This is a great country we live in. Face it folks, no one is perfect. With slavery, we all proved that statement true. My ancestors did not “legally” arrive in the United States until the early 1900s after they were “advised” to leave their homes in central Europe. They were the lucky ones. Nonetheless, those who grew up in the ragtime music era were a bit racist. While skin color differentiated many, in retrospect, talent separated the participants.

We were blessed in the 1960s. Skin color never made a difference to my generation. It is something that was simply accepted. Not everyone can speak this way. That’s their problem to a degree. In essence, however, it is our overall problem. It’s one we need to address every day. It makes today more special to me and it should for you as well.

History of Juneteenth

Juneteenth, also known as Freedom Day, Jubilee Day, Emancipation Day, and Black Independence Day, is a holiday commemorating the emancipation of enslaved African Americans in the United States. "Juneteenth" is a blend of "June" and "nineteenth," the date of its celebration.

Juneteenth marks the actual day, June 19, 1865, when Union General Gordon Granger arrived in Galveston, Texas. He announced General Order No. 3, proclaiming freedom for enslaved people in Texas. This came two and a half years after President Abraham Lincoln issued the Emancipation Proclamation on January 1, 1863.

Juneteenth symbolizes the end of slavery in the United States and is a day to honor African American history, culture, and contributions. It represents the struggle for freedom and the ongoing fight for civil rights and equality. Celebrations often include community gatherings, educational events, cultural festivals, parades, and historical reenactments.

Texas was the first state to recognize Juneteenth as a holiday in 1980. Since then, all other states and the District of Columbia have recognized Juneteenth in various ways. On June 17, 2021, President Joe Biden signed the Juneteenth National Independence Day Act into law, making Juneteenth a federal holiday. It serves as a reminder of the past injustices and the continued efforts needed to achieve true equality.

Juneteenth is a powerful symbol of freedom and resilience, reflecting the long and continuing journey toward equality and justice for African Americans. It is a day to celebrate progress, acknowledge struggles, and inspire future generations to continue the pursuit of civil rights.

