When BoJ Governor Kazuo Ueda took over earlier this year, the absolute last thing anyone should have expected was a quick “about face” with respect to the decision making process at the BoJ. It’s just not the way the Japanese do business. In other parts of the world, more dramatic changes are inherent and the respective analysis of Europe or the United States must be taken into consideration; they’re just different.

Ueda has a lot on his plate, some of which is discussed below but more importantly, getting a handle of just how the Japanese business culture reacts is where we’ll start. There’s more to reading a technical chart and that’s important to note when dealing with Japan.

Japanese Business Culture Characteristics

The Japanese business culture is known for its unique and distinctive characteristics, shaped by traditional values, societal norms, and historical practices. Here are some of the key aspects that define Japanese business culture:

Respect & Hierarchy: Respect for authority and seniority is deeply ingrained in Japanese culture. Hierarchical relationships are emphasized in the workplace, and deference is shown to superiors, past or present. Decision-making involves consensus-building, and employees are expected to follow instructions from their higher-ups without questioning them.

Group Harmony “Wa”: The concept of "wa" emphasizes group harmony and cooperation over individual interests. Japanese businesses strive to maintain a cohesive and harmonious work environment. Conflicts are generally addressed discreetly and indirectly to preserve this harmony.

Long-Term Perspective: Japanese companies often take a long-term view of business, focusing on sustainable growth and relationships with stakeholders rather than short-term gains. This approach fosters stability and trust in the business community.

Business Card Etiquette: Exchanging business cards, known as "meishi," is a crucial part of business introductions in Japan. The exchange is done with great respect, using both hands to offer and receive cards. It is customary to study the card briefly and show appreciation before placing it neatly in a cardholder.

Punctuality: Punctuality is highly valued in Japanese business culture. Arriving on time for meetings and appointments is considered to be a sign of respect and professionalism.

Consensus Decision-Making: Japanese businesses often seek consensus among team members before making decisions. This process can be time-consuming but ensures that everyone's input is considered.

Work Ethic: The Japanese work ethic is renowned for its dedication, discipline, and diligence. Long working hours and commitment to the company's goals are considered essential for success.

Overtime & "Karoshi": The culture of long working hours can lead to "karoshi," a term used to describe death from overwork. While there have been recent efforts to address this issue, it remains a significant aspect of Japanese business culture.

Business Meetings & Communication: Japanese business meetings are generally formal affairs. There are specific protocols for speaking, such as using honorific language when addressing superiors. Non-verbal communication, such as subtle nods and gestures, is essential to convey agreement or understanding.

Gift-Giving & Hospitality: Gift-giving is a common practice in Japanese business culture used to show appreciation or build relationships. When you are invited to someone's home or a business dinner, it is customary to bring a small gift.

Dress Code: Japanese business attire is typically conservative and formal. Men often wear dark-colored suits, while women opt for business suits or dresses. The appropriate dress code can vary depending on the industry and company culture.

Overall, Japanese business culture places a strong emphasis on harmony, respect, and dedication to its collective success. Understanding & respecting these cultural norms are vital for successful business interactions in Japan.

With respect to change at the highest levels of the BoJ, Ueda needs to deal with “face” or “mentsu” as connected to dignity, honor and public standing. One can lose face, for example, by being blamed for something in front of others, and one can also gain face, for example, by being praised in front of others. Protecting your face and others’ face is crucial in Japanese culture as it helps maintain group harmony. If Ueda had acted too quickly he would have caused prior leadership to “lose face”. That was not going to happen. Despite what he was thinking, exactly as he started, “silence” was going to be a big part of his communication style. He’s now been there long enough so it’s time to expect some changes to be made.

Japan’s Move

The Bank of Japan on Friday loosened its yield curve control “YCC” policy, a pillar of the central bank’s efforts to limit borrowing costs and stimulate the economy. Yields on 10-year Japanese government bonds jumped to their highest level since 2014, while the yen seesawed between gains and losses as investors speculated whether this tweak was a precursor to more drastic changes for Japan’s ultra-easy monetary policy.

The YCC was introduced in 2016 after years of heavy bond buying under quantitative easing. The BoJ wanted to keep short to medium term rates low while allowing longer term rates to go higher. The goal was to encourage consumers to spend and head off the risk of deflation, without depressing returns for financial institutions including life insurers.

The BOJ said it will control 10-year yields “flexibly.” It will allow them to rise above the 0.5% level, a reference rate, while “nimbly” using bond purchases to guide yields. The central bank will also offer on a daily basis to buy 10-year JGBs at 1%, effectively raising the yield cap to that level from 0.5%. By keeping the 0.5% target in place, the BoJ is reining in speculation of further policy tightening ahead.

The BoJ’s monetary stimulus program, spearheaded by Ueda’s predecessor Haruhiko Kuroda, has turned the bank into the largest owner of stocks and government bonds in Japan. With more than half of all government bonds now the property of the central bank, trading in what should be an easily-available asset thinned. The BoJ said tweaks to the YCC band are aimed at improving the functioning of the market, a position it reiterated Friday. Many economists interpreted the tweak as laying the groundwork for exiting a decade of extraordinary stimulus policy.

The BoJ is the last major anchor of rock-bottom interest rates and Japanese investors have spent more than $3 trillion offshore in search of higher yields. Economists warn that even a small shift to policy normalization may prompt Japanese cash to flood out of global markets and back home. In addition to being the biggest foreign holders of US government debt, Japanese funds have massive investments in debt and high risk loans worldwide.

Speculation of a more significant shift, the abandonment of YCC, will bolster the yen and deal a blow to bond markets worldwide. The BoJ will avoid premature speculation of rate hikes, how we do not know but that why understanding how Japanese business is transacted helps.

