up or down in times like these but before discussing where I stand and my related positions, let’s dig a bit deeper into the world of the U.S. Dollar.

The U.S. Dollar can decline in value due to a variety of factors. Here are some of the main causes:

Interest Rates

Federal Reserve Policies: If the Federal Reserve (“Fed”) lowers interest rates, the dollar may weaken because lower rates make the U.S. less attractive to investors seeking higher returns.

Interest Rate Differentials: If other countries raise their interest rates while the U.S. maintains or lowers theirs, capital may flow out of the U.S., weakening the dollar.

Economic Data

Weak Economic Indicators: Poor economic data, such as weak GDP growth, high unemployment, or declining consumer confidence, can lead to a decline in the dollar as it signals a weakening economy.

Inflation: High inflation can erode the purchasing power of the dollar, leading to its decline. If inflation in the U.S. rises faster than in other countries, it can make the dollar less attractive.

Trade Deficits

A large and persistent trade deficit means that the U.S. imports more than it exports. This can lead to a decline in the dollar because more dollars are being sold to buy foreign goods, increasing the supply of dollars on the global market.

Political Uncertainty

Political instability, uncertainty regarding government policies, concerns about fiscal responsibility, and rising national debt, can decrease confidence in the dollar, causing it to weaken.

Global Economic Conditions

Economic Growth in Other Countries: If other economies, especially those of major trading partners, grow stronger, their currencies might appreciate relative to the dollar.

Safe Haven Flows: In times of global financial uncertainty, investors may flock to other safe-haven currencies, such as the Swiss Franc or Japanese Yen, leading to a decrease in demand for the dollar.

Foreign Exchange Interventions

Central banks and governments might intervene in the foreign exchange markets to influence the value of their currencies. If foreign governments or their central banks sell U.S. dollars, this can lead to a decline in the dollar's value.

Market Sentiment

Speculative Activity: Traders’ & investors' perceptions and actions significantly influence the dollar's value. If the market sentiment turns negative towards the dollar, it can lead to a sell-off, weakening the currency.

Geopolitical Events: Events such as wars, sanctions, or trade disputes can cause uncertainty or instability, negatively affecting the dollar.

Dollar Supply

If the supply of U.S. dollars increases significantly, perhaps through extensive quantitative easing or other monetary policies, this can lead to a decline in its value due to simple supply and demand dynamics.

The U.S. dollar can increase in value, or appreciate, due to several key factors. Here are some of the main causes:

Interest Rates

Federal Reserve Policies: When the Federal Reserve (“Fed”) raises interest rates, the U.S. dollar often strengthens. Higher interest rates attract foreign investors seeking better returns on investments in U.S. assets, increasing demand for the dollar.

Interest Rate Differentials: If U.S. interest rates are higher than those in other countries, it creates an incentive for investors to move capital into U.S. assets, leading to an appreciation of the dollar.

Economic Performance

Strong Economic Data: Positive economic indicators, such as robust GDP growth, low unemployment, and strong consumer spending, can boost investor confidence in the U.S. economy. This can lead to increased demand for the dollar as investors seek to invest in a strong economy.

Low Inflation: If inflation is low in the U.S., the purchasing power of the dollar remains stable, making it more attractive to investors and causing it to appreciate.

Global Demand Safe-Haven Assets

Economic Uncertainty: In times of global economic uncertainty or financial crises, investors often flock to the U.S. dollar as a safe-haven asset. The dollar is seen as a stable and reliable store of value, leading to increased demand and a stronger dollar.

Geopolitical Stability: The U.S. is often perceived as a stable political and economic environment, which can make the dollar more attractive during times of geopolitical turmoil.

Trade Balance

Trade Surpluses: If the U.S. exports more than it imports, it creates demand for the dollar because foreign buyers need to purchase dollars to pay for U.S. goods and services. This demand can lead to a stronger dollar.

Capital Inflows: Large inflows of foreign investment into U.S. assets, such as stocks, bonds, or real estate, increase the demand for dollars, contributing to its appreciation.

Monetary Policy

Quantitative Tightening: If the Federal Reserve reduces money supply through quantitative tightening or other monetary policy measures, the reduced supply of dollars can lead to an increase in its value.

Central Bank Actions Abroad: If foreign central banks expand monetary policies, lowering interest rates or engaging in quantitative easing, their currencies might weaken relative to the dollar, contributing to its appreciation.

Market Sentiment

Investor Confidence: Positive market sentiment towards the U.S. economy, government policies, or the financial markets can lead to increased demand for the dollar. Investors may view the U.S. as a favorable destination for their capital, driving up the value of the dollar.

