I’ve lived a long time in this industry and if there is one thing I’ve learned it’s to look for the unexpected. Face it folks, it happens which is why long-term investors, traders and hedgers like me do well. In between the rallies and the crashes trend followers are the “kings” but when that trend changes most of them just turn into “jokers”.

The markets, stocks, bonds, gold, currency and more have been very good to me. The S&P is up about 7% from it’s late 2021 high. I’m up a lot more. I did participate in the market downside but turning to higher dividend paying stocks, turn around specials and a few AI gems helped and most are still in the portfolio. How about you?

As I review all of the signals out there, especially the ones that dictated the “crash” some of you were alive for, it appears to me that the Dot-Com bubble is alive living in the AI world. Maybe I’m right and maybe I’m wrong. Either way I’m a winner as I’m hedged and with new highs being hit it’s a good idea to be hedged.

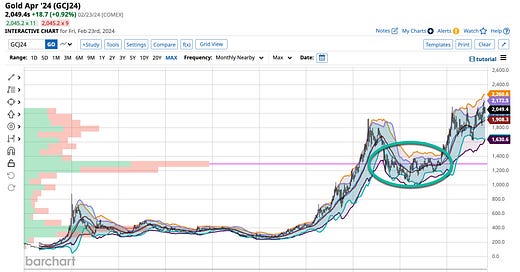

I read a lot. Good analysts write a lot. Most think we’re on the edge of a major move downward. I tend to agree as seasonally, it’s time but in reality no one ever knows. I’ve taken the time to “rebalance” my portfolio but for me that’s a daily exercise. I’m still a gold, bond and Yen holder and that’s not going to change. While it is kind of a hedge I see it as something that is inevitable. At some point “interest rates” are going to come down and when they do I’ll reap the rewards. We’ll have a “down home” party here in Texas when it happens. Y’all are invited.

For Now I’ll Just Teach

Hallelujah brothers and sisters, chances are The Ticker EDU and related courses are going to hit the airwaves this week. I’m due to receive a printed copy of my infamous book, “The Ticker’s Bible” on Tuesday but there’s more. Today I’m just going to post a tidbit about my rules to wet your whistle. When it is all ready to take flight I’ll let you all know. Until then here’s a “reviewed” excerpt about my rules. Thanks for waiting.

The Ticker’s Rules

Question: What Rules Are The Most Important to Follow?

Answer: Everyone needs rules no matter what they do. Making rules is important. Following your rules is more important. With respect to our providing educational knowledge drilling our rules into that “space between your ears” several times is the best way to go. Consider the following as being the ones necessary for you to become the “best damn investor or trader” you can possibly be.

Make a solid plan and learn the basics of investing and trading before you start. If not, you’ll fall into the category of just being “lucky” and it doesn’t last. Chances are blowing yourself out of the “water” more quickly than not will. Remember, it’s best to begin practicing using a “paper” account. Follow your plan. Think about it; you’ll be making your first plan. I hope you’re not just doing that for fun. You are creating your plan for you; use it. If you are putting it together as just an exercise do something else. Investing or trading is an important, life changing decision so in short, don’t screw it up.

Choose your trading style. I’m a position trader but I’ll always jump on a solid day, swing or scalp trade. Choosing a trading style helps you build your plan; it doesn’t preclude you from trading other styles. Understand your “risk and reward” status, what you can afford to lose before taking chances. Do not overtrade. Trade within your boundaries; wait for opportunities to arise, those that you plan for, the ones that find you.

Cut your losses short. There will be many more opportunities. Let your profits run but remember that greed kills; bulls make money, bears make money and pigs get slaughtered. People too often look for the “big one”. Take a small piece from every transaction knowing you can always identify the next one. Do not stay too long in a good trade. This is for all you day traders. Your plan dictates a “desire” like the hamburger chain, “In & Out”. Follow your plan; if it’s not working reevaluate it and reassess what type of investor or trader you are especially if you’re not profitable. Making changes is a normal everyday occurrence.

Not having a position is a position. Adding a third moniker to the list of positions I use, “long”, “short” and “flat” works. Being out of the market is a position. It’s very good to sit on the sidelines from time to time. Just watching and listening to what’s happening worldwide is a job in and of itself. Learn from your losses and mistakes. Do not define the word “idiot” in its primary form by doing the exact same thing over-and-over again expecting a different result.

That’s it for now. I still have a couple sections to record for Udemy. When done we’ll have ten (10) sections and more are on the way. Through what we call the Education Horizon five (5) sections are done and five (5) more are in progress. Education Horizon offers a lot more but again, I’ll tell you more when it is all available. Until then, keep an eye or ear on the market as when you least expect it, something happens.

Hey, y’all, maybe I’ve been living in Texas a little too long but there’s no place I would rather be than here. Music is pretty good down here. There’s a bend towards rock and roll with a country style then there is straight out country. They are both good and a few of them actually come with messages. Tracy Lawrence and his “Lessons Learned” video are right up my alley. All he is doing is singing about his life. All we are about to do is to teach you what we’ve learned in life. Gather ‘round y’all and take a look. From where I’m sitting it’s pretty good. Best always and thanks for giving me the time.