Summer is a great time of year. It’s a perfect time to travel and enjoy your family and friends. Above all, it’s a great time to learn and The Ticker is here to do that for you the “right way”. What do we mean by learning the “right way”?

I’ve been involved in the securities industry for 55+ years. Experience is important and giving it back to you is priceless. For the last couple of years, I’ve written a book, “The Ticker’s Bible”, posted regularly here and on LinkedIn, and assembled a course based on the foundation, bricks, and mortar in this industry. It’s available from “The Ticker” for just $99 during our introduction. If you act now you will receive more than $1,000 worth of value but available thoughts are filling up fast. Join and learn the “right way” as it makes a difference.

Summer is a great time to learn. Options are a great tool to put into your bag for many reasons. As derivatives, they can be both speculative and risk-averse, it all depends on how you want to use them. Here are a few basic option concepts and how I use option contracts to speculate.

Options Are Your Friend

The Basics

All types of options, equity options, stock options, and futures options are financial derivatives. They give the holder the right, not the obligation, to buy a “call option” or sell a “put option” for a specific quantity of an underlying asset at predetermined prices, the “strike price”, within a specified period the “expiration date”.

A call option provides the holder the “right” to buy the underlying asset at the strike price before the option's expiration. Call options are used by investors who believe the asset price will rise.

A put option gives the holder the right to sell the underlying asset at the strike price before the option's expiration. Put options are used as a “hedge” against potential asset price declines or for speculative purposes.

The strike price or exercise price, is the actual set price where the underlying asset can be bought or sold when exercising the option. It’s set at the time of creation and remains fixed throughout the option's lifespan.

The “expiration date” is the fixed date when option contracts become invalid and cease to exist. After this date, the option can no longer be exercised. Equity options have “expiration dates” on a monthly, weekly, and daily basis.

The premium is the price paid by the option “buyer to the seller” for the rights associated with the option. It represents the option’s “intrinsic value” & “time value”. Premium is tied to asset price, strike price, time to expiration, volatility, and interest rates.

The intrinsic value is the difference between the current price of the underlying asset and the strike price. For calls, the “intrinsic” value is positive if the asset price is higher than the strike. For puts, the intrinsic value is positive when the price is lower than the strike.

The time value of an option reflects the potential for the option to gain value before expiration. It is tied to the time remaining until its expiration, expected asset price volatility, and interest rates. “Time value” diminishes as the option approaches its expiration date.

An option is “in-the-money” when its “strike price” is favorable compared to the “current price” of the underlying asset. For calls, the asset price is higher than the strike price. For puts, the stock price is lower than the strike price.

An option is “out-of-the-money” when its “strike price” is not favorable when compared to the current price of the underlying asset. For calls, the asset price is lower than the strike price. For puts, the price is higher than the strike price.

An option is considered “at-the-money” when its strike price is about equal to the current price of the underlying asset.

The bid price is the highest price a “buyer” will pay for an options contract; the ask price is the lowest price a “seller” will accept. The difference between the bid and ask prices is the “bid-ask spread”.

Speculators

Option buyers or option holders “purchase” options to gain the right to buy “call option” or sell “put option” on the underlying asset at a specified price within a specified period. They use options to speculate, hedge or generate income.

Option sellers or option writers, are individuals or institutions who sell options to option buyers. They are “obligated” to fulfill the terms of the option contract if the buyer exercises. Sellers receive “premiums” from option buyers in exchange for this “obligation”.

Call options are purchased by investors who think that the price of the underlying asset will rise. Owning call options gives the holder the opportunity to benefit from price appreciation. Call holders exercise the option and buy the underlying asset at the strike price before or on the expiration date. The seller or “writer” of a call has the obligation to sell the underlying asset if the option is exercised by the holder.

The potential profit increases as the price of the asset rises above the strike price. The holder benefits from the difference between the market price and the strike price, minus the option cost premium. The risk for calls is limited to the premium paid for the option. If the price of the underlying asset does not reach or exceed the strike price, the holder may not exercise the option which results in a loss of the premium.

A put option is a contract that gives the holder the right to sell the underlying asset at the strike price within the expiration period. Puts are purchased by investors who anticipate that the price of the underlying asset will decrease in the future. Owning a put allows holders to benefit from potential price declines. The put option holders have the right to exercise the option and sell the underlying asset at the strike price before or on the expiration date.

The seller or “writer” of a put option has the obligation to buy the underlying asset if the option is exercised. The profit increases as the price of the underlying asset decreases below the strike price. Holders benefit from the difference between the strike price and the market price, minus the cost of the option premium. The risk for put options is limited to the premium paid for the option. If the price does not decline below the strike price, the holder may not exercise the option, resulting in a loss of the premium.