Did You Watch The VIX

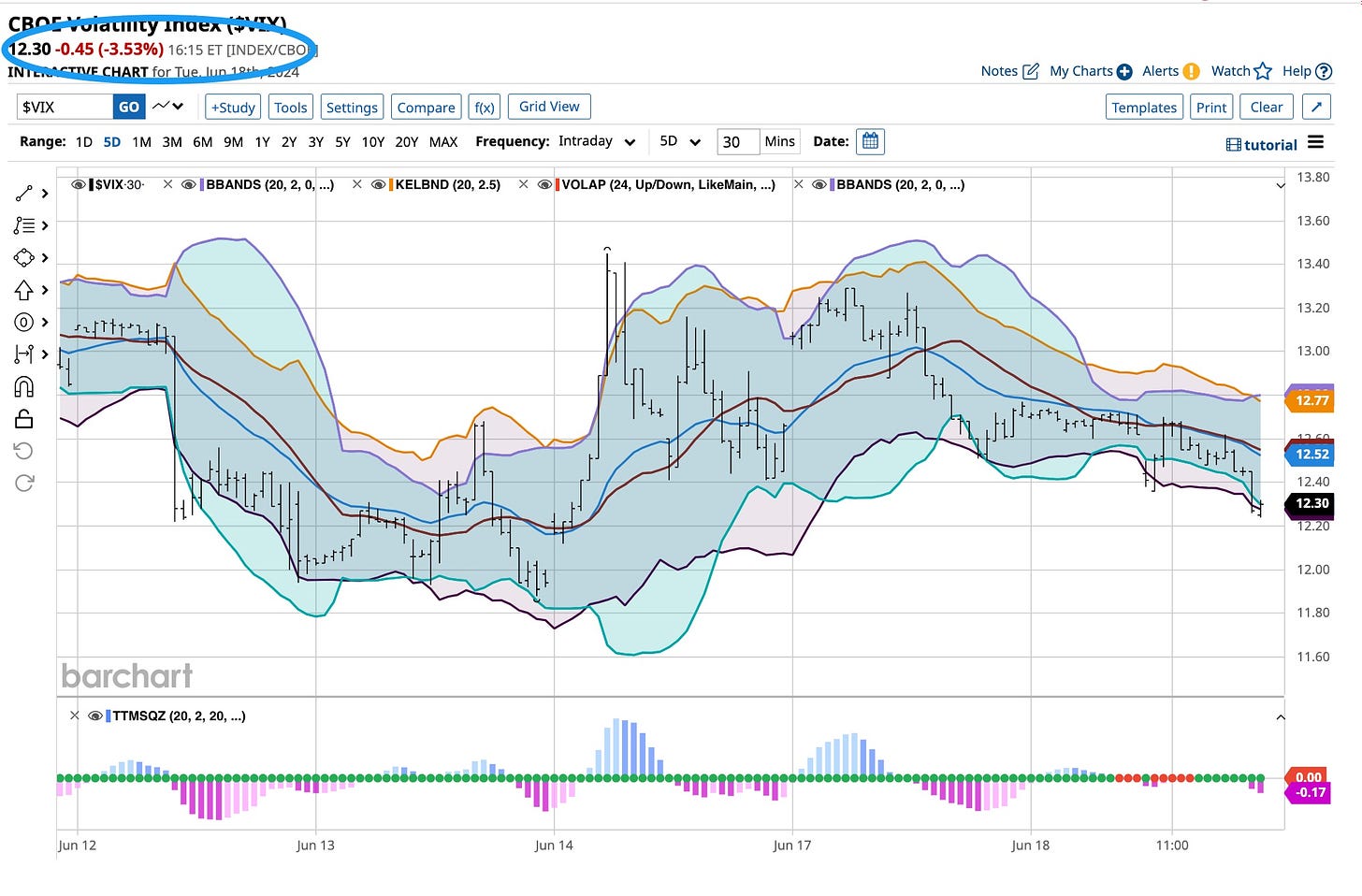

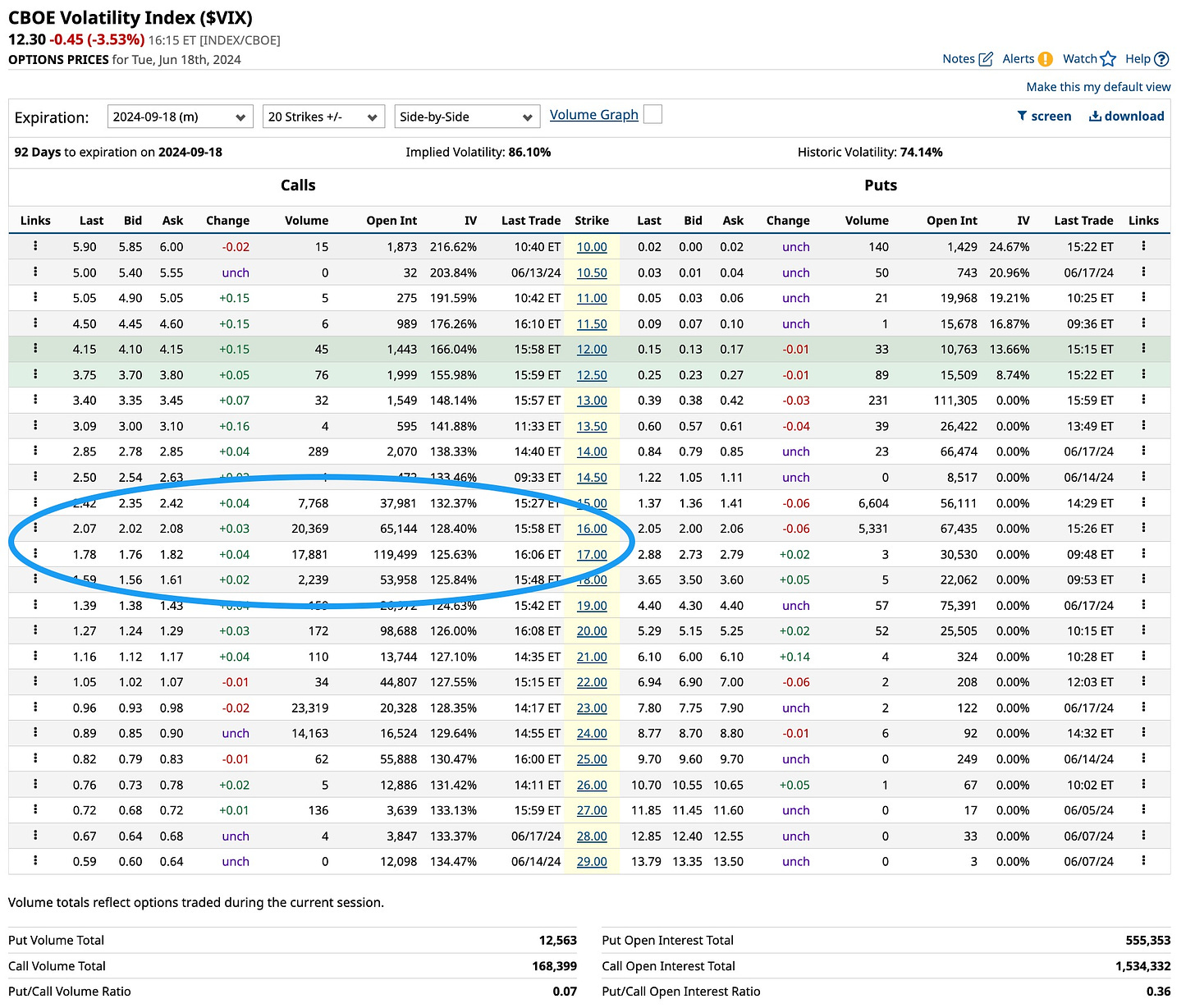

I’m a teacher. I’m also a person who loves to learn. It’s a boring week. Nonetheless, it’s still possible to learn something. Such was the case with the indices, the VIX, and the 2024 September 16 call options. The indices closed higher, the VIX closed lower but a higher close was noted for the 2024 September 16 call options. Go figure, right? Since I’ve watched and traded this arena for years, this activity does not surprise me.

What Else I’m Watching

Like Emily Litella, it’s always something, right? It is for certain. I have interest rates on my mind and you should too. It’s a political year. There’s no denying that. Recent economic reports suggest we’re witnessing a “slowdown”. The only thing thing that needs to slow down is the money supply. For some reason, although the powers that be suggest this is a period of quantitative tightening, the sheer amount of money in circulation worldwide continues to expand.

When that spigot is finally turned off, people will stop spending. Unfortunately, they will do it all at once. We know that’s not a good thing. Just look at housing prices. If there is one area of concern, it’s related to housing, rental payments, and the effect of higher interest rates on this segment. I do not see another 2008-style financial crisis but I am worried, especially because this is a political year and the administration in power wants to stay in power. I expect some type of stimulus that puts money into the hands of the most vulnerable. Keep your eyes open. Otherwise, it’s time to lower rates.

I own lots of bonds, notes, and bills across the board, all paying over 5%. That’s a good thing, especially if interest rates come down and that’s what I expect. A while back, I bought the 30-year bond future slightly below the 114 level. I still own every contract I acquired. It’s trading above 120 and I expect it to move to higher levels.

In addition, after months of sitting on my hands, I’m taking a long, hard look at one of my favorite indicators, the Russell 2000 Index. Years ago there was a bigger difference in these indices. The Russell 2000 was comprised of small capitalization firms but that has changed. Small has disappeared being replaced by high tech and regional banks. If rates are truly headed lower, the high-tech firms will refinance costly debt service and the regional banks might even make a few extra bucks on increased margins. Rates are headed lower so it’s time to start looking at taking a long position in the Russell 2000.

