Finally, I have a little time on my hands. It’s been busy. Between managing a few Roth IRA accounts—there have been some changes—and writing AI responses, everyone uses time, which I’ve not had. Those who follow me on The Ticker generally know a bit sooner than others. It’s worth it, so take a look.

Employment Numbers Are Deceptive

Politics is also, but that goes without saying. Nonetheless, the current administration has been bragging, but like the guy running the government, you can see through all of them. When the majority of jobs being created are governmental hires, it is time to put on your crash helmet, as trouble is brewing. That’s what we’ve seen, and I am sure Jerome Powell has been watching.

Last week, the jobs report was abysmal. Manufacturing is basically dead, and it shows. When it comes down to it, what did you expect? The world is talking about how AI is going to revolutionize everything. Well, guess what? It has, but the ultimate overall victim will be jobs. You can’t have it both ways. If AI’s going to produce a wave where we all become more productive, essentially, you need fewer people to do the tasks at hand. Ask Intel, and they’ll tell you. They are significantly cutting back, and the trend is just getting started. We saw it months ago, and I trust you did as well. If you are one to take action when we give it, you are.

Rates Are Headed South

The questions are how much, how fast, and how soon. On a dime, those “allegedly” in the know are talking bigger and faster cuts than they were last month. What changed? Nothing really. The Federal Reserve is tasked with balancing inflation and jobs. They gave up on their 2% inflation target about a month ago. I’ve been a firm believer that without a substantial recession, it wasn’t going to happen. Right again, but now we’ve seen what can happen if the “herd” tops buying and companies start “firing” workers simultaneously. It ain’t pretty, and it’s reflected in the indices.

What’s Happening With Our Positions

A lot is happening, but since hindsight is “20 / 20,” the actions we suggested have been right on target. We’re shortening up the maturities of our debt position as short-term rates are going to fall faster than long-term rates. That’s not surprising. We have also been buyers of higher dividend-producing investments. That’s not rocket science, but when it comes down to it, we’re sticking with companies that can “pay their bills,” so we’re taking the risk out of the equation.