So How Do I Use Options To Speculate

Everybody wants to learn options. The problem is that no one wants to put the time in to understand everything options can do. We’re starting with the simplest strategy. All investors and traders want to speculate or they would not be here. Options offer much more but “speculation” is a great place to start.

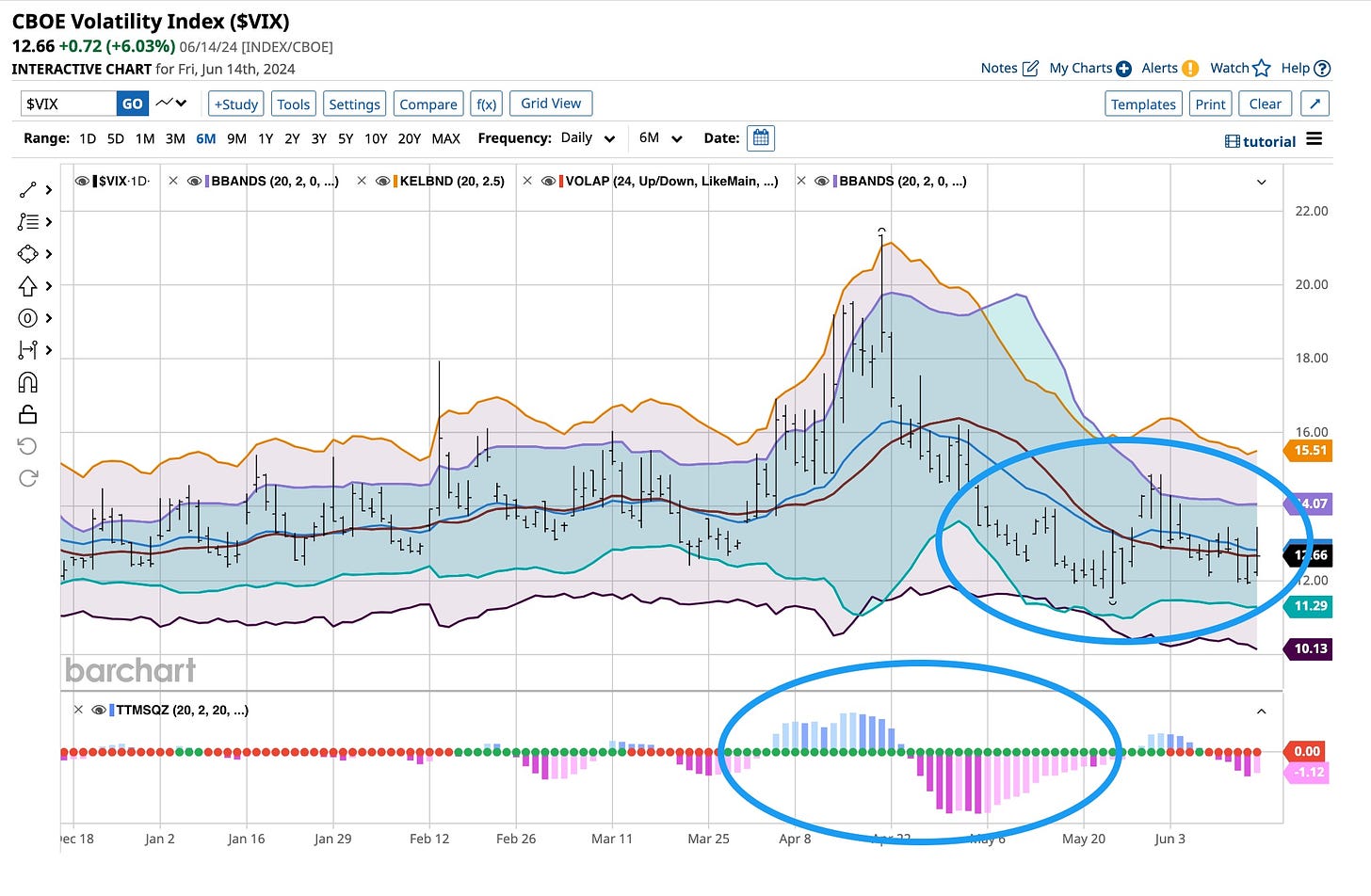

I’m a longer-term position trader than not. I look for the “herd” to be wrong and they have a tendency to overshoot expectations. Most are inflicted with “FOMO”, the fear of missing out. I’m also a macroeconomist and believe in technical mean reversion. I believe what goes down must go up and let those opportunities find me but remember I know what to look for. I’m a long-term VIX call option buyer. There are rules that I follow. Here are a few that work far more often than not.

Buy when they, the “herd” sells. The options are undervalued and the probability of increasing prices is higher.