Speculative Activity: Currency traders may buy dollars in anticipation of future appreciation, further increasing demand and driving up the value.

Global Liquidity Preferences

Demand for Dollar-Denominated Assets: Global preference for holding reserves in U.S. dollars, especially by central banks and financial institutions, can lead to consistent demand for the currency, supporting its value.

Use as a Global Currency: The U.S. dollar’s role as the world’s primary reserve currency and its widespread use in global trade and finance means that there is a constant and high demand for dollars, which can contribute to its appreciation.

Political Stability

Stable Government and Policies: The perception of a stable U.S. government and predictable economic policies can increase investor confidence, attracting foreign investment and supporting a stronger dollar.

In summary, the U.S. dollar can increase or decrease in value due to factors like higher interest rates, economic performance, demand for safe-haven assets, trade balances, monetary policy decisions, market sentiment, and the global demand for dollar-based assets.

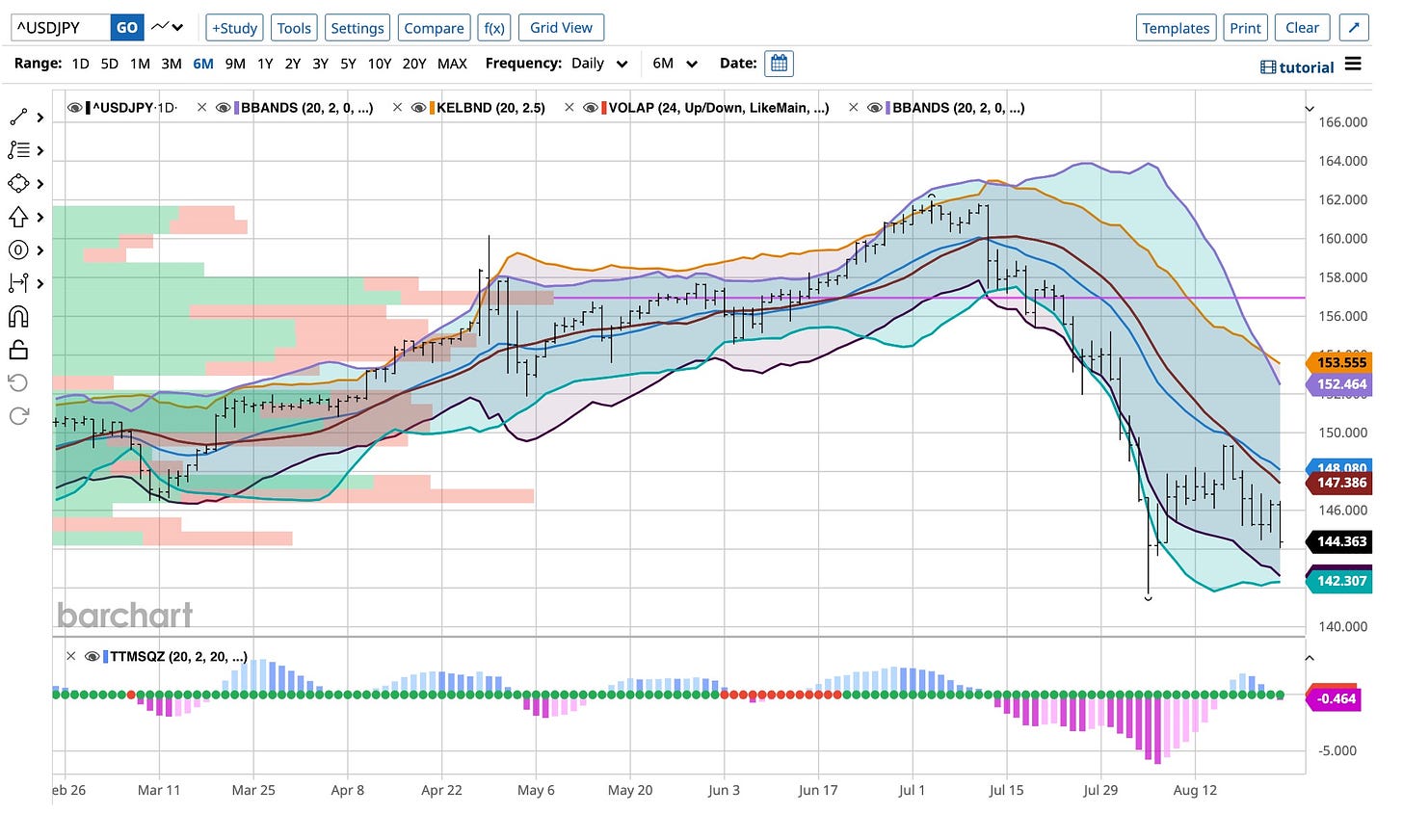

Currently, I am short the U.S. Dollar and long the Japanese Yen. Interest rates are on the downside in the U.S. and European continent. Japan is now raising its rates and the “carry trade” is dead. It‘s been a great trade and one I’ll continue to add on any dollar strength.

