Having a percentage of your investible risk capital in Bitcoin makes sense. What is it? Does it act like a stock, a commodity, or a currency future? All things considered, that answer is yes for all, so what are you waiting for? Try a little. It can’t hurt.

Technically, A Golden Cross Is Good

The Bitcoin price has just printed a rare Golden Cross on the weekly chart. This is a technical signal that historically appears once every market cycle. This Golden Cross has previously preceded some of Bitcoin’s most explosive bull runs, and analysts are eyeing its return as a sign that the next bullish leg up could be near.

A Golden Cross occurs when a shorter-term Moving Average (“MA”), usually the 20-week MA, crosses above a longer-term one, like the 50-week MA. In the crypto world, this technical formation is perceived as a significantly bullish indicator, and that often leads to a long-term trend reversal or the start of a new uptrend.

Bitcoin price has just flashed a Golden Cross, one that has only been seen three times in the past decade. Each time Bitcoin has printed this Golden Cross, it has undergone a parabolic move upwards. Now, in 2025, five years after the previous Golden Cross appearance, Bitcoin has once again printed this powerful signal and could be on the verge of another historic rally. While the exact percentage price increase this time remains unknown, the consistency of the pattern has sparked the analyst’s prediction that Bitcoin may be gearing up for a powerful rally.

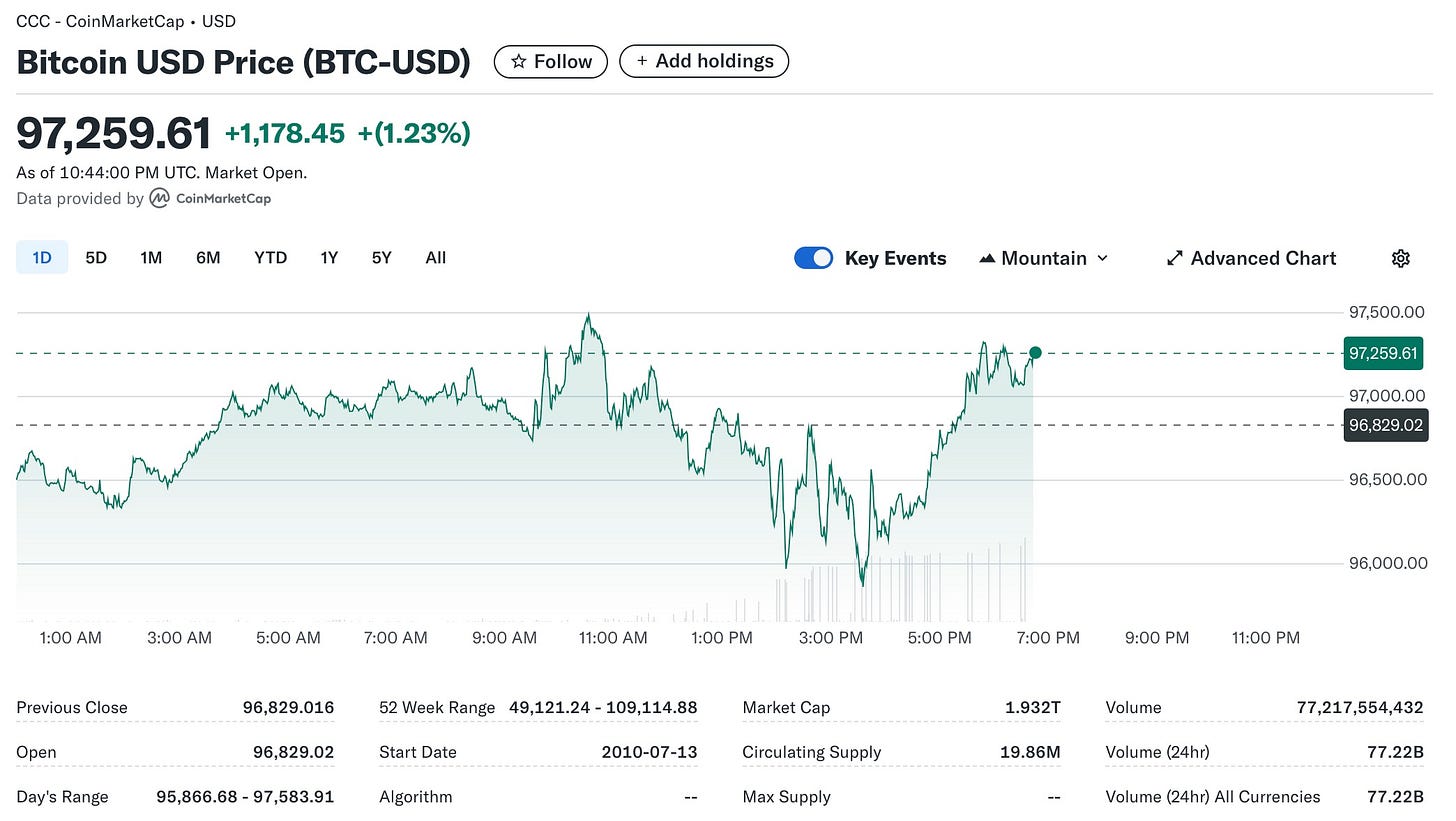

Bitcoin's rise above $90,000 is supported by reduced tariff concerns and growing buyer interest. A surge in Bitcoin-related investment inflows suggests potential price increases despite ongoing market uncertainty. As the tariff war begins to ease, buying interest has returned, helping Bitcoin rise above $90,000 per coin. Recent activity in Bitcoin options and ETF inflows suggests that strong price increases for Bitcoin are likely in the coming weeks. Just under $500 million has flowed into call options set to expire in late June, while over $3 billion has entered ETFs. These movements support the notion that buyers will maintain their advantage, especially if the tariff war does not escalate further and the Federal Reserve continues with planned rate cuts.

However, the biggest uncertainty remains with the tariff situation. Donald Trump has indicated he will reassess trade agreements and take further action. The marketplace remains uncertain, and this volatility is expected to persist for the next few months.

After successfully defending the long-term support around $74,000 per Bitcoin, I got a few more coins at $76,000. Demand is picking up. Buyers are testing the psychological barrier of $100,000, and it could pave the way for a move toward new record highs.

Damn, I sure am talking a lot. When there is something that notes a change, be it on the technical or fundamental side, and I see it, you’re going to hear about it. I like the energy markets, especially LNG. If you are following me, you know my picks and why. Same thing here, I’m long Bitcoin. How about you?