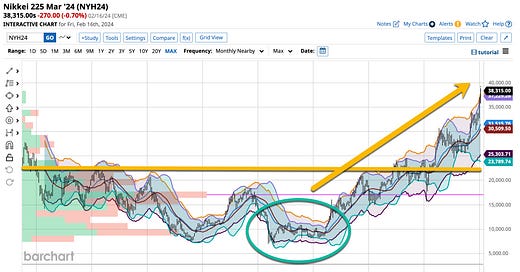

It was one hell of a week happening in a first quarter in February. I am a reader and a listener first with 55+ years of experience. I remember when the Nikkei hit its highs in the late 1980s and basically “struggled” thereafter to get back to its highs. No one ever thought it would take thirty-five years but it has and for good reason. Japan’s economy and its markets are essentially closed. The majority of its investment capital is found within its own markets. Bonds and debt for certain but equity investments account for a majority of its internal investments in today’s world.

The world, myself and Warren Buffett included have come to the conclusion that it is now the “place to be” especially given the current exchange rate between the Yen and the Dollar. At 150 it is apparent that the world thinks that’s a cheap price to pay for a Yen and it is. Bonds, well they basically pay nothing when compared to what’s earned elsewhere but their stocks, well they are cheap.

I’m dependent upon the “powers that be” the “big boys” to pick most of the securities I currently control in this market and have been for quite some time. They made a call years ago and have stuck with it, especially given the fact that in essence, Japan can’t get out of its own way. Recently there has been a great interest in the Nikkei as it gets close to its “all time highs”. Along with that comes both sides of the coin. Some say it is time to folow the “herd” and add more money to the portfolio. Others profess that the Nikkei has “done its thing” and it is tie to harvest a few of the winners. As I stated to me, I’ll just let them decide and turn my attention to China. That’s a solid story for another day. Today we’ll deal with Japan but keep your ears and eyes open for a story or two or three about what I’m buying as China turns itself around.

Germany Is & India Will Soon Boast Bigger Economies Than Japan

Japan unexpectedly slipped into a recession at the end of last year, losing its title as the world's third-biggest economy to Germany. This raises doubts about when the central bank would begin to exit its decade-long ultra-loose monetary policy.

Some analysts are warning of another contraction in the current quarter as weak demand in China, sluggish consumption and production halts at a unit of Toyota Motor (“TM”) all point to a very challenging path to an overall economic recovery.

Yoshiki Shinke, a senior executive economist at Dai-ichi Life Research Institute said “ . . . the sluggishness in consumption and capital expenditure that are key pillars of domestic demand. The economy will continue to lack momentum for the time being with no key drivers of growth."

Japan's gross domestic product fell an annualized 0.4% in the fourth quarter after a 3.3% slump in the previous quarter. Market forecasts called for a 1.4% increase. Two consecutive quarters of contraction typically define of a technical recession.

While many analysts still expect the Bank of Japan to phase out its massive monetary stimulus this year, the weak data may cast doubt on its forecast that rising wages will underpin consumption and keep inflation around a 2% target. Stephan Angrick, senior economist at Moody's Analytics stated, "two consecutive declines in GDP and three consecutive declines in domestic demand are bad news, even if revisions may change the final numbers at the margin." He’s one hell of an analyst and quite frankly should be followed by everyone. He is right when he states that, “this makes it harder for the central bank to justify a rate hike, let alone a series of hikes."

Economy minister Yoshitaka Shindo stressed the need to achieve “solid wage” growth to underpin consumption, which he currently believes is "lacking momentum" due to rising prices. He continues by reciting that "our understanding is that the BOJ looks comprehensively at various data, including consumption and risks to the economy in guiding monetary policy."

As I stated and further recite again, there are far better people in this world who know whole hell of a lot more than I do. I depend upon them for guidance as undoubtedly I believe they know more than I do. I’ll always stick to what I know and you should too.

The BOJ has been laying the groundwork to end negative rates by April and overhaul other parts of its ultra-loose monetary framework. In my opinion, the BOJ is likely to “go slow” on any subsequent policy tightening amid these lingering risks. Exiting an “accommodative” policy would come at a time the U.S. Federal Reserve is “pausing” after aggressive interest rate hikes. It’s widely expected to reduce borrowing costs this year despite the “monkey wrenches” of inflation that have been thrown into pathways currently being evaluated.

