From a trip to the grocery store, to a quick bite at Jersey Mike’s, from just picking up potting soil at Home Depot to sitting by the pool, listening to what people have to say is enlightening. I have a tendency to get the attention of others wearing my favorite T-shirt “Make Orwell’s 1984 Fiction Again” but in the past it was mostly “where did you get that remarks”. Over the last couple of days there’s been more critical commentary on everything from transgenderism to the heat down here in Texas, from the price of watermelon being 50% higher than last year to disgust over Hunter Biden’s deal. One person even remarked about how much it cost him to get his boots resoled; now down here in Texas you know that’s a problem. Well at least not everyone was talking about COVID; thinking back when that’s all people were talking about the markets soared. Maybe we should bring it back, eh?

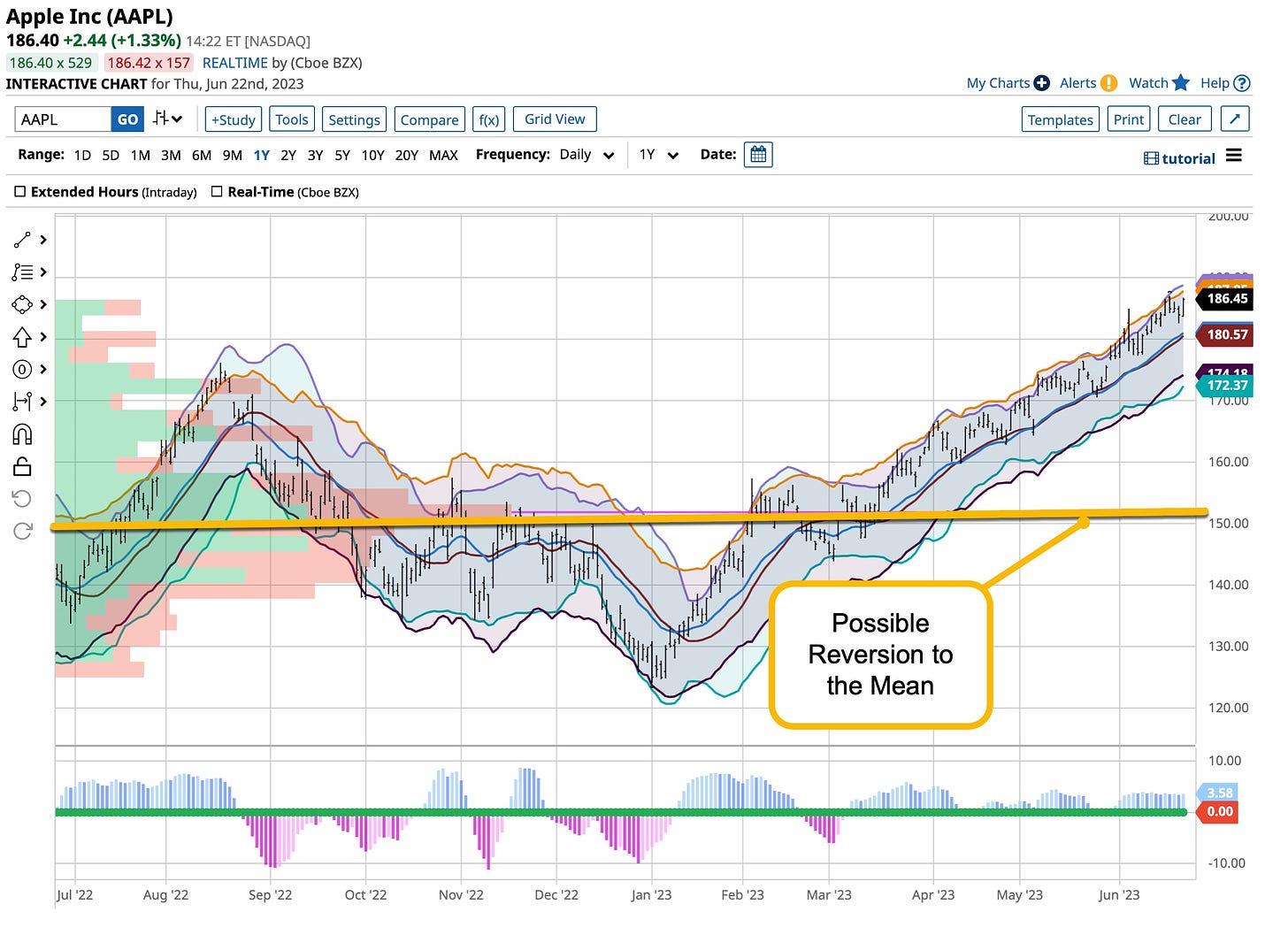

Reading wise, some of the best diametrically opposed and opinionated materials I’ve ever read are hitting the threads. I read a lot and do my best to sort through several of the same sites you do. It’s summer and the vacation season is upon us. Usually people I follow are either at their beach house or traversing the globe with family. However