What a week and good thing. Other than the UK taking rates higher next week there’s little on the “economic radar screen” until a few employment reports hit around July 7th. It’s summer folks, get used to it. At the same time be appreciative of what rolled across the news wires last week. I stayed up late, dug into my “history” banks, thought through a bunch of “what ifs”, all the time digesting what was. Relationships between the Dollar, Yuan, Yen, Gold, 30-Year Bonds, Corn, Soybeans and more “strutted their stuff” across the “exhibition floor”, most in an expected manner. The macroeconomic side of the coin landed “heads or tales” most of the time making it easy to predict its direction, at least from “A” to “B”. Then there’s “C” to “D”; better flip that coin again.

The geopolitical coin however, a gold one for good measure, left some uncertainty on the table based primarily on China’s next move. That’s what I’ll be talking about this Sunday evening. It’s the part I consider to be, post “A” to “B”, the “C” or “D” part. In other words it depends. What this segment relies upon is not “cast in stone”, it’s “cast in uncertainty”, political uncertainty with a dose of weather thrown in for things that grow. I dug into a few of the caveats necessary to understand “what’s next” in order to obviate the uncertainty. I want you, post discovering where to search for then unearth information to make your own decisions. Do what I did; weigh the potential outcomes and assess which direction, up or down, even sideways, you believe the Dollar, Yuan, Yen, Gold, 30-Year Bonds, Corn, Soybeans will go next. It doesn’t do you or me any good if I’m telling you what to do, no. I want you to be the one doing that, not me. If not, I haven’t transferred my knowledge and experience into the “space between your ears”. That’s the objective, right?

So let’s get started. If it looks like you’ve seen a lot of what follows you’re right. Put a bright “gold star” on your forehead as most of this was posted yesterday to give you a head start. Rome wasn’t built in a day; becoming the best damn investor or trader you can be takes time; it’s a marathon, not a sprint.

The U.S. Dollar

Powell paused this week. That action was countered with his statement that interest rates are still going higher but the markets only reacted to the former and the Dollar retreated setting up the rest of what I’ll be discussing here and Sunday. Which way it’s going next is quite “cloudy” but for certain, it’s not going to be determined from the usual suspects; I don’t see a relevant economic report hitting the wires until perhaps it’s time to hear from Powell later in July. It’s China, China, China that’s going to give us direction but don’t worry, the “big guy” has a plan, right?