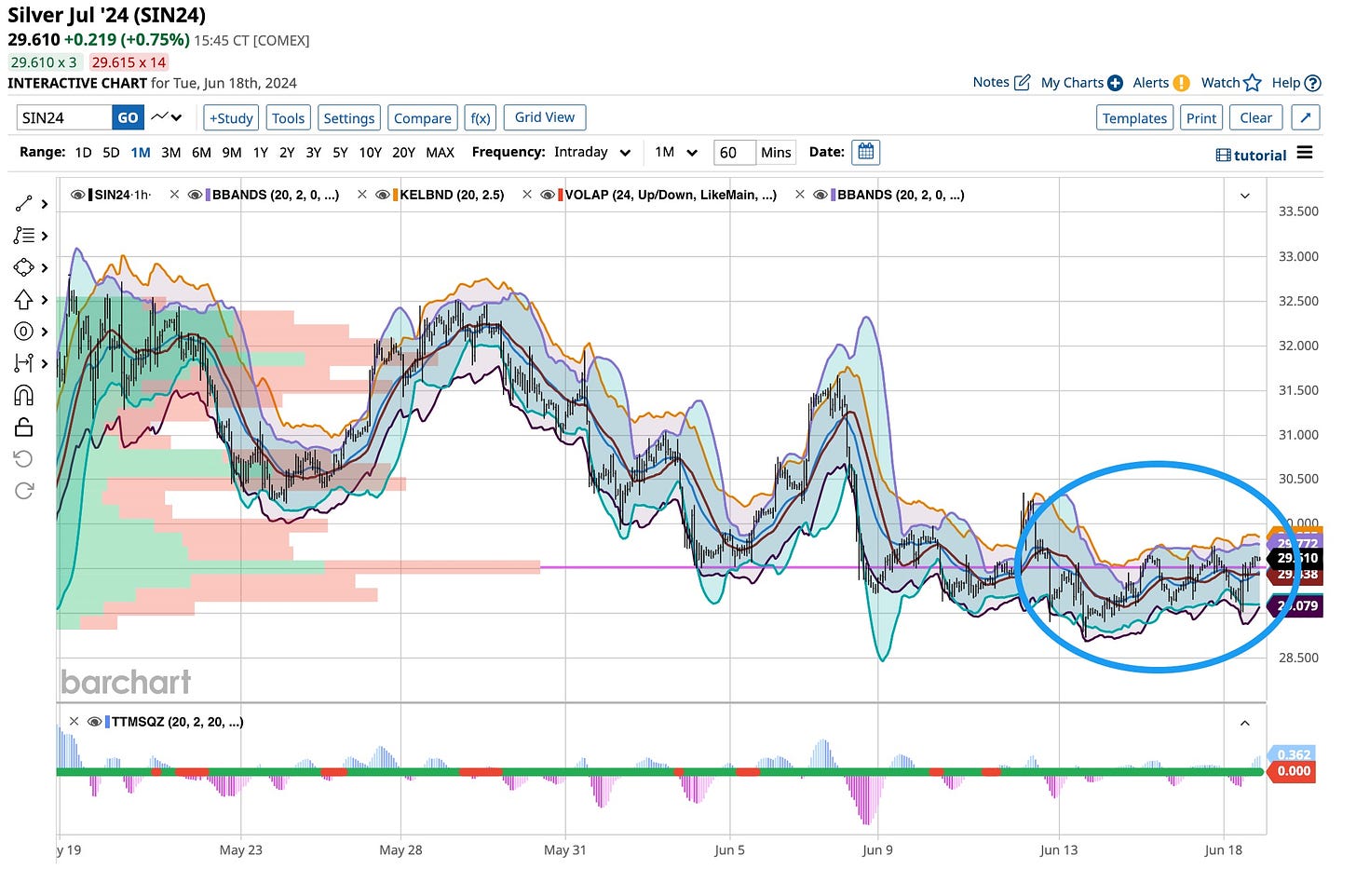

Don’t forget about the metals, in particular Silver and Copper. I made a small fortune in both this year. trailing stops got me out well above where they are trading now and that’s a good thing. I’ve been sitting on a lot of cash and it needs to find a home. Many people, some quite biased, believe this rising tide will float some inefficient miners. I think they are wrong but these two metals, for supply and demand reasons, will head a bit higher.

A day off you say. Sorry folks, not me and not for most of the people I tutor regularly. There is always something to learn and I hope to lead you to “greener” pastures. As always, thanks for joining us at The Ticker during our $99 introduction. It’s a step I require you to take before becoming a “1-on-1” tutorial customer. I want you to fully understand what is meant by learning the “right way” first. Once you pick that up you are more than welcome to learn more “1-on-1”. Thanks always and enjoy your holiday.

Gilda Radner was perhaps the greatest talent we ever knew from SNL. Taken from us far too soon, her memorable renditions live on today through YouTube. Like Gilda, it seems to me that you never know what opportunities the markets will bestow upon you. Remember, let these opportunities find you, don’t go looking for them. Stay far away from FOMO as the “fear of missing out” is a tool of the “herd” and they usually are wrong. Buy when they sell and sell when they buy. If you give us the opportunity you’ll learn the “right way”. It’s priceless and it works. Best to all, always.