this year they seem to be hunkered down defending everything from why Powell will not be successful lowering unemployment just raising rates to wondering what’s next in the geoeconomic world. Most are consistent in their opinions but I’m beginning to see a shift. Growth oriented writers, you know the ones that more often than not hook themselves to future “moon shots” are discussing “value” stocks, one even mentioning Nutrien as being her top choice. She must have read one of my recent posts I noticed a perennial bull say “the top is in” on Apple. While I agree, reading it in an article from him was surprising. Is it “game changing”, perhaps, perhaps not. I’m seeing evidence in Apple’s chart that this could be the case.

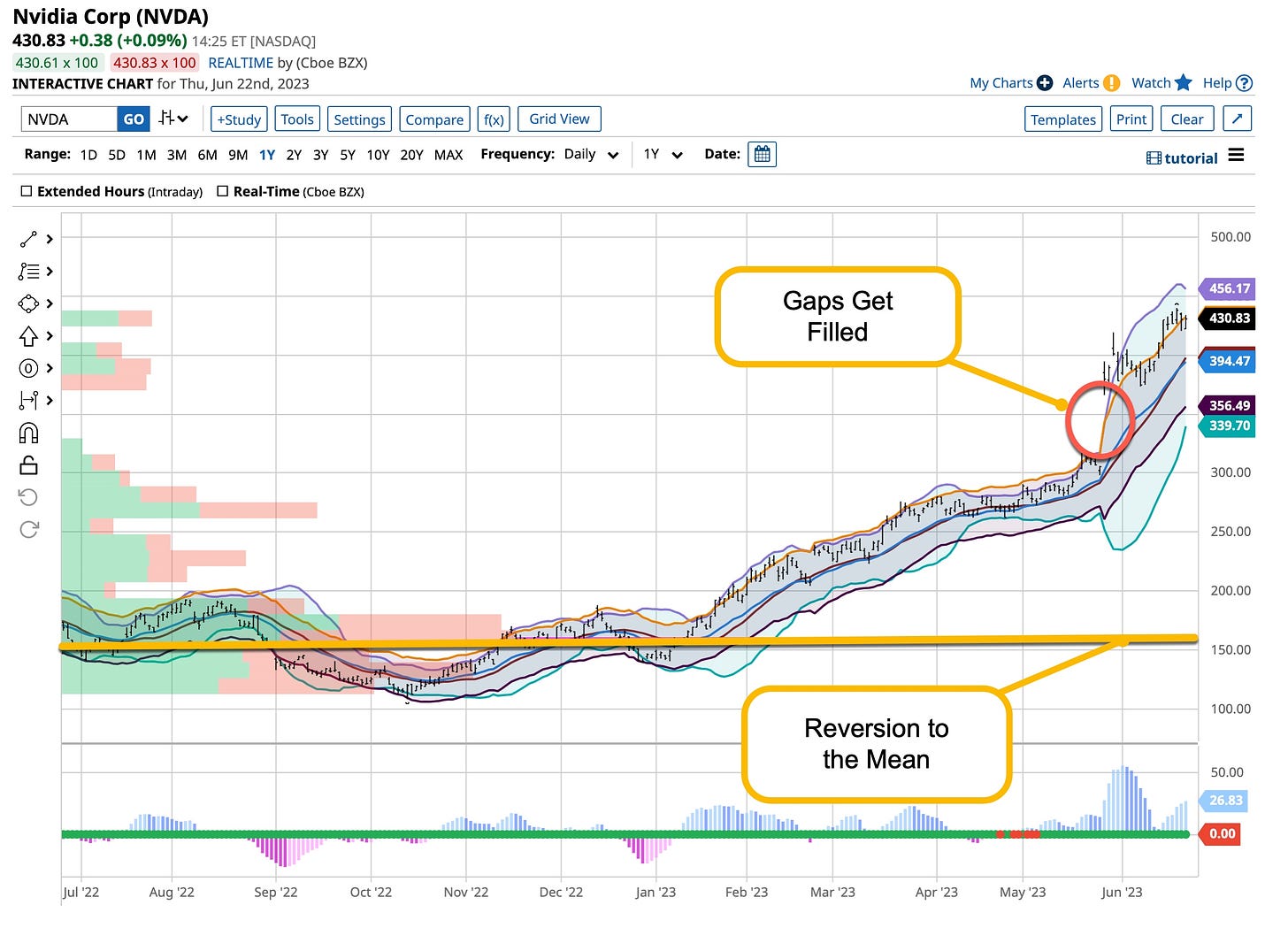

Some writers are talking about the need for Nvidia to “close the gap” from its recent run but in the same article speak of the changing dynamic of AI. I’ve been a member of NVDA’s beta program for more than a year, primarily in their audio / visual side of development. We’re working on combinations that would permit the written word to turn itself into a video presentation. That’s game changing and should be taken into consideration but other entities, many of which are private, are doing the same thing.