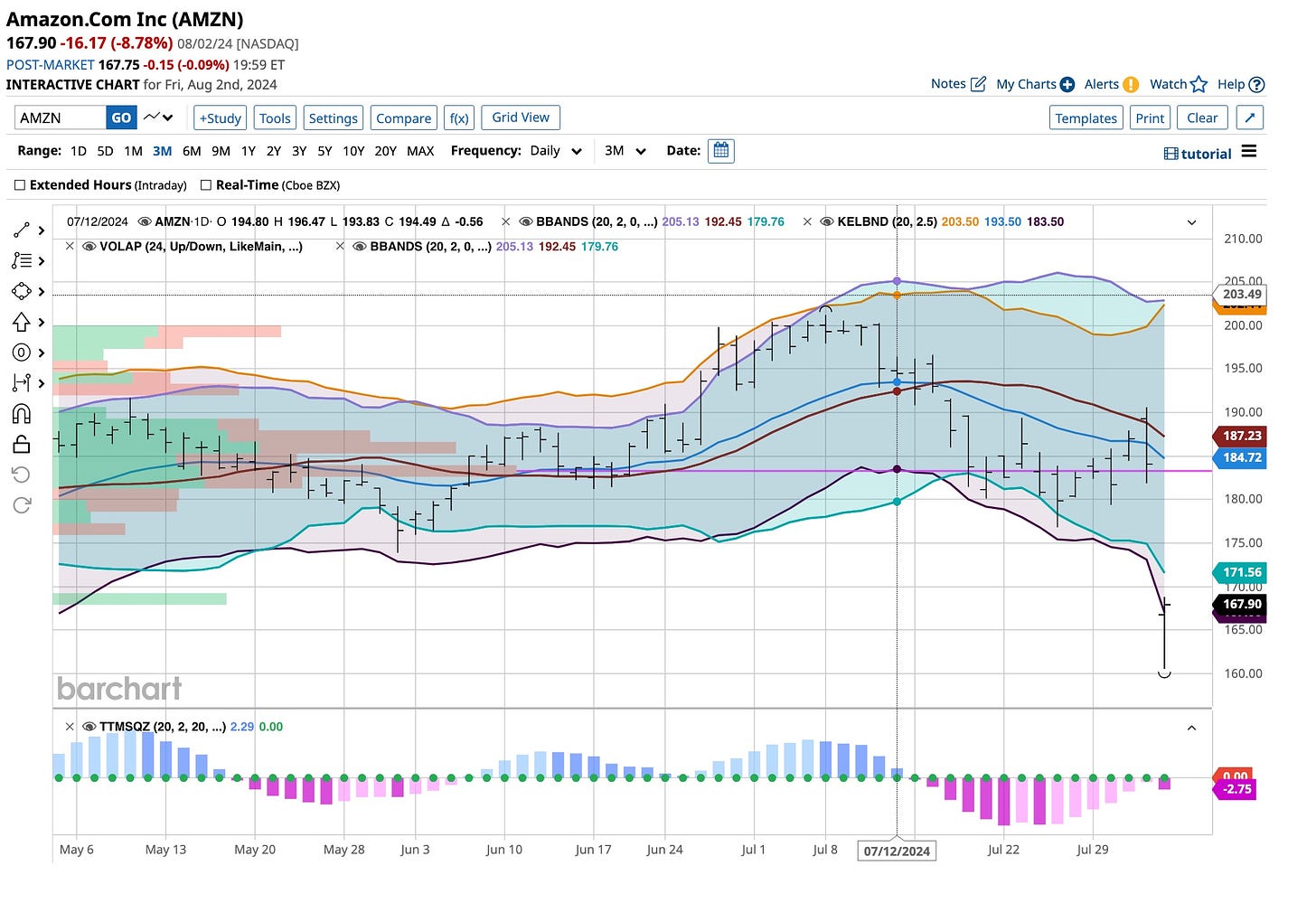

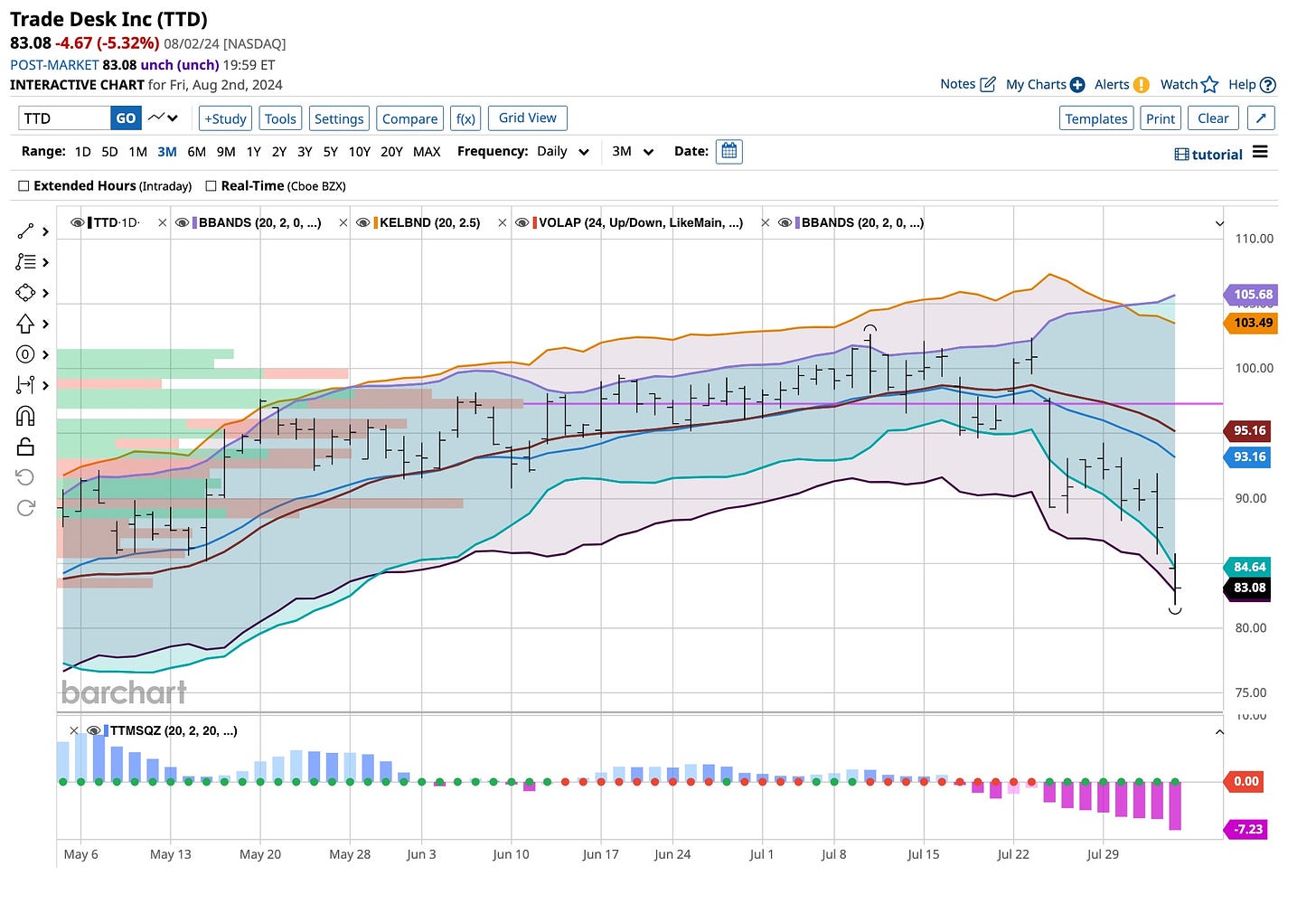

On the stock side, while we hold several securities that have appreciated, we are using covered call positions to protect our profits. For those securities we want to acquire, we are selling naked puts. I hope the prices of these stocks, like Amazon (“AMZN”) and the Trade Desk (“TTD”), stay on the downside so we can add more to the money managed. Besides, we’re down on these. If you are interested, follow The Ticker. I’m a little more vocal on that site than here.

A Few Other Thoughts

No one ever knows what’s next, so we hedge. You should, too. If you’ve watched what we have done with VIX call options, I need not go further. We buy when they sell and sell when they buy. Invariably, the “herd” is wrong, but the velocity of “mistakes” they make shows up when they’re too late to join the party. We used “trailing stops” on the 2025 March 20 VIX call options on Friday and made more than 500% on our initial buy orders.