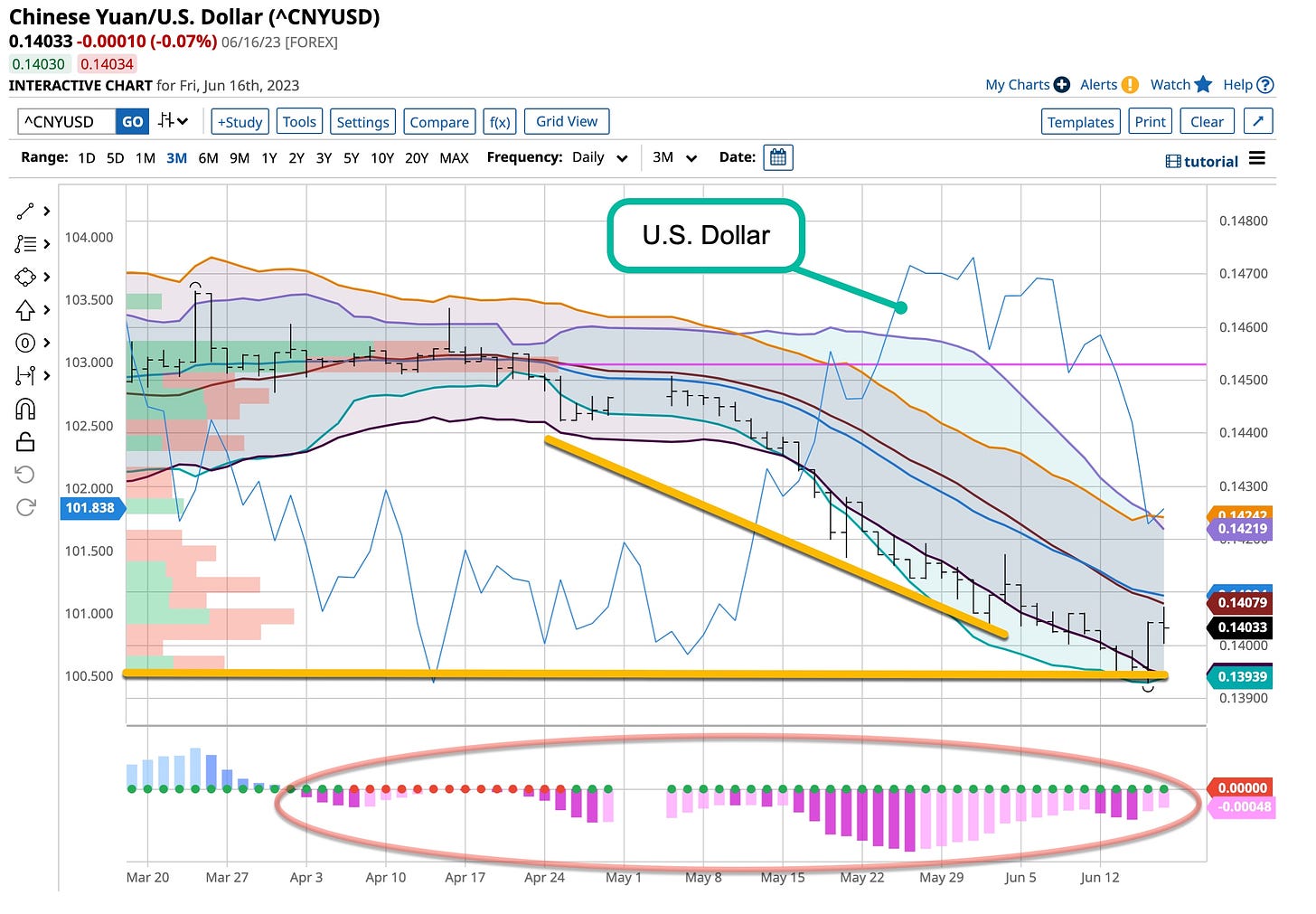

The Yuan

China lowered their interest rates, the Fed paused, but it also warned of higher future rates. As expected, the Yuan decreased in value against the Dollar. Like everything in today’s market, the news was “oversold” as was the subsequent rebound but the die is cast; the Dollar is going to head higher against the Yuan regardless of heading lower against the Euro and the Pound where interest rates are heading higher. What China does next set the stage everywhere as discussed below.

Gold

“Hurry up and wait” seems to be the watchword phrase for gold and there’s a lot to wait for. The Fed paused, that should have moved Gold higher but it didn’t. I do not think gold reacted to Powell’s subsequent statements of future tightening. No, I think there’s validity to China raising capital by selling some of its stockpile of gold. Just a little supply and demand at work. Politics, and the uncertainty that surround it, comes at a time when prevailing issues between our political parties is reaching a level never seen before. Someone is going to get paid to pull that “secondary issuance” off. Maybe that’s why those who run the major brokers have visited and met with Chairman Xi. Maybe Bill Gates is buying a ton or two.