Ueda is keeping several plates spinning. He defended the move as a technical change designed to make YCC more sustainable, and give the bank ammunition in case prices overshoot its target. In a week that saw the Federal Reserve and the European Central Bank signal the most aggressive hiking campaign in decades is near an end, Japan has taken two steps forward and one step back. It’s moving away from a framework that was designed to make mega-easing sustainable. Officials can’t bring themselves to say that makes things more complex. Financial market volatility from this initial change is very likely. Hold on to your hats.

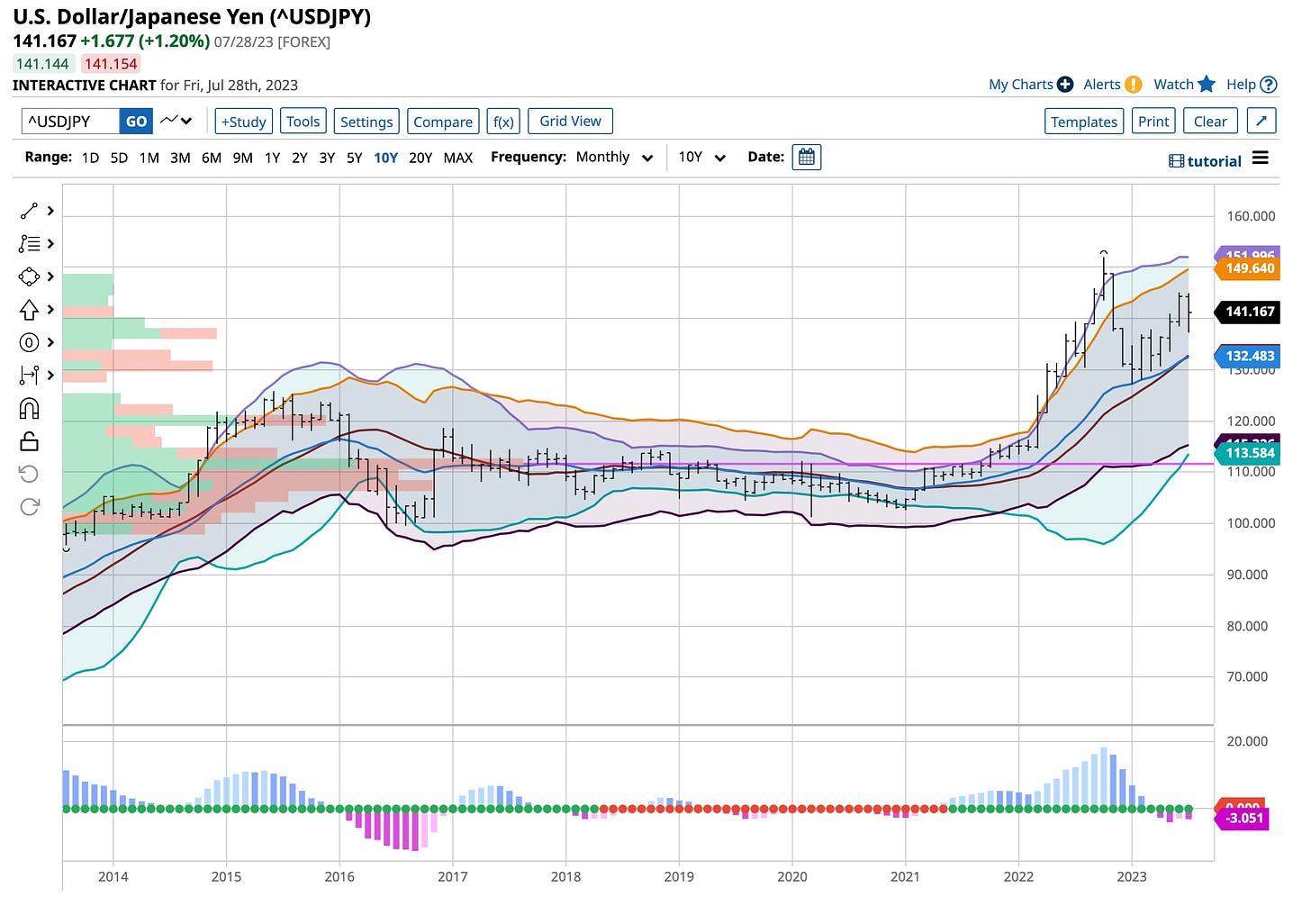

In my fourth trade, since Ueda took over, I was “short” the Japanese Yen at an average of about 143.50. It pays to trade overnight. When announced the Yen crashed. I closed out my trade for a nice profit around 138.50. It closed back above the 141.00 mark. I’ll more than likely reposition as rates in Japan have to rise; inflation targets are far from being met and further changes are in the pipeline.

My thanks to Barchart as usual. Take advantage of the free month offered and learn. I hope you all enjoy their charts. Their webinars on using them is better. Give Barchart a try, just “click here”; get a trial for free at no risk. It just might be the best ‘click’ you’ve ever made.

Well, it’s time to spend the next couple weeks refining my initial course on Udemy. I’ll have a snippet or two available to share during the coming weeks and look forward to hearing what you think. It’s a labor of love and thanks in advance for your comments,.

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Have you ever done business in Japan? It’s not the easiest thing I’ve ever done. From buying fasteners to trading California wine for steel ingots made in Korea it does get done. Simple advice, learn how not to use the word “no”; maintain a dignified stance; be thankful for the opportunity then just sit back and wait. They want to do business, so do you but they must feel that they’re in control of the transaction. If not nothing is going to happen.