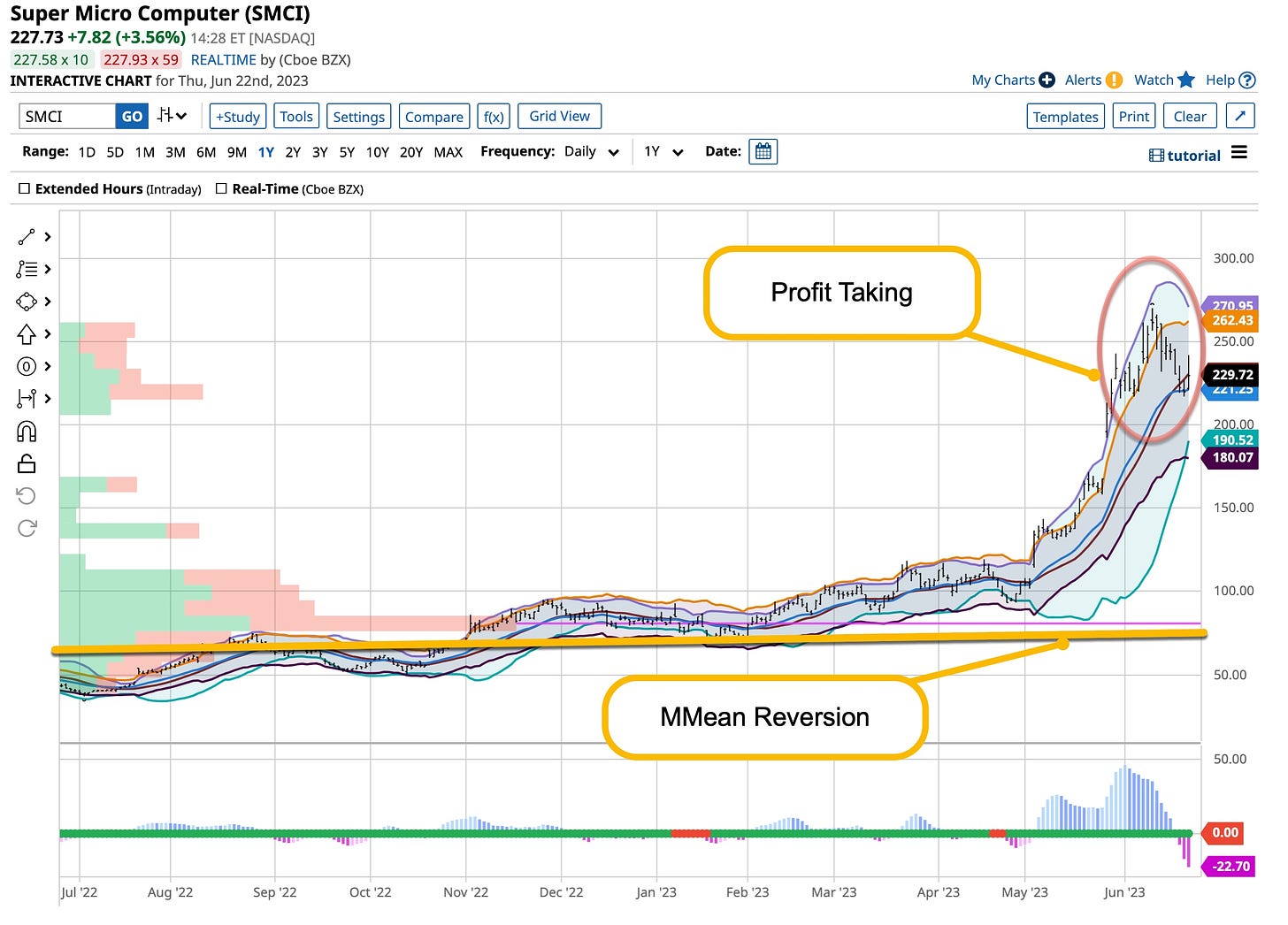

As far as Super Micro Computer, together with simply rebalancing my portfolio, along with realizing that “greed” kills I significantly reduced my exposure and took profits on what ended up being a 4X bagger. I would rather be lucky than good; the harder I work the luckier I get prevailed once again; thanks “lady luck”.