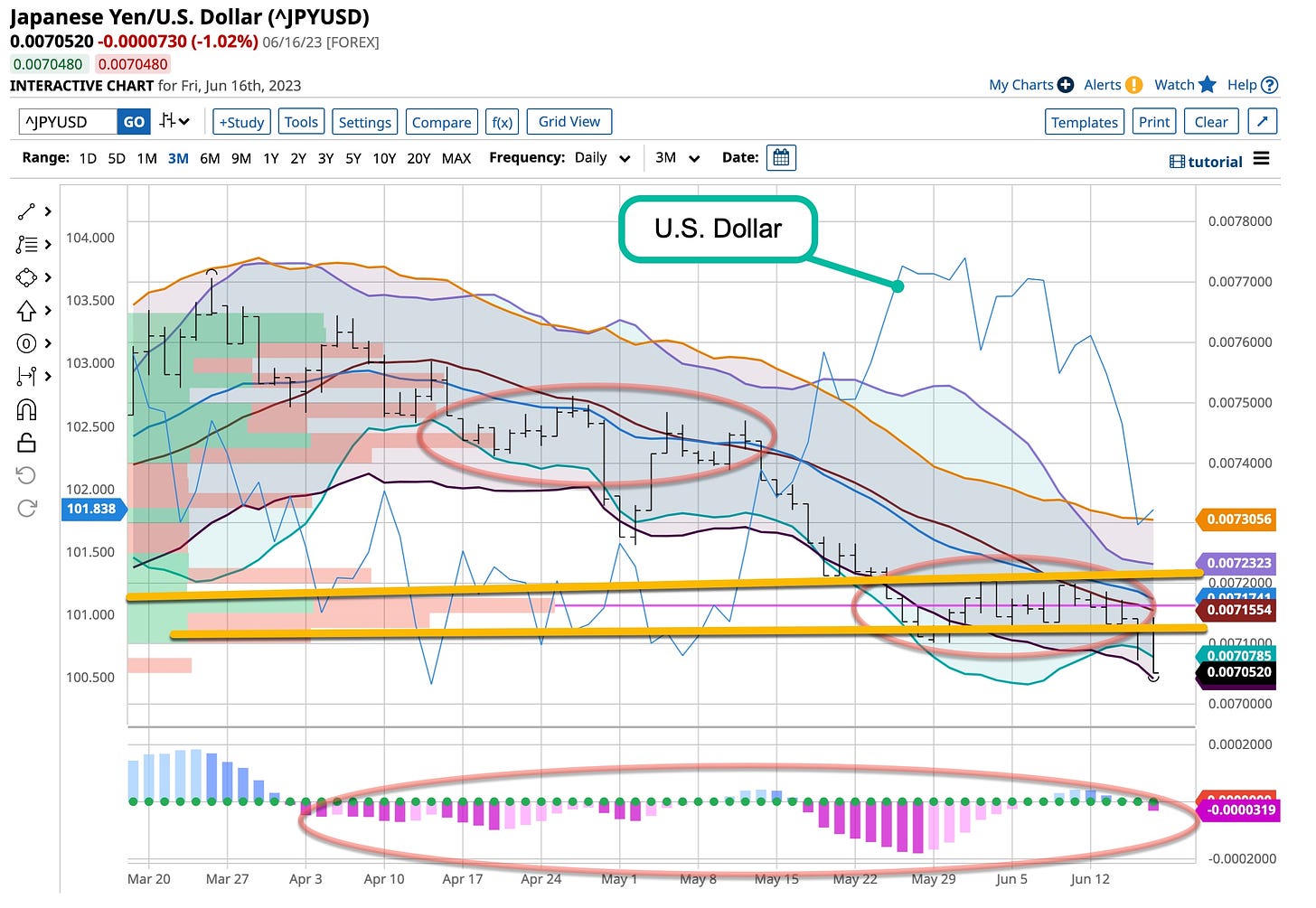

The Yen

The Ueda run BoJ left everything that’s kept the Yen weak for years in place again last week but times they are a changing. Inflation has been above their 2% target for much too long and the “natives” are getting restless. How long will Japan’s national base of investors, to the exclusion of the government itself, allow rates that are effectively set at “zero” to remain? Something has to give but for now, and until the Yen breaks back through 140, the Dollar’s weakness will be disregarded. It’s difficult to determine how exactly what China does will affect Japan. They have an ultra closed economic system that’s controlled by what can be considered a proletariate type structure. I’ll pass on this prediction; what do you think?