Tariffs Matter

I do not talk much when uncertainty rules and we do not have much certainty today. I’m also more of a teacher than not so giving you an understanding, a definition and better knowledge of what things are is more of my liking.

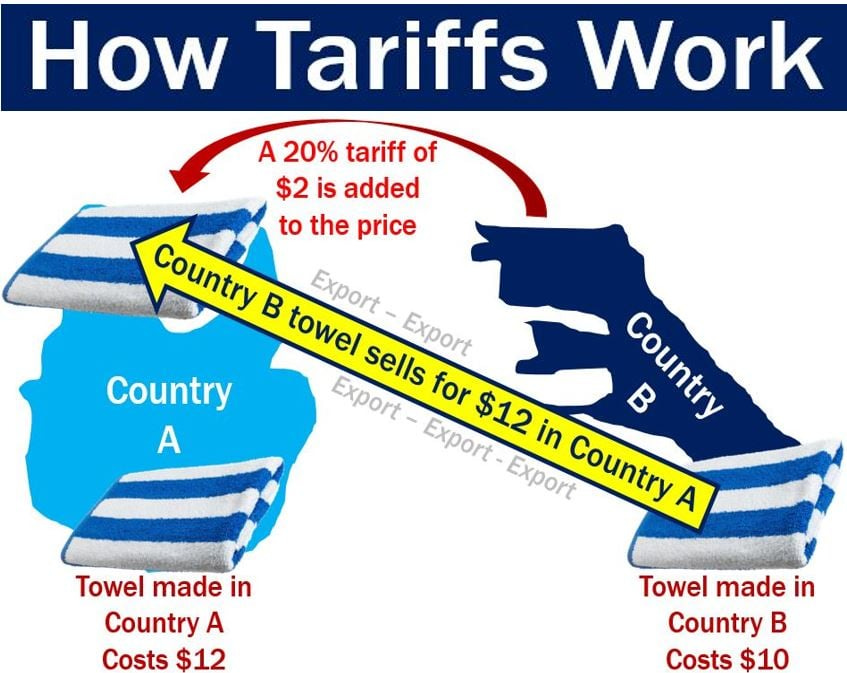

An “import tariff” is a tax or duty imposed by a government on goods and services imported into a country. The primary purposes of an import tariff are to:

Protect Domestic Industries: By making imported goods more expensive, tariffs can encourage consumers to buy domestic products, thereby protecting local industries from foreign competition.

Generate Revenue: Tariffs can be a source of income for the government.

Control Trade Balance: Tariffs can be used to influence the trade balance by reducing imports, which can help reduce a trade deficit.

Import tariffs are usually calculated as a percentage of the value of the imported goods, but they can also be a fixed amount per unit of the goods imported.

Tariffs on foreign country imports have different effects depending on the strength or weakness of the U.S. dollar. Here's how a weaker U.S. dollar interacts with tariffs:

Effectiveness of Tariffs With Weaker Dollar

Import Costs: When the U.S. dollar is weak, imported goods become more expensive even without tariffs. Tariffs, which are essentially taxes on imports, further increase the cost of these goods. Therefore, tariffs can be more effective in reducing the quantity of imports because the overall price increase (due to both the weak dollar and the tariff) might discourage consumers and businesses from buying foreign goods.

Reduced Foreign Competition: Higher import prices due to tariffs combined with a weaker dollar can make domestically produced goods relatively cheaper and more competitive. This could help domestic industries by reducing foreign competition in the U.S. market.

Impact on Consumers

Higher Prices: The combination of a weaker dollar and tariffs makes imported goods significantly more expensive, which can lead to higher costs for consumers. This reduces the purchasing power of consumers and could lead to inflationary pressures if domestic substitutes are not available or are also expensive.

Limited Choices: Tariffs make foreign goods more expensive and potentially less available. Consumers might face limited choices or have to pay more for certain products.

Impact on Trade Balance

Potential Improvement in Trade Balance: Theoretically, higher tariffs and a weaker dollar could improve the trade balance by reducing imports (due to higher costs) and encouraging exports (as U.S. goods become cheaper for foreign buyers). However, this depends on the elasticity of demand for imports and exports.