The International Monetary Fund revised up its global growth forecast in January as the outlook for the United States and China brightened, but warned of risks including geopolitical tensions in the Middle East. While BOJ officials have not offered clues on when they could end negative rates, many market players expect it to happen either in March or April. Some analysts say Japan's tight labor market coupled with its robust corporate spending plans are keeping alive the chance of an early exit from ultra-loose policy. That’s the side I am taking and believe the Yen versus the Dollar is headed to the 125 level sooner than not. That ‘s the side of the trade I’ve been on and will stay on until it happens.

Open Versus Closed Economies

In economics, there are two basic concepts when studying international trade. These go hand in hand with how an economy is to trade or trade with foreign economies. On the basis of the free movement of labor and money with other countries, a country’s economy is classified as either open or closed economies.

The key difference between open and closed economies is based on “capital markets”. An open economy encourages international trade, investment and capital flows, while a closed economy restricts these activities to protect domestic industries and achieve self-sufficiency.

In an open economy, a person or company can buy shares of a corporation located in another country or buy foreign currency and conduct business outside the borders of their home country. On the contrary, the closed economy makes it impossible to trade in the capital market beyond its borders, in other parts of the world.

An open economy is one in which a nation can actively trade goods or services with other nations. It imports foreign goods and services for local use and exports local production to receive income. In a closed economy, goods or services are seldom if ever exchanged with other countries. The survival of people and economic activities are self-sufficient, meaning they are satisfied locally without the need to use goods or services from abroad. Which one is more “advantageous” depends on various factors and perspectives.

Advantages of Open Economies

Increased Access to Foreign Markets: An open economy can access a larger customer base, leading to increased trade, investment and economic growth.

Increased Competition: Open economies will compete with foreign companies, leading to greater efficiency and innovation.

Specialization: Open economies can specialize in producing goods and services, leading to higher productivity and lower costs.

Diversification: An open economy can diversify its sources of income, reducing the risks associated with relying on a single market.

Advantages of Closed Economies

Greater Control Over Domestic Markets: A closed economy has greater control over its domestic markets. It protects domestic industries from competition.

Reduced Exposure to External Shocks: A closed economy is less vulnerable to external shocks, global economic crises or political instability in other countries.

Greater Protection of Local Jobs: A closed economy can protect local jobs and prevent outsourcing to foreign countries.

Preservation of National Identity: A closed economy can preserve its national identity and culture by reducing the influence of foreign companies.

Whether an open or closed economy is more “advantageous” depends on a country’s specific circumstances and goals. A country may choosebased on its natural resources, level of development and political stability.

Which Economy Is Better For Japan

Due to advantages to a country’s economy and its citizens, open economies are better than closed ones. Countries engaging in a healthy “trade interaction” with their peers benefit economically, culturally, socially and technologically. Although there are few closed economies today, there are moderately closed economies exhibiting significant limitations. Japan is one of them despite it being open to international trade due in to their essentially closed economic system.

Open economies contribute to the development of people. It is important to highlight that for these benefits to be “real”, the actual conditions between all countries must be mutually beneficial. Japan exhibits qualities of both types of economies as trade is an important feature and function of the Japanese economy.

Unfortunately, due to its own actions, Japan has established a very tight hold on how it operates in the financial world. It controls internal investment making decisions on how its financial markets are represented to the world by controlling its markets. As Japan’s Nikkei looks to, after thirty-five years of missing the mark, finally hit highs in their stock markets, internal decisions may change.

Seldom a performer like Angela Lansbury graces the stage. We were so lucky to have her especially when she performed as “Mame”. Face it, she is one o a kind and never afraid to “Open a New Window”. You should never be afraid to do just that it but face it, it’s time for Japan to do the same thing, it’s time. I’m one of the few who has been involved in macroeconomics, geopolitics and above all geoeconomics for years. It has been a pleasure but unfortunately most o you never experienced what I have. Today it seems everyone has an opinion of nothing more than ups and downs in the markets. Remember, it has been thirty-five years since the Nikkei has seen a new high. Maybe it is about to happen. I’d rather see the Japanese change the way they operate in the financial markets and I’m “betting” on it happening in a big way. How about you?