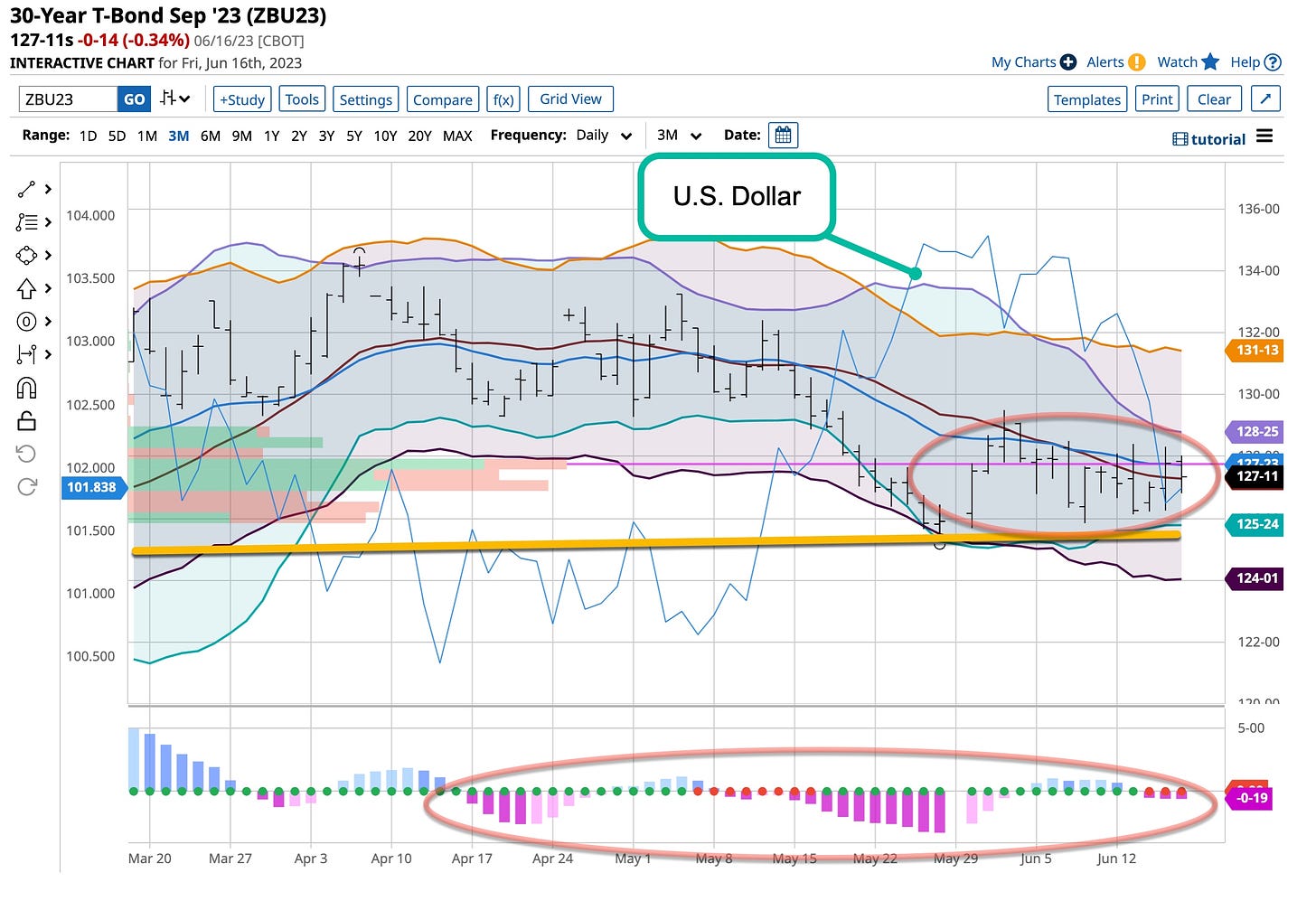

30-Year U.S. Treasury Bond

The granddaddy of the yield curve just can’t get out of its own way. It’s been basically directionless to the exception of a few blips to the downside but has not yet tested its lows around 117.50. For the U.S., for a yield curve to invert its going to need to do just that unless the rest of the shorter term instruments simply collapse in unison and that is unlikely given the probability of higher rates as inflation remains too high.

Think about it, Powell took a break and the reactions in interest bearing instruments were more like a “yawn” than anything else. Are they preparing for something out of nowhere like the Chinese selling its U.S. debt holdings or at least a portion of them? If not with the Fed pausing, regardless of its future threat of tightening, yields should’ve come down but they didn’t. Keep your eyes on this one. China’s actions control where it’s heading going forward and they need capital not just a minor interest rate drop to jump start their economy.

Corn & Soybeans

Now to some of my favorites, Corn and Soybeans. The world has to eat, right? These two commodities represent some of the largest sized commodities we export. When the Dollar declines the price of Corn and Soybeans increase, especially if the Dollar’s declining trend is expected to last.

When trading commodities of this nature you need to keep one eye on the Dollar and, in jest, the “other two” on the weather and crop reports. If you remember I suggested looking at a premier fertilizer stock Nutrien recently. There’s reasons for that past its P/E of less than 5 and dividend payout of close to 3.5%. If the U.S. manufactures any type of products it’s food. Add in the battle for Ukraine and “food” is a good place to be invested.

Hope you enjoyed “The Week That Was & What’s Next”. Sorry it took two articles to get you ready for it but seldom does the opportunity arise to teach you in “real time”.

I’m just a “young” 68 years old and trust me, I’m rested up and the yard work is done. Time to watch the final round of the U.S. Open and remember my Dad; hi Dad, miss you, especially today. I wonder who he’s picked to win the Open. Since Tiger’s not in the mix it could be a difficult choice for him.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Here’s to Gershwin and Ella Fitzgerald on the eve of Juneteenth. I had the pleasure of seeing her in concert; amazing talent. It’s “Summertime”, anything can happen and it can, especially when it’s least expected. Bet the “big guy” has a “hotline” to Chairman Xi in his Rehoboth Beach White House, probably sitting right next to his stolen stash of “confidential papers” beside his Corvette. There ought to be law; oops, that’s right there is, for some; “God save the queen”.