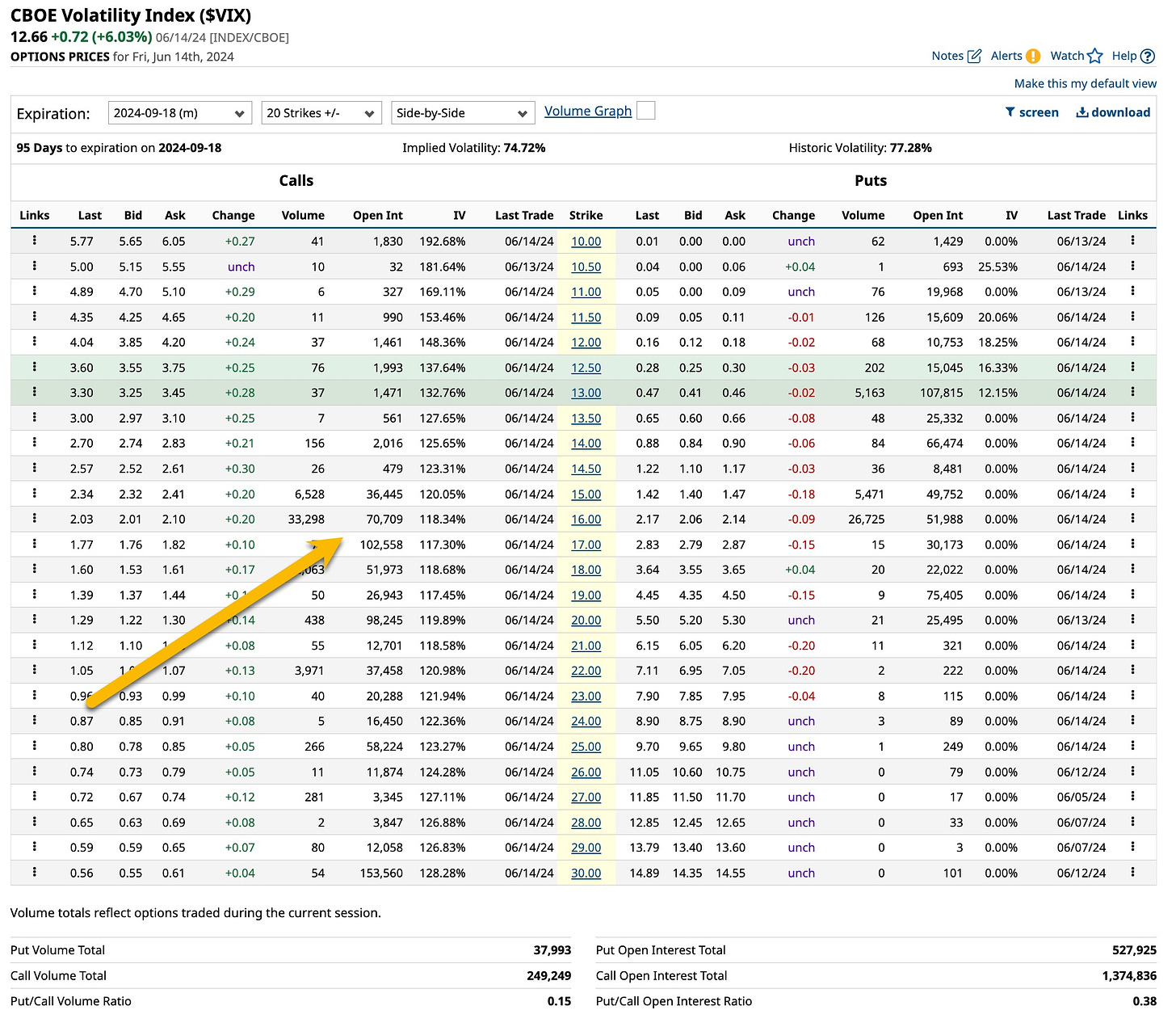

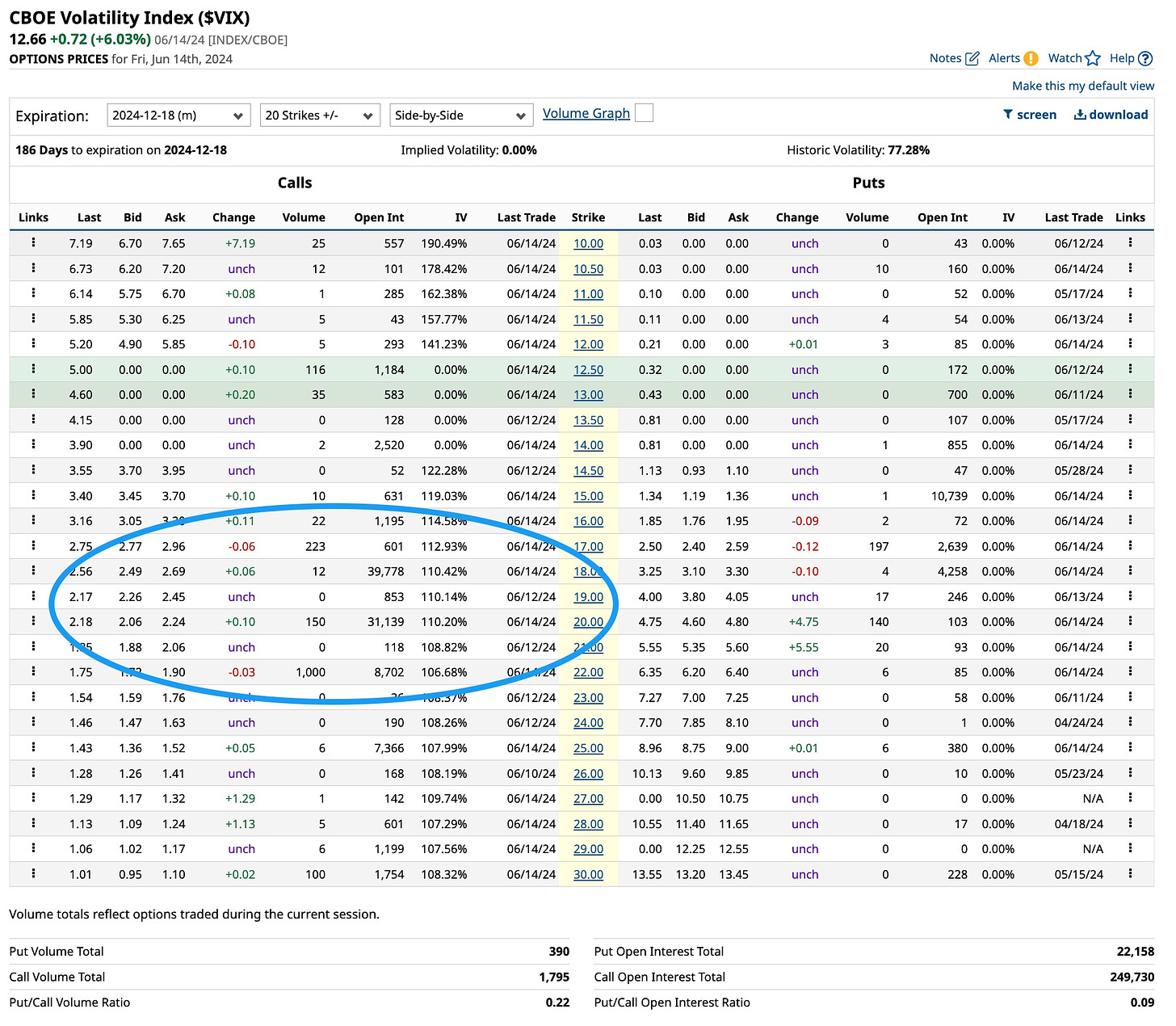

Only buy call options strikes where the open interest and volume are the highest.

Look at longer-term options that are three to six months, or more, in duration.

The call option does not have to exceed its strike price for you to make money.

Don’t be greedy as pigs get slaughtered.

I’ve been buying 2024 September 16 and December 20 call options. I’m up about 25% in both. I’ll sell half of the position if profit approaches 50%. If upside performance continues, I’ll sell half of what remains at higher levels. If the option price continues higher, I’ll sell the rest of the position and sit and wait for another opportunity to find me. I’m not going to chase anything. FOMO, the fear of missing out, is a tool the herd uses. I’ll take advantage when they do.

Learning how to work with options is imperative to becoming better when it comes to investing and trading. More than fifty years ago, prior to all of the tools we have today, direct contact between buyers and sellers was necessary. Consider yourself lucky to be able to “click” today. Much of the option world is easy to learn. Some take time but it is worth it. Get your feet wet first then open up your mind to what options can do for you. Employing them improves, protects, and enhances your portfolio performance.

Everybody has options. It just depends on how you use yours. The Clash sang “Should I Stay Or Should I Go” many years ago but their words reflect the real world. When we use options there’s a reason behind it. More often than not we seek to increase returns in the portfolio by simply selling covered calls. We do speculate but more so to ‘hedge’ against “out-of-nowhere” events. We sell naked put options below the current market price of assets we want to own. When you look at all of the things you can do, options can be daunting. That’s why we start with the “simple” stuff. Thanks for listening.