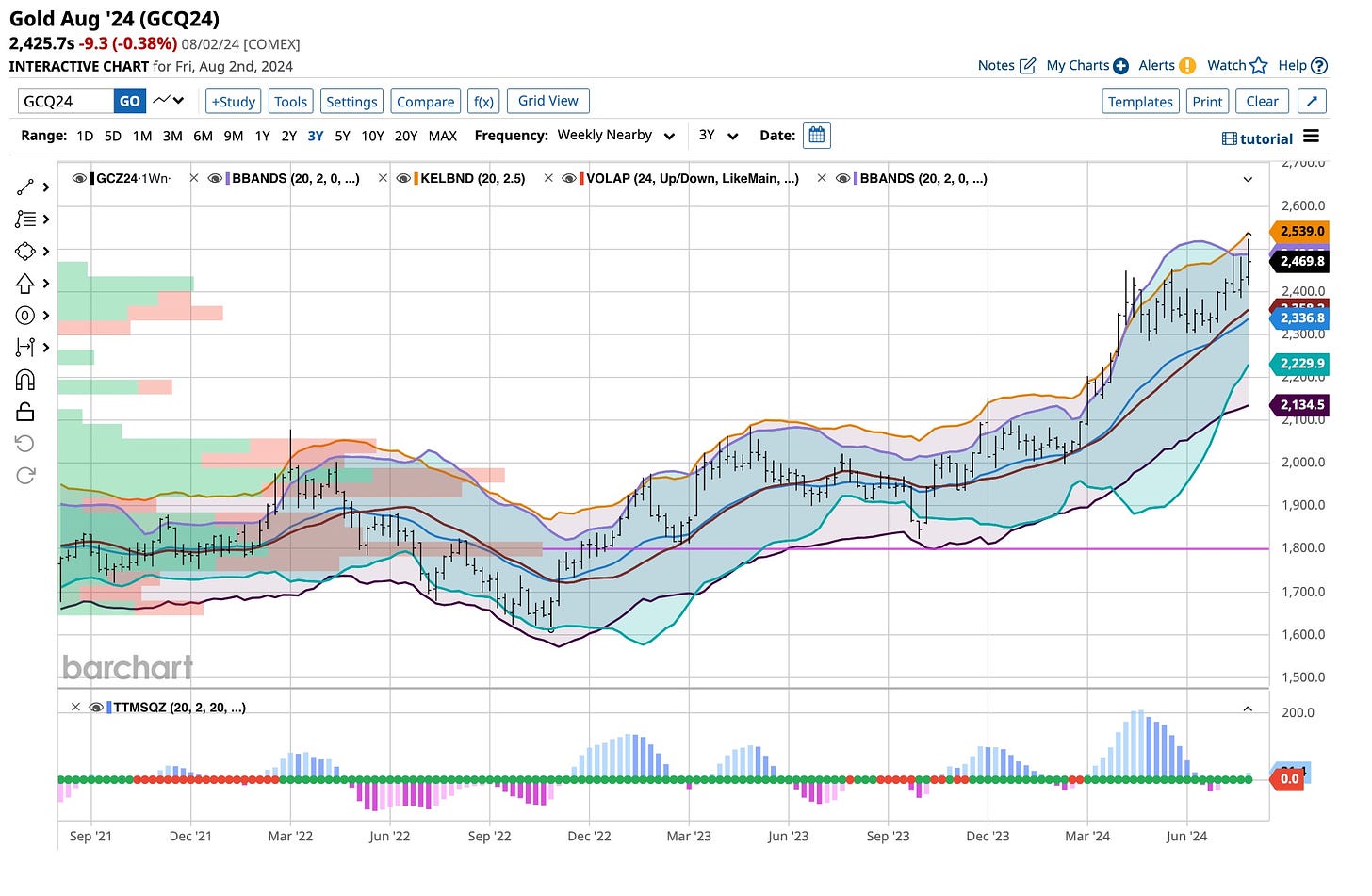

Keep in mind that we are still very long “gold bullion” and short the dollar, especially against the Yen, as the carry trade is dead. Silver futures are pretty much the only real risk on the table right now as we harvested the Bitcoin trade I put in place when Mr. Trump was shot. Otherwise, cash is king, and we’re sitting on a pile of it, just waiting for lower prices, just like Warren Buffett.

Lots Happening At The Ticker

I’m a business person. While I love sharing my investment and trading experiences, I am not doing it for my health. We’re about to make a few changes, one of which we’ll bring to your attention after Labor Day. Until then, enjoy summer. Remember, it goes throughout August, and many movers and shakers know how to vacation.

Yellow Submarine was a classic. Face it, we all live there. Do we really know what is next? I work at it daily but always hedge against the inevitable that I’ll too be wrong. I have holding power and understand how to use options and how to put time on my side. Keep in mind that time is the only commodity you cannot replace. Use it wisely, and above all, don’t waste it. Think, hope, pray and wish are bad words. Patience is good, especially when an investment or trade doesn’t go as expected. It happens, and if you’re listening to someone who is never wrong, listen to someone else.