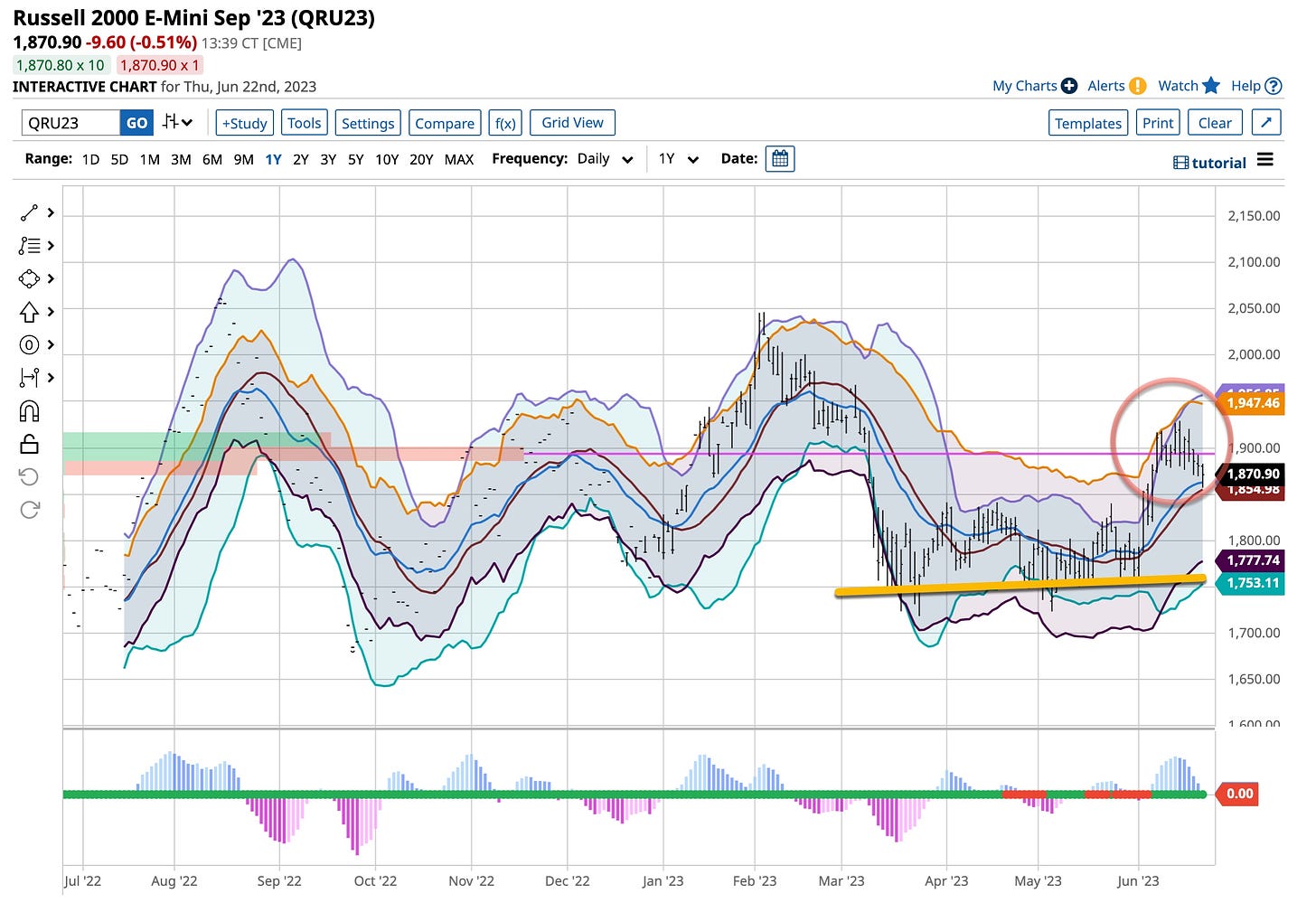

Nonetheless the content of what I’m reading today is changing. Maybe it’s just that it’s summer, maybe not. The market topping in late 2021 is still on people’s mind and many believe it’s happening again. I do and have acted acted accordingly recently with the purchase of longer term VIX 20 calls and shorting the September Russell 2000. So far so good. I’m not always right but I’m consistent. I’m long the Yen again versus the Dollar again; maybe “4” is a charm.

I’m still a “bear”, a big one and I see problems that simply cannot be fixed with just rate increases. I go grocery shopping at several different stores weekly. Inflation is embedded. First hand observations are the best research. Give it a try.

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

The Who was ahead of its time. “Tommy Can You Hear Me” pretty much sums up my message of today. You have two ears and two eyes. Keep your “one mouth” shut and use your ears and eyes; observe then speak. As Dad used to say, “better to keep mouth shut and let it be though you’re a fool than to open mouth and leave no doubt”.