Foreign Relations & Retaliation

Risk of Retaliation: Other countries might retaliate with their own tariffs on U.S. exports, which could offset any potential gains from a weaker dollar. This could lead to a trade war, which might harm the global economy and U.S. businesses that rely on exports.

Business Impact

Increased Costs for Import-Dependent Industries: U.S. businesses that rely on imported materials or components might face higher costs, which could reduce their profitability or force them to raise prices, potentially reducing their competitiveness.

In summary, tariffs on foreign country imports can be more effective in protecting domestic industries and reducing imports when the U.S. dollar is weaker because the cost of imports is already higher. However, this can also lead to higher prices for consumers, potential inflation, and strained trade relations. The overall effectiveness of tariffs in such a scenario depends on the specific economic context, including the elasticity of demand for imports and the availability of domestic substitutes.

When the U.S. dollar is stronger, tariffs on foreign country imports interact differently compared to when the dollar is weaker. Here’s how a stronger U.S. dollar impacts the effectiveness of tariffs:

Effectiveness of Tariffs with Stronger Dollar

Import Costs: A stronger U.S. dollar makes imported goods cheaper because it takes fewer dollars to buy foreign currencies. However, when tariffs are applied, they increase the cost of these imports. The effect of tariffs may be less pronounced with a strong dollar because the initial cost of imports is lower, potentially offsetting some of the impact of the tariff.

Less Impact on Reducing Imports: Since a stronger dollar reduces the baseline cost of imports, the price increase caused by tariffs might be less significant. This means that consumers and businesses may still find it economical to purchase foreign goods, even with tariffs in place. As a result, tariffs may be less effective in reducing the volume of imports.

Consumer Impact

Moderated Price Increases: With a stronger dollar, the price increase due to tariffs might be less noticeable to consumers. While tariffs still raise the cost of foreign goods, the strong dollar can partially counterbalance this, resulting in smaller overall price hikes. This can lessen the negative impact on consumers’ purchasing power compared to a weaker dollar scenario.

Broader Access to Foreign Goods: A stronger dollar and relatively lower import costs, even after tariffs, can mean consumers have broader access to foreign goods at competitive prices, which might limit the intended protective effects of tariffs on domestic industries.

Trade Balance Impact

Potential Worsening of Trade Balance: A stronger dollar makes U.S. exports more expensive for foreign buyers, potentially reducing export demand. Simultaneously, cheaper imports, even with tariffs, could lead to an increase in the trade deficit, as consumers may still prefer the lower-cost imported goods.

Domestic Business Impact

Less Protection for Domestic Producers: With a strong dollar, tariffs may provide less protection to domestic producers because the price advantage of foreign goods (due to the strong dollar) might still make them competitive despite the tariff. This could limit the effectiveness of tariffs in promoting domestic industry growth.

Foreign Relations & Retaliation

Risk of Trade Imbalances: A strong dollar combined with tariffs could exacerbate trade imbalances, leading to tensions with trading partners. If other countries feel that the U.S. is unfairly advantaged by its currency and protectionist measures, they might retaliate with their own tariffs, leading to a trade war.

Inflation Impact

Lower Inflationary Pressure: The stronger dollar reduces the cost of imports, which can help keep inflation in check. Even with tariffs, the overall cost increase might be smaller, leading to lower inflationary pressure compared to a weaker dollar scenario.

In summary, tariffs on foreign country imports are less effective with a stronger U.S. dollar. The strong dollar makes imports cheaper, which can offset some of the price increases caused by tariffs, reducing their impact on import volumes and domestic industry protection. While consumers might benefit from more stable prices, the intended goals of tariffs, such as reducing imports or protecting domestic industries, might be harder to achieve in this context.

So, what does this all mean to the upcoming elections? It means a lot, but more so, it means that little, if anything, is going to change in the short term if Trump is elected. It seems to me that “inflation” is here to stay. The only action that will bring prices down is to “drill baby drill.” As we get closer to election day and both party policies are better defined I’ll chime in. For now, I’ll just give you the options that may arise. Use them wisely and stay tuned.

Robert F. Kennedy, Jr. gave one hell of a speech on Friday. When his uncle gave his inaugural address more than sixty years ago, he asked a question. What can you do for your country? Well, what can you do? I know I am going to vote, and I’m going to go out in my community and make sure others do as well. I’ve heard enough to make my choice but I still respect others who are undecided. My country has done a great deal for me. Like teaching from my years of knowledge, it’s time for me to